2 Inflation-Beating Investments Paying Monthly Income Right Now

Interest rates are rising fast. But with borrowing become more expensive by the day, the best CD savings rates are still languishing at 2.70% or less. Here are 3 great alternatives to add inflation-beating monthly income to your investment portfolio right now in 2022

David Garner

2 Inflation-Beating Income Investments in 2022

Unless you’ve been living under a rock, you will know that inflation is at it’s highest level for forty years.

You’ll also probably know that the Fed’s weapon of choice in their battle against rising prices has so far been to raise interest rates… a lot!

As a matter of fact, interest rates on 30-year fixed rate mortgages have risen from an all-time low of 2.65 percent in January 2021, to 5.81 percent in June 2022, with almost all of that uplift coming in the first 6 months of 2022 alone.

Of course, this is significantly impacting purchasing power for homebuyers.

In May this year, the National Association of Realtors announced that the cost of purchasing a home is now 55% more expensive than this time last year.

So this is all bad news for homebuyers and sellers alike. But one group that usually benefits from a rising interest rate environment are savers and investors.

Where’s The Benefit?

If interest rates are going up, yields to income-bearing investments tend to follow suit.

And rightly so. In such an environment we need a better return investment to offset the value-eroding effect of inflation.

So, if the 119% increase in mortgage borrowing rates is anything to go by, savers must be dancing a merry dance right now, right?

Well, no!

Rates on low risk investments like certificates of deposit are still delivering only very low single digits. In fact, the best CD rate I could find while researching this article was Banesco USA, offering 2.70% for a 1-year deposit.

Couple that with inflation at a forty-year high running more than 9%, and wage growth struggling to keep up, it’s never been more important to invest as effectively and profitably as possible, just to keep up.

Simply put, if you’re not earning at least 9% on your investments, you’re getting just a little bit poorer every single day.

As a result, savers and investors are looking further afield for investments and strategies that will ern and grow their wealth faster than inflation depreciates it.

But with a potential recession looming, financial markets are looking more volatile than ever. So where does one find inflation-beating returns in 2022?

Here are my own personal top investing options delivering the best possible returns right now in 2022, through 2023, and beyond.

Invest Smarter With My Top 2 for 2022

Before I get into the nuts and bolts an give you my exact top 3 inflation-beating investment options, I want to remind you of something you probably already know but might have forgotten.

This is something so simple (and boring), but at the same time is far and away the most effective wealth creation and preservation strategy on the planet.

This is the exact, super-simple strategy I use for my own investments.

It is quite simply the most effective long-term strategy to grow your wealth through any set of economic circumstances, including periods of inflation and economic correction such as today.

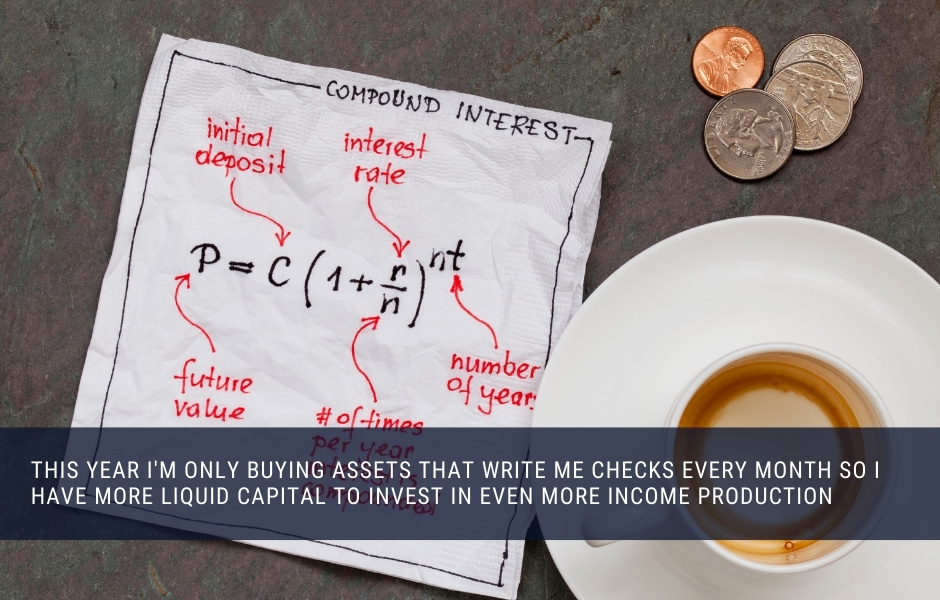

My friends… let me remind you the power of compound interest.

At it’s heart, compounding is very simple.

One invests in assets that produce income (that’s ALL I do), and then reinvest that income immediately into more income-generating assets.

Thus, you begin to earn interest on your interest, and so on.

It’s that simple, it really is. And this stupidly simple concept is what makes the poor rich, and the rich richer. Over the long-term, the difference in overall returns between compounding and not compounding is staggering.

So, that’s why I’ve chosen to write specifically about income-bearing investment options today.

And even more specifically, in order to further turbo boost the effect of compounding and make it as effective at growing your wealth as possible, we are going to look specifically at investments that pay monthly income.

Why? Because the more often you have new income to invest, the quicker your money will compound, and the faster you will grow your wealth. And… the better protected you are from the wealth-eroding effects of inflation.

So without any further ado, here are my top 3 monthly income-generating investments paying more than 9% in 2022.

1. Private Money Lending

I’m a real estate investor first and foremost. I buy houses, I renovate them, then I lease them to long-term tenants and collect the rental income. I’ve been doing that for 10 years, I currently own over 100 properties, and I’m pretty good at it.

That’s my business. But on a personal level, I also lend some of the money I collect from rental income to other investors as a private money lender.

So, I also know a little bit about ‘being the bank’. Or, as a guest said recently on our investing podcast, being a ‘lienlord rather than a landlord’.

Private money lending makes it onto my list today because it pays well.

In today’s market you can easily earn between 9% and 15% p.a. in interest and ‘points’ annually.

That’s a great return that allows you to beat inflations hands down, even at today’s level.

Private money lending is also relatively passive. It pays interest every month (remember compounding). It’s not too risky (backed by real estate), and with the right level of education and knowledge absolutely anyone can do.

All that makes private money lending a solid contender as part of my to list of inflation-beating investments that pay monthly income.

What is Private Money Lending

Private lending is pretty simple. It’s when one investor (lender) loans money to another investor (borrower), and the loan is secured against real estate owned by the borrower.

Terms (interest rates and lending ratio etc.) for private loans vary wildly depending on the project, the borrower, and the level of risk the lender feels is involved in funding the project.

Typically, private loans are set over 6 to 60 months and are ‘interest only’, meaning each monthly payment consists entirely of interest, and the principal is repaid either at maturity of the loan or before.

There are lots of reasons real estate investors loan and borrow money. In most cases, using private money means real estate investors can access fast cash on a short-term basis to purchase and renovate real estate to sell to rent out.

Being the Bank

As a private money lender, you don’t own the real estate, rather, you’re the bank.

You have a promissory note, which is basically a contract between you and the borrower detailing the terms of the loan.

You also have a mortgage deed or deed of trust which is recorded on the title of the real estate in the County records.

The note and deed work together to provide you with defined terms and security for your investment.

Once the lender funds the loan, he borrower uses the funds to purchase and improve a property.

During the course of the loan, the borrower pays the lender interest – usually monthly – and will then either sell or refinance the property with a more traditional bank or commercial mortgage in order to pay back the private money lender and take their own profits.

This arrangement works really well. The private money lender earns a great rate of interest of their money, while the real estate investor gets to use leverage (the lender’s money) to significantly increase their return on investment, and invest in bigger projects than they might be able to afford with their own money alone.

What are the Benefits of Private Money Lending

Aside from the great return on investment, the main attraction to private money lending for money is the fact that it is a relatively passive way to invest when compared to buying, renovating, and selling or managing houses or apartments.

Low Maintenance

As the bank, the private money lender simply collects their monthly interest payment, and, all being well, collects their payoff at loan maturity – or before in some cases. There are no tenants to manage, no repairs, no insurance or property taxes to worry about.

Investment Security

Private money lending is also a fairly safe way to invest.

While you don’t actually own the real estate, you have a legal first charge recorded on title, so the property can be sold to recoup your investment in a worst case scenario.

So, private money lending gives you a great return, and you have all of the capital security of real estate, with none of the hassles (or costs) of ownership.

But what are the risks?

Risks of Private Money Lending

As with any investment, private money lending carries risks.

Aside from general market risk, there are risks associated with the borrower, the property, and the project plan.

The level of risk involved in private money lending tends to vary based on the quality and experience of the borrower, the location and condition of the property, the size of any planned renovation work.

Lenders will set their terms based on the level of risk they perceive. This might include lending a higher or lower amount of the total required project budget (loan-to-value or LTV), charging a higher or lower rate of interest, or asking for additional collateral or a personal guarantee from the borrower.

Ultimately, the main risk for private money lenders is that the borrower stops making payments, and/or is unable to repay the loan at maturity.

The real question, however, is why have they stopped paying.

Maybe they ran out of money before finishing the project. Perhaps they can’t secure the refinancing to pay back the loan. It could be that they can’t sell the property for the price they were hoping for, or maybe they have something else going on that you don’t know about.

Whatever the reason, your backstop is always the real estate. So, provided you have structured the terms of your loan appropriately, you should always come out whole eventually.

How to Invest in Private Money Lending

In order to become a private money lender, first you will need to educate yourself on how to set your own lending criteria and how to conduct your own pre-funding due diligence process – often called ‘underwriting’ by seasoned lenders.

There are plenty of online groups and forums on various social media platforms and other websites where experienced investors are usually happy to share their knowledge and answer questions.

There are also industry bodies such as the American Association of Private Lenders which offers member benefits and educational courses.

Once you feel confident you know enough about private money lending to make your first investment, you’ll need to find a borrower to work with.

If you want to stay local, then you can attend local real estate investor group meetups and network with active real estate investors and other private money lenders. There are also online groups, too.

If you find a borrower with a project you’d be happy to fund, I highly recommend engaging an appropriately qualified attorney to draw up or review your loan paperwork, and ALWAYS close your loan properly through independent escrow with lenders title insurance.

The alternative of course is to work with another private lender or broker who will find you a deal to fund and do much of the work for you, such as the Garnaco Private Lending Program.

2. Mortgage Notes (Real Estate Notes)

Staying with the theme of real estate, another great way to invest for monthly income without having to own property is to buy real estate notes (also referred to as mortgage notes).

Mortgage notes make my list today because they can pay a great rate of monthly income. I’ve seen income-paying ‘performing’ notes from various sources delivering yields of between 9% and 12% this year.

Notes are also relatively low-maintenance. They offer the capital security of real estate but with far more liquidity than the underlying bricks and mortar. And best of all… absolutely anyone can buy, sell or trade real estate notes with no restrictions.

So let’s dive in and take a look at this high-income alternative investment…

What are Mortgage Notes

First, let’s clear something up.

What we refer to as ‘notes’, ‘real estate notes’, or ‘mortgage notes’, are debts secured against real estate, and actually consist of two parts; a promissory note, and a lien (a mortgage deed or deed of trust).

Much like in private money lending, and much like the mortgage loan the bank gave you to buy your home, the promissory note defines the terms of the loan (amount, interest rate, term, monthly payments, default clauses etc.), while the lien/deed records the loan on the title to a piece of real estate.

The two parts work together to create what we often just refer to a note.

So, when we buy a ‘note’, we are actually buying a promissory note, deed, and whole pile of other paperwork, too. But we’ll get into that shortly.

Now that we have the basic terminology down, let’s get into a bit more detail.

There are two main factors to consider when buying real estate notes, and these will define the type of note you may or may not want to purchase…

- Note performance

- Lien position

Of course there’s much more to it than that, but these two elements really go a long way to defining the desirability of a note in relation to your personal investment objectives, so it’s important that you understand them.

Performance

A note is considered performing if the borrower is current on payments. Performing notes are income-producing assets. Investors buy performing notes for the regular monthly income they produce.

A note is considered non-performing if the borrower has stopped paying (in default) for more than 90 days. A non-performing note is considered bad debt, and as a result they tend to trade a significant discount to the face value.

Investors buy non-performing notes with the hope of either modifying the loan to help the borrower start paying again, or to exit through the real estate, either by a foreclosing the loan or other means such as making an agreement with the homeowner to pass on title.

Lien Position

The lien that provides the security for your note investment will be in either first or second position on title.

If you have to foreclose the loan and force a sale of the property, 1st position liens are paid back first. 2nd position liens are paid back from any remaining proceeds after the 1st position lien is settled. That means that 2nd position liens might get back less than the due amount if the property sells for less than the total combined debt.

This makes notes 2nd position liens much more risky investments than those with a first position lien.

So, for the purposes of this article, we are going to focus on performing notes in 1st position. That gives us an asset that is paying regular monthly income ,with a good level of security, and comparatively low risk.

Buying and Selling Mortgage Notes

Now we know what we’re looking for, let’s look at how to buy mortgage notes on the secondary market.

Here’s how it works…

Often, a lender that originates a loan will sell the loan to a buyer on the secondary market.

Many of these loans are then packaged into mortgage-backed securities and sold to pension funds and other institutional investors.

Sometimes smaller lenders (regional banks and credit unions for example) will sell loans to private note investors.

There are two main reasons a lender will sell a note.

- They will sell a ‘performing’ note to recapitalise or exit their investment.

- They will sell a defaulted or ‘non-performing’ note to exit a bad debt.

It’s highly unlikely that you’ll get a big bank to sell you a single mortgage note, and if you want to buy a real estate note direct from a smaller lender, you’ll have to spend time building relationships with the right people.

That said, you will also find lots of private investors and brokers selling both performing and non-performing notes on a number of online note trading platforms that have emerged in recent years.

If you want to start looking for mortgage notes for sale, you can check out my list of legit sources for buying and selling real estate notes here.

What are the Benefits of Mortgage Note Investing

Again, speaking specifically to the benefits of 1st position performing notes, they can make a great addition to any portfolio where the goal is to diversify, improve risk-adjusted returns, and/or collect regular income for the purposes of compounding (or spending).

Low Maintenance

A performing mortgage note with a low loan-to-value, secured against a decent property, and with a good quality borrower who has always kept up payments is a fairly safe bet that is likely to continue to pay you well every month with little to no active management on your part – especially if you use a loan servicer to collect payments and deal with the borrower (recommended).

Good Returns

Yields can be pretty great, too. While interest rates on real estate notes can vary wildly depending on a variety of factors related to the quality of the original loan/borrower, notes can often be purchased at a discount to the actual amount owned by the borrower, so the yield to the investor can be significantly higher than the interest rate on the owed amount (unpaid balance or UPB). It’s not uncommon for good quality performing notes to deliver yields between 9% and 15%.

Good Liquidity

Finally, real estate notes are relatively liquid compared the physical real estate. It’s possible to sell a note quickly, even on the same day, provided you can find a willing buyer and negotiate a mutually agreeable price. Of course, there are lots of online platforms where you can list your mortgage note for sale if you need to access quick cash, or simply want to exit your investment.

What are the Risks

Just like private money lending mentioned above, investing in notes carries risks.

If the borrower stops making payments on a note, you will have to go through a process to call the borrower in default, chase down payments, possibly arrange payments plans, forbearance, forgiveness, or even negotiate taking title to the property or foreclosing.

If you are having your note serviced by a loan servicer who collects payments, they shouldbe able to deal with the borrower on your behalf. But of course, that service doesn’t come for free.

There are endless reasons for borrower default, and often a borrower will rectify a minor default, but in a worst case scenario you may have to seek an exit through the real estate.

This might mean doing a deal with the borrower to vacate the home and deed title of the property to you, or you may ultimately have to foreclose the loan.

Beware that you could end up stuck in potentially lengthy and costly negotiations and/or court proceedings in order to take title or force a sale. Even then, there is no guarantee that the proceeds of a foreclosure sale will be sufficient to make you whole, so there are lots of factors at play.

All that said, if you set your investing criteria and due diligence process right before you buy a note, making sure to focus on loans with good quality borrowers and risk-averse loan terms such as low LTVs, you will simply sit back and collect your monthly payments without issue.

How to Invest

There are many way to invest in real estate notes.

You can buy notes direct from banks, credit unions and other lenders, but it is unlikely that you will find many lending institutions prepared to sell single performing notes to private buyers.

There are even note investment funds you can invest in and let an experienced fund manager do all the hard work in exchange for cut of the profits.

Private Sellers and Brokers

You can purchase mortgage notes in the secondary market from private sellers or ‘brokers’.

The secondary market for real estate notes has grown and evolved significantly in recent years, and there are now a number of online mortgage note trading platforms that allow private buyers and sellers to interact and list their real estate notes for sale.

You will find folk selling notes simple because they have other things to use their cash for, and other investor that bought non-performing notes who managed to get the borrower paying again, and are now selling as a reperforming note to exit their investment.

If you do go down this route, try to make sure you are dealing directly with the actual note owner and not a middle man, and make sure to do your due diligence. there are lots of companies that can help you check out the paperwork, and you can find my own note investment due diligence process in this article I wrote about non-performing notes.

Seller Finance Notes

Another option that is very popular with note investors, especially those seeking performing notes, is to buy seller finance notes.

Seller financing is when someone selling a house offers the buyer financing.

The buyer will pay the seller some cash as a deposit, and the seller will carry a note for the balance. Effectively the seller become the bank, loaning the money to the buyer for the purchase.

The seller may then sell the note to a note investor to pull their cash out.

This kind of transaction is a pretty common with real estate investors who use seller financing as way to sell their flips and rental properties to buyers who may not qualify for a traditional mortgage at that moment.

Whether you buy a note from a private seller, or from a real estate investor who originated the loan to sell their property, 1st position performing notes will make a great inflation-beating addition to your portfolio in 2022.

Related: Real Estate Note Investing 101 – Everything You Need to Know

In Summary

So there you have my top 2 investments that deliver yields in excess of 9%, and pay regular monthly income to reinvest and compound your returns to beat rising inflation.

Now of course I realise that both my suggestions are real estate-related, but that’s just my World. It’s what I know, and it’s what I’m good at, and I know for a fact that I’m making more than 9% on every private money lending deal and real estate note I buy right now.

Honestly, as simple as it sounds, that strategy of buying assets that write me checks every month, then reinvesting those checks into more assets that write even bigger checks is ALL I’m doing right now, and I get to see my bottom line – my true net worth – grow every single month.

I hope you found this article useful, and be sure to check back soon!

Related: See Live Inflation-Beating Investment Deals in our Private Investor Portal Right Now