Will These 5 Florida Housing Markets Crash in 2025?

Florida Housing Market Warning: 5 Cities at High Risk of Price Declines for International Investors

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

For international real estate investors, the Sunshine State has always been attractive. Florida offers warm weather and a strong tourism industry. But not all parts of Florida are equally stable for U.S. property investment. Recent data points to growing risks in some popular housing markets. Understanding these risks is crucial for protecting your consistent cash flow from rental properties.

This article highlights five Florida cities currently at high risk of significant home price declines. We will explore why these areas are vulnerable and what this means for your investment strategy in 2025.

Investment Properties: Browse Turnkey Rental Properties in the U.S. in our Online Portal

Key Takeaways: Florida Housing Market Risks

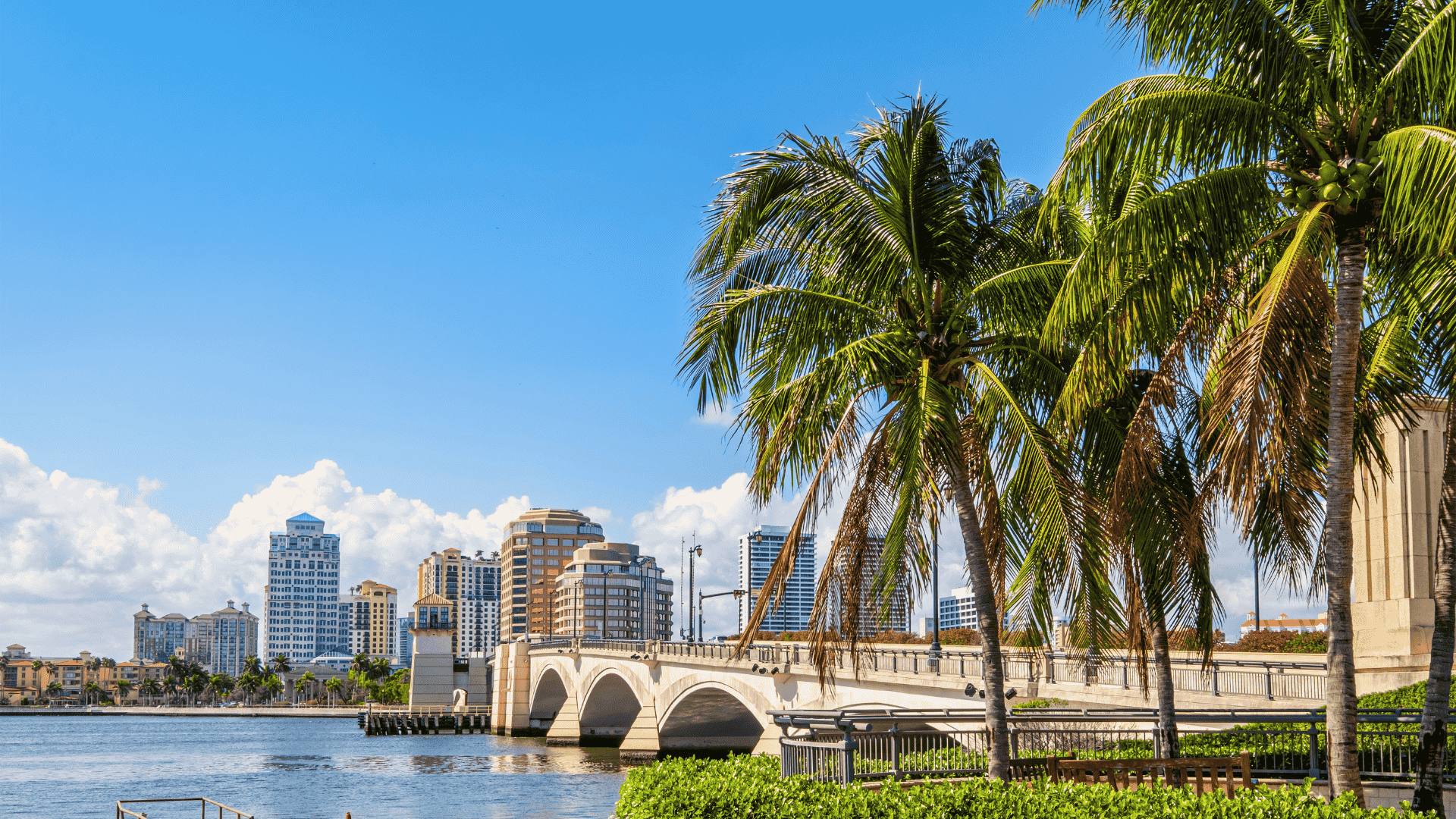

- Five High-Risk Cities: Lakeland, North Port, St. Petersburg, West Palm Beach, and Cape Coral are identified as having a high risk of price declines.

- Recent Price Drops: These cities have already seen notable year-over-year price decreases.

- Factors at Play: Over-affordability, increased housing supply, cooling buyer demand, and a pullback from some investors are driving these risks.

- Market Correction: Florida’s rapid price growth is now entering a correction phase.

- Investor Caution: International investors should approach these markets with extra caution. Focus on thorough due diligence to protect your cash flow rentals.

- Long-Term View: While risks are present, long-term fundamentals can still offer opportunities in select properties.

Related: The Best U.S. Real Estate Markets for Non-Resident Investors

The Warning Signs – Florida Markets at Risk

Recent analysis points to specific Florida housing markets showing signs of vulnerability. These areas could see more significant home price declines. For international real estate investors, being aware of these risks is the first step in making informed decisions.

Five Florida Cities at High Risk

According to April 2025 data from Cotality, five Florida housing markets are at a “very high risk” of a major price decline. These cities had rapid price increases in previous years. Now, they are entering a correction phase. The statewide average appreciation in Florida has dipped to -0.8%.

Here are the five cities identified with a high risk of price decline, along with current year-on-year house price trends as of June 26th 2025:

Related: US Housing Market 2025: Prices, Prospects & Profitable Regions

| City | Year-over-Year Price Change (April 2025) | Key Factors Contributing to Risk |

|---|---|---|

| Cape Coral, FL | -7.3% | Affordability issues, rapid past growth, supply/demand shift. |

| Lakeland, FL | -3.1% | Affordability breaking points, increased inventory, cooling demand. |

| North Port, FL | -9.21% | Overheated market, rising inventory, reduced buyer interest. |

| St. Petersburg, FL | -7.1% | Affordability concerns, increase in available homes. |

| West Palm Beach, FL | -11.5% | High past appreciation, shifting market dynamics. |

What Does “High Risk” Mean for Investors?

A “high risk of price decline” means that market conditions suggest a higher likelihood that home values will continue to fall. For international investors, this means:

- Potential for Depreciation: Your property’s value might decrease, impacting your equity.

- Impact on Cash Flow: If rental income doesn’t keep pace with expenses or if vacancies rise, your consistent cash flow could be affected.

- Buyer’s Market: Sellers in these areas may need to offer concessions or lower prices to attract buyers. This gives buyers more power to negotiate.

Related: Best U.S. Real Estate Markets for First Time Investors

Why These Florida Markets Are Vulnerable

The risks in these Florida markets stem from a combination of local and broader economic factors. Understanding these underlying causes helps international investors make informed decisions.

Factors Contributing to Vulnerability

- Affordability Breaking Points: After years of rapid price increases, homes in these areas became very expensive for many buyers. This reduces the pool of potential buyers. When homes are too expensive, demand cools down.

- Increased Inventory: More homes are coming onto the market. When there are more homes for sale than buyers, prices tend to fall. This shift from a seller’s market to a buyer’s market pressures prices.

- Cooling Migration and Demand: Florida saw a huge influx of new residents during the pandemic. This drove up prices. Now, that rapid migration is slowing down. This reduces overall demand for housing.

- Investor Pullback: Some investors who bought during the peak might be pulling back or selling. This can increase supply and put more downward pressure on prices.

Based on the fact that house prices in Florida have risen so rapidly in the past few years, this correction is not only natural, but essential for ongoing housing affordability.

Related: The Best U.S. Mortgage Options for Non-Resident Real Estate Investors

A Deeper Look at the Dynamics

- Interest Rate Impact: High mortgage rates make it harder for buyers to afford homes. Even in more affordable markets, the cost of borrowing can deter buyers.

- Speculative Investments: Some areas might have seen speculative buying. This means investors bought hoping for quick, large profits. When the market slows, these properties can be sold quickly, adding to inventory.

- Insurance Costs: High and rising property insurance costs in Florida also impact affordability for both homeowners and cash flow rentals investors. These costs can reduce the profitability of a rental property.

For international investors, these factors mean that while the sun might still be shining, the real estate investment climate in these specific Florida cities is becoming more challenging.

Related: 5-Year Forecast for the U.S. Housing Market (June 2025)

Strategic Considerations for International Investors

Navigating high-risk markets requires a thoughtful approach. For international real estate investors focused on U.S. property investment and consistent cash flow, here’s how to proceed.

Approach with Caution

- Deep Due Diligence: Do not rely on past performance. Research current local market conditions thoroughly. Look at recent sales data, active listings, and days on market.

- Analyze Cash Flow Rigorously: Calculate potential rental income against all expenses. This includes property taxes, insurance, maintenance, and potential vacancy rates. Ensure there’s a strong margin for consistent cash flow.

- Long-Term Horizon: If you invest, plan for the long term. Price corrections are often part of a market cycle. A property bought for its long-term rental income potential might still be viable.

- Avoid Speculation: This is not a market for quick flips or speculative gains. Focus on fundamental value and sustainable rental demand.

Related: How to Structure Your U.S. Property Investment for Tax Efficiency and Liability Protection

Maximizing Your Investment Strategy

- Look for Value: In a buyer’s market, you might find properties offered below peak prices. This can be an opportunity if the long-term outlook is good.

- Focus on Specific Neighborhoods: Even within a “high-risk” city, some neighborhoods might be more stable. Research areas with strong local amenities, good schools (if relevant), and consistent demand.

- Diversify Your Portfolio: Do not put all your investment capital into one high-risk market. Consider diversifying across different U.S. states or cities with more stable outlooks.

- Partner with Local Experts: Work with a trusted real estate agent and property manager who have deep local knowledge. They can provide insights into micro-market trends and potential challenges.

For international investors, understanding the nuances of these Florida markets is crucial. While the headlines might sound alarming, they also signal a shift that can create new entry points for those prepared to take a measured, strategic approach to U.S. property investment.

Related: Falling House Prices in the USA: Everything You Need to Know

Conclusion: Informed Decisions for Florida Investments

The warnings about price declines in Lakeland, North Port, St. Petersburg, West Palm Beach, and Cape Coral are important for international real estate investors. Florida’s housing market is undergoing a correction after a period of rapid growth. This means increased risk in these specific areas.

However, understanding why these markets are vulnerable allows for a more strategic response. For investors focused on consistent cash flow from U.S. property investment, the current environment demands extra caution and thorough analysis. By focusing on strong fundamentals, carefully calculating potential returns, and seeking expert local guidance, you can navigate these challenges. This approach will help you make wise choices in the evolving Florida real estate landscape.

Previous Article: Is the Cape Coral Real Estate Market Going to Crash in 2025?

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your U.S. real estate investment journey today with high-quality cashflow real estate. Book a Agende uma conversa estratégica gratuita e individua with a member of our senior management team to discuss your personalized strategy.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Agende uma conversa estratégica gratuita e individua with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

Frequently Asked Questions (FAQs) About Florida’s High-Risk Housing Markets

- Q1: Which Florida cities are at high risk of a housing price crash in 2025? A1: According to recent data, Lakeland, North Port, St. Petersburg, West Palm Beach, and Cape Coral are identified as high-risk markets for significant home price declines.

- Q2: Why are these specific Florida markets considered high risk for price drops? A2: These markets are vulnerable due to factors like past rapid price increases (leading to affordability issues), an increase in housing inventory, a slowdown in buyer demand, and a general market correction after unsustainable growth.

- Q3: How have home prices in these high-risk Florida cities changed recently? A3: These cities have already experienced notable year-over-year price declines as of April 2025. For example, Cape Coral saw a -6.5% drop, Lakeland a -4.7% drop, North Port a -4.6% drop, St. Petersburg a -4.0% drop, and West Palm Beach a -3.9% drop.

- Q4: What should international investors do if they own property in these high-risk Florida markets? A4: If you own property in these areas, consider a long-term holding strategy if your cash flow is strong. Price your property competitively if selling. Monitor local market trends closely and consult with a local real estate expert.

- Q5: Is it still possible to find good investment opportunities in Florida despite these risks? A5: Yes, but with increased caution. Focus on thorough due diligence, analyze cash flow potential carefully, and research specific neighborhoods within or outside these high-risk areas that demonstrate stronger, more stable fundamentals and demand for cash flow rentals.

![USA Property Investment for Foreign Buyers [2025 Guide]](https://cashflowrentals.net/wp-content/uploads/2025/07/USA-Property-Investment-for-Foreigners-Expert-2025-Guide-500x383.png)