Understanding Lien Position and Priority for Private Lenders

David Garner

Lien Position and Priority 101

If you are thinking about note investing or private lending, you need to understand lien position and priority. The lien provides security for your investment, but not all liens are created equal. Some types of lien might even stop you recovering your investment in a foreclosure. So, pay close attention!

Pro Tip: Get fully-vetted private lending deals in your inbox every Thursday

Contents:

What is a Lien

From the point of view of a note investor or private lender, the lien is the backstop for your investment. It is a deed – usually a mortgage deed or a deed of trust – which is recorded against the title to a piece of real estate in the County land records.

The lien gives you the right to take ownership, or force the sale of the real estate if the borrower defaults on the terms of a mortgage loan. these terms are included in a separate promissory note which is not recorded.

While the specific terminology to be included in a mortgage or deed of trust varies from State to State, every lien should contain at least the following:

- Borrowers’ name(s)

- Real Estate address

- Legal description of the Real Estate

- Amount of the debt

Once a loan is fully repaid, the lender should record a release (or satisfaction) of mortgage or a reconveyance of deed in the county land records. This releases the lenders charge over the property.

Related: Private Lending 101 – Everything You Need to Know About Private Lending

Voluntary Liens

Voluntary liens are recorded in agreement between the Lender and the Borrower. As an investor in mortgage notes, whether as an originating private lender or a secondary note investor, you will have either a 1st position or second position lien in the form of a mortgage deed, or deed of trust.

The position of the lien determines the order in which creditors are settled in a foreclosure. This is known as the “first in time, first in right” rule. So, if the proceeds of the sale are insufficient to repay all liens, 2nd position creditors would lose out first.

1st Position Liens

First position liens usually take priority over all other liens. That said, there are some instances where other liens can take priority over even a first position mortgage. This is why ensuring clean title (and title insurance) is so important. We’ll cover this more later in this article.

2nd Position Liens

A 2nd position mortgage is a junior lien. These are paid out only after the first position lien has been settled in full. Second mortgage loans, equity release loans and Home Equity Line of Credit (HELOC) will be in 2nd position.

For the purposes of private lending, you really want to make sure that you are always in first position. If you do loan in second position, make sure your return on investment reflects the extra risk you are taking.

Related: Note Investing 101 – Everything you Need to Know About Real Estate Mortgage Note Investing

Involuntary Liens

As a private lender, you might also come across involuntary liens. Some of which can take priority over even a 1st position lien, placing your entire investment at risk.

Judgement Liens

Involuntary liens include judgement liens. A judgement lien happens when someone loses a legal case in court and the winner can file a lien against the losers property. The most common types of judgement liens you might come across are placed by unsecured creditors.

Credit card companies, personal loan providers or holders of unpaid medical bills can all file liens against a property if they sue and win a money judgement in court.

For the most part, judgement liens are settled last of all in a foreclosure. So, if you are in first, or even second position, most judgement liens in and of themselves pose little threat to your investment.

But there are some liens which take priority over all other liens in a foreclosure. These are dangerous and can have a huge impact on the security of your investment in a foreclosure. In some cases, the creditor has the right to place a lien without even going to court.

Mechanic’s Liens

A mechanic’s lien is another type of judgement lien insofar as the creditor requires a court judgement to file the lien. This can happen if a homeowner fails to pay a contractor. The contractor can use their court judgement to file a lien against the property. In some cases the contractor can even force the sale of the home.

If the contractor started work or supplied materials to the property before your first position mortgage was signed or recorded, then the mechanic’s lien can take priority over 1st position liens in a foreclosure.

HOA Liens

In most cases, a Condominium Owner Association (COA) or a Home Owners Association (HOA) has the right to file a lien against property where the owner has failed to pay fees or special assessments. They do not require a court judgement, and these liens can take priority over a first position mortgage in a foreclosure.

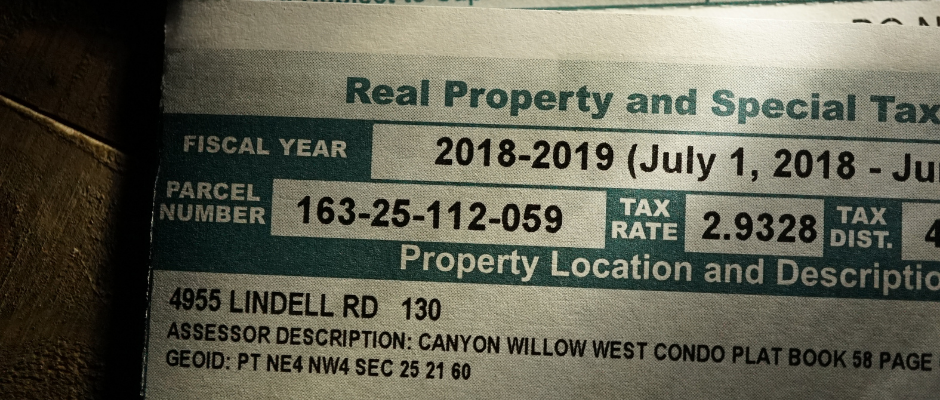

Property Tax Liens

A property tax lien takes priority over all other liens, period! This is one example of where the “first in time, first in right” rule does not apply. One way or another the Government will get their taxes!

I have seen property tax debt destroy the investments of plenty of note investors and private lenders. I can bring to mind at least two prominent examples of real estate owners that let unpaid property taxes back up for more than 3 years. The properties were lost to a tax sale. The Lenders lost their entire investment!

IRS Liens

The Internal Revenue Service will file a lien against a property if back taxes remain unpaid. Whilst an IRS lien does not take priority over a first position mortgage, they do have the power to force the sale of the property.

In most States, the recipient of court-ordered child support can file a lien for unpaid payments without a court judgement. Child support liens do not take priority over 1st position mortgages.

Related: The Ultimate Pre-Lending Checklist for Private Lending Investors

Foreclosure Example

Let’s say you are a private lender with a first position mortgage for $100,000. Your borrower defaults, and you enter into a foreclosure.

This borrower also has a 2nd mortgage for $15,000, a mechanics lien for $50,000 from some home improvements, and a $5,000 property tax lien. In addition, the borrower has a $10,000 lien from a credit card company.

Some of these involuntary liens put the integrity of your investment at risk even though they were filed after your first position mortgage.

Assume the property is sold as a foreclosure for $110,000.

From the proceeds of the sale, the property tax lien is settled first, leaving $105,000. Then, the mechanic’s lien is settled because the contractor started work before your first mortgage was recorded.

This leaves just $55,000 for you, even though you were the first position lender. Due to the other liens, you are effectively taking a $45,000 haircut on your investment.

In this case, the second mortgage lender and the credit card company get nothing. They must pursue the borrower separately for their debt.

Related: The Investors Guide to Real Estate Appraisals and Due Diligence

A Note of Caution

As I explain here, it is absolutely critical to understand the true value of the real estate. But, it is also essential to check the condition of the title for any private lending investment. Having prior knowledge about pre-existing lien position and priority is essential.

It is also important to understand your Borrower (credit risk). If they have a lot of outstanding credit, or are already underwater with previous loans – it may be a case of throwing good money after bad. A borrower that is using a new loan to settle previous debts that have gotten out of control could be a red flag.

Exercise caution. Make sure you understand real estate and the borrower, and you will be well-positioned to minimize your risk of loss if something goes wrong.

Invest: Learn about our Private Lending Program for passive income investors here

More Private Lending and Note Investing Articles

- Where to Buy Mortgage Notes – A Complete List of Verified Sources

- Private Lending 101 | The Complete Guide to Private Money Lending

- Note Investing 101 – Everything you Need to Know About Note Investing

- How to Invest in Notes – 7 Note Investing Strategies

- What is a Note and What Terms Should It Contain?

- Performing vs Non-Performing Notes – Which is the Better Investment?

- The Private Lender’s Guide to Assessing Credit Risk

- Understanding Lien Position and Priority

- How to Buy Mortgage Notes Online in 2021

- How to Assess Real Estate for note Investing and Private Lending

- Find Performing Notes for Sale in 2021

- Private Lending 101 – Everything you Need to Know About Private Money Lending

- Is Buying Mortgage Notes a Good Investment in 2021?

- Note Investing vs Rental Properties – Which is the Best Investment?

- Performing Notes – What Why and How to Buy

- Is Real Estate Note Investing Risky?

- Real Estate Notes vs REITs – Which is the Better Investment?

- The 3 Best Real Estate Investing Opportunities in 2021

- What is the Difference Between a Note and a Mortgage?

- Real Estate Notes – Everything You Need to Know

- My Top 5 Real Estate Note Investing Tools and Resources

- 3 Note Investing Funds for Passive Investors

- Using Note Investing to Boost Your Monthly Income

- Non Performing Notes – Everything You Need to Know

External Resources: