Warnings Signs for Investors in Joe Biden’s Housing Policy

David Garner

Note Investors and Private Lenders Beware

With the United States of America seemingly decided on a Biden/Harris presidency, it is important for us to consider what changes may now come, and how best to position ourselves to avoid undue risk, and flourish.

In this short series of articles, I will take you through some of the proposed changes to US housing policy under the new administration, and look at the potential impact for investors in the real estate market.

Today in part 1, we look at how some of the proposed legislation might affect private lending and note investing.

Don’t Miss Out: See Exclusive Investment Opportunities in Your Inbox Every Thursday

Table of Contents

- The US Housing Market Today

- Biden’s Housing Policy Overview

- Key Concerns for Note Investors and Lenders

- What Does it all Mean?

Before we dive into the nitty gritty of policy detail, it’s important to get a baseline. Let us take a quick look at today’s real estate market.

US Housing Market Snapshot Q3 2020

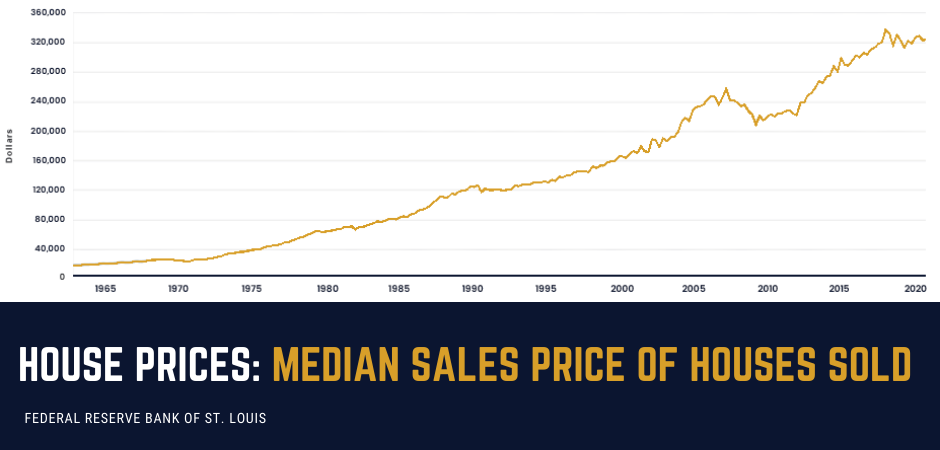

As 2020 draws to a close, the US real estate market is sitting at the business end of an 11-year bull run. House prices are up 56% since 2009, and yet there are no signs of an impending crash such as we experienced in 2007. Why? Basic supply and demand.

You see, there is a huge housing shortage. Inventory is at an all-time low, with only 3.6 months of supply listed for sale right now. That is way below the previous 2009 peak of 12.8 months.

At the same time, record low interest rates have made paying higher houses prices more affordable. And the American Dream is alive and well… people still want to own their own home.

Of course, what goes up must come down. Eventually prices will become too high, and/or interest rates will start to rise again. Buying activity will abate, inventory will rise, and prices will fall. This is how the market works.

But with interest rates likely to remain low for several years, and no sign of millions of more homes coming to the market, things look pretty stable, at least for now.

Related Content: Everything You Need to Know About Becoming a Private Lender

Biden’s Housing Policy

With a pricey but affordable and relatively stable market as a starting point, what will a Biden presidency bring in terms of housing policy that might impact us as investors?

According to the Biden campaign website, the President Elect’s housing policy is based on 4 key pillars:

- Ending redlining and other discriminatory and unfair practices in the housing market.

- Providing financial assistance to help hard-working Americans buy or rent safe, quality housing, including down payment assistance through a refundable and advanceable tax credit and fully funding federal rental assistance.

- Increasing the supply, lowering the cost, and improving the quality of housing, including through investments in resilience, energy efficiency, and accessibility of homes.

- Pursuing a comprehensive approach to ending homelessness.

To achieve its goals of making home ownership accessible and affordable for all, Biden intends to invest $640 billion into the housing market over the next decade.

Sounds great, right? Well, as always, the devil is in the detail.

Concerns for Private Lenders and Note Investors

There are plenty of good ideas in Biden’s plan for housing. Tax credits for first time buyers to fund deposits, potentially Federal insurance for higher risk loans, and lots of money for affordable housing development to name a few. But of course, there are things we should be concerned about.

“If you are involved in real estate as private lender or note investor, you should be paying very careful attention to this administration. Rarely has Government intervention in any market resulted in anything but calamity in the end.”

David Garner, Garnaco

Whether you are a landlord, house flipper, private lender or note investor, there are parts of this proposed legislation that could impact your business in a number of ways.

Let’s look at some of the specifics that might be particularly relevant for private lenders and note investors.

Related Content: Everything You Need to Know About Becoming a Private Lender

A New Bill of Rights for Homeowners

As part of the commitment to end unfair practice in the housing market, Biden intends to introduce a new Bill of Rights for homeowners. This will be modelled on the current California Homeowner Bill of Rights. This is effectively a piece of legislation designed to protect homeowners from foreclosure.

The President Elect wants to roll out a national bill, and to significantly expand its scope.

According to the Biden campaign website, this new legislation will:

- Prevent mortgage brokers from leading borrowers into loans that cost more than appropriate.

- Prevent mortgage servicers from advancing a foreclosure when the homeowner is in the process of receiving a loan modification.

- Give homeowners a private right of action to seek financial redress from mortgage lenders and servicers that violate these protections.

- Give borrowers the right to a timely notification on the status of their loan modifications and to be able to appeal modification denials.

Whilst this all sounds great for homeowners, there is a great deal for investors to be concerned about, and my immediate questions would be:

- Who will decide what an ‘appropriate cost’ for a loan should be?

- What will qualify as predatory practice?

- What will the criteria be for borrowers to qualify for protections and/or recourse against their lender?

- What burden of proof will lie with the borrower to prove they qualify as such?

- What recourse will be awarded to borrowers?

[Key Concerns] Lenders and note owners could be forced into modifying loans with existing borrowers if the terms are now deemed to be ‘inappropriate’ under new guidelines. This could be the interest rate, fees, or how the loan was written at the time.

This also applies to new loans, and could make it impossible to set appropriate interest rates that accurately reflect the lender’s risk.

Depending on the scope of any new legislation, some loan modification strategies may no longer be allowed. This could seriously limit options for profitable workouts and exit strategies for note investors.

Expanding Government Oversight and Intervention

Much of Biden’s approach to housing is based on the expansion of Federal oversight and enforcement that was rolled back by the incumbent Trump administration.

This includes expanding the scope of the Community Reinvestment Act to apply to non-bank lenders.

The Community Reinvestment Act was passed by President Jimmy Carter in 1977. It requires Federal regulators to assess banks on how well they meet the credit needs of low and moderate-income neighborhoods.

Under Biden’s revised terms, some non-bank lenders would also be required to meet these standards. This extra regulatory burden would include providing a statement detailing their commitment to the public interest and to lending and investing without discrimination.

Non-bank lenders would not only have to stump up the cost of establishing the systems and processes required to comply with the Act, but also to then monitor and enforce them on an ongoing basis.

Furthermore, Biden intends to restore enforcement powers to the Office of Fair Lending and Equal Opportunity, a division of the Consumer Financial Protection Bureau. This would allow these agencies to enforce settlements against lenders found to have discriminated against borrowers.

While the Trump administration increased the burden of proof for those claiming discrimination in the financial services sector, the Biden Administration is seeking to reverse this.

[Key Concerns] All this results in more cost and more risk for lenders. Private lenders and note investors might find their business activities and investments unexpectedly caught under the umbrella of a Federal regulator.

They may find themselves accused of discrimination with little burden of proof on the Plaintiff and the full weight of the Federal Government at their back.

Related Content: Everything You Need to Know About Becoming a Private Lender

What Does it all Mean?

In the long run, time has proven that large scale State intervention has rarely had a positive impact in any commercial market. Just look at the cost of healthcare or education.

If any of this new legislation were to make it into law, lenders would – quite rightly – become more cautious. And cautious lenders only lend to prime customers.

If private money lenders and other non-bank alternatives are also regulated out of business, then access to homeownership for anyone with less than perfect credit becomes almost impossible. And so, the renters trap persists.

I spoke to Alex Breshears, a private lending expert and owner of Infinite Road Investments, a private lender and fund manager based out of Richmond;

“With more oversight and legislation businesses have to bring people on staff to worry about compliance and process all the extra paperwork involved in whatever that system of regulation and legislation requires. That potentially makes the cost of doing business unsustainable for smaller companies.”

Alex Breshears, Infinite Road Investments, LLC

But let us get something straight. A Republican-led Senate will likely block any sweeping changes from the White House into becoming actual law. That said, there is plenty here to keep our eyes on.

Look out for part 2 of this series, where will look at Biden’s housing policy from the point of view of the Landlord. Make sure you don’t miss out by subscribing to our weekly newsletter here.