Top 7 U.S. Cities to Invest in Rental Properties in 2025

Discovering Your Next Opportunity: Best Cities to Buy Rental Properties in the U.S.

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

For property investors seeking robust and reliable income streams and long-term equity growth, identifying the top U.S. cities for rental properties is paramount. While many markets offer potential, the most lucrative opportunities combine strong tenant demand, investor-friendly regulations, and sustainable growth.

I’ve purchased over 120+ rental properties in the USA since 2016. This guide draws on up to date (June 2025) market analysis and current economic indicators. I’ll highlight my leading contenders for rental property investment, ensuring you can build a diversified and profitable portfolio.

Investment Properties: Browse Turnkey Rental Properties for Sale in our Online Portal

Key Criteria for Top Rental Property Markets

When evaluating this toplist of U.S. cities for rental property investment, I analysed the most important characteristics that contribute to stable cash flow and sustainable long-term equity growth. Beyond speculative growth, the “best” markets for rental properties (in my experience) are defined by:

- Landlord-Friendly Laws: States and cities with regulations that protect property owner rights and streamline eviction processes contribute to a more predictable investment environment.

- Strong Rental Demand: High demand, driven by population growth, job creation, and diverse demographics (e.g., young professionals, families), ensures low vacancy rates and consistent rental income.

- Stable Cash Flow & High Rent-to-Price Ratios: Markets where rental income reliably covers expenses and provides a healthy return on investment are essential, often indicated by a favourable rent-to-price ratio.

- Diversified Economies: Cities with multiple thriving industries are less susceptible to economic downturns, providing job stability for tenants and sustained housing demand.

- Relative Affordability & Sustainable Growth: Markets where property values are reasonable relative to rental income, coupled with steady, rather than speculative, price appreciation.

- Low Vacancy Rates: A low percentage of unoccupied rental units indicates a healthy and competitive rental market.

Related: The Best U.S. Real Estate Markets for Foreign Nationals and Non-Resident Investors

Top U.S. Cities for Rental Property Investment in 2025: Detailed Market Insights

Here’s a deeper look at the data supporting my list of the best cities for rental property investment:

1. Cleveland, Ohio

Cleveland offers an attractive entry point for property investors with highly affordable housing and a robust healthcare sector driving demand. The largest employer in Cleveland is The Cleveland Clinic, a world-leading medical facility. Healthcare is a very recession-resilient sector, and healthcare employees make fantastic tenants.

Cleveland consistently ranks high for housing affordability, making it easier for resident to rent and/or purchase their own home. It’s also attractive for real estate investors looking to build multi-property portfolios with less cash. Crucially, after decades of decline, the population of Cleveland is now growing, signalling strong future growth in demand for housing.

- House Prices: $145,000 (Realtor.com Cleveland Housing Market)

- Average Rent (June 26, 2025): $1,478.66 per month (Waller, Weeks and Johnson Rental Index)

- Estimated Rent-to-Price Ratio: Approximately 1.02%

- Population Growth (2023-2024): +0.30% (U.S. Census May 2025)

- Jobs Growth (12-month): +0.3% (BLS Economy at a Glance: Cleveland-Elyria-Mentor, OH MSA)

- Housing Affordability (May 2025): The typical home priced at $145,000 in Cleveland requires less than 30% of the median household income of $75,000. (Realtor.com May 2025 Affordability Benchmark)

Recommended Cleveland Neighbourhoods for Rental Property Investment:

- Old Brooklyn: An excellent C-Class city suburb for rental property investors. Old Brooklyn has an exceptionally strong rental market, and lots of affordable single family homes and small multifamily properties.

- Clark Fulton: Bordering the north of Old Brooklyn, Clark Fulton offers a strong rental market, affordable homes, and a growing local population.

- Puritas-Longmead: Offering rental property investors stability, affordable house prices, and demand from both renters and homebuyers.

Things You Should Know Before Buying Rental Properties in Cleveland

- Cleveland has a high crime rate relative to the national average. Some neighbourhoods are better or worse than others. It is often tempting for investors to chase ‘cheap’ investment properties, but this is often a mistake. Cheap properties in ‘D-Class’ neighbourhoods often come hand-in-hand with a problematic tenant base. This can result in property damage, inconsistent rental income, evictions, and higher property management costs.

- Make sure you do your research on the neighbourhood in which you intend to buy rental properties.

- Property taxes in Cleveland can be high. They are reassessed every 6 six years and can vary significantly from one neighbourhood to another.

- Make sure you have current property tax information when underwriting your rental property investment in Cleveland.

- Cleveland is home to some of the oldest properties in America. Some buildings can be over 100+ years old. While that is not necessarily a problem, you should be aware that older properties often incur higher maintenance costs. Always get a home inspection and a sewer inspection before you buy a rental property in Cleveland.

- Also make sure you incorporate higher maintenance reserves when underwriting your deal.

- The city of Cleveland and some suburbs require their own city inspections when a property is sold.

- Work with a local partner who understands the city requirements and standards.

Future Outlook for the Cleveland Rental Property Market

The population of Cleveland now growing, adding to future demand for housing. Huge investments in infrastructure and urban revitalization are well underway, including a $1.1 billion investment in Cleveland’s Hopkins International Airport, and plans for a $3.4 billion investment in a new stadium for the Cleveland Browns amongst many others.

With demand for good quality housing in the city suburbs on the rise, and housing affordability among the best in the United States, investors in Cleveland’s rental property market are likely to enjoy steady long-term price appreciation and consistent cashflow.

Download Report: Download the Comprehensive Cleveland Real Estate Market Investor Report

2. Kansas City, Missouri

Kansas City’s diversified economy, particularly in healthcare, technology, logistics, and animal health, fuels consistent job growth and a stable rental market. It’s a landlord-friendly state, adding to its appeal. The suburbs of Kansas City offer more competitive house prices than downtown. Rent to price ratios in these neighbourhoods can exceed 1%.

- House Prices: $251,631 (Zillow Home Price Index – May 2025)

- Average Rent: $1,546.65 per month (Waller, Weeks and Johnson Rental Index – June 2025)

- Estimated Rent-to-Price Ratio: Approximately 0.614% (higher in city suburbs)

- Population Growth: +1.1% (FRED: Resident Population in Kansas City, MO-KS (MSA))

- Jobs Growth: Annual increase of 1.2% (BLS Feb 2025)

- Housing Affordability: Kansas city was ranked 7th in the U.S. for housing affordability for single family homes (Economic Development Corporation)

Recommended Kansas City Neighbourhoods for Rental Property Investment:

- Independence: A popular suburban neighbourhood with both renters and first time homebuyers. Independence offers rental property investors an affordable entry price and strong rent-to-price ratio.

- Raytown: An up and coming suburban city neighbourhood. Attractive house prices and a strong renter base. Raytown offers rental property investors consistent cashflow and strong long-term house price appreciation.

- Blue Hills: The Blue Hills neighbourhood has a lot of very affordable housing and excellent rental yields. As more residents move in, house prices are appreciating.

Things You Should Know Before Buying Rental Properties in Kansas City

- Kansas City is lacking in good quality public transport. This can make some neighbourhoods less desirable if they are located away from major employment centres.

- Make sure you do your research on the neighbourhood. Stick to suburbs located close to major employment centres.

- In the suburbs of Kansas City there can be high unemployment and crime in some neighbourhoods. This can create problems with the tenant base.

- Research the neighbourhood properly. Focus on localized employment and crime data.

- Kansas and Missouri experience an average of 150 tornadoes every year. Extreme weather can result in higher property insurance premiums.

- Make sure you get a verified buildings insurance quote when you are underwriting your rental property investment in Kansas City.

Future Outlook for the Kansas City Rental Property Market

With a growing population and more jobs being added to the local economy every year, demand for good quality housing from renters and homebuyers is likely to continue to increase in Kansas City.

Big investments in the recession-resilient healthcare sector are likely to provide more reasonably well-paid jobs for residents in Kansas City. This will be reflected in steady house price appreciation and consistent cashflow for rental property investors.

View Properties: Browse Turnkey Rental Properties in Kansas City in our Online Portal

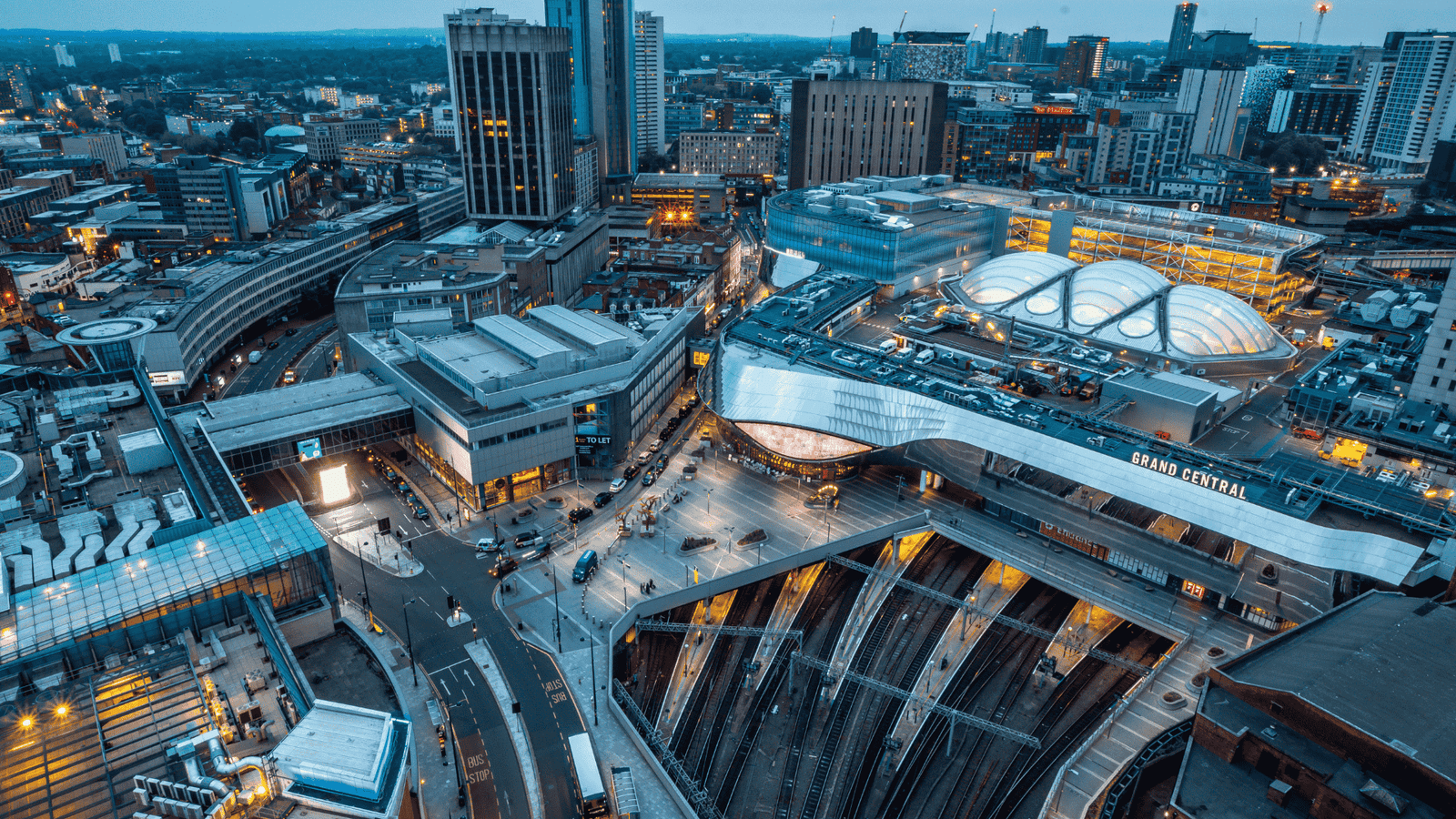

3. Birmingham, Alabama

Birmingham Alabama offers an attractive combination of affordability and solid rental yields, underpinned by a revitalized economy and ongoing urban development. The recession resilient economy is growing, providing more jobs. The housing market is one of the most affordable in the U.S., driving demand for housing from both renters and homebuyers.

- House Prices: $135,342 (Zillow House Price Index)

- Average Rent: $1,466.63 per month (Waller, Weeks and Johnson Rental Index)

- Estimated Rent-to-Price Ratio: Approximately 1.1%

- Population Growth: +0.9% (Macrotrends Birmingham Metro Area Population)

- Jobs Growth: +0.8% (BLS Economy at a Glance: Birmingham-Hoover, AL MSA)

- Housing Affordability: Birmingham is listed as the cheapest mid-size city for homebuyers, and 54% of Birmingham listings are considered affordable (Meridian Link)

Recommended Birmingham Alabama Neighbourhoods for Rental Property Investment:

Hueytown: Located 15 miles from downtown Birmingham, Hueytown boasts a high owner-occupancy rate of 76.4%. Homes are affordable, and rent to price ratios vary between 0.5% to 1%.

Forestdale, Adamsville, & Graysville: These neighbourhoods are suburban, with good access to the city. The tenant base is exceptionally strong, offering rental property investors consistent cashflow.

Pleasant Grove: Located around 20 minutes drive west of Birmingham. High household income and excellent employment rate offer rental property investors income security and the potential for long-term price appreciation.

Things You Should Know Before Buying Rental Properties in Birmingham Alabama

- The weather in Birmingham Alabama can be challenging with hot and humid summers. this can result in more maintenance and/or repairs for HVAS systems, or even property-related issue such as mold.

- Make sure the systems in your rental property are well-maintained. Replace or service the HVAC before your tenant moves in, and encourage them to replace the filet and top up fluids.

- Birmingham suffers from a lack of public transport which can make some neighbourhoods difficult for commuters who rely on public transport.

- Carefully research the neighbourhood location. Focus on neighbourhoods with high car ownership and/or better public transport links.

- Much like Kansas City, Birmingham can suffer from some extreme weather events. This can result in property damage and higher home insurance premiums.

- Make sure you get a verified home insurance quote to include in your underwriting when reviewing rental property investment in Birmingham.

Future Outlook for the Birmingham Alabama Rental Property Market

As one of the most affordable housing markets in the United States, demand for good quality housing from renters and first tie homebuyers is very strong in Birmingham.

The typical monthly mortgage payment in Birmingham is around $150 less than the average monthly rent payment. This affordability, combined with a growing jobs market and rising population will continue to drive steady price appreciation and consistent cashflow for rental property investors.

View Properties: Browse Turnkey Rental Properties in Birmingham Alabama in our Online Portal

4. Toledo, Ohio

Toledo, Ohio stands out as a great market for rental property investors because of its extremely well-priced housing and consistent rental demand, making it an excellent market for cash flow-focused property investors.

- House Prices: $127,750 (Zillow Home Price Index)

- Average Rent: $1,301.15 per month (Waller, Weeks and Johnson Rental Index)

- Estimated Rent-to-Price Ratio: Approximately 1.01%

- Population Growth: +0.065% (FRED: Resident Population in Toledo, OH (MSA))

- Jobs Growth: +0.4% (BLS Economy at a Glance: Toledo, OH MSA)

- Housing Affordability: Known as one of the most affordable housing markets in America, offering some of the lowest entry prices for investors in the U.S. (Realtor.com)

Recommended Toledo Neighbourhoods for Rental Property Investment:

- The Five Points Area: This neighbourhood includes one of the most popular school districts in Toledo. West Toledo and Library Village in particular offer excellent entry level house prices and strong rent to price ratios.

- Toledo University Area: The Scott Park and Deveaux neighbourhoods offer a solid and diversified tenant base including workers, professionals and students. Rental yields are also excellent.

- Old West End: A quiet suburban neighbourhood spanning 25 blocks. Properties are extremely competitively priced compared to surrounding neighbourhoods, and rents are relatively high.

Things You Should Know Before Buying Rental Properties in Toledo

- Due to the low house prices and relatively high rents, there is lots of competition from other rental property investors in Toledo.

- Make sure you come prepared. Have your down payment funds ready, and get a pre-approval for your mortgage (preferably a DSCR loan) before making an offer.

- There are lots of undermaintained properties in poor condition in Toledo. While this can be an opportunity, be careful not to buy yourself a headache, or invest in property on an undesirable street.

- Make sure you get a home inspection and sewer scope before you close on a rental property investment in Toledo. Also make sure to assess the condition of other houses on the street.

- There is a high level of poverty in Toledo, with many households living on or below the poverty line. This can result in poor quality tenants who struggle to pay rent on time, or at all.

- Partner with a good quality local property manager, and make sure they vet tenants thoroughly.

- Toledo has suffered a lack of investment infrastructure. You will find lots of poor quality roads needing big repairs.

- Make sure you assess the neighbourhood carefully. If you can’t visit the area before you buy a rental property, use Google street view to walk the street.

Future Outlook for the Toledo Rental Property Market

While property prices and rental yields in Toledo are some of the best in the United States, local residents often struggle with affordability. That said, house prices are still rising in Toledo due to it’s growing economy, lower cost of living, and economic development.

As one of the cheapest property markets in America, it’s likely that house prices will continue to rise, and well-located rental property investments will continue to outperform for the foreseeable future.

View Properties: Browse Turnkey Rental Properties in Toledo Ohio in our Online Portal

5. Memphis, Tennessee

Memphis consistently ranks high for cash flow potential due to its low property prices and robust rental demand, making it a favourite for investors seeking strong returns.

- House Prices: $150,448 (Zillow Memphis Homes)

- Average Rent: $1,498.19 per month (Waller, Weeks and Johnson Rental Index)

- Estimated Rent-to-Price Ratio: Approximately 0.99%

- Population Growth: -0.08% (FRED: Resident Population in Memphis, TN-MS–AR (MSA))

- Jobs Growth: +0.1% (BLS Economy at a Glance: Memphis, TN-MS-AR MSA)

- Housing Affordability: Memphis is renowned as one of the most affordable major markets in the U.S. for homeownership, directly translating to investor accessibility (National Association of Realtors Research)

Recommended Memphis Neighbourhoods for Rental Property Investment:

Whitehaven: Large, established residential area with affordable homes and consistent rental demand, driven by proximity to FedEx. A solid tenant base ideal for rental property investors focussing on consistent cashflow.

Frayser: This suburban neighbourhood has some of the most affordable house prices in the area with high cash flow potential. There is a crime problem in Frayser, but recent law enforcement and community efforts indicate the ongoing trend is positive, suggesting a brighter future ahead.

Orange Mound: Historic area undergoing intense revitalization, with potential for long-term growth and stable rents. This was the first African American neighbourhood in the U.S. to be developed by and for African Americans. While it faced challenges like urban decline and crime in the late 20th century, Orange Mound has seen significant revitalization efforts in recent decades.

View Properties: Browse Turnkey Rental Properties in Memphis Tennessee in our Online Portal

6. Baltimore, Maryland

Baltimore, a major economic hub in the Mid-Atlantic, demonstrates a stable housing market with reasonable entry points and consistent rental demand.

- House Prices: $188,791 (Zillow House Price Index)

- Average Rent: $1,926.54 per month (Waller, Weeks and Johnson Rental Index)

- Estimated Rent-to-Price Ratio: 1.02%

- Population Growth: +0.72% (Macrotrends Baltimore Metro Area Population)

- Jobs Growth: +0.8% (BLS Economy at a Glance: Baltimore-Towson, MD MSA)

- Housing Affordability: Baltimore is ranked the 22nd most affordable city for homebuyers in 2025. (WalletHub)

Recommended Baltimore Neighbourhoods for Rental Property Investment:

Canton Square: This neighbourhood is close to downtown Baltimore, making it a popular location for real estate investors The area is undergoing a lot of revitalization, offering rental property investors the potential for good house price appreciation.

Federal Hill: Federal Hill is popular with professionals, young couples, and single individuals. It’s located in South Baltimore, within walking distance of the Inner Harbor and Downtown Baltimore.

Hampden: Located in north Baltimore, Hampden properties are typically brick-built townhomes. House prices are below the national average, and rents are relatively high, offering excellent potential for rental property investors.

View Properties: Browse Turnkey Rental Properties in Baltimore in our Online Portal

7. Indianapolis, Indiana

Indianapolis, a growing Midwestern city, offers a promising environment for property investors with its affordable housing and expanding economy.

- House Prices: $233,611 (Zillow House Price Index)

- Average Rent: $1,612.81 per month (Waller, Weeks and Johnson Rental Index)

- Estimated Rent-to-Price Ratio: 0.69% (Higher in the city suburbs)

- Population Growth: +1.16% (MacroTrends)

- Jobs Growth: +0.4% (Bureau of Labor Statistics Indianapolis-Carmel, IN Economy at a Glance)

- Housing Affordability: While home prices in Indianapolis are well below the national average, it is worth noting there is a distinct lack of affordable housing options for low-income families (Indy.gov)

Recommended Indianapolis Neighbourhoods for Rental Property Investment:

Broad Ripple: Known for its vibrant nightlife, trendy shops, and proximity to the Monon Trail, Broad Ripple attracts a young, active demographic, making it a great spot for rental properties.

Fountain Square: This neighbourhood has experienced significant revitalization and boasts a thriving arts and culture scene, attracting a diverse and creative population.

Meridian-Kessler: A historic neighbourhood with beautiful homes and tree-lined streets, Meridian-Kessler offers a charming atmosphere and attracts those seeking a more established, family-friendly environment.

View Properties: Browse Turnkey Rental Properties in Indianapolis in our Online Portal

OptimizingYour Rental Property Investment

Successful rental property investment goes beyond selecting the right city; it requires meticulous planning and execution – and partnerships with high quality local professionals. Consider these aspects to optimize your investment:

- Property Management: For remote investors, engaging a reliable local property management team is crucial. They handle tenant screening, maintenance, and rent collection, ensuring smooth operations and freeing up your time.

- Cashflow Analysis: Always underwrite your rental property investments by carrying out a through cashflow analysis. Compare expected annual rental income to the property’s purchase price and ALL associated costs. Make sure to account for sufficient reserves for vacancies maintenance, and capital expenditures. Aim for a healthy cash-on-cash return that aligns with your investment goals.

- Understanding Local Regulations: Familiarize yourself with local zoning laws, rental ordinances, and landlord-tenant statutes. This expertise helps in navigating legal landscapes, ensuring compliance, and avoiding potential pitfalls (and costs).

- Tenant Screening: Implementing a rigorous tenant screening process is vital to securing reliable tenants who pay rent on time, adhere to lease terms, and care for your property.

- Maintenance and Upkeep: Regular property maintenance not only preserves the asset’s value but also keeps tenants happy, reduces turnover, and protects your investment long-term.

By leveraging these insights and focusing on cities with strong fundamentals for rental properties, property investors can build a resilient and profitable real estate portfolio in the U.S. market.

View Investment Properties: Browse Turnkey Rental Properties in our Online Portal

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your U.S. real estate investment journey today with high-quality cashflow real estate. Book a Free 1-2-1 Discovery Call with a member of our senior management team to discuss your personalized strategy.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

Frequently Asked Questions (FAQs) About Investing in U.S. Rental Properties in 2025

- Q1: What are the best U.S. cities to buy rental properties for consistent cash flow in 2025?

- A1: The top U.S. cities recommended for rental property investment in 2025, focusing on consistent cash flow and long-term wealth, include Cleveland (OH), Kansas City (MO), Birmingham (AL), Toledo (OH), Memphis (TN), Baltimore (MD), and Indianapolis (IN). These cities offer a strong combination of affordability, rental demand, and economic growth.

- Q2: What key criteria should international real estate investors use to select U.S. rental markets?

- A2: International investors should prioritize markets with landlord-friendly laws, strong rental demand, stable cash flow with high rent-to-price ratios, diversified and growing economies, relative affordability, and low vacancy rates.

- Q3: Why is Cleveland, Ohio, a good choice for rental property investment in 2025?

- A3: Cleveland offers exceptional housing affordability (median price $145,000), a strong rent-to-price ratio (approx. 1.02%), and a growing population. Its economy is bolstered by the recession-resilient healthcare sector (Cleveland Clinic) and a growing tech scene, attracting quality tenants and supporting long-term appreciation.

- Q4: What are some recommended neighborhoods for rental property investment in Cleveland, Ohio?

- A4: For rental property investment in Cleveland, consider neighborhoods like Old Brooklyn (affordable single-family homes, strong rental market), Clark Fulton (affordable homes, growing population), and Puritas-Longmead (stability, affordable prices, demand from renters and homebuyers).

- Q5: What should investors be aware of when buying rental properties in Cleveland, Ohio?

- A5: Investors should research neighborhoods carefully due to varying crime rates, be aware of potentially high property taxes (reassessed every 6 years), anticipate higher maintenance costs for older properties (some 100+ years old), and understand that the city and some suburbs require their own property inspections upon sale.

- Q6: Why is Kansas City, Missouri, considered a strong market for rental property investors?

- A6: Kansas City boasts a diversified economy (healthcare, technology, logistics, animal health) leading to consistent job growth. It’s a landlord-friendly state, and its suburbs offer competitive house prices with rent-to-price ratios that can exceed 1%.

- Q7: Which neighborhoods are recommended for rental property investment in Kansas City, Missouri?

- A7: Recommended neighborhoods in Kansas City include Independence (popular suburb, affordable entry, strong rent-to-price ratio), Raytown (up-and-coming, attractive prices, strong renter base), and Blue Hills (affordable housing, excellent rental yields).

- Q8: What are the potential challenges of investing in Kansas City, Missouri, rental properties?

- A8: Challenges include a lack of good public transport in some areas (requiring focus on car-ownership neighborhoods), potential for high unemployment and crime in certain suburbs (necessitating thorough neighborhood research), and the risk of extreme weather events like tornadoes, which can lead to higher property insurance premiums.

- Q9: What makes Birmingham, Alabama, an attractive market for international real estate investors?

- A9: Birmingham offers an attractive combination of affordability (one of the cheapest mid-size cities for homebuyers) and solid rental yields. Its revitalized, recession-resilient economy is growing, adding jobs and driving demand for housing from both renters and homebuyers.

- Q10: Can you name some good neighborhoods for rental property investment in Birmingham, Alabama?

- A10: Recommended neighborhoods in Birmingham include Hueytown (high owner-occupancy, affordable homes, 0.5% to 1% rent-to-price ratios), Forestdale, Adamsville, & Graysville (suburban, strong tenant base), and Pleasant Grove (high household income, excellent employment rate).

- Q11: What are important considerations for investors buying rental properties in Birmingham, Alabama?

- A11: Key considerations include managing HVAC maintenance due to hot, humid summers (potential for mold), a lack of public transport (focus on car-friendly neighborhoods), and the risk of extreme weather events (requiring verified insurance quotes).

- Q12: Why is Toledo, Ohio, a good market for cash flow-focused property investors?

- A12: Toledo stands out for its extremely well-priced housing (median price $127,750) and consistent rental demand (average rent $1,301.15), leading to an excellent estimated rent-to-price ratio of approximately 1.01%. It’s known as one of the most affordable housing markets in the U.S.

- Q13: What specific neighborhoods in Toledo, Ohio, are recommended for rental property investment?

- A13: Recommended Toledo neighborhoods include The Five Points Area (popular school district, affordable entry, strong rent-to-price ratios), Toledo University Area (diversified tenant base, excellent rental yields), and Old West End (competitively priced properties, relatively high rents).

- Q14: What challenges should investors anticipate when buying rental properties in Toledo, Ohio?

- A14: Challenges in Toledo include high competition from other investors, the prevalence of undermaintained properties (requiring thorough inspections and street assessment), a high level of poverty that can lead to tenant payment issues (necessitating thorough tenant vetting by a good property manager), and poor quality roads (requiring careful neighborhood assessment, possibly via Google Street View).

- Q15: How does a diversified economy benefit a rental property market?

- A15: A diversified economy, with strong sectors like healthcare, technology, and logistics, creates consistent job growth. This attracts and retains a stable workforce, which in turn fuels demand for housing, leading to a strong and reliable rental market.

- Q16: How does housing affordability impact rental property investment?

- A16: High housing affordability makes it easier for residents to rent or buy, driving overall housing demand. For investors, it means lower entry prices, potentially higher rent-to-price ratios, and the ability to build multi-property portfolios with less capital, leading to better cash flow.

- Q17: What is a “landlord-friendly state” and why is it important for investors?

- A17: A landlord-friendly state has laws that generally favor property owners in disputes with tenants, making it easier to manage properties, enforce leases, and handle evictions if necessary. This reduces risk and operational headaches for investors, contributing to more consistent cash flow.

- Q18: What is a good rent-to-price ratio for a rental property?

- A18: A higher rent-to-price ratio indicates better potential for cash flow. While what’s “good” can vary by market, ratios around 1% (monthly rent as a percentage of purchase price) or higher are often considered strong for cash flow-focused properties.

- Q19: How can international investors ensure consistent cash flow from their U.S. rental properties?

- A19: To ensure consistent cash flow, international investors should focus on markets with high rental demand, strong rent-to-price ratios, and low vacancy rates. Partnering with a good local property manager who performs thorough tenant screening is also crucial.

- Q20: What role does population and job growth play in rental property appreciation?

- A20: Growing populations and increasing job opportunities directly fuel demand for housing, both for renters and homebuyers. This sustained demand contributes to steady long-term price appreciation for rental properties and helps maintain low vacancy rates, supporting consistent cash flow.