U.S. Tax Guide for Foreign Property Investors

David Garner

The Complete Guide to U.S. Taxes for Foreign Property Investors

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

Hi… Welcome to my 2025 guide to U.S. taxes for Foreigners buying U.S. real estate 👋

My name is David Garner, and I’ve closed on over 100+ rental properties in the United Sates for my own portfolio as an overseas-based Non-U.S. Citizen since 2016.

Real estate is one of the most advantageous parts of the U.S. tax code, but if you’re not careful you can end up overpaying your U.S. taxes or worse, end up with financial penalties.

I see Foreigners make the same simple mistakes over and over again, and end up:

💥 Losing properties to tax sale

💥 Getting fines and penalties

💥 Overpaying income tax

💥 Overpaying capital gains tax

💥 Overpaying FIRPTA

💥 Getting caught in estate/gift tax traps

The good news? By the end of this guide you’ll have everything you need to know to:

✅ File your taxes correctly

✅ Maximise deductions

✅ Minimize U.S. income tax

✅ Minimize capital gains tax

✅ Minimize FIRPTA tax

✅ Plan for estate taxes

If you’re a Foreigner looking to invest in real estate in the USA safely and legally from overseas, this is for you!

Table of Contents

➡️ Overview of U.S. Taxes for Foreigners

➡️ Property Tax

➡️ U.S. Income Tax for Foreigners

➡️ FIRPTA Withholding Tax

➡️ U.S. Capital Gains Tax for Foreigners

➡️ U.S. Estate Tax for Foreigners

➡️ Gift Tax

Whether you already own property in the U.S. (like me), or you’re looking to buy your first property, I hope you find this guide useful.

IMPORTANT NOTICE: I am not a tax advisor. This article does not contain financial or tax advice. The information contained is based on my own personal experience of owing real estate in the United States as a Non-Resident Alien. You should seek professional advice from a suitably qualified CPA before making any financial decisions.

💼 Overview of U.S. Taxes for Foreign Property Owners

Foreigners are treated differently compared to U.S. citizens under the U.S. tax code, so it’s important to understand what taxes you are liable for, how to file your tax return, and of course how to minimize your U.S. tax liability legally.

If you misreport, or fail to report your U.S. income, you could overpay your taxes or be liable for big financial penalties or even criminal charges.

Here is a quick reference list of the U.S. taxes you’ll learn about in this guide:

💸 Property Tax

💸 Income Tax

💸 FIRTA Withholding Tax

💸 Capital Gains Tax

💸 Estate Tax

💸 Gift Tax

But first, let’s review the basics and take a look at how ‘Foreigners’ are defined and treated by the IRS.

👽 What is a Non-Resident Alien

The IRS defines a Non-Resident Alien as any individual who:

🗽 Is not a U.S. citizen or National

🪪 Does not hold a green card

📆 Does not pass the substantial presence tests

As a Non-Resident Alien, you will need to file a U.S. tax return to declare any U.S.-sourced income, including;

💵 Rental income

🏘️ Income from a property sale

You’ll file your U.S. tax return annually, but you’ll need a few things in-hand first…

🔢 Individual Taxpayer Identification Number – ITIN

An ITIN is basically the Foreigners equivalent of a U.S. social security number. You’ll need one to do pretty much anything financial in the U.S. as an individual like open a U.S. bank account.

You need to apply for your ITIN on or before the date you file first U.S. tax return (see below).

You can apply for an ITIN by mail with the following information:

📄 Completed Form W7

🌍 Proof of your foreign status

🪪 Identification

The process can take up to 9 weeks – especially during tax season – so be prepared to wait.

🔢 Employer Identification Number – EIN

If you are going to use a U.S. LLC to hold your property (recommended), you will need an EIN number (Employer Identification Number).

An EIN is the tax identification number for your LLC. You’ll need this to open a U.S. bank account – so you’ll want to do this right away when you form your LLC.

You can apply for an EIN number by fax phone or mail. You’ll need to complete Form SS4 and have the following information to hand:

📋 Legal name of the LLC

🏢 Type of entity

❓ Reason for applying

🧑💼 Responsible party

📌 Mailing address

🏘️ Business activity

Once you have your LLC and EIN number, you will be able to:

🏦 Open a U.S. bank account

🏠 Buy property

💵 Get a mortgage

🛡️ Get insurance

📋 File a U.S. tax return

The IRS can take a while to process EIN applications, sometimes many weeks. An alternative option is to purchase an established LLC with an existing EIN number.

Get An Investor Kit: Speak to Our Team About Purchasing an Established LLC with an EIN Number and U.S. Bank Account

📈 U.S. Tax Rates for Non-Resident Foreigners

The default tax rate for Foreigners with U.S.-sourced income is the FDAP rate (Fixed Determinable Annual & Periodical):

💸 FDAP Rate: 30% of Gross Income

The FDAP rate applies to all you U.S. source income by default. However, when you file your U.S. tax return you can make the ECI tax election to have some types of U.S. income taxed as “Effectively Connected Income” (ECI election).

💸 ECI Rate: Net Income Taxed at Graduated Rates

I’ll cover what types of income can be taxed as ECI income, and how to make the ECI election later in this guide.

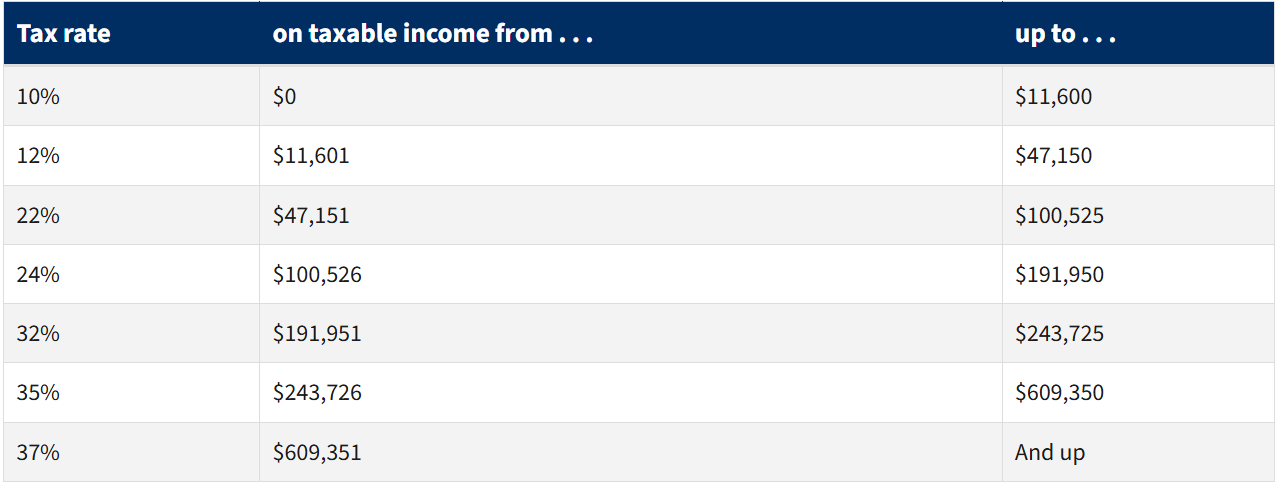

📈 U.S. Graduated Tax Rates (ECI Tax Election)

🗂️ Filing Your U.S. Tax Return as a Foreigner

You’ll need to file various forms with the IRS every year to report your US-sourced income.

📄 Form 1040-NR – This is the Non-Resident Alien Income Tax Return. You’ll use this form to report any U.S. income received that year (1040-NR PDF).

📄 Form 1040 Schedule A – For reporting deductions such as state and local income taxes and charitable donations (Schedule A PDF).

📄 Form 1040 Schedule E – For reporting itemized deductions if you are claiming the ECI election (Schedule E PDF).

📄 Form 4562 – For reporting amortization and depreciation (Form 4562 PDF).

📄 Form 1040-NR Schedule NEC – For reporting any non-ECI income (Schedule NEC PDF).

📄 Form 1040-NR Schedule OI – On this form you’ll report your country of residence, any travel to the U.S., and any exemption you are claiming due to a tax treaty (Schedule OI PDF).

📄 Form 5472 – To report any financial transactions between your LLC and its foreign related parties (Form 5472 PDF).

📄 Form 1042 – You’ll report any withholding tax that was withheld such as FDAP or FIRPTA (Form 1042 PDF).

If your investment structure contains a foreign corporation , you will also need to file:

📄 Form 1120-F – To report any income, gains, losses, deductions, credits, for the foreign corporation (Form 1120-F PDF).

I strongly advise hiring a CPA to prepare you U.S. tax return. If you misreport your income or miss the filing deadline you could be subject to heavy penalties and lose any potential tax elections.

⏰ U.S. Tax Filing Deadline for Foreigners

Non-Resident Foreigners must typically file our U.S. tax return by the 15th day of the 4th month after your tax year ends. For most people that will be April 15th.

🤝 Tax Treaties

Tax treaties typically define where certain types of income are taxed, and at what rate. In most cases I have seen, tax treaties require real estate to be taxed in the country in which the real estate is located.

A tax treaty could offer:

📉 Lower withholding tax rates or exemptions

📉 Avoidance of double taxation

It’s important to understand the terms of any tax treaty that is in place with your own country to figure out if there are any potential benefits or extra costs. You can view a list of U.S. tax treaties here.

📝 Summary and Tips

Understanding your responsibilities when it comes to U.S. taxes is absolutely crucial.

Here are top tax tips for Foreigners buying or owning real estate in the United States:

📄 Read your tax treaty

📝 Get an EIN

📝 Get an ITIN

📑 Keep good records

🎯 Make the ECI Election

💰 Maximize deductions

🗂️ File all the right forms

⏰ File on time

Again, my advice is to hire a CPA who understands the specific needs of a Non-Resident Alien Foreigners.

Got Questions: Book a Free 1-2-1 Strategy Call with me or a Member of my Team

🏘️ U.S. Property Taxes – A Guide for Foreigners

If you own a property in the U.S. you’ll pay property taxes!

Property taxes are the main source of funding for local government, paying for things like:

🧑🎓 Schools

👮 Emergency Services

🏗️ Infrastructure

🔢 How are Property Taxes Calculated

Property taxes are calculated based on the assessed value of the property – this is broken down into the value of the land and improvements (buildings).

The local tax assessor will reassess property values periodically and property taxes are adjusted accordingly. In some states this is done annually, in others over multiple years. For example, property values in Ohio are reassessed every 6 years.

⌛ When are U.S. Property Taxes Due

You will receive a property tax statement when the taxes are due in the county your property is located.

Property tax payment deadlines vary from state to state and by county. For example, property taxes in Cuyahoga County, Ohio are due on the third Thursday of February and July.

Make sure you know when property taxes are due in the County your property is located, and make sure you have a reliable U.S. postal address to receive property tax statements.

💵 How to Pay Property Taxes in the U.S.

There are two ways to pay your property taxes if you own real estate in the United States.

You can pay directly to the local tax assessors office. Some offices accept online payments, while others still require checks or money orders.

If you have a mortgage, you will usually pay your mortgage lender a pro-rated amount each month which will be held in escrow and the lender will pay the property taxes for you.

🚨 What Happens if I Don’t Pay my Property Taxes

This is serious! If you don’t pay your property taxes you’ll be hit with penalties and interest.

The tax collector will also place a lien on your property.

A property tax lien prevents you from selling the property without paying the outstanding property taxes.

If you continue to miss payment, the county will eventually put your property up for sale at auction to repay the amount you owe and you could lose the property entirely.

✅ Tips for Managing U.S. Property Taxes for Foreigners

If you are not based in the United Sates, you need to make sure of a few things to ensure you don’t miss property tax bills and potentially lose your property.

⌛ Find out when property taxes are due in your county.

📩 Get a reliable U.S. postal address with digital mail forwarding to receive property tax bills.

💰 Put enough money aside ahead of time to pay the property tax bill immediately when it arrives.

💸 Deduct further pro-rated amounts from your rental income to stay ahead of the curve.

⚠️ Remember – if you fail to pay property taxes, you could lose your property! ⚠️

💸 U.S. Income Tax for Foreigners

As I have already mentioned, there are two primary tax rates for Foreigners with U.S. sourced income:

💰 Fixed Determinable Periodical Annual (FDAP)

💰 Effectively Connected Income (ECI)

The default tax rate for Foreigners with U.S. income is the FDAP rate, but you can elect to have certain types of income taxed as ECI when you file your U.S. tax return.

📉 What is FDAP Tax for Foreigners

First, FDAP is actually a withholding tax. That means the gross amount of tax (30%) is withheld at source by the U.S. payer who acts as the withholding agent.

Withholding agents might include anyone who sends you money, such as:

🧑💼 Real Estate Brokers

🧑💼 Property Buyers

🧑💼 Attorneys

🧑💼 Title Companies

🧑💼 Property Managers

🧑💼 Your own LLC

Because the IRS finds it more difficult to collect tax from Foreigners they require the U.S. payer to withhold the tax amount instead. In some cases, your own LLC might also be the responsible withholding agent.

📈 Effectively Connected Income

Most of us Foreigners who own rental properties in the U.S. will make the ECI election when filing our U.S. taxes.

This means that you are declaring that your rental income is effectively connected to a U.S. trade or business. We can do this because we are treating our properties as a business by renting them to tenants.

Making the ECI election allows you to:

✅ Avoid FDAP withholding

✅ Make deductions for your costs

✅ Make deductions for depreciation

✅ Pay tax on your net income

✅ Pay tax at the standard rates

By maximizing your deductions you may be able to reduce your taxable income to zero or even carry over on-paper losses.

✅ What Type of Income Qualifies as ECI

For foreign property investors, the following types of U.S. income can can classified as effectively connected income:

🏠 Gains and losses from the sale real estate

💵 Rental income

There are other types of income that can also be ‘effectively connected’, but as property investors we’re mostly concerned with these two.

📝 How to Make the ECI Election for Rental Income

You will make the ECI election by attaching a statement to Form 1040-NR when you file your first U.S. tax return.

The statement must include the following information:

✅ That you are making the ECI election.

✅ Whether you are making the election under IRC section 871(d), or in relation to a a tax treaty.

✅ A complete list of all your U.S. real estate holdings.

✅ What percentage of each property you actually own.

✅ The property addresses.

✅ Details of any major improvements to your properties.

✅ The dates you have owned the properties.

✅ The income you have received from the properties.

✅ Details of nay years a prior ECI election was made or revoked.

Once you make the ECI election it stays in place permanently unless you or the IRS revokes it, so all of your income in subsequent years will be classed as ECI income.

In order to avoid FDAP withholding you will also need to provide any U.S. payer with Form W-8 ECI every year. This contains a declaration that the income is effectively connected to a U.S. trade or business and withholding is not required.

📉 ECI Deductions For Rental Properties

Once you make the ECI election, there are a ton of deductions you can make from your gross rental income to reduce your taxable income in the U.S.

You will report deductions on Form 1040-NR Schedule E. Here’s a list of deductible expenses for foreign rental property owners:

🏘️ Property Operating Expenses

These expenses are fully deductible when paid and incurred in the tax year:

✅ Property management fees

✅ Leasing commissions

✅ HOA dues / condo association fees

✅ Utilities paid by the landlord (e.g., water, gas, electric, trash)

✅ Repairs and routine maintenance

✅ Lawn care, landscaping, snow removal, pest control

✅ Turnover cleaning or maintenance costs

📋 Taxes, Licenses & Fees

Deductible as incurred (except for those required to be capitalized):

✅ Property taxes

✅ Business license fees

✅ Local occupancy taxes (for short-term rentals)

✅ Rental registration and inspection fees

✅ Annual LLC or state filing fees (if U.S. entity owns the property)

🛠️ Capital Expenditures (Depreciated, Not Expensed)

Deducted over time using MACRS depreciation:

✅ Building depreciation (excluding land)

✅ Capital improvements (new roof, HVAC, flooring, etc.)

✅ Major renovations or additions

✅ Appliances, furniture (depreciated over 5 or 7 years)

✅ Initial startup costs (amortized if incurred pre-rental activity)

🏦 Financing & Loan Expenses

Mortgage interest is deductible as incurred. Upfront loan costs such as origination fees and loan points are added to the cost basis of the property and amortized over the loan term:

✅ Mortgage interest

✅ Loan servicing fees

✅ Points or loan origination fees

✅ Mortgage insurance premiums

🛡️ Insurance

Deductible in the year paid:

✅ Landlord insurance

✅ Umbrella liability insurance

✅ Hazard/flood/hurricane coverage

✅ Title insurance (if paid during ownership — not acquisition)

💼 Professional & Legal Services

Must be directly related to managing or preserving the rental property:

✅ Legal fees (evictions, contracts, compliance)

✅ Bookkeeping or accounting services

✅ Tax preparation fees (pro-rated to the rental portion of the return)

✅ Real estate consulting or investment advisory services

🖥️ Administrative & Office Costs

Allowable for actively managing from abroad:

✅ Home office deduction (if you meet the IRS requirements)

✅ Software (property management, accounting, tax)

✅ Phone/internet (pro-rated if shared with personal use)

✅ Office supplies, postage, and storage costs

📢 Advertising & Tenant Acquisition

Deductible when incurred to fill or market the property:

✅ Online advertising (Zillow, Facebook, etc.)

✅ Professional photography

✅ Tenant screening and credit check fees

✅ Broker commissions (if for lease, not sale)

💸 Tenant & Eviction-Related Costs

Directly deductible if they relate to keeping or removing a tenant:

✅ Legal fees for eviction

✅ Court filing costs

✅ Cash-for-keys payments

✅ Security refund shortfalls (if withheld for damages)

🧮 Calculating Depreciation on Rental Properties

One of the biggest deductions you can make on your U.S. tax return is depreciation. As I already mentioned, depreciation and amortization are reported on a sperate IRS form (Form 4562).

Often, the depreciation deduction will reduce your taxable income to zero, or even generate on-paper losses to carry over into future years.

That said, depreciation is recaptured when you sell the property (see later), so it’s not free money!

🧮 Establishing a Cost Basis for Rental Properties

In order to make deductions for depreciation, first you have to establish an accurate cost basis of your property. This is the original value of the property for tax purposes.

It’s important to know the cost basis of the property because you’ll use it to calculate depreciation, and your capital gains tax liability when you sell the property.

The cost basis of the property typically looks like this:

Original purchase price PLUS purchase costs PLUS capital improvements MINUS land value.

The cost basis can be increased or decreased over time. It will DECREASE ⬇️ when you deduct depreciation, and INCREASE ⬆️ when you make a capital improvement such as replacing a roof.

🧮 Calculating Depreciation Deductions for Rental Properties

Different items are depreciated over different timelines, and depreciation for some items can be accelerated over a shorter timeline, so it’s important to get accurate advice from a suitably qualified CPA.

That said, to make the basic depreciation deduction on your U.S. tax return, you will typically divide the cost basis of the property by 27.5 for the annual deduction.

Here’s a rough example:

Purchase Price: +$250,000 (a)

Purchase Costs: +$12,500 (b)

Capital Improvements: +$25,000 (c)

Land Value:-$40,000 (d)

Cost Basis: $247,500 ((a+b+c)-d)

Annual Deprecation: $9,000 ($247,500 / 27.5)

So in this simplified example, you can deduct $9,000 form your gross income on your U.S. tax return.

Here’s how that might look:

Gross Rental Income: $25,000

Operational Deductions: $12,500

Mortgage Interest: $7,000

Deprecation Deduction: $9,000

Taxable Income: -$3,500

In this hypothetical example, you have legally created an on-paper loss of -$3,500 for the year, reducing your U.S. income tax liability to zero. You may also be able to carry over those losses to subsequent years.

Bear in mind this is a highly simplified example that lacks nuance. I highly recommend you seek out the services of a qualified and experienced CPA who works with foreign property investors.

📉 Depreciation Recapture

It’s important to again make a note that depreciation is not free money!

When you sell the property depreciation is recaptured. This could increase the amount of your gain that is taxed, and the tax rate you pay.

🧮 Calculating Depreciation Recapture for Rental Properties

Let’s continue with the example we used above, and let’s say you sell the property after 10 years for $500,000.

Original Cost Basis: $247,500

Claimed Depreciation: $90,000 ($9,000 x 10 years)

Adjusted Cost Basis: $157,500 ($247,500 MINUS $90,000)

Sales Price: $500,000

Calculated Capital Gain: $342,500 ($500,000 MINUS $157,500)

So in this example, the first $90,000 is subject to depreciation recapture at a rate of 25% or your graduated tax rate (whichever is less).

Deprecation Recapture Tax Amount: $22,500 ($90,000 x 25%).

This amount is then added to your total capital gains tax bill (see below).

🏘️ FIRPTA Withholding Tax

The Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) is a withholding tax imposed on the sale of U.S. property (real estate) by Foreigners.

This means a withholding agent will retain a portion of the sales proceeds and send it to the IRS on your behalf.

If you are selling a U.S. property you own in your personal name, the buyer or broker acts as the withholding agent.

If your U.S. LLC is selling the property, it is your LLC that acts as withholding agent.

📉 FIRPTA Withholding Tax Rates

Typically, the withholding agent must withhold 15% of the total sale price of the property.

Once FIRPTA withholding tax is paid, you can reclaim any overpayment when you file your next U.S. tax return with the correct capital gains tax calculation (see later).

✅ Exemptions From FIRPTA Withholding Tax

There are various FIRPTA tax exemptions available for Foreigners selling U.S. property.

The five most common exemptions from FIRPTA withholding tax are:

✅ You are selling a U.S. property for less than $300,000, and the person you are selling it to intends to live in the property.

✅ You provide an IRS exemption certificate that excuses or reduces FIRPTA withholding.

✅ There is a provision in a tax treaty that excuses FIRPTA withholding for you.

✅ You don’t receive any money from the sale of the property.

There are various other exemptions from FIRPTA withholding tax. You can review a list from the IRS here.

📑 FIRPTA Withholding Tax Certificates

When you sell your U.S. property, you may be able to obtain a withholding certificate from the IRS that reduces or eliminates FIRPTA withholding tax.

You can apply for a withholding certificate directly from the IRS, but it can take a few months to process so make sure you do this well in advance of selling your property.

You must also inform the buyer prior to the closing date that you have applied for certificate.

The main reasons the IRS might issue a withholding certificate are:

✅ The IRS determine that the withholding amount would be more than your actual tax liability.

✅ You are exempt from paying U.S. tax due to a tax treaty.

✅ You make an agreement to pay your taxes and provide security.

You can apply for a FIRPTA withholding certificate using Form 8288-B, and you must also provide the IRS with accurate records to verify the basis of your application.

🏘️ Capital Gains Tax for Foreigners Selling U.S. Real Estate

As noted in the example above, any gains from the sale or transfer of property in the U.S. by a Foreigner who has made the ECI election will be subject to tax at the graduated tax rates.

Continuing our example, let’s look at how the remaining portion of the capital gain would be taxed:

Total Gain: $324,500

Depreciation Portion: $90,000

Remaining Gain: $234,500

Your $234,500 gain will be taxed at the graduated rates as follows:

$0 to $11,600 at 10%: $1,160

$11,601 to $47,150 at 12%: $4,266

$47,151 to $100,525 at 22%: $11,742

$100,526 to $191,950 at 24%: $21,942

$191,951 to $243,725 at 32%: $16,568

Remaining $8,775 at 35%: $3,071

Capital Gain Tax Bill: $58,749

As a rule of thumb, you might pay an effective tax rate of about $25% on a $250,000 capital gain.

Get Help Today: Book a 1-2-1 Strategy Call with me or a member of my team and start exploring your next investment in the U.S. property market

🏘️ U.S. Estate Tax for Foreigners

If you own assets located in the United States when you die, your estate will have to report the assets to the IRS, and your estate/heirs may have to pay U.S. estate taxes.

🔓 U.S. Estate Tax Exemptions

While U.S. citizens have a generous exemption, Foreigners are not so lucky:

🗽 U.S. Citizen Exemption: $13,900,990

🌍 Foreigners Exemption: $60,000

So the United States will tax the value of a Foreigners estate over $60,000.

🔢 Calculating the Value of Your U.S. Assets

The IRS requires you (your estate) to state the total value of assets situated in the United States at the time of death.

They may also want to know the value of your assets located outside the United States as well. This might be very important in order to claim exemptions and credits under the terms of a tax treaty.

Generally, the IRS will use Fair Market Value to value the assets.

You can typically make deductions from the gross estate value, including:

⚰️ Funeral expenses

📝 Administration expenses

⚖️ Claims or judgements against the estate

🏛️ Unpaid mortgages and liens

👩👩👦 Marital deductions

📉 Certain uncompensated losses

💸 Charitable deductions

If the total value of your U.S. assets exceeds $60,000, the executor of your estate will need to file Form 706-NA with the IRS.

💵 U.S. Estate Tax Rates for Foreigners

Here are the graduated U.S. estate tax rates for Foreigners:

| Estate Value From | Estate Value To | Tax on Bottom of Range | Rate on Excess |

|---|---|---|---|

| $0 | $10,000 | $0 | 18% |

| $10,000 | $20,000 | $1,800 | 20% |

| $20,000 | $40,000 | $3,800 | 22% |

| $40,000 | $60,000 | $8,200 | 24% |

| $60,000 | $80,000 | $13,000 | 26% |

| $80,000 | $100,000 | $18,200 | 28% |

| $100,000 | $150,000 | $23,800 | 30% |

| $150,000 | $250,000 | $38,800 | 32% |

| $250,000 | $500,000 | $70,800 | 34% |

| $500,000 | $750,000 | $155,800 | 37% |

| $750,000 | $1,000,000 | $248,300 | 39% |

| $1,000,000 | Over $1m | $345,800 | 40% |

📉 Mitigating U.S. Estate Taxes for Foreigners

There are various options for Foreigners seeking to mitigate or avoid U.S. estate taxes, including tax treaty provisions and investment structuring.

🤝 Tax Treaty Benefits for U.S. Estate Taxes

The first port of call for mitigating U.S. estate taxes is to refer to any tax treaty that might exist between your country and the United States.

In many cases – such as the UK and Canada – there are provisions to provide pro-rated unified credits to offset U.S. estate taxes for citizens of those countries.

A unified credit allows the estate to take advantage of the more generous estate tax allowance exemptions that apply to U.S. citizens for the portion of their estate that comprises U.S. assets.

In many cases a unified credit could offset your entire U.S. estate tax liability. You can view a list of U.S. tax treaties here.

🏢 Using Corporate Structures to Avoid U.S. Estate Taxes

If there is no applicable tax treaty provision to rely on, there are certain corporate structures you can use that will help avoid or minimize U.S. estate taxes for Foreigners, for example:

✅ Use a foreign corporation to hold the property.

✅ use an irrevocable trust, or a trust that would not be included in your estate.

✅ Use a two-tier structure with the property held in a U.S. corporation, whose shares are held by an offshore company.

A word of caution… While the structure can help you plan for, minimize, or avoid U.S. estate taxes, they may also result in higher income taxes and/or capital gains taxes.

Make sure to get professional advice from a suitably qualified tax planner, probate attorney, and/or CPA to make sure you follow the rules, and don’t end up with a bigger tax bill!

🏘️ Other Useful Articles