Is Buying Mortgage Notes a Good Investment in 2021?

David Garner

4 Note Investing Strategies for 2021

As millions of homeowners fall delinquent on their mortgage payments in 2021, savvy investors are already taking advantage of the best opportunity to acquire wealth and income since 2008.

Contents

Related: Find Top Quality Performing Notes for Sale in our Private Lending Program

A Wave of Opportunity

2020 was one hell of a year, and it looks like the beginning of 2021 is not going to be wildly different. As vaccines for Covid slowly roll out across America we will see the economy reopen, eventually returning to full strength. But for now, the true fallout from the global pandemic of 2020 is yet to be realized.

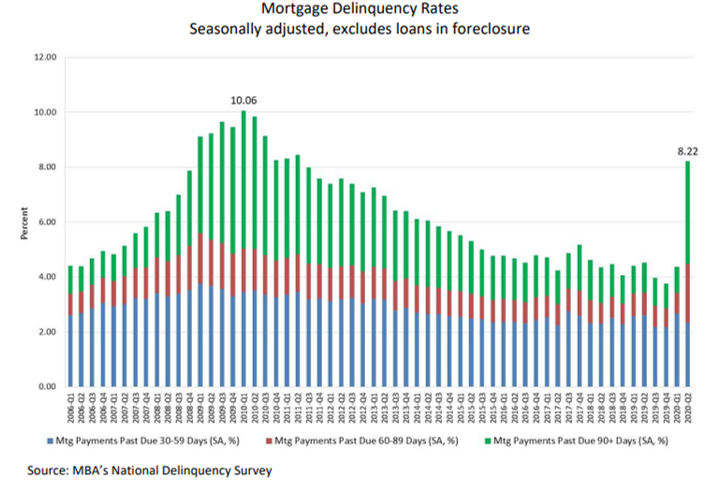

According to the Mortgage Bankers Association, the delinquency rate for mortgage loans on residential properties has more than doubled year-over-year with around 4 million loans now in default (December, 2020). This is not far off the all-time peak of 2010.

Worse still, around 2.5 million borrowers are more than 90-days overdue on their loans. Again, the highest rate since 2010. The evidence tells us that once a borrower falls 3 months behind like this, they rarely claw their way back. Most ultimately end up in foreclosures or some sort of pre-foreclosure sale.

As lenders start to consider their exit strategies for this mounting bad debt, a wave of opportunity is emerging. Back in 2008 to 2012, well-positioned investors made a fortune buying up bad debt and foreclosed real estate at deep discounts to future market value. Today, although the reasons for loan defaults are starkly different, the net result is the same.

Related: Note Investing 101 – Everything you Need to Know About Note Investing

Note Investing Strategies for 2021

Covid aside, now is a good time to invest in real estate. Limited inventory, low interest rates, and trillions of dollars of Federal stimulus continue to support rising house prices as buyers and investors compete for available homes. It is January, and I am already hearing directly from hedge funds with mandates to acquire 1,000’s of single family homes, funded with low-cost loans from major investment banks (thank you , Fed) and private investor capital.

Of course, there are several ways for smaller investors to participate in this transfer of wealth. Precisely how you get involved will of course depend on your personal investing objectives, attitude to risk, and how ‘hands-on’ you really want to be.

If you are looking for passive income – as many note investors are – then seller financed notes and private lending should be your primary strategies. There will be lots of opportunity here for sure. If you are keen to take a more risk-on approach in the hunt for the big bucks (and you have the time, knowledge, and resources to invest), pre-foreclosure real estate and non-performing notes will be the way to go.

Related: How to Buy Mortgage Notes Online in 2021

Non-Performing Notes

Let us start with the really big (potential) wins. As the growing number of 90-day delinquencies slowly transition into foreclosures, lenders will seek to rid their balance sheets of this bad debt. This is how many investors made millions during the global financial crisis, and they are doing so again today.

If you are able to put in the time and effort to find and build relationships with the right people, it is possible to pick up non-performing loans from banks and credit unions for pennies on the dollar. There are a few decent online tools – such as BankProspector – that will help you to locate lenders with non-performing notes to sell, along with the contact details of the people in charge.

Exit strategies are wide and varied for investors buying mortgage notes. Often the best course of action is to modify the loan with the existing borrower. Creating re-performing notes like this allows one to resell the note for a profit or keep it for the yield yourself. It is also possible to borrow against a note to free up your working capital or foreclose the loan and work out an exit through the real estate.

While buying non-performing notes can be a good investment, this strategy also requires an equally huge amount of time, effort, knowledge and resources. Note investing in nuanced and complex, so as always, the best investment you can make is in your own education.

Related: Performing vs No Performing Notes – Which is the Better Investment?

Pre-Foreclosure Real Estate

If you cannot or do not wish to cultivate relationships with existing lenders, it is sometimes possible to do a deal with a distressed homeowner and/or their lender before they reach the point of foreclosure. There will be no shortage of these opportunities in 2021. In fact, I am already buying a number of houses in this way.

There are literally millions of homeowners that are struggling to make ends meet right now, and the best course of action for many will be to sell their home, settle their debts and start afresh. This creates a superb buying opportunity for creative investors. Lenders too are sometimes keen to cut their losses to get the bad loan off their books.

Options include discounted cash purchases, short sales, and subject-to sales. In any case, working with a motivated seller can facilitate large purchase discounts and thicker profit margins for the incoming investor.

Related: Where to Buy Mortgage Notes in 2021 – A Complete List of Verified Sources

Seller Financed Notes

Moving on to more passive note investing strategies, we take a look at seller financed notes. A seller financed note is generated when an owner sells a piece of real estate and loans some of the purchase funds to the buyer. The buyer will usually pay a sizeable deposit and the seller will a carry a note for the balance, collecting monthly payments from the buyer.

I sell lots of my properties using seller financing – it is a great way to help people become homeowners when they (or the property) might not immediately qualify for a traditional home loan.

With the wealth of opportunity in the real estate market in 2021, there will be plenty of investors using seller financing as an exit strategy for their real estate investments. This will include other note investors that bought non-performing loans and resold the real estate post-foreclosure.

It is also worth noting that mortgage lenders are tightening their criteria in 2021. This will significantly increase the number of people that are unable to acquire a home with a traditional mortgage – widening the opportunity for private investors prepared to fill the void with seller financing.

Related: A Note Investors Guide to Compiling Real Estate Appraisals

Private Lending

Finally, if you are looking for low-risk, reliable, passive monthly income, private lending will be the best note investing strategy for you in 2021. Private lending involves partnering with a real estate investor and providing capital for their acquisitions and rehab. Again, with the wealth of buying opportunities in 2021, there are lots of experienced real estate investors seeking extra funds to capitalize on discounted properties.

Terms and returns for private lending deals are usually pretty good, especially considering the largely passive nature of this form of investing. Loan to values of 65% or less, decent rates of interest between 8% and 12%, as well as upfront points, discounts and back end equity shares all amount to a good investment in 2021.

I have seen more than a few successful real estate investors sell of their property portfolios and transitions their capital exclusively into private lending. This usually happens when the investor gets to the point of wanting an easier life – not having to deal with tenants, property managers, property taxes and maintenance.

Finding a good borrower(s) to work with is key. One option is the Garnaco Private Lending Program, where investor can acquire notes with low loan to values, strong interest rates and good quality, experienced borrowers. You can also look to local REIA meetups to network with investors and build relationships with potential borrowers in your local market.

Related: An Introduction to Private money Lending

Some More Note Investing Articles:

- Where to Buy Mortgage Notes – A Complete List of Verified Sources

- Note Investing 101 – Everything you Need to Know About Note Investing

- What is a Note and What Terms Should it Contain?

- Performing vs Non Performing Notes – Which is the Better Investment?

- The Private Lender’s Guide to Assessing Credit Risk

- Understanding Lien Position and Priority

- How to Buy Mortgage Notes Online in 2021

- How to Assess Real Estate for note Investing and Private Lending

- Find Performing Notes for Sale in 2021

- Private Lending 101 – Everything you Need to Know About Private Money Lending

- Is Buying Mortgage Notes a Good Investment in 2021?

- Performing Notes – Everything you Need to Know

- Is Investing in Real Estate Notes Risky?

If you would like to receive details of the latest investment deals, click here to receive our Priority Investor weekly email, with details of exclusive investor-ready note and lending deals direct to your inbox once per week.