Is This One Place Officially America’s Worst Housing Market?

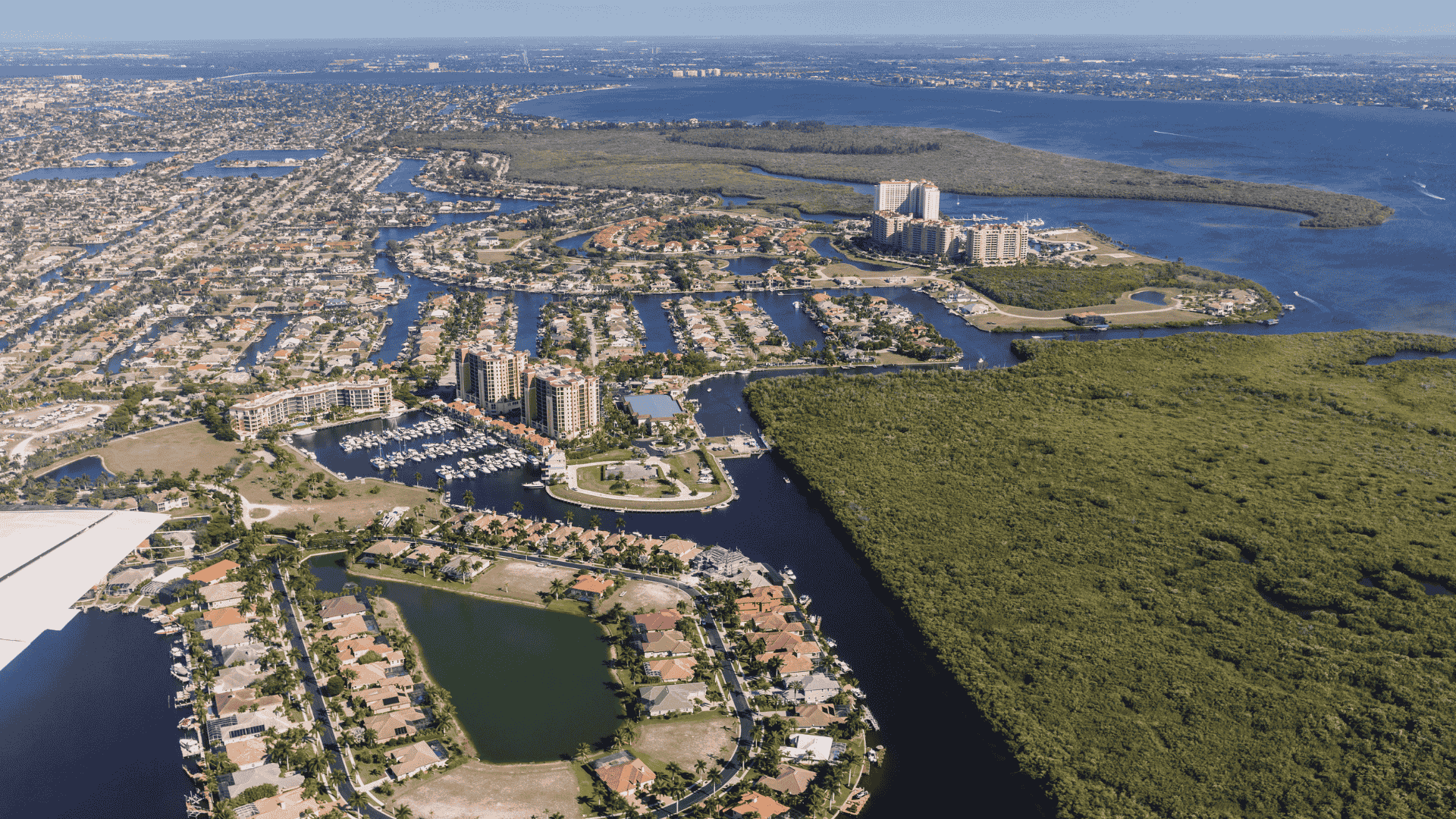

Cape Coral, Florida: Why It’s Considered America’s Toughest Housing Market for Investors

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

When I’m speaking to new clients, the most common markets of interest are Florida and Texas. But for international real estate investors, understanding market risks is as crucial as identifying opportunities. While Florida has long been a magnet for U.S. property investment, one particular city, Cape Coral, is currently facing significant challenges. It has even been labelled as potentially the “worst housing market in America.”

This article breaks down the complex factors contributing to Cape Coral’s current housing struggles. We will explore the data and discuss the implications for homeowners, potential buyers, and especially for real estate investors focused on consistent cash flow and long-term wealth in the U.S.

Investment Properties: Browse Turnkey Rental Properties in our Online Portal

Key Takeaways: Cape Coral Housing Market Challenges

- Extreme Overvaluation: Cape Coral homes were significantly overvalued, leading to a sharp correction.

- Significant Price Drops: The city has experienced notable home value declines in the past year.

- Hurricane Ian’s Lingering Impact: The aftermath of the 2022 hurricane continues to severely affect the market.

- Florida’s Insurance Crisis: Skyrocketing and often unavailable property insurance is a major financial burden.

- High Costs: Elevated property taxes and mortgage rates compound affordability issues.

- Investor Caution: The combination of falling values and high carrying costs presents substantial risks for international real estate investors.

Related: U.S. Real Estate Market Forecast and Expert Predictions for the Next 5 Years (2030)

The Perfect Storm in Cape Coral’s Housing Market

Cape Coral’s current housing market challenges stem from a confluence of factors. These include a history of overvaluation, recent price declines, the enduring impact of a major hurricane, and a statewide property insurance crisis.

Extreme Overvaluation

For a period, homes in Cape Coral were selling far above their sustainable value. Florida Atlantic University (FAU) ranked Cape Coral as the most overvalued market in the U.S. as of August 2023. At that time, homes were selling for approximately 69.19% above their long-term pricing trend. This level of overvaluation set the stage for a significant market correction.

Recent Price Declines

Following this period of inflated values, Cape Coral has seen a notable downturn. Zillow data indicates that home values in Cape Coral dropped by 8.9% in the past year (as of July 2nd 2025). This is a significant decline, especially when compared to national trends.

Hurricane Ian’s Lingering Impact

Hurricane Ian, which struck in September 2022, caused catastrophic damage across Cape Coral. The widespread destruction continues to affect the market. Many properties remain damaged or unlivable, and the rebuilding process is slow and costly. The sheer scale of the damage has created a prolonged period of uncertainty for property owners and potential buyers.

The Florida Insurance Crisis

Compounding the challenges from Hurricane Ian is Florida’s severe property insurance crisis. Many insurance companies have either left the state or drastically increased premiums. Statewide, property insurance costs have risen by as much as 40% annually. For some properties, obtaining insurance coverage at any price has become nearly impossible. This dramatically increases the cost of homeownership and makes investment highly speculative.

High Property Taxes and Mortgage Rates

Florida is known for its relatively high property taxes, which add another layer of financial burden for homeowners. When combined with the current elevated mortgage interest rates, the overall cost of owning a home in Cape Coral becomes significantly less affordable. This reduces buyer demand and puts further downward pressure on prices.

Supply and Demand Imbalance

Despite the weakening demand, builders continue to construct new homes in Cape Coral. This ongoing supply, coupled with reduced buyer interest due to high costs and risks, creates an imbalance. An excess of available homes in a market with diminishing demand often leads to further price depreciation.

Related: Will These 5 Florida Housing Markets Crash in 2025?

Implications for Homeowners, Buyers, and Investors

The challenging conditions in Cape Coral have distinct implications for different groups within the real estate market.

For Current Homeowners

Many homeowners in Cape Coral may find themselves in a difficult position. Those who purchased at peak prices are likely to be “underwater,” meaning their mortgage balance exceeds their home’s current value. The combination of high insurance premiums and property taxes adds significant carrying costs, potentially leading to financial strain. While a “paper loss” only becomes real upon selling, the inability to sell or refinance can create considerable stress.

For Potential Homebuyers

A declining market might seem like an opportunity for lower prices. However, buying in Cape Coral currently comes with substantial risks. While you might acquire a property at a reduced cost, the high and uncertain insurance premiums, potential for hidden hurricane damage, and the risk of further value depreciation make it a highly speculative purchase. Thorough due diligence, including comprehensive inspections and verified insurance quotes, is absolutely essential.

For Real Estate Investors

For real estate investors seeking consistent cash flow from U.S. rental properties, Cape Coral presents a high-risk environment.

- Negative Cash Flow Potential: The combination of potentially falling rental rates (due to weakened demand or oversupply) and rapidly increasing carrying costs (especially insurance and taxes) can easily lead to negative cash flow.

- Uncertain Appreciation: While lower entry prices might seem tempting, the market’s instability makes long-term price appreciation highly uncertain in the short to medium term.

- High Vacancy Risk: If residents leave due to economic hardship or difficulty rebuilding, vacancy rates could rise, further impacting cash flow.

- Complex Management: Dealing with hurricane damage, insurance claims, and potentially struggling tenants adds significant complexity to property management.

Our advice: Investors should approach Cape Coral with extreme caution. Deep local market knowledge, a robust risk assessment, and a clear understanding of all potential costs are paramount before considering any U.S. property investment in this area.

Related: The Best U.S. Real Estate Markets to Buy Rental Properties in 2025

Broader Florida Context

While Cape Coral faces unique and severe challenges, it’s important to note that the broader Florida housing market is also experiencing a cooling trend. Major cities like Miami, Tampa, and Orlando are seeing slower price gains compared to the recent boom.

However, Cape Coral’s situation is an extreme example of market correction, exacerbated by specific local factors like hurricane recovery and the insurance crisis. Florida’s overall strong population growth continues to be a long-term driver, but the immediate financial burdens are impacting affordability across the state.

Related: Is Cape Coral the Next U.S. Housing Market to Crash in 2025?

Conclusion: Navigating High-Risk Markets

Cape Coral, Florida, stands as a stark reminder that not all housing markets behave uniformly, even within the same state. Its severe overvaluation, coupled with the devastating aftermath of Hurricane Ian and a crippling insurance crisis, has created a uniquely challenging environment.

For international real estate investors, this market serves as a crucial case study in risk assessment. While lower prices may emerge, the high carrying costs and uncertainties make U.S. property investment in Cape Coral particularly speculative. Prioritizing markets with more stable fundamentals and predictable consistent cash flow remains key to building long-term wealth. Always conduct thorough due diligence and seek expert local advice before making any investment decisions in high-risk areas.

Previous Article: 5 Texas Housing Markets at High Risk of a Crashing by 2026

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your U.S. real estate investment journey today with high-quality cashflow real estate. Book a Free 1-2-1 Discovery Call with a member of our senior management team to discuss your personalized strategy.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

Frequently Asked Questions (FAQs) About Cape Coral’s Housing Market for Investors

- Q1: Why is Cape Coral, Florida, considered one of the worst housing markets in America?

- A1: Cape Coral is facing severe challenges due to extreme overvaluation, significant home price drops (5.9% in the past year), the lingering effects of Hurricane Ian’s widespread damage, a statewide property insurance crisis with skyrocketing premiums, and high property taxes combined with elevated mortgage rates.

- Q2: How overvalued were homes in Cape Coral, according to Florida Atlantic University?

- A2: As of August 2023, Florida Atlantic University (FAU) ranked Cape Coral as the #1 most overvalued market in the U.S., with homes selling approximately 69.19% above their long-term pricing trend.

- Q3: What impact did Hurricane Ian have on the Cape Coral housing market?

- A3: Hurricane Ian (September 2022) caused catastrophic damage, leading to widespread destruction. Many properties remain damaged or unlivable, and the slow, costly rebuilding process continues to create prolonged uncertainty and depress the housing market.

- Q4: How does Florida’s property insurance crisis affect homeowners and investors in Cape Coral?

- A4: The crisis means many insurers have left the state or drastically increased premiums (up to 40% annually), making coverage expensive or even impossible for some properties. This significantly raises the cost of ownership and holding an investment property.

- Q5: What are the main risks for international real estate investors considering Cape Coral?

- A5: Key risks include potential for negative cash flow due to falling rental rates and high carrying costs (insurance, taxes), uncertain long-term price appreciation, and high vacancy risk if residents leave. Property management can also be complex due to damage and insurance claims.

- Q6: What advice is given to potential homebuyers in Cape Coral?

- A6: While lower prices might be available, buyers should be cautious due to high insurance costs, potential hidden damage, and the risk of further value depreciation. Thorough inspections and verified insurance quotes are essential.

- Q7: How does builder activity contribute to the market imbalance in Cape Coral?

- A7: Despite weakening demand, new home construction continues in Cape Coral. This adds to the existing supply, creating an imbalance in a market with reduced buyer interest, which can lead to further price depreciation.

- Q8: Is the entire Florida housing market experiencing the same severe issues as Cape Coral?

- A8: While the broader Florida market is also cooling, Cape Coral’s situation is an extreme case. Major cities like Miami, Tampa, and Orlando are seeing slower gains but are not facing the same combination of specific local factors like extensive hurricane recovery and severe insurance challenges.

- Q9: What is the primary focus for international investors when considering high-risk markets like Cape Coral?

- A9: The primary focus should be on robust risk assessment, deep local market knowledge, and a clear understanding of all potential costs. Prioritizing markets with more stable fundamentals and predictable consistent cash flow is generally advised for building long-term wealth.

![USA Property Investment for Foreign Buyers [2025 Guide]](https://cashflowrentals.net/wp-content/uploads/2025/07/USA-Property-Investment-for-Foreigners-Expert-2025-Guide-500x383.png)