Mortgage Notes For Sale | The Ultimate List of Note Sellers

Investor Bonus: See Exclusive Performing Mortgage Notes For Sale Every Thursday

Looking to add real estate notes to your investment portfolio or retirement account? Don't get caught by scammers... Here's my complete list of legit online sources to find mortgage notes for sale right now

David Garner

Mortgage Notes For Sale – My Ultimate List

Real estate note investing (and private money lending) can be very profitable, but where do you find good quality mortgage notes for sale?

Well, you need search no more! Here is my comprehensive list of mortgage note sellers where you’ll find thousands of mortgage notes for sale right now!

See Mortgage Notes for Sale: Join 5,000+ investors and get brand new and exclusive mortgage note sale listings delivered to your inbox for free every Thursday

Contents:

- Deciding What Type of Mortgage Notes to Buy

- Mortgage Notes For Sale Online

- Crowdfunding Websites

- Note Brokers and Funds

- Private Lending Investments

- Buying Mortgage Notes From Banks

- How to Get Started

While this list won’t make you a real estate note investing expert, there are over 20 resources where you’ll find all types of real estate notes for sale.

I hope you find it useful. If you want to see details of NEW exclusive mortgage notes for sale every week, join the Priority Investor Email below.

[/fusion_text]Deciding What Type of Mortgage Notes to Buy

A quick crawl of the internet will tell you that there are many different types of mortgage notes for sale out there.

There are performing notes and non performing notes (paying vs non-paying borrowers), and there are also 1st position and 2nd position loans along with a ton of other variations.

It’s worth ‘noting’ early on that 1st-position loans carry less risk of loss to the lender in a foreclosure situation than 2nd position notes (I’ll cover that in more detail later in this article). But ultimately, the type of note(s) you buy should be defined by your personal investing objectives and tolerance for risk.

Whatever kind of mortgage note you buy, there will be some work involved if you are to maximize your return on investment while minimizing risk.

Mortgage Note Investing Strategies

Here are the 7 most common mortgage note investing strategies used by private investors:

- Flipping notes to other investors (wholesale to retail)

- Rehabbing notes and reselling to other investors (value add)

- Purchasing notes to own and/or sell the real estate

- Originating seller financed notes for income or resale

- Rehabbing (modifying) notes and keeping them for passive income

- Buying performing notes for passive income

- Originating private money lending loans

So, if earning relatively low-risk, low-maintenance passive income is your goal, look for 1st position performing notes to buy and hold.

You could also consider originating private money lending loans where you choose the borrower and project, and you set the loan terms.

If on the other hand you want to seek out the big jackpot financial wins (and you have more time, expertise and resources to hand), you should maybe look for heavily-discounted non-performing notes for sale instead.

Don’t Miss Out: Join 5,000+ investors and get brand new and exclusive mortgage note sale listings delivered to your inbox for free every Thursday

Mortgage Notes for Sale Online

The first port of call for most investors new to the note investing game is to search for mortgage notes for sale online.

While there are plenty of places you can buy mortgage notes online, it is important to remember that you will be paying retail prices for these notes.

If you want to buy mortgage notes at wholesale prices, you need to buy direct from banks and other lenders, or from the 1st-tier investors that already buy mortgage notes directly from these institutions.

I’ll cover buying notes direct from lenders in another article. For now, here is a list of online sources that offer mortgage notes for sale online to the general public.

Garnaco Investor Program

Garnaco is a real estate investment business with it’s own lending investing program.

Garnaco helps investors earn more passive income with 1st position performing notes and private lending investments.

The company funds acquisitions for its affordable housing program by partnering with investors who buy mortgage notes secured against the real estate.

Garnaco also send out details on new mortgage notes for sale every Thursday in their Priority Investor email newsletter.

Fin out more about this program here.

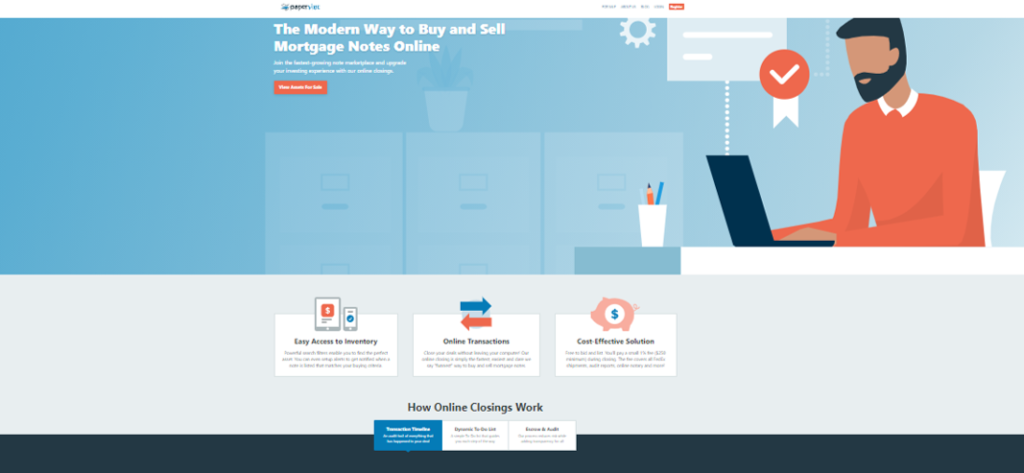

Paperstac

Paperstac has taken buying and selling mortgage notes completely online.

The platform bills itself as the first fully-digitized mortgage note transaction engine, and they’re not wrong.

Anyone can buy and sell mortgage notes on Paperstac.

They have digitized the entire process, from listing notes for sale, through negotiations, contracts, notary and shipment.

Listing a mortgage note for sale on Paperstac is free, and they charge a nominal fee of 1% for successful sales.

This can be a great option for anyone looking to buy their first mortgage note because the platform essentially holds your hand right the way through your purchase, making sure you don’t miss any of the important little details.

Notes Direct

Notes Direct is another online mortgage note trading platform that allows you to buy and sell mortgage notes and real estate online.

You will find all sorts of mortgage notes to buy here, including performing notes, non-performing loans, and physical real estate.

This platform allows pre-vetted buyers to submit qualified offers to buy mortgage notes. There is also an email list you can join that will alert you when new mortgage notes are listed for sale.

Loan MLS

Loan MLS is a mortgage note trading platform that boasts a membership of over 20,000 qualified note investors and mortgage note buyers, making it a great place buy and sell notes.

As well as listing mortgage notes for sale, they have a wanted ads section where you can post details of the kind of notes you are looking to buy.

There is also the option to work with loan originators to fund new loans, which is a great option if passive income is your goal.

Loan MLS does not charge any fees or commissions, making it a cost effective way to buy notes.

Watermark Exchange

Watermark Exchange operates a mortgage note trading desk where larger institutional investors and banks can list their notes for sale to retail note investors.

According to it’s website Watermark expects to have over 9,000 notes listed for sale in 2023.

Watermark offer a great search feature that shows notes for sale geographically. You can search and find a unique map of notes and real estate in your target area.

You can also use Watermark’s own due diligence process and investment forecast for each note.

They also operate a Buyers Club where you can buy off-market mortgages.

Note Trader Exchange

Note Trader Exchange is an online platform that matches mortgage note seller with buyers.

For buyers, they list mortgage notes for sale from banks, institutions, and private investors.

NTE also offers sellers several note buying options when listing their mortgage notes for sale on the site, including Buy it Now, Place a Bid or Make and Offer.

Buying a Mortgage note through Note Trader Exchange is fairly simple using their 6-step closing process. using a Licensed Title/Escrow Company.

CREXi

CREXi is an online marketplace and MLS that lists commercial real estate and mortgage notes.

To find notes to buy on CREXI, you can navigate to the the ‘for sale’ section, and filter listing by type ‘note’.

Commercial properties such as multifamily or industrial buildings tend to be larger, and so the real estate notes for sale on CREXi are inevitably quite large also.

View Notes For Sale: Join 5,000+ Investors in Our Private Lending Portal and See Exclusive Off-Market Investment Opportunities Every Week

Note Investing Crowdfunding Websites

If you want the passive income from mortgage notes, but do not have the knowledge, time, or capital required to buy whole mortgage notes, you can instead look to one of many crowdfunding platforms that offer investments in mortgage notes.

The Title III of the JOBS Act – the Crowdfund Act – was finally adopted by the SEC in October 2015.

This new law allows companies to use crowdfunding to issue securities to retail investors, something that was not previously permitted.

Crowdfunding is especially prevalent in the real estate industry.

There are a number of well-established crowdfunding website offering smaller partial investments in single family homes, multifamily properties, industrial real estate and real estate debt.

Peer Street

Reserved for accredited investors, Peer Street connects buyers with notes from some of the country’s leading loan originators.

This platform is ideal if you are looking for a hands-off way to invest in notes.

There are number of different products on Peer Street, and you can use the done-for-you service to build a portfolio of notes to spread your risk across multiple loans.

Despite being reserved for accredited investors only, if you do qualify as such you can invest in a mortgage note with as little as $1.00.

Returns are not as good as other methods of investing in notes at roughly 6% to 9% p.a., but Peer Street are well established and have a proven track record of returning over $175 million in interest to its investors.

Patch Lending

Patch lending is another crowdfunding website that allows you to invest in real estate debt alongside other investors.

Like Peer Street, this is not like buying an individual note.

The team at Patch Lending (formerly Patch of Land) source the deals, do the due diligence, then post them online for investors to fund.

One great thing about Patch Lending is the fact that they sometimes invest their own money in the deals they promote.

You can invest with as little as $5,000, and earn returns up to 12% p.a. The projects on this platform tend to be between 30 days and 36 months.

Fundrise

Fundrise is another crowdfunding option that allows you to invest in real estate notes alongside other experienced investors.

This is another done-for-you service that suits passive investors who do not want to spend the time effort and resources to buy mortgage notes direct from sellers or lenders.

There are a number of investment options to choose from at Fundrise, and you can start with an investment of just $500.

One of the best features of this platform is the fact that every investment is regulated by the Securities and Exchange Commission (SEC).

Lending Home

While Lending Home do sell whole mortgage notes to institutional investors, if you are an individual (accredited) investor you can buy ‘platform notes’.

Lending Home are a direct lender, meaning they loan out their own capital then sell the notes on their online platform.

Lending Home has minimum investment of $50,000, but you can invest as little as $5,000 in individual loans.

That means that even the minimum investment amount allows you to build a portfolio of up to 10 notes.

Every investment is for a minimum of 12 months and they have an AutoInvest feature that will reinvest your monthly interest check in new loans.

Note Brokers and Funds

We have already covered a bunch of online mortgage note investing platforms, and some of the best note crowdfunding website…

…Now, let’s talk about note brokers and funds.

Note brokers typically buy mortgage notes wholesale from banks and other large investors, some of these notes they will keep, others they will offer for sale.

You will find that brokers offer a range of notes for sale to the general public, including re-performing notes they have worked out themselves, to just flipping the trash notes they do not want or have not been able to work out.

Note funds are collective investments that offer shares, units or memberships in a fund.

The fund will use investor capital to will buy mortgage notes, and the fund manager will then work out those loans to the most appropriate exit strategy (or hold).

Often these funds offer a fixed or preferred return to their investors, with excess profits going to the fund manager.

Paper Assets Capital

Paper Assets Capital is a note broker that runs a trade desk and a note fund.

You can buy individual real estate notes direct from their trade desk, or units in their note fund.

Anyone can buy an individual mortgage note, but fund investments are reserved for accredited investors.

The Paper Assets Capital note fund (PAC FUND IV, LLC) offers unit holders a fixed return of between 8% and 12% p.a.

Depending on how much you invest. The term of an investment in the fund is 36 months.

I would imagine that many (if not all) of the individual mortgage notes for sale through the trade desk will be mortgage notes that the fund is selling…. effectively using the trade desk as an exit strategy for the fund.

Fusion Notes

Fusion Notes is a Colorado-based mortgage note investor that offers the opportunity to invest in their mortgage note fund.

Fusion also provide training and education for note investors.

Fusion are the primary buyer and seller for all of their notes, so they are note a note broker.

Equity First Funding

Equity First Funding are a real estate and note investment company.

They buy and sell notes for their own account, and also buy real estate and sell with seller financing and then sell those notes.

The Equity First website has a listing portal where they display all of their mortgage notes currently for sale.

The platform includes some useful filters for performing notes, non performing notes and sub performing notes.

Noteworthy Investments

Noteworthy Investments is a buyer and seller of mortgage notes based out of Cape Canaveral, Florida.

There is not a great deal of information available on their website about the types of mortgage notes they have for sale.

It is assumed that they will operate in a similar fashion to other note brokers and investors on this list.

Noteworthy offer a free note analysis for mortgage note sellers, where they will provide an in-house valuation of your note before you sell.

NoteOlogy

Noteology describe themselves as a full service mortgage note investing company.

According to their website, they buy and sell performing and non performing mortgage notes, as well as physical real estate.

If you want to buy mortgage notes from NoteOlogy, you can register as a note buyer on their website. They will add you to their investor list and send new notes for sale by email

The Note Factory

According to their website, The Note Factory “creates a continuous stream of high yielding notes each month”.

They do this by buying real estate and selling it with seller financing – they then allow investors to buy the mortgage notes they create.

Judging by the testimonials on their website, mortgage notes available for sale through The Note Factory generate investment returns of around 10% p.a.

Edward J Adams Note Brokerage

Edward J Adams is a long-standing family business that buys and brokers all sorts of mortgage notes.

They will provide a quote for your note if you are selling, and if you are looking to buy mortgage notes you can register with them via their website

According to its website, this brokerage firm deals is all sorts of debt instruments, including Mortgages, Land Contracts, Deeds of Trust, Lotteries and Annuities.

There are no mortgage notes listed for sale online, so you will have to contact them for a current inventory.

Evergreen Note

Located in Seattle, WA. Evergreen Note work with home owners, builders, developers, and other real estate professionals to create seller-financed notes that they make available for sale to investors. They also buy and broker mortgage notes.

Evergreen buy and rehab their own real estate to create seller financed note, and they also buy and sell both performing and non performing notes.

PPR Note Co

We cannot run a list of places to buy mortgage notes without giving an honorable mention to Dave Van Horn’s PPR Note Co.

Dave has been a trailblazer in note investing education, and is one of the most well-known note investors in America. He is also a published Author with a best selling book on Amazon.

PPR used to sell non performing notes via an online platform. Now now they have multiple note investment fund offerings for accredited investors that pay fixed returns.

PPR provide their investors with useful regular updates on their portfolio of notes.

Private Lending Investment

If you do not want to buy notes alongside other investors via crowdfunding, but you do want passive income without spending too much time and effort learning the note investing business, then private lending is one of your best options.

Real estate investors use private money lending to buy and rehab properties.

Private money (or hard money as it is sometimes known) allows the RE investor to close quickly with cash, whereas traditional bank financing can be hard to obtain for some properties, often takes way to long to close, and carries terms that are not suitable for shirt term RE investment projects such as flips.

For the private lender, they get to originate their own loan, set their own lending terms, and get to know all about their borrower and the collateral in advance of lending.

The fact that your borrower is a real estate investor and not an owner-occupier has a number of distinct advantages over buying pre-existing mortgage notes.

Here are a few options that will allow you to see private lending opportunities online.

Garnaco Private Lending Portal

Garnaco’s private lending program allows investors to purchase individual whole mortgage notes secured against property owned and managed by the Garnaco Group.

The notes fund the acquisition of real estate for the company’s affordable housing program, and every investment is designed to create a home ownership opportunity for low and middle income families.

The investor program has funded the acquisition of over 100 affordable homes since 2016, and pays investors annual returns of between 8% and 12% p.a.

You can see exactly how the investor program works right here.

Connected Investors

Connected Investors does what it says on the tin…

…It matches borrowers with private lenders and note investors.

I have used Connected investors personally to connect with private lenders, and the system works pretty well.

They have a huge list of lenders willing to fund all sorts of real estate deals, including fix & flips and long term rental properties.

If you are a private lender looking to connect with potential borrowers, this is a good place to start.

Buying Mortgage Notes From Banks

So far we have covered online note exchange and listing platforms, crowdfunding websites, note brokers, funds and private lending.

But if you want to access the really big returns from note investing, you need to buy non-performing notes direct from the bank.

Now, this is by far the most financially rewarding way to buy notes (wholesale), but it is also the hardest.

It requires a lot of time, effort and resources to buy mortgage notes from banks.

If it were easy, everyone would be doing it!

Buying real estate notes from banks is a people business.

No banks list their non-performing notes for sale online, so you have to find the right person to speak to at the bank and build a real relationship with the seller.

Relationships are absolutely fundamental to your success or failure when trying to buy mortgage notes from any bank.

All that said, there are some useful tool that will help you identify banks that have non performing notes.

BankProspector is a great online tool that identifies lenders with non-performing notes and REO.

It also gives you decision-maker contact information and other key data to help you identify good note buying opportunities.

When I last looked, they had 5,082 banks, 5,275 credit unions and over 39,000 contacts in their database.

Once you’ve identified a tape of notes for sale, it’s up to you to pick up the phone!

How to Get Started

So there you have it…

If you’re hoping to buy mortgage notes, this list gives you plenty of options.

As I alluded to earlier, the best starting point is to figure out your personals goals and objectives.

Having a handle on exactly how much time, effort and resources you’re prepared to commit to investing in mortgage notes will define the type of mortgage note you should buy.

If it’s hands-off passive income you want, then you can buy performing notes or do some private lending.

If you really want to get your hands dirty, then start building relationships with banks and other note investors with a view to buying non-performing loans to sell or keep long term.

I hope you’ve found the information contained here useful, and I wish you all the very best on your mortgage note buying journey!

Some More Mortgage Note Investing Articles

- Where to Buy Mortgage Notes – A Complete List of Verified Sources

- Note Investing 101 – Everything you Need to Know About Note Investing

- How to Invest in Notes – 7 Notes Investing Strategies

- What is a Note and What Terms Should It Contain?

- Performing vs Non-Performing Notes – Which is the Better Investment?

- The Private Lender’s Guide to Assessing Credit Risk

- Understanding Lien Position and Priority

- How to Buy Mortgage Notes Online in 2021

- How to Assess Real Estate for note Investing and Private Lending

- Find Performing Notes for Sale in 2021

- Private Lending 101 – Everything you Need to Know About Private Money Lending

- Is Buying Mortgage Notes a Good Investment in 2021?

- Note Investing vs Rental Properties – Which is the Best Investment?

- Performing Notes – What Why and How to Buy

- Is Real Estate Note Investing Risky?

- Real Estate Notes vs REITs – Which is the Better Investment?

- The 3 Best Real Estate Investing Opportunities in 2021

- What is the Difference Between a Note and a Mortgage?

- Real Estate Notes – Everything You Need to Know