Why Blackstone Are Buying More Rental Properties in the U.S.

Why Blackstone is Back in the Rental Home Market: What Investors Need to Know

As a real estate investor with over 120+ U.S. rental properties, I’m always watching the big players. So, when a giant like Blackstone starts increasing its stake in U.S. rental homes, it’s worth paying attention. The American alternative asset manager, known for its significant interests in rental housing, is once again making big moves in the U.S. housing market.

- Blackstone’s Return: The investment giant is actively acquiring U.S. rental homes.

- Growth-Driven Strategy: Their investments closely follow areas with strong job and population growth.

- Diverse Portfolio: They own apartments, student housing, mobile home parks, and single-family rentals.

- Market Dynamics: Buying is currently cheaper than building, supporting rent growth and limiting new construction.

- Implications for Investors: Expect continued strong rental demand and potential appreciation, but also increased competition for assets.

Turnkey Rental Property: Browse Turnkey Rental Properties For Sale in Our Online Portal

Blackstone’s Renewed Focus on Rental Housing

Blackstone isn’t new to the rental housing game. In recent years, they’ve spent billions acquiring major brands like Tricon Residential, American Campus Communities, and AIR Communities. This isn’t just about accumulating properties; it’s about a strategic approach to a market they clearly see as ripe for further investment.

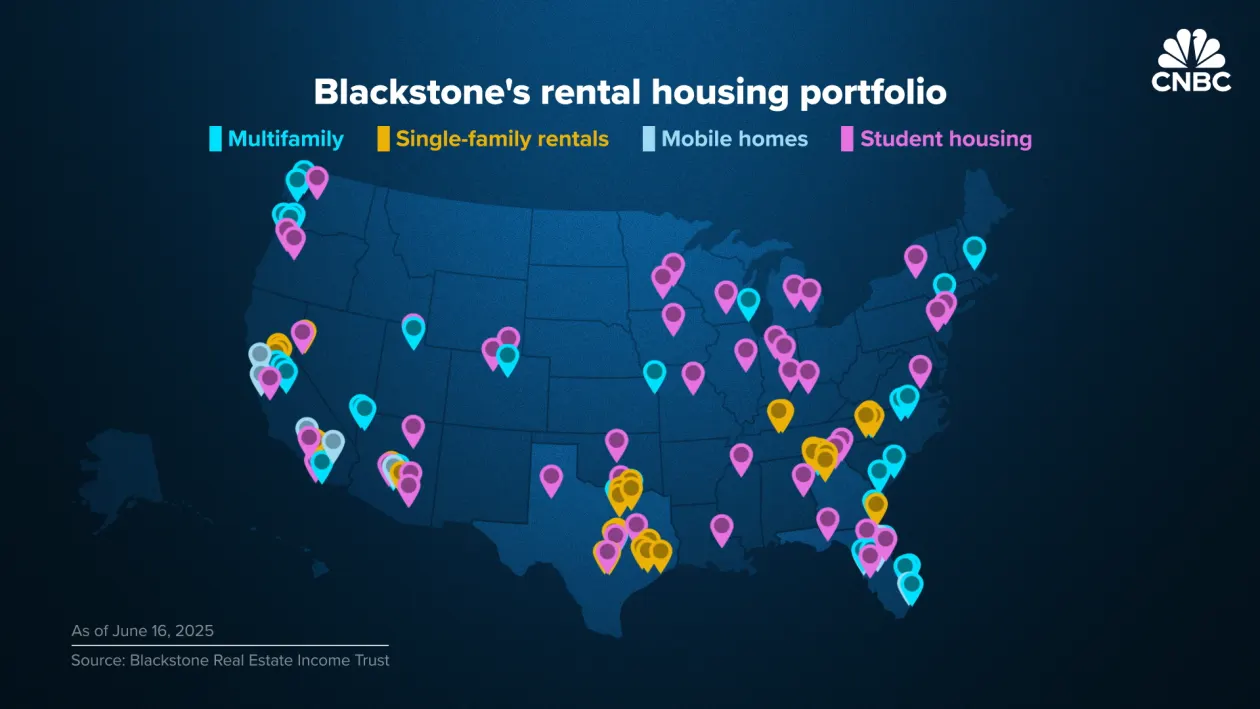

Their rental housing portfolio is quite diverse, with apartment complexes, student housing, mobile home parks, and single-family rental properties. This broad approach has allowed them to capitalize on different segments of the rental market. What’s particularly interesting is the geographic concentration of many of their U.S. assets: major cities such as New York and key Sun Belt states like Texas, Georgia, and Florida.

Blackstone’s U.S. Rental Property Portfolio Locations

Source: Internal data from Blackstone, as reported by CNBC.

This geographic focus isn’t accidental. As Kathleen McCarthy, global co-head of Blackstone Real Estate, explained to CNBC, “Really what we try to follow across the globe is job and population growth.” This aligns perfectly with what many of us know: where people are moving for jobs, demand for housing, both for sale and for rent, will follow.

Related: U.S. Housing Shortage Hits All Time High in 2025

The Scale and Strategy Behind the Acquisitions

It’s easy to assume a company as large as Blackstone owns a massive chunk of the housing market. However, they’ve stated they own less than 1% of the 46 million rental homes across the country. Still, i think 1% of the entire rental property market in a market as big as the United States is significant! While their ownership in the Blackstone Real Estate Income Trust (BREIT) product alone includes at least 274,859 rental housing units, this is just a slice of their overall real estate portfolio.

Craig McCann, principal at SLCG Economic Consulting, noted that “Of their $315 billion in real estate, only roughly $55 billion is in the BREIT product, which is sold to retail investors.” This puts their rental home acquisitions into perspective within their broader investment strategy.

Blackstone’s origins as a private equity firm, using techniques like leveraged buyouts to acquire and improve distressed assets, highlight their long-standing expertise in value creation. Greggory Warren, senior equity analyst at Morningstar, observed that “They recognized early on the value of diversification.” This foundational principle continues to guide their varied real estate interests.

Related: Northeast is Hottest U.S. Housing Market in June 2025

Why Now? The Economic Underpinnings for Investors

The timing of Blackstone’s renewed buying spree is particularly telling for real estate investors. It points to underlying economic conditions that favor rental housing as a strong investment class.

Will Pattison, head of real estate research at MetLife Investment Management, provided a key insight to CNBC: “Buying is still cheaper than building in many markets, as is typical at the start of a new cycle. This is limiting construction and supporting rent growth.” This statement perfectly encapsulates the current opportunity.

When construction costs are high and new supply is constrained, existing rental properties become more valuable. This dynamic leads to:

- Sustained Rent Growth: With limited new inventory, demand for existing rentals remains high, allowing landlords to increase rents.

- Reduced Competition from New Builds: Less new construction means less competition for your existing rental properties.

- Appreciation Potential: The scarcity of housing, combined with population and job growth, creates a strong environment for property value appreciation.

Related: 30 Cities Where Housing Inventory is Still Tight in 2025

Conclusion: What Blackstone’s Moves Mean for Your Portfolio

Blackstone’s strategic re-entry into the U.S. rental home market offers valuable lessons for us mere mortal real estate investors. Their focus on areas with strong job and population growth, combined with their recognition that buying is currently more cost-effective than building, highlights a clear path to profitability. That’s pretty much what I’ve been doing since 2016 – although on a miniscule scale by comparison.

This isn’t just about following the big money; it’s about understanding the fundamental market forces at play. The continued housing supply shortage, coupled with high construction costs, creates a compelling environment for rental property investments. For your portfolio, this means prioritizing markets with robust economic indicators, considering the long-term value of rental income, and recognizing that well-located, well-managed rental properties are likely to remain in high demand.

Related: Where and Why Americans Are Buying Real Estate Overseas

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your U.S. real estate investment journey today with high-quality cashflow real estate. Book a Free 1-2-1 Discovery Call with a member of our senior management team to discuss your personalized strategy.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

❓ Frequently Asked Questions

Why is Blackstone investing heavily in U.S. rental homes again?

Blackstone is re-entering the U.S. rental home market due to strong fundamentals like job and population growth, and the current market condition where buying existing properties is often cheaper than building new ones, which supports rent growth.

What types of rental properties are included in Blackstone’s portfolio?

Blackstone’s rental housing portfolio is diverse, including apartment complexes, student housing, mobile home parks, and single-family rental properties, with a notable concentration in major cities and Sun Belt states.

How significant is Blackstone’s ownership in the overall U.S. rental market?

Despite their large portfolio, Blackstone states they own less than 1% of the approximately 46 million rental homes across the U.S., indicating their holdings are a small fraction of the total market.

What are the key economic factors driving Blackstone’s real estate investment strategy?

Blackstone’s strategy is driven by following job and population growth, recognizing the value of diversification, and capitalizing on market conditions where high construction costs limit new supply, thereby supporting rent growth.

What does Blackstone’s renewed interest mean for individual real estate investors?

Blackstone’s moves signal confidence in the long-term stability and growth of the rental market. For individual investors, this reinforces the potential for strong rental demand, property appreciation, and the importance of investing in growth markets. It also highlights increased competition for desirable assets.

About the Author

David Garner has over 120+ personal property acquisitions in the U.S. real estate market as a Non-Resident Alien foreigner, bringing extensive practical experience to his insights. He specializes in guiding international investors through the complexities of the U.S. property landscape, focusing on cash flow opportunities, financing, and strategic wealth building. His deep understanding of the market, combined with his client-centric approach, makes him a trusted advisor for global investors seeking to establish and grow their U.S. real estate portfolio.

![USA Property Investment for Foreign Buyers [2025 Guide]](https://cashflowrentals.net/wp-content/uploads/2025/07/USA-Property-Investment-for-Foreigners-Expert-2025-Guide-500x383.png)