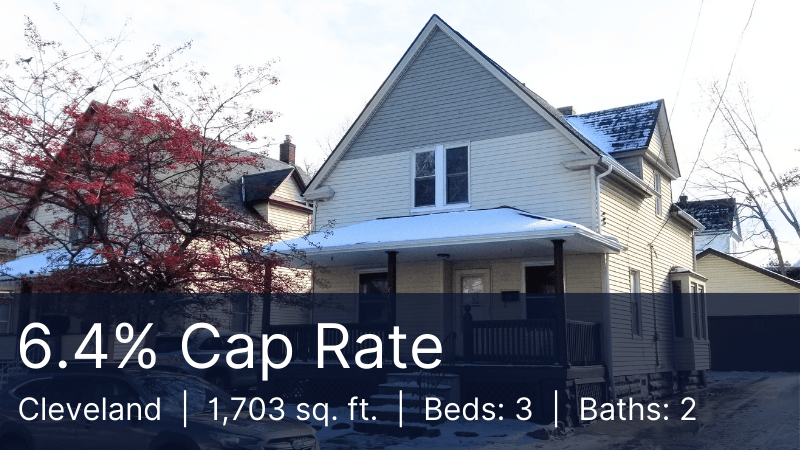

Old Brooklyn, Cleveland, OH

Single Family Home

|

Turnkey Rental

Please note that this investment is now closed. Information below is for historical purposes only.

Property Description

This fully renovated single family home was acquired by a client in April 2024 as part of a 2-property portfolio, with an initial investment of $61,250

Property Details

🏠 Single Family Home

🛏️ 3 Bedroom

🛁 2 Bathroom

📐 1,702 sq. ft.

📐 Lot: 3,920sq. ft.

🛠️ Fully Renovated

💵 $1,700/month rents

🏦 Finance Approved

💰 $61,250 Initial Investment

Neighbourhood

Old Brooklyn is located south of the city of Cleveland, around 12 minutes’ drive from the major employment centres in downtown.

Property prices have been rising steadily for 5 years at an average annual rate of 11.46%, and home ownership is increasing at 10X the U.S. national rate.

✅ Population Growth*: +7.58%

✅ Jobs Growth: +1.58% p.a.

✅ Income Growth: +3.94% p.a.

✅ Capital Appreciation: +11.46% p.a.

✅ Unemployment: +0.32% p.a.

✅ Home Ownership: +3.3% p.a.

✅ Rent Price Trend: +4.4% p.a.

✅ Vacancy Trend: -1.7% p.a.

*Population growth is over 5-years based on a 3-mile radius of the subject property. Data provided by Corelogic. For access to the full neighbourhood report, please Download Financials or Schedule a Call.

Renovation

The home was renovated to an exceptional standard, including;

🏠 Completely new kitchen

🏠 Completely new bathroom

🏠 Interior remodel throughout

🏠 New water heater

🏠 Electrical updates

🏠 Plumbing updates

Financing

Loan Type: 30-Year Amortized

Terms: 30-Year Fixed Interest

Interest Rate: 7%

Loan to Value: 70%

Loan Amount: $122,500

Loan Payment: $815

Investment Returns

🧮 Initial Cap Rate: 6.4%

💵 Gross Rents: $1,700

📈 10-yr ROI: 26.9% p.a.

Due Diligence

🔍 Our team completed a comprehensive due diligence process, including;

✅ Purchase analysis

✅ Financing pre-approval

✅ 30-yr buy and hold analysis

✅ Seller disclosure review

✅ Scope of work review

✅ Initial home inspection

✅ Title report

✅ CMA valuation

✅ 328-datapoint neighbourhood analysis

✅ Lease & rent roll review

✅ Lenders Appraisal (valuation)

✅ Title Insurance

✅ Final Home Inspection

Investment Update - March 2025

This property has been independently valued in March 2025.

📈 Valuation: $186,600

📈 Value Increase: $11,600 (+6.6%)

📈 Net Cashflow: $1,247 (2024-25)

📈 Rent Increase (April 2025): +5.8% ($1,800)

For access to the supporting documents for this case study, please Download the Financial Analysis or Schedule a Call.

Basic Investment Details

Investment

$175,000

Asset Type

Turnkey Rental

Monthly Gross

$1,700

Monthly NET

$115

Cap Rate

6.4%

Projected ROI*

26.9% p.a.

*Projected ROI is a 10-year average. For a comprehensive breakdown, please download the financial analysis document.