The Most Powerful Force in Investing

David Garner

The Simple Truth That Will Change Your Perspective Forever

If you want to truly take control of your money, and your future financial security, it is essential that you spend time understanding certain concepts.

Once you get to grips with these fundamental – but often forgotten – rules that influence the World around us, it will change the way you make investing decisions forever.

Let’s start with a thought experiment.

How Not to Drown in Beer Watching The Dallas Cowboys

Imagine you are watching the Dallas Cowboys. You are sitting in the very top row of seats at the AT&T Stadium, right at the back. The cheap seats, if you please.

Now, this place is huge. It is the largest indoor stadium in the NFL. It cost $1.15 billion to build, has seating for 80,000 people (105,000 at a push), and you could fit almost 6 trillion pints of beer into the bowl. That is a LOT of beer!

Now, if someone placed a single drop of said beer into the middle of the pitch (about 0.5ml), and one minute later, they place two drops, and a minute after that, four drops. Each minute, the amount of beer dropped into the middle of the AT&T Stadium doubles.

Are you with me so far?

OK, good.

Now, ask yourself this. If the beer could not escape, how long would it be before you, in your cheap seat, were under water (or under beer in this case)?

A few hours? A day? Maybe longer?

In fact, the AT&T Stadium would be overflowing with beer just after 68 minutes. If you had not brought diving gear, the 69th minute would be your last chance to get out – or meet a very, very drunken demise!

I’m guessing that is a lot quicker than you might have thought, right?

Well, it gets even more interesting than that. You see, the situation would change very slowly at first, and then change very rapidly.

After 60 minutes, the stadium would still be more than 99.8% dry. At 65 minutes, still 87.5% empty. But a mere two minutes later, after 67 minutes, it would be 50% full. After 68 minutes everything would be fully submerged.

It Affects Everything Around Us

Filling the Dallas Cowboys Stadium with beer is an extreme example of something known as compounding. Over longer periods of time, it affects all sort of things around us.

Take population growth for example. It took mankind (in our current form) approximately 200,000 years to populate the Earth with 1 billion people by the year 1800. Then just 200 short years later, BOOM, we are at 7.8 billion in 2021. Why? Compounding.

The same goes for global energy consumption… the size of the national debt… food consumption. Compounding is the reason the World is changing so quickly nowadays.

This idea of compounding – also known as compound interest or yield stacking – is absolutely essential for ALL investors. Owning assets that generate regular income (the more frequent, the better), and immediately reinvesting that income in more assets is the most efficient way to grow your wealth in the long-term. You get interest on your interest. It’s simple, undeniable Math!

Why You Should Care

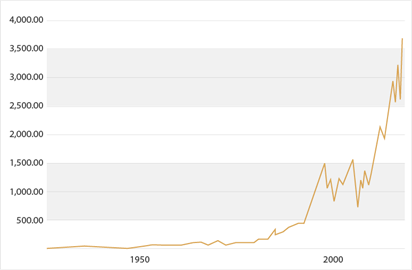

To help visualize what compounding means specifically for investors, below is a chart of the US stock market from the end of 1927 to December 2020, a span of 93 years.

Despite some ups and downs along the way, this chart offers a clear and simple visual demonstration of the power of compounding.

Had you invested in the S&P 500 at the very beginning of this period, your investment would have returned 21,397% total. Not bad, right?

Well, if you diligently reinvested dividends every year to leverage the power of compounding, that same investment would have returned 674,413%.

That’s a LOT more!

This is the power of compounding in action. It is essential that you think about it when making decisions about what to do with your own money.

Let me explain a bit further how it works.

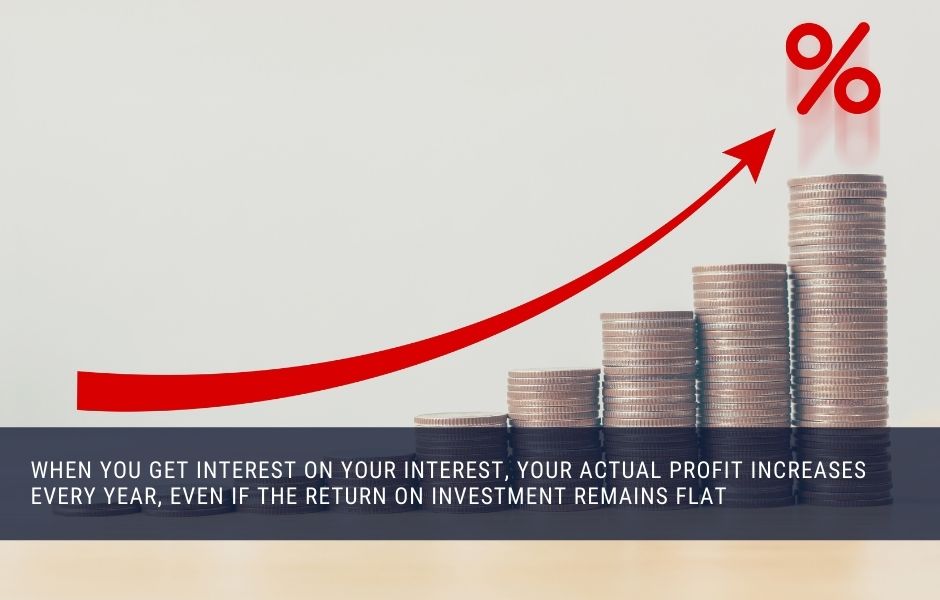

Getting Interest on Your Interest

Imagine there is an investment that will pay you a regular 10% a year. You invest $100 in it. After one year, you make a profit of $10 and now have a total of $110.

You decide to reinvest your profit into the same investment. In the second year, you make a profit of $11 (being 10% of $110), bringing your total to $121. In the third year you do the same, making a profit of $12.10 (10% of $121) taking your total funds up to $133.10. And so on…

Look carefully and you will notice something here. Although the rate of growth is constant – the annual profit of 10% – the amount of profit increases each year. First, it’s $10, then $11, then $12.10…

The upshot of this is that when investors keep reinvesting their profits then the size of the profits gets bigger over time, on average and all other things being equal.

What’s more, it shows why achieving life-changing results takes time and patience. You need to start investing as early as you can and see it through for as long as possible (until you need the money). But it is never too late to start. As the old saying goes, the best time to plant a tree is 100 years ago, the second-best time is right now.

Of course, in the real world, most investments do not give you the same fixed rate of return each year (hint hint, our private lending program does!). Otherwise, the above chart of the US stock market would be a perfectly smooth curve.

Remember, diversification is the cornerstone of risk management. If you invest in a variety of assets, sometimes you will make more than average, sometimes less, and sometimes you will lose. But the same basic power of compounding is still in action. If you act consistently, with a solid plan, it will bear fruit over time.

Doubling Up and the Rule of 70!

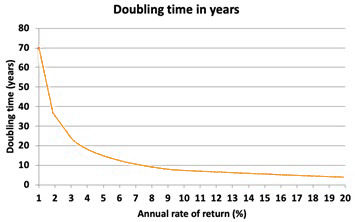

Another way to look at this is to ask how long it takes to double your money at a given rate of return. Here is another chart that compares rates of return with doubling times.

Unsurprisingly, higher rates of return lead to faster doubling times. But it is also a very curved relationship on the left-hand side of the chart.

There is a great rule of thumb that gives a good, approximate answer to the question of how long it will take to double your money. I use it all the time. It is called the “Rule of 70”.

Basically, if you want a decent estimate of how long it will take you to double your money at an expected rate of return, just divide that rate into the number 70.

For example, if the rate is 5% a year, the rule of 70 gives a doubling time of 14 years (70 divided by 5).

If you apply this to our private lending program (shameless plug), you will earn at least 9% interest, so it would take less than 8 years for you to double your money (70 divided by 9).

Many of our investors also further compound their returns by reinvesting their monthly interest check in a particular investment fund we recommend. This turbocharges annual returns to more than 18% and cuts the time to doubling your money down to less than 4 years!

What is the Lesson Here?

The fundamental lesson is this. Think about the shape of the doubling time chart again.

It tells us that increasing rates of return from very low levels to mid- or high-single-digit returns slashes doubling times.

At 1% a year, using the precise underlying maths, the doubling time is 69.7 years. At 2% it drops to 35 years. At just 5% a year that plummets to 14.2 years. At 10% a year it reduces further to 7.3 years.

In other words, investors in products with low rates of return have an opportunity to dramatically shorten the time to double their money. That is achieved by finding products and strategies that lift their average returns from low single digits to high single digits or low double digits.

This is a crucial insight in our current, low-yield world.

With the dividend yield to the S&P 500 at less than 1%, interest on cash deposit not much better, and the coupon to the safest of income assets – US Treasuries – at close to zero, investors MUST look further afield for assets that deliver a better rate of return in 2021.

References: