The Top 3 Monthly Dividend Stocks For February

David Garner

A Market to Nowhere?

January was a month for stocks that saw high-growth plays plummet on fears of imminent rate hikes. The Nasdaq came literally two 3% up days away from its worst January in history.

When stocks decline in January, typically February sees more of the same, along with the other 10 months of the year. Although corporate earnings, for the most part, have continued coming in strongly this February, there are certainly mounting concerns about market sentiment.

Thus far, February has not been quite as bad as January. There are thoughts that many rate hikes could be priced in already, and countries worldwide are dropping COVID restrictions.

However, negative catalysts remain.

Pro Tip: Get NEW monthly income investments in your inbox every Thursday

“The market’s really basically going a whole lot of nowhere this year,” Annandale Capital CEO George Seay said to Yahoo Finance Live on February 9. “There’s some real headwinds on the growth part of the market.”

While this quote may be a bit ominous, the cracks on the ground cannot be ignored. Once sexy stock picks continue tanking. For one, Facebook’s parent company Meta (FB) reported underwhelming earnings. It saw the largest market-cap wipeout in stock market history, and shares plunged over 25%. The much-maligned Peloton also saw its CEO step down while slashing 2,800 jobs and its full-year earnings outlook.

Even large-cap traditionally strong dividend payers like ATT plunged after announcing it would slash its extremely popular annual dividend by 47%.

Not all is lost, though. Other options in the market can offer greater dividend yields that come monthly and are forecasted to rise in the future.

Quality, monthly dividend-paying stocks offer consistency, something that’s sorely lacking in today’s market.

As Real Estate Investment Trusts (REITs) commonly have the most substantial monthly dividend yields, coupled with solid forward yields, each of our 3 top monthly dividend-paying stocks this month are REITs.

Remember- under the IRS tax Code, REITs must pay 90% of their taxable income to shareholders. Because this means REITs typically don’t pay corporate income taxes, that means mouth-watering, potential monthly dividends for your portfolio.

Based on a deep dive into financial research platform Finbox, here are our 3 monthly dividend payers to consider in February based on current yield and forward prospects.

Pro Tip: Get NEW monthly income investments in your inbox every Thursday

SL Green Realty Corp. (NYSE:SLG)

SL Green Realty Corp. is our first top monthly dividend payer this month. An S&P 500 company and Manhattan’s largest office landlord, it is a fully integrated REIT primarily focused on acquiring, managing, and maximizing the value of Manhattan commercial properties.

As of December 31, 2020, the company held interests in 88 buildings totaling 38.2 million square feet, including ownership interests in 28.6 million square feet of Manhattan buildings and 8.7 million square feet securing debt and preferred equity investments.

Look, the future of full-time work back in the office is questionable. If anything comes from this COVID crisis, a permanent hybrid work-from-home and office model could very well persist. The fact is, it’s working both for employees and employers. So it is pretty questionable why a company like SL Green would make our list.

However, this list is based on numbers. SL Green is a company that has long offered investors stable monthly dividends.

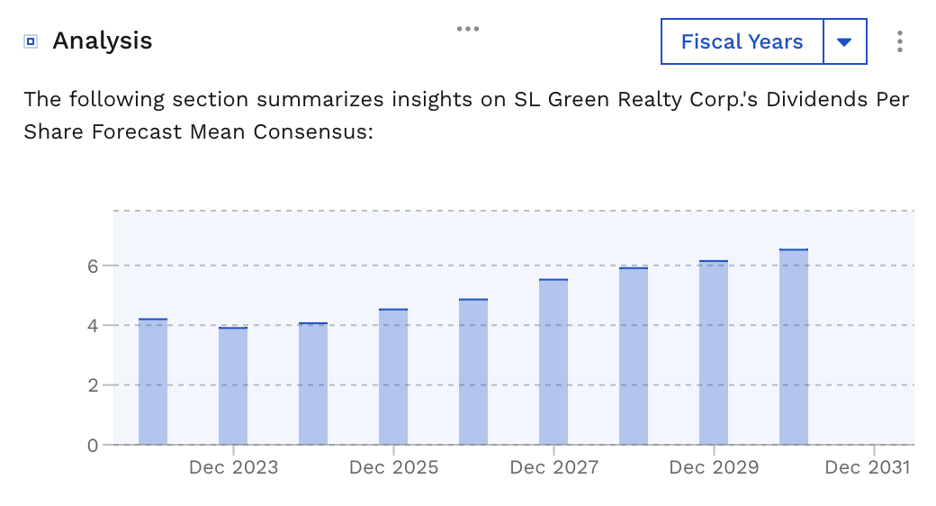

The stock has had an underwhelming start to the year. However, management has been aggressively buying back shares, positioning the company for continued dividend payments projected to grow over time. You can find companies with higher current dividend yields than SL Green’s 8.5%. Yet, what was so attractive about this company was its forecasted yield for the next fiscal year and the next five. Finbox data shows its mean consensus dividend per share forecast for the next fiscal year is $4.2013 and $4.3127 for the next five fiscal years.

Source: Finbox

ARMOUR Residential REIT, Inc. (NYSE:ARR)

ARMOUR Residential REIT, Inc. is a Florida-based REIT that invests in residential mortgage-backed securities (MBS) in the United States. Its securities portfolio primarily consists of Government-sponsored entities (GSE) and the Government National Mortgage Administration’s issued or guaranteed securities backed by a fixed rate, hybrid adjustable rate, and adjustable-rate home loans. It also owns unsecured notes and bonds issued by the GSE and the United States treasuries and money market instruments.

The company’s stock has underwhelmed year-to-date, but it’s at a potentially mouth-watering valuation, with a low Price / Book multiple. It also offers a desirable current 13.0% dividend yield and a mean consensus dividend per share for the next fiscal year of $1.20.

Ellington Residential Mortgage REIT (NYSE:EARN)

Ellington Residential Mortgage REIT specializes in acquiring, investing in, and managing residential mortgage-and real estate-related assets.

Founded in 2012 and based in Old Greenwich, Connecticut, it also acquires and manages residential mortgage-backed securities (RMBS), including agency pools, agency collateralized mortgage obligations (CMOs), and non-agency RMBS comprising non-agency CMOs, both investment grade, and non-investment grade.

Although Ellington is a stock that’s performed reasonably well over the long term, it’s currently hovering around a 52-week low. It has a current dividend yield of 11.6% and a mean consensus dividends per share forecast of $1.1800 for the next fiscal year.

Wrapping Up

Mr. Market is a fickle beast with emotional instabilities. If you’ve been around the market long enough or read Benjamin Graham’s “The Intelligent Investor,” you’re well aware.

In markets like this, which have a “meh” sentiment at best, never panic, and be sure to diversify and chase consistency.

Monthly dividend payments offer peace of mind for all three of those things. You know your monthly payments will consistently come and are projected to grow over time- so why panic? Many of these monthly dividend-paying stocks are probably also in sectors you’ve overlooked, such as REITs and energy, adding diversification. Most importantly, they offer consistency in a market that sorely lacks it right now.

The above options are three strong choices that can help you navigate these times. But of course, there are plenty of other opportunities, as well. We encourage you to do your due diligence, find consistent income streams, and stay as level-headed as possible in a world full of panic.