Private Lending Investment | A Step By Step Guide For Investors

Investor Bonus: See Investor-Ready Private Lending Deals Every Thursday

With record-level inflation, a volatile stock market, and record-high interest rates, more investors are turning to private money lending as a way to cash in and earn high rates of passive income. Here's everything you need to know to get started...

David Garner

The Investor’s Guide to Private Money Lending

I’ve been investing in real estate since 2010. But my first investment wasn’t in a property, it was an investment in debt.

That was 13 years ago, and since then I’ve bought and sold millions of dollars in mortgage notes and real estate. I’ve also loaned, borrowed or brokered millions more in private money loans.

Over the years, I’ve hit some home runs. But I’ve also made some mistakes and lost money on deals, too!

Today, I’m going to pass on some important lessons I’ve learned over the course of all those deals. I’ll include the good the bad and the ugly, and hopefully help you along in your own private lending journey.

Contents:

- My Experience with Private Money Lending

- What’s in this Guide

- What is Private Money Lending?

- Who can be a Private Money Lender

- 9 Reasons to Consider Private Lending

- Why do Real Estate Investors Use Private Money Loans

- Essential Elements of Every Private Money Lending Deal

- The Paperwork

- Property

- Payor

- Plan

- A Step-by-Step Process to Private Money Lending

- 1. Setting up Your Private Mending Structure

- 2. Setting Your Private Lending Criteria

- 4. Doing your Due Diligence (underwriting)

- Assessing the Plan

- 3. Finding Someone to Lend To

- 5. Closing Your Loan

- 6. Collecting Payments and Oversight

- 7. Dealing with Defaults and Foreclosures

- A Private Money Lending Case Study

- Another Private Money Lending Case Study

- Risks in Private Lending

- Private Lending FAQs

Now remember, this guide won’t make you an expert in private money lending, but it will give you everything you need to start looking at potential deals with some confidence. And just to be clear… I’m not offering you any personal financial or investing advice! So, with that out of the way, let’ get started…

My Experience with Private Money Lending

I am a real estate investor first and foremost. But I have also been both a Borrower and a Lender.

My overall experience includes buying & selling mortgages (performing and non-performing), private money lending, fix and flips, and rental properties.

Today, my real estate business operates a growing affordable housing rental portfolio comprising over 75 single family homes.

I have personally partnered with private lenders on 100’s of real estate deals. In fact, the vast majority of my current portfolio was acquired using private money loans.

The private money funding model works really well for me.

I’ve also helped dozens of other investors become successful private lenders through our investor program.

I don’t claim to be an expert on private money lending, but I do have some mileage and battle scars as both a lender and borrower that you can benefit from.

So, now we’re not strangers anymore, let’s take a look at what you’ll find in this guide…

Don’t Miss Out: Get fully-vetted private lending opportunities delivered to your inbox every Thursday

What’s in This Private Money Lending Guide?

This guide is not exhaustive. It’s not intended to be. I’ve been in the game for 10+ years and I still learn something new almost every day.

What you will find here are the need-to-know basics. My aim is to give you enough good quality information to start your own private lending investment journey.

In doing so, you’ll be able to create more passive monthly income in your retirement account or investment portfolio, and reach your own financial and wealth creation goals quicker!

Throughout this guide, I’ll show you the basic structure of a private lending investment deal…

We’ll look at how to structure your investment, how to set your own lending criteria, where to find private lending deal to invest in, and how to do your own due diligence (underwriting).

I’ll also show you what to do if something goes wrong, such as what to do if your borrower defaults.

And to help make this all make sense, I’ll walk you step-by-step through a couple of real life case studies using deals I personally completed this year.

I hope you find this guide useful!

What is Private Money Lending?

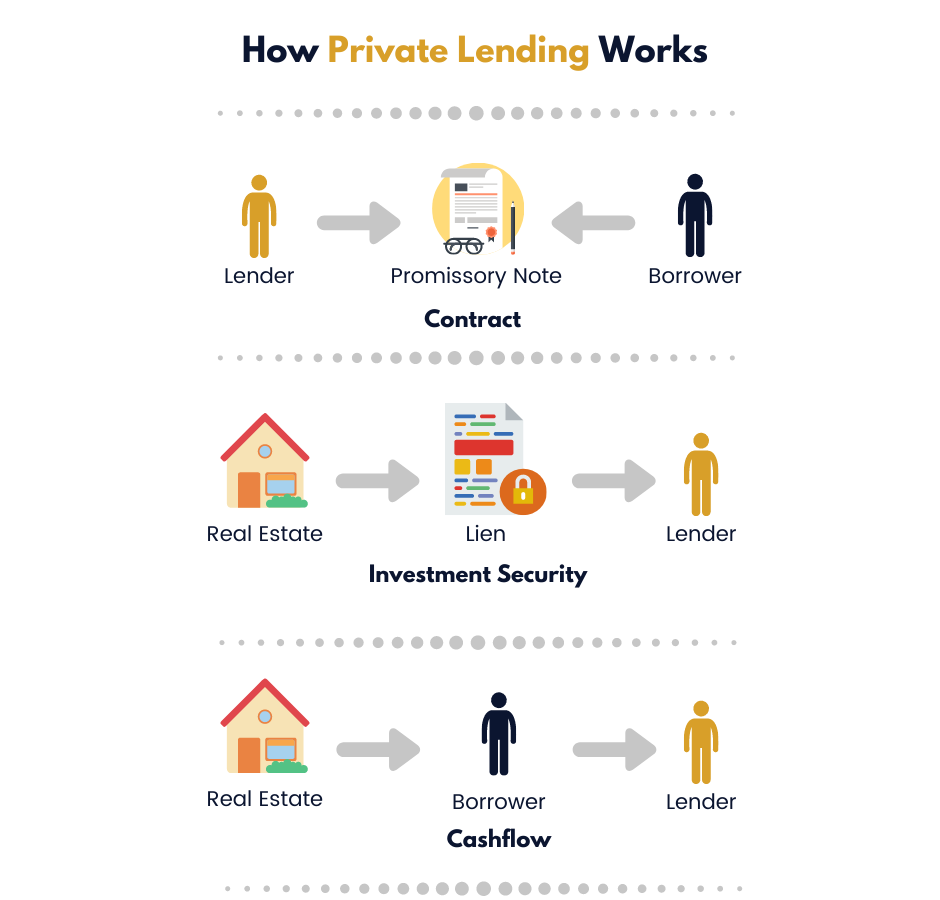

Private money lending is essentially non-bank lending.

In a nutshell, it is when a private individual loans money to a private borrower, and the borrower puts up a piece of real estate as collateral for the loan.

The lender is often referred to as a passive investor, while the real estate investor who is borrowing is considered ‘active’.

Be careful though…

…In reality, while private money lending is of course more passive of an investment strategy than say, flipping houses, it is by no means completely ‘hands free’.

For the real estate (active) investor, using borrowed money is a profit amplifier…

Using someone else’s money for some (or all) of a short-term real estate investment project means better cash-on-cash returns.

Also, using cash loans form private investors allows the real estate guy to close on a deal fast, and enjoy much more flexible terms than traditional bank financing.

For the lender, loaning out your money can be a great way to earn passive monthly income and a great rate of interest. At the same time, you can rely on physical real estate as security for your investment.

If it’s done right, private money lending can be a win-win for everyone!

Related Content: The Essential Private Lender’s Checklist

Who Can Be A Private Money Lender?

Luckily, in a world where Government overreach and regulation seems to be on the increase, right now absolutely anyone can be a private money lender.

If you are holding some cash, either as after-tax savings, or in a retirement account such as a self-directed IRA or 401(k), then you can be a private money lender too (that’s not to say you should, though).

In my own Private Lending Program we help all sorts of folk, from retirees to busy professionals, to take part in private money lending investments.

The common ground between these two seemingly very different groups of people is that they both generally want to be more passive investors.

Neither group wants to spend a ton of time managing their investments, so that’s why they choose private money lending!

Related Content: The Ultimate Guide to Appraising Real Estate for Private Money Lending

9 Reasons to Consider Lending Private Money

Private lending isn’t for everyone.

Like any investment, there are risks, and it is certainly not impossible to lose money. That said, if done well, private lending can be a great way to add more passive monthly income to your portfolio.

In my experience, these are some of the main reasons people get into private money lending:

- Having a large disposable income from your employment or a business (or both)

- Actively building your retirement account

- Already having built a large retirement account such as a self-directed IRA or 401(k)

- To diversify your investment portfolio (out of stocks and shares, mostly)

- Needing more passive income – for example a retiree

- To invest in real estate, but you do not want to to buy/rehab/manage/sell properties

- Concern about the volatility in financial markets, and the next recession

- Inheritance of a lump sum

- Specifically needing monthly income from your investments to cover living costs

If any of these apply to you, you might want consider an investment in private lending. Especially if you want to build a well-diversified portfolio that is not over-exposed to the stock market, or you need dependable, passive monthly income.

Related Content: 5 Ways Real Estate Investors Use Notes

The Essential Elements of a Private Lending Deal

So now you know why private money is a useful tool for real estate investors. And of course, you already know why passive monthly income is attractive to investors (duh!).

So, now let’s get into the nitty gritty, and look at the 3 basic components of every private lending investment.

- Paperwork

- Property

- Payor

You could also add ‘Plan’ to this, as every private lending investment you make will be based on a specific plan for the property (or at least, it should). But for the purposes of this guide, I’ll talk about that in the section under ‘Property’.

In this next section, I’ll briefly introduce all three of these main elements, and then we’ll take a deep dive into each individual part in the later section on due diligence later on.

Private Lending Paperwork

Unlike unsecured loans which comprise usually just a promissory note (like with P2P lending for example), the paperwork involved in a real estate private lending deal has two main parts; a promissory note and lien (or deed).

These documents perform very different functions, but both are equally important.

The Promissory Note

A promissory note (also referred to as ‘notes’ or ‘real estate notes‘) is simply a contract between the lender and the borrower.

This document contains the terms of the loan, including the amount owed, term, maturity and interest rate.

The note should also contain clauses defining rights and recourse for the lender in the event of a default such as late or missed payments.

The terms and clauses contained in any note will depend on the specific deal done between borrower and lender at the time the note was originated.

In some cases there will be State-specific language too, which is why it is super important to have your documents drafted – or at least checked over – by a real estate attorney licenced in the State in which the property is located.

Related: A Guide to Promissory Notes for Private Lenders and Note Investors

The Lien (or Deed)

The lien is a deed recorded on the title of a property in the County records and acts as security for your loan.

This will be either a Mortgage Deed or Deed of Trust depending on which State the real estate is located in.

The deed records the debt, and gives you (the lender) the right to take ownership, or force the sale of the real estate if the borrower defaults on the terms of the promissory note. That’s how the note and lien and deed work together!

I’ll go into more details on what your deed should contain later. But for now, here’s some of the most basic information that should be included in your deed:

- Borrowers’ name(s)

- Real Estate address

- Legal description of the Real Estate

- Amount of the debt

Once the debt is repaid, you will record a release (or satisfaction) of mortgage or a reconveyance of deed in the county records. This releases your legal charge over the property.

Related: Understanding Lien Position and Priority for Lenders and Investors

At the end of the day, your paperwork and the language it contains will vary depending on the specific deal you are doing with your borrower, and even the State the property is located in.

For example…

…I write a clause into my promissory note that allows the lender to demand a Deed in Lieu of foreclosure if I default. That allows the lender to avoid costly and lengthy foreclosure proceedings if they so wish.

Other deals I have done share equity profits with the lender when the property is sold, and some notes have had mutual extension clauses that trigger extra interest payments (points) to the lender on agreement to extend.

The beauty of private lending is that you are in control. You can negotiate terms that suit you, the borrower, and the deal at hand.

So, that’s your brief intro to private lending paperwork.

Of course, there’s plenty more paperwork involved, but we’ll cover that later. For now, let’s move on and take a look at the real estate.

Related: Note Investing 101 | The Complete Guide to Real Estate Note Investing

The Property

When you become a private money lender, the real estate acts as security for your investment. As such, there are some key elements you really need to understand before you get started.

If your borrower defaults for whatever reason, you might end up owning the property. Then, you might have to finish the job the borrower started (rehab for example) in order to sell the home to recoup your money.

You might end up keeping the property for longer than that… there are lots of possibilities.

That’s why it’s important to understand the Borrower’s plan for the property, and it’s feasibility.

When you are first presented with a private money lending opportunity, as a bare minimum your borrower should have a handle on the following things already:

- Full address

- Property description (property type square footage, floors, bedrooms and bathrooms)

- Current condition (photos/video would be great)

- As-is valuation

- Scope of work (for any renovations the borrower plans to do)

- The plan (is this a fix and flip, long term rental, or something else)

- Some local market data

What this info will tell you is whether this particular property fits your lending criteria (we’ll cover that shortly).

You will also want to ensure that the title is clean, but that kind of thing comes out in the wash when title work is done before closing (and also why you have lender’s title insurance).

When it really boils down to it, the questions you are asking at this stage are:

- Would you be prepared to own this house (and finish the job) if the deal went to sh*t?

- Is the borrower’s plan for the property realistic in terms of cost/time?

- Will the end product be in-demand in the local market?

But don’t worry, we’re just about to get to the part where we talk about setting your lending criteria, and I’ll be diving into all this in much more detail.

Related: How to Appraise Real Estate for Private Lending and Note Investing Deals

The Payor (your Borrower)

Ask any private lender what part of a deal they consider to be most important, and 9 out of 10 will say the borrower.

It has been said that a good borrower can turn around a bad project, and a bad borrower can ruin a perfectly good project.

In my experience, that’s pretty much bang on the money

First and foremost (and I’ll probably repeat this later), only do business with people you trust, and who can demonstrate a solid track record of executing the kind of project they are proposing to you.

For example, when a new investor joins my private lending program, we show them a bunch of our most recently completed rehabs in the same market they’ll be lending in, either on video or on a face to face site visit.

We also let them speak to other lenders in our program about their own experiences.

Most importantly, we do what we say we’re going to do, which is the BEST way to build trust.

One important point to note here…

…your actual borrower may be a person, or a corporate entity, and your due diligence process will differ slightly based on this. But fundamentally you are doing business with a human being, so keep your focus there.

Related: Assessing Credit Risk for Private Lending and Note Investing

Setting Your Private Lending Criteria

A private lending deal can be structured any one of a thousand ways.

You will first need to set your own parameters as to the type of deals you will consider investing in. This will take into account things like:

- Property type

- Location

- Project type

- Deal structure

- Borrower

These things will ultimately be defined by your own investing goals and risk tolerance, so my advice is to start there and work back.

Here are some of the main considerations you will need to make when compiling a vetting criteria that aligns with your investing goals and risk tolerance…

How Much to Lend

You’ll need to take into account not just how much money you have available, but also how much of it you’re prepared to risk in one single deal.

Remember, you might end up owning the property. Even finishing the job yourself if it all goes pear-shaped So, keeping some ‘dry powder’ is essential…

… you don’t want to be in a position where you own a part-renovated house that needs $20,000 to finish renovations which you don’t have!

There are other considerations that might require more capital too. For example…

What if the rehab costs or timeline overrun and the borrower needs more capital?

What if they fail to pay property taxes?

What if something happens to the borrower (illness or whatever)?

What if the property takes longer to sell/rent/refinance than anticipated?

What if someone places liens on the property?

All of these things may require extra capital in order to keep the project afloat, so it’s better to have some spare cash available and not need it, than to need it and not have it!

Lending Ratios

Once you’ve figured out how much capital you’re prepared to lend, you should decide what you’re lending parameters are.

The lending ratio refers to how much you lend as a percentage of the property or project value.

As a rule of thumb, most private lender’s I know will lend at 65% of the property/project value or less, although some will venture up to 70%.

As a lender, the lower your investment in comparison the the value of the asset, the more likely you’ll get all your money back if things go wrong.

Here are some examples of the most common lending ratios in private money lending…

Loan-to-Value (as-is)

This is where you lend as a percentage of the current ‘as-is’ value of the property. This might be more than the purchase price if the borrower is buying the property at a big discount the the as-is value.

Loan-to-Value (ARV)

ARV means ‘ after repair value’. This is the future projection of the property value once the borrower has completed any rehab work. So, Loan-to ARV is your investment as a percentage of the future value of the property.

Loan-to-Contract

This is where the private lender loans money based on the purchase price stated in the purchase contract.

If the loan-to-contract ratio is less than 100%, your borrower will have to have sufficient funds to complete the purchase, and possibly any planned rehab.

Splitting Purchase and Rehab

Some lenders will lend based on percentages of the purchase price and renovation budget separately.

For example, you might fund 80% of the purchase price, and 100% of the rehab amount.

Or, you might fund 100% of the purchase price and non of the rehab.

There are endless combinations here, and every lender will have their own idea of what they will lend based on the property, project borrower.

I have lenders in my program that fund 100% of purchase price and rehab, but their interest rate is very high, and often they require an equity share as recompense for the extra risk they are taking.

I also have more conservative lenders that will only lend against fully-renovated homes, at a maximum loan-to-value of 65% or less. In those cases, the interest rate and return to the lenders is lower, reflecting the lower level of risk to their capital.

Interest Rate, Yield and ROI

There is huge variance in interest rates charged by private lenders based on the specific project plan, property, deal structure and borrower quality.

In general, market rates for private money loans range from about 6% p.a. to about 15% p.a.

Where you set your own private lending interest rates is down to you.

You want to rewarded fairly for your risk, but you also want to remain competitive.

You might venture to take a look at what interest rates are charged by other private or hard money lenders in your market and go from there.

The key thing to remember here is that your interest rate is the premium you are charging for the use of your funds, and for the risk you are taking.

But the interest rate isn’t always 100% of your return. Sometimes the deal structure will add value too.

Private Lending Deal Structure

Aside from the interest rate, there are other opportunities to boost your return on invest through creative deal structuring.

For example, deals funded through our private lending program are often discounted.

This means that the loan (note and deed) may be set at say, $50,000… but the private lender will fund only $47,000 at closing.

In this case, the private lender will be paid interest on the higher amount, and will be repaid the higher amount at maturity. So, a $3,000 discount becomes a profit for the lender when the loan is paid off.

You can also add points to your loan, which is effectively upfront interest, as well as processing fees, underwriting fees, administrative fees and in some cases, late payment fees.

This kind of deal structuring can boost your annualized return on investment significantly. But remember, if the cost of your capital is too high, a good borrower will look elsewhere, and it is the good borrowers that you really want!

Term

As I mentioned earlier, private money loans are usually short term loans used by real estate investors to buy property fast, add value, and then either sell or refinance to pay back the private lender. The good ol’ fix and flip!

But there are other RE investors that require loans with longer terms.

With this in mind, the length of the loan you provide should fit with the project plan (as well as your own investing parameters).

The term you set should take into account the amount of time your borrower thinks it will take to complete the renovation phase, and how long you think the property will take to sell or refinance

I know lenders that are quite active and will only lend for a maximum of 12 months. There are others I know that are more passive and prefer to invest in longer term loan of up to 5 years or even longer.

In my experience, private money lending terms usually fall within the 6 to 60 month range, depending on the project the loan is funding, and the personal criteria of the lender.

Use of Funds and Dispersal

How your funds are accessed and used is an important part of any private money lending investment.

Usually, there will be an element of funding required to purchase the property, and further sums required to fund renovation/rehab.

Your borrower should provide you with a full Scope of Work, detailing the renovation costs and timeline of any work that is scheduled as part of the the project.

You can then schedule to provide a certain amount of funds for the purchase price at closing, and then release further funds for renovation as required, this will usually be as each phase of the project is completed by the contractor.

This being the case, you will want to see proof that the work has been done to an acceptable standard before releasing funds.

You may also want to put those rehab funds into escrow at closing (or at least provide proof of funds) so that your borrower is confident they will be available when needed.

Property Type and Location

This part of your lending criteria is highly subjective.

I know plenty of lenders that will fund projects nationwide.

I also know lenders that will only fund deals in their own backyard.

Where you lend is really down to your own personal preference, but you should definitely understand local market conditions for the deal to hand.

All that said, wherever you might want to lend, you might find that there is no room for another private lender in that market, or that existing lenders are offering terms you cannot, or will not match.

Maybe there are no borrowers you’d like to work with, or perhaps deal sizes are bigger than you can fund right away.

That being the case, you can always do some research and find other markets that fit your criteria and start there.

For example, I know a lender based in California who only funds deal in Indiana.

The deal sizes in that market fit with his parameters. He has already established relationships with borrowers there. And, he has done enough deals to know the market fairly well.

I also have many lenders in my program funding loans in Pennsylvania who are based all over the US.

When it comes to the type of property you will, or will not lend against, that should really be defined by the market the property is located in.

You might personally like 3-bed 3-bathroom houses, but that might not be the right product for the local market.

For example, I know that in one of the markets I invest in, 4-bedroom properties with at least 2 full bathrooms make the best rentals because the renting demographic have big families.

In another of my markets, demand is higher for smaller starter homes, so we buy mostly 2 or 3-bedroom homes for our rent to own program there.

It’s horses (or houses) for courses, really.

Project Type

There are all sorts of real estate investment projects seeking private funding.

You might choose to only invest in fix and flips with a short timeline. Then within that niche there are big rehab projects, small ‘lipstick’ renovations and everything in-between.

Perhaps you might prefer longer terms rental property loans with less turnover such as the 36-month bridge loans we offer in our program.

All things considered the key here is risk. More specifically, your own personal perception of, and tolerance for risk.

Bigger rehab projects are more likely to encounter problems with cost and time, and so present a bigger risk to the investor and the lender.

These types of projects can still make great investments, but you should adjust your terms accordingly.

With bridge loans for rental properties, the loans are longer and the interest rates lower. But the collateral property is already renovated and tenant-occupied, so there is much less risk.

Borrower Criteria

I’ve put this last in the ‘Setting Your Private Lending Criteria’ section, but it’s probably the most important part.

As I’ve already mentioned, a good borrower can save a bad project, but a bad borrower can ruin a good project.

So regardless of the type of project, the property, the market, or the deal structure, you should only work with people that you can communicate well with, and that you can trust.

For me, track record and communication is of paramount importance when dealing with borrowers. And I know that is what my lenders value most also.

We’ll get into some of the specifics borrower due diligence in the next section, but in the first instance just be sure to deal with people your gut tells you you can work well with.

So there you have it…

…once you get all of this down, you’ll have a good idea of what kind of deal, location, real estate and borrower will fit your own private lending criteria.

Then it should be pretty easy to discard deals that don’t fit, and shortlist those with potential.

Now, let’s get down to brass tacks and start looking at conducting your due diligence when you do find a deal to invest in.

See Live Deals: Get fully-vetted private lending deals in your inbox every Thursday

Private Lending Due Diligence

When it comes to private lending, your due diligence process is effectively a process of elimination with which you are aiming to filter out deals that do not fit the personal lending criteria you set (see section above).

Your due diligence process will be largely subjective, but there are of course many technical boxes to be checked too, and that’s what we’re going to cover here, starting with your borrower.

Assessing the Borrower

When ranking the holy trinity of Paperwork, Property, and Payor in terms of importance, most of the private lenders and note investors I speak to tend to put the Borrower first.

Of course, everything else with the deal has to fall in line, but without a competent borrower, the deal is lost before it’s even begun.

So, one more time, just for good luck…

…a good borrower can turn around a bad project, and a bad borrower can ruin a good project.

Since first getting involved in real estate in 2010, I have seen plenty of perfectly sound projects fall apart.

Almost all of the private lending losses I have witnessed or personally experienced have been caused by the borrower being unable or unwilling to fulfil their end of the bargain.

A lack of experience, incompetence, and/or unfortunate circumstances have played their part, but it has been sketchy behaviour on the part of borrowers has been the downfall of otherwise perfectly sound projects.

This has taken many forms, including outright wilful fraud, not rehabbing properly (or at all), not paying property taxes, straight up theft, and ‘robbing Peter to pay Paul’.

This all distils down to one, easy lesson…

…as a private lender, you should only work with people you trust, and that you can truly partner with on a deal. Even then, there are no guarantees!

Here are some early-stage red flags I look out for that might indicate your borrower could end up being a problem if things go wrong.

- No experience, or little experience with the specific type of project that they want funding.

- No cash reserves.

- They plan on doing the rehab themselves – not through a licensed General Contractor.

- No solid Plan A and Plan B (and ideally Plan C) to exit the investment.

- They have not or cannot provide documentation (BPO, Scope of Work etc.).

- They do not respond to your communication in a timely manner.

- You get vague answers when you ask specific questions about them or the project.

- They tell you there is ‘no risk’.

- Their projections for the project are overly optimistic.

- They cannot demonstrate a good team (contractors, relators, attorney etc.).

The overriding rule here is still to trust your gut.

If you you just don’t gel with a potential borrower’s style, then politely decline and keeping looking, even if the deal looks great.

Remember, you are in the driving seat. There are plenty of great borrowers out there seeking private funding for their deals.

All that said, if and when a borrower makes your shortlist, here are some of the simple, basic boxes you should check…

Pro Tip: Get fully-vetted private lending deals in your inbox every Thursday

Due Diligence for Individuals

If your borrower is an individual or individuals (as opposed to a corporate entity), here is a list of the things you may want to check out:

- Personal details (name, address etc.)

- Track record proof

- References (if available)

- Background check

All of these elements are useful in putting together an overall picture of your borrower.

Personal Details

Obviously, you’ll want their full name and address, and date of birth, SSN, etc. All of this will be important when it comes to financial reporting and taxes.

Track Record

For me, this is the most important part.

While everyone has to start somewhere, you really want to work with borrowers that can demonstrate a track record of successfully completing projects in the market they are operating in.

For example, in our Private Lending Program, we provide new lenders with walkthrough videos of recently completed rehabs.

Sometimes they even visit us for a tour of the market, and see current and completed rehabs.

You can also check County records to see how many properties they have bought and sold in their name, or the name of any of their LLCs.

Real estate is mostly all public record, so much of the corroborating evidence you require is accessible from one source or another.

References

If the borrower is not new to the game, they have most likely borrowed money before. Ask to speak with previous lenders they have worked with for references.

We invite new lenders in our program speak to current and previous lenders that have invested full cycle with us (money in – money out).

Credit Report

While useful as part of a bigger picture, a credit score is not always the best indicator of someone’s ‘lendability’ when it comes to private lending.

Some private and hard money lenders will pull a credit report, others don’t. My commercial refinance lender does not, for example.

When vetting tenants and buyers for our Pathway to Home ownership Program, I have seen applicants with poor credit scores who have never missed a payment. Simply their utilization of credit drives down the score, so the overall report is more important than the number.

Background Check

In my experience, running a background check can be often far more revealing than a credit score.

Someone can have great credit, but then have all sorts of shady stuff on their criminal record that might give you pause when it comes to making private lending decisions.

Of course, you may not feel that a background check is necessary if you have spent the time and effort building a solid long-term relationship with your borrower, but my advice is to err on the side caution, at least at first.

For example, we once had a tenant application with great credit and great income. But when we ran our background check through the court system it turned up that the guy had Federal charges for bomb-making and illegal gun possession.

We had another that had outstanding murder charges.

Both of these were a hard NO from us.

Cash Reserves

If the project plan and deal structure requires that the borrower put in some of their own money for a portion of the purchase price or renovation budget, then you want to be sure they have those funds to hand.

Due Diligence for Corporate Entities

In most cases your actual borrower will be some type of corporate entity. This being the case, there are some different details to check out.

- EIN number

- Certificate of good standing

- Certificate of incorporation or equivalent

- Operating Agreement

- Register of Members

Remember, regardless of the entity that is actually doing the borrowing, your partner in the deal is a human being.

So, while all of this paperwork is important, please refer to the section above and run your checks on all members of the LLC as though they were individual borrowers.

In summary, remember that you are not a bank. In fact, one of the biggest reasons a real estate investor will use a private lender is because the lending terms and application criteria for private money loans are far more flexible than a bank.

As a private lender, you are not really all that interested in debt-to-income ratio, or a stellar credit score. Instead, you are looking for obvious red flags that put you off doing business with this person personally (as well as making sure the deal stacks up and the project is good of course).

Ultimately, you are vetting to shortlist capable, competent borrowers with a solid track record and a good deal for you to fund.

If you keep that in mind, you can develop a process that is right for you.

Related: Assessing Credit Risk for Private Lending Deals

Assessing the Real Estate

As I already mentioned in the section on setting your lending criteria, you may have some boundaries as to the type and location of real estate you will lend against.

So, you will need to do some basic research to see if the property (and market) being offered as collateral fits that criteria or not.

For example:

- Is the property in a location you will lend in?

- Is it the right kind of product for the market?

- Is the plan for the property appropriate?

Maybe you don’t want to fund a luxurious short term rental (AirBnB) type projet in a low income neighborhood.

Perhaps an affordable housing project in an upscale neighbourhood might be a bad idea.

Perhaps you might not want to fund a quick fix and flip in an areas where properties stay on the market for 6 months.

But if the property or market does meet your general private lending criteria, you can then dig a little deeper to make sure the specific house will make good collateral.

In order to do that, you’ll want some information about the property, title, taxes and liens…

The Physical Property

The physical property is the backstop for your investment if things go wrong. It’s important, and the most important things you want to know are:

- What is the property worth right now?

- What renovations are to be conducted (and the cost)?

- What is it likely to be worth when the renovation work is complete?

- Is it the right property for the borrower s plan in that market?

Most of the information you require about the physical real estate can be gathered from a Brokers Price Opinion (BPO), and Scope of Work (SoW), including:

- Area (sq. ft.)

- Number of bedrooms

- Number of bathrooms

- Year built

- Lot size

- What type of property (Single family, multi family, commercial etc.)

- House type (e.g. ranch, rambler, colonial, split-level)

- How many levels

- The current condition of the property

- Annual property taxes

- Details of the renovation, including cost and timeline

Once you have this information, you can use it to figure out whether this is the type of property likely to be in high demand in that local market…

…and you can do that by further analysing local market conditions.

The BPO will also provide you with a lot of the information you might want to know about the market, too, such as:

- The amount of time properties take to sell

- The price of active listings of similar properties

- Sold prices for recent sales of similar properties

This info tells you if the property is likely to sell or rent well once the renovation work is complete.

If you want, you can also further analyze the market using a range of public sources to find out:

- Historical and current population growth rates (local area/wider area/nearest commutable metro area)

- Historical and current property vacancy rates

- How close is the property to transport links?

- Is employment in the area growing?

- Are there big, stable local employers?

- Is it more a rental market, or are house owner occupied?

- What are the crime stats?

- Is the property in a flood zone?

- What do properties of the target type rent for?

- Are local schools any good

All of this ancillary information is freely available from various sources around the internet, but in my experience it is best to speak to people already operating in the area.

Just remember though, opinions vary. One person may hate an area, while another loves it. You must draw your own conclusions.

This is why borrower track record is important.

If they can demonstrate that they are buying the right type of houses, in the right area, and are capable of devising and executing an appropriate (and profitable) project plan and exit strategy, then you are likely on to a winner.

Taxes Titles and Liens

If you are happy with the property and the borrower’s plan, the next step is ensuring the property has clean title.

I have seen plenty of deals unravel for lenders where proper title work has been lacking.

The good part is that you don’t need to become an expert in title work.

Make sure to close your loan through an attorney or title company that does comprehensive title work, and make sure you get lenders title insurance.

Remember…. successful private lending requires team, team, team!

Personally, I buy mostly ‘low-income affordable housing’ for our Pathway to Homeownership Program, and those are the deals my private lenders fund.

Often these are distressed properties, and some have even been abandoned for years. So, there are often title issues that arise before I can close on a deal.

Over the years, I have come across tax liens, mechanics liens, and HoA liens, all of which can all get in the way when a property is to be sold or refinanced…

…and if the property can’t be sold or refinanced, you won’t get repaid.

As a side note, it is also important to make sure your borrower keeps up to date with their bills.

While title may be clean at the time of closing, if property taxes run up, or the property is encumbered with other liens because the borrower hasn’t paid their bills, this could seriously impact your investment.

Again… even more reason to put the borrower first when deciding whether to lend.

This is also where a good loan servicer might be a good idea.

We have a company service loans for our private lenders and they check that we have paid property taxes and have insurance in place in an annual basis.

Having got this far, by no means are you all of a sudden an expert on private money lending, but at the very least you know the due diligence basics when it comes to checking out your borrower and assessing the real estate.

Now, let’s take a close look at the paperwork…

The Paperwork

If you are comfortable with your borrower, and they have a property/deal/plan that fits your criteria, you can then start putting together your paperwork for the deal.

Aside from your promissory note and deed, there are also some other documents you’ll want to have drawn up, so your total deal package will look a bit like this:

- Loan Agreement

- Promissory Note

- Deed

- Escrow Instructions

Remember, this is just your loan paperwork. There’s a ton of other stuff, too.

But don’t worry, I’ll give you a complete list at the end of this guide, and provide links to some great resources to get you started.

Promissory Note Checklist

I already talked about the fact that your promissory note is the legal contract between you and the borrower.

As such, it needs to be bulletproof.

You will be relying on the language in both your note and deed to get your money back if the deal goes South.

My advice is to have a competent attorney draw up your paperwork.

Every state has different language and legal requirements when it comes to private lending, but here are some of the key terms and clauses you will find in most promissory notes:

- Total amount of the loan

- Monthly payment

- Origination date

- Maturity date

- Loan term (length of the loan)

- Interest rate before default

- Interest rate after default)

- Borrower’s address

- Lender’s address

- How payments will be applied?

- Late payment provisions

- Usury Savings Clause

The promissory note should also contain waiver provisions, which may include:

- Notice

- Demand

- Notice of intent to accelerate

- Notice of acceleration

- Maturity protest

- Notice of protest

- Foreclosure notices that can be waived by law

- Anti-deficiency statutes

As you can see, there is a lot to be contained in a promissory note, and every lender has different requirements and therefore different language.

For example, I recently has a lender’s attorney ask that some of the language in our note be added to the Mortgage deed.

Another asked for an additional deed in lieu clause that would allow the lender to take ownership of the property if I defaulted on the loan

Pro Tip: Do not use a free template as your promissory note and/or deed! Get the advice of an experienced attorney that understands State and Federal laws around private lending in that state.

Mortgage/Deed of Trust Checklist

As with your promissory note, you should have a qualified real estate attorney draw up your Mortgage deed or deed of trust.

Here is a non-exhaustive list of what most deeds will contain:

- Due on Sale Clause

- Language on Lender Recourse Provisions

- Signed by Borrower

- Notarized by a Notary Public in Good Standing

- Language Requiring Insurance on Property

- Language Requiring Borrower to Pay Taxes Accrued and Due

- Late Charge Provisions

- Foreclosure Procedures

- Accurate Legal Description with Property Lot and Block

To reiterate, you can use a template by all means. But have your attorney provide one specifically for you and the deal at hand. Don’t just use one you downloaded for a couple of bucks from the internet.

There are lots of good law firms specializing in private lending, and I’ll provide some references at the end of this guide.

If your deed contains the wrong language, or is missing something that is required in the state or county the property is located in, then you could become unstuck later on.

Other Loan Paperwork

Aside from your note and deed, there is some other paperwork to consider when entering into a private money lending transaction.

This includes a loan agreement, personal or corporate guarantee, and escrow instructions.

Loan Agreement

In our Private Lending Program, we call this a Funding Agreement. Most lenders will call it a loan agreement or something similar.

This agreement – signed by lender and borrower – effectively ratifies your verbal agreement to fund the deal, and serves as the foundational document for a private lending transaction.

This agreement should contain the terms of the loan you have agreed to, and also identify other paperwork involved in the loan such as the note and deed.

It should also reference the rights and obligations of both the lender and borrower.

Here are the key points we include in our own Funding Agreement:

- Title of the agreement

- Effective date

- Name and address of all parties

- Recitals:

- The borrower has signed a contract to purchase the property

- The lender has agreed to fund a loan of $X amount

- Statement clarifying use of funds

- Agreement:

- Closing date

- Closing company name and address

- Reference to the Promissory Note, Mortgage Deed and Scope of Work

- Lender agrees to fund $X before closing date

- Borrower agrees to pay for lenders title insurance

- Borrower to name Lender named as loss payee on hazard insurance

- Borrower agrees to pay property taxes and liens

- Borrower commits to executing the Scope of Work

- Miscellaneous legal jargon

Of course, your own loan agreement will be subjective, and the recitals, terms and agreements it contains might vary from one deal to the next.

Once again, you are best to have an attorney provide any legal paperwork that you might have to rely on in court if things go bad.

Personal Guarantee

A personal guarantee effectively imposes a personal obligation to repay on the borrower or a third party in the case of a default.

This could be useful if the proceeds of a sale of the real estate are insufficient to repay the total loan amount.

Personal guarantees are common where an LLC is the borrowing entity.

A private lender might ask for a personal guarantee from the LLC members or someone other than the principal borrower, such as a family member or partner.

One thing to note here…

…if the actual borrower is someone’s 401K or IRA retirement account, then then the owner of the account cannot legally provide a personal guarantee. That’s why some private lenders will not originate loans those kind of entities.

Escrow Instructions

When it comes to funding the loan, you will want to use a title company or attorney to close your loan, and you will need to provide them with clear escrow instructions.

These instructions clearly state what must happen before escrow is closed. They are effectively your written instructions to the escrow holder detailing the terms and conditions of the loan.

Before closing, you will provide the escrow holder with a copy of all loan paperwork, including the note and deed, along with the escrow instructions.

Your escrow instructions should include provisions for the following:

- Loan amount

- Loan terms such as points etc.

- Proposed funding deadline

- Proposed closing date

- Paperwork required

- All costs and fees and payees

- All borrower obligations

- All lender obligations

- Details of insurance policies required

- Use of funds schedule

Again, your escrow instructions will be based on the deal you have agreed with your borrower, and the lending laws of the state and county the property is located in.

So, that just about covers your private lending paperwork in terms of the actual loan itself.

To summarize…

First, you’ll sign a loan agreement, then you’ll draw up a promissory note and deed, and finally you’ll provide escrow instructions to the closing co.

You may also want to request a copy of the title report from the closing co. to review yourself, or have your attorney review before funding.

Where to Find Private Lending Deals?

If you do decide you want to get into private money lending, I will guarantee right here and now that you have no trouble finding potential borrowers. Finding good ones, on the other hand, that’s infinitely more complicated.

Remember, You’re not looking for deals to invest in. You’re aiming to find people you can work with first. If those people can then bring you a good project to lend on from time to time, that’s great!

But where to start? Well, of course there are ‘done for you’ private lending programs like mine, but if you prefer to go it alone you may want to start closer to home.

There may be folk in your existing network of friends, family and business associates that are investing in real estate and require funding.

I have spoken to plenty of lenders that did their first deal with a ‘known associate’ (with varying levels of success).

But to find the best deals, and the best borrowers to work with, you will most likely have to look outside your existing circle of contacts.

You’ll need to start networking, and make yourself known as a potential provider of capital for deals.

Luckily, there are a few time-tested and proven ways to do that.

Find Deals Here: Get details of fully-vetted private lending opportunities in your inbox every Thursday right here

Real Estate Groups

Sometimes, the old ways are still the best…. Sometimes!

Real estate networking meetings can be a great place to meet potential borrowers.

There are always local groups that hold regular local meetings, and with the magic of the of the internet you can find REIA groups all over the country through their websites and social media pages.

Edwin Epperson III is a former Green Beret special forces solider turned professional investor and private lender who I interviewed for our podcast recently.

He first found out about private money lending by attending local real estate networking groups during downtime from his intensive military training.

He was there to learn about real estate investing first and foremost, but ended up meeting an experienced private lender who eventually became his mentor, and also introduced him to a wider network of professional lenders and potential borrowers.

Today, he not only lends his own money, he also helps other private lenders invest their funds, too.

One of the best things about REIA groups is the grapevine!

Much like in the very small and connected mortgage note investing community, bad reputations tend to stick, so bad apples float to the surface pretty quickly.

Online Platforms

Nowadays, there are ton of online platforms that offer opportunities to participate in private lending and real estate note investing, many of which offer mortgage notes for sale, so you can buy existing loans from other investors.

My own Private Lender Portal lists opportunities to invest in fully-vetted private lending investments that fund the acquisition and regeneration of affordable housing.

There are others, too. If you want to buy exiting mortgage notes, you can check out my complete list of where brokers, funds and online platforms here.

Brokers Advisors and Professionals

Another great source to meet potential borrowers is through loan brokers, financial advisors, and other real estate professionals such as realtors, contractors, attorneys and closing companies.

Private lending brokers are often lenders in their own right who have more deals than they can fund. They may offer to bring other lenders into a deal.

Usually, the deal will involve the broker doing all the hard labour of due diligence, deal structuring, and management. In exchange they earn points on the loan, and potentially a portion of the interest, too.

Financial advisors may also have clients or contacts that are investing in real estate that require private funding.

This also goes for real estate professionals including; realtors, contractors, insurance agents, home inspectors, appraisers, title companies, attorneys, and even the code enforcement and licencing guys at the county office.

This guide isn’t a how-to on networking, but you should certainly get yourself out there.

The key is to introduce yourself the people that know the people that would be your borrowers.

Hard Money Lenders

The difference between hard money and private money is that hard money lenders are typically professional lenders with a fully fletched business behind them.

Private lenders, on the other hand, are typically normal folk like you and I investing their own funds in a small number of deals.

The hard money guys originate a lot of loans to real estate investors all the time, and often they will use funds from other investors to fund their deal flow.

So, you may be able to partner with them on a loan, or sometimes they will have an investment fund of sorts that you can invest in.

A Word of Advice on Social Media

One final note on finding your first private lending deal… be very wary of social media.

While these platforms can be a great networking tool, and useful for boosting exposure and introductions, they should not be relied upon in their entirety to vet potential borrowers.

Sure, you might meet a potential borrower of Facebook. But then be sure follow through with your due diligence process as you would with any other prospective business partner.

Above all else, take your time. Don’t ‘jump into bed’ with the first borrower you meet. Take the time to build solid, long-term relationships. Stay in touch, and communicate long enough to get to know the real person behind the internet presence.

Find Deals Here: Get fully-vetted private lending deals in your inbox every Thursday right here

A Private Lending Case Study

OK, so by now you know how to set your own private lending criteria. You also know how to find potential borrowers and deals, and you know how to run a basic due diligence process.

Now I’ll walk you through you an example of a real deal I did as borrower with one of my private lenders recently.

1224 Finch Street, New Castle, PA 16101

I used a small private loan from an investor (Elizabeth) in our Private Lending Program to fund the purchase of an affordable home for our Pathway to Homeownership Program in New Castle, Pennsylvania.

Deal Summary and Timeline

- 11/03/2019 – Acquisition identified

- 11/08/2019 – Property inspection

- 11/09/2019 – Deal agreed with seller

- 11/09/2019 – Due diligence sent to lender

- 11/10/2019 – Lender agreed to fund

- 12/4/2019 – Purchase closed

- 12/07/2019 – Renovation started

- 12/12/2019 – Lease agreed

- 02/06/2020 – Renovation complete

- 03/01/2020 – Tenant moved in

- 02/28/2021 – Purchase offer received

- 03/30/2021 – Sale closed and lender repaid

So, here’s a little more detail on how this particular deal worked out for everyone involved.

From Purchase to Payoff

My team had identified a property to purchase for our affordable housing program.

We already knew this house would make a great fit for our Pathway to Homeownership Program because we own similar houses in this neighborhood.

The seller was very motivated because the house needed a lot of work, including a new roof, so we got a great deal on the purchase price, but we had to close fast and have cash ready.

After agreeing terms with the seller, I had my contracting team inspect the property along with my Realtor.

We produced a BPO and a Scope of Work, and we also had our Realtor produce estimated buyer’s costs, so we knew exactly how much cash we’d need to bring to the closing table and complete the project.

Here’s what the deal looked like for me as the real estate investor and borrower:

- Purchase Price: $10,000 (Right?!?!)

- Closing Costs: $3,396.50

- Renovation Budget: $9,385

- Total Cash Required: $22,781.50

The after repair value (ARV) of $38,000 was based on closed sales of similar properties in the neighbourhood.

We sent all of due diligence to Elizabeth, and she agreed to provide a loan of $25,000 subject to due diligence.

This covered all the projected project costs, plus a reserve for taxes, vacancies and repairs, and I would be responsible for any overage due to rehab overspend or any unexpected expenses.

We sent the lender the due diligence, including the Scope of Work, Brokers Price Opinion, and a video walkthrough of the property shot during our inspection.

After reviewing the file, she was happy to proceed with funding the loan,

So now we were able to schedule closing and have the closing co. start title work.

Here’s what the deal looked like for the lender:

- Loan Amount: $25,000

- Loan to ARV: 65%

- Interest Rate: 9%

- Points to Lender $750

- Monthly Payment: $187.50

- Term: 60 months

We provided escrow instructions to the lender to approve, and these were then sent to the closing co. along with copies of the promissory note and deed.

Title came back clear, and the closing co. provided a draft HUD settlement statement and a proposed closing date.

Closing was scheduled for December 4th, 2019, and the lender funded escrow 24 hours before closing.

Once we closed on the home, our contracting team got to work. Having completed over 100 rehabs in our market, our team are pretty good at creating a good quality housing product on a tight budget.

At this stage, we had already started paying monthly interest payments to our lender on 25th of the month.

Due to the high demand for good quality housing in this market, we were able to agree a lease with a long-term tenant before rehab was even complete.

Once the tenant moved in, we started collecting rent, while continuing to service interest payments to Elizabeth.

We received a cash offer on the home from an affordable housing fund in February, 2021.

Closing was scheduled for March 30th, and when we closed, Elizabeth was paid out, and we took our equity profit.

Here’s what the investment looked like for the lender after payoff:

- Investment: $25,000

- Time Invested: 17 Months

- Points Interest: $750

- Term Interest: $2,812.50

- Payoff: $25,000

- Total Profit: $3,562.50

- Annualized ROI: 11.4%

This turned out to be a great deal for our lender, and she rolled her funds over into one of our next acquisitions.

Related: 829 Prindle Street – A Private Lending Case Study

What are the Risks of Private Lending?

You are totally forgiven if you feel that this guide promotes private lending as a good investment.

You’re right, I certainly do promote it as such.

Private lending has worked well for me as both a lender and borrower for the past ten years, and I have used this funding model to build a portfolio of over 100 properties, earn tons of passive income, as well as pay out hundreds of thousands of dollars in passive income to my lenders.

All that said, there is certainly risk involved in private lending. If you are note careful, it can be just as easy to lose money as make it!

I have certainly lost money on private lending deals, and I have seen other investors suffer the same fate.

I’ll use this last section to introduce you to the 5 areas of risk with a private money lending deal…

… and I’ll tell you a real life horror story, that ended with hundreds of investors losings millions of dollars.

Finally, I’ll tell you about 10 ways you can lose money as a private lender.

Hopefully, by the end of this section (and ultimately, this guide), you’ll have enough knowledge to set some ground rules that will help you to avoid some of the mistakes I (and others) have made in the past.

Related: Is Note Investing Risky?

The 4 Types of Risks in Private Lending

When it comes to loaning money to someone else for a real estate project, there are 4 key areas of risk.

- Credit risk

- Collateral risk

- Market risk

- Investment risk

I’ll go into a little more detail on each of these here…

Credit Risk

Credit risk is effectively the risk that there will, at some point, be a problem with your borrower.

Most likely that will be the borrower being unable or unwilling to make a payment or payments on the loan and therefore fall into default.

Of course, there could be an almost infinite number of underlying reasons for their default.

Personal problems, running out of money, ill health, incompetence, fraud, even death. I’ve seen them all over the years I’ve been in real estate

Remember, you designed your lending criteria and associated due diligence process to filter out potentially bad borrowers, but that in no way guarantees that things might not go awry at some point for some reason.

After all… bad things happen to good people all the time.

Related: The Complete Guide to Credit Risk for Private Lenders

Collateral Risk

As I’ve already talked about at length in this guide…

…in private lending, the real estate acts as the security and backstop for your investment.

There is, of course, a ton of stuff that can go wrong with real estate, especially during renovation projects, including (but certainly not limited to):

- Cost and time overruns,

- Material shortages

- Material price increases

- Labour shortages

- Labour price increases

- Extra large capex items (electrics, foundation, plumbing, a roof)

All of these can completely derail a renovation project that looked great on paper.

I’ve done well over 100 rehab projects, an I can tell you from first hand experience that not a single one has come in on the exact time and budget I planned for.

Some came in under budget and cheaper. Other came over budget and took way longer than expected.

There really is no exact science to it. You find out what you really need to do once your contractor actually gets in there and starts taking things apart.

This is why it is important to understand the as-is value of the property, as well as the future ARV. you may have to sell the property in it’s current, unfinished state to recoup your money!

It is also why I have some investors in my private lending program that will only lend against fully renovated and stabilized assets!

You could also have problems with title, but hopefully you took my advice and closed your loan through an appropriate title company or attorney who did full title work, and you also got yourself lenders title insurance!

Remember… private lending is profitable. You get a great rate of interest. But that rate of interest and overall return on investment is recompense for the risk you are taking, so always bear that in mind.

Related: How to Appraise Real Estate for Note Investing & Private Lending

Investment Risk

This is quite broad, but i thought it worth including as a section in its own right as it applies to all areas of investing (and life).

Every investment carries risk. All of them. Every single one.

Anyone tells you anything different, they’re either, naive, or lying to you.

According to the Economic times, investment risk can be defined as:

The probability or likelihood of occurrence of losses relative to the expected return on any particular investment.

Your lending criteria and due diligence process is designed to align you with borrowers and projects that your would be comfortable investing in.

The question you should ask yourself is…

…are you comfortable with the level of risk you are taking with the borrower, property, plan, market etc.

Simply put, investment risk is the level of uncertainty of success. The ever present potential for not achieving the expected or projected investment returns laid out in your plan and paperwork.

In short, investment risk is present any time you exchange money in return for an expected result.

In private lending, investment risk can be mitigated with solid due diligence on your borrower, your paperwork, the property and the plan.

You cannot eliminate investment risk, but you can plan for it, and have contingencies in place if things do go wrong.

Market Risk

This is a big one in real estate.

No matter the state of the market, there is ALWAYS someone somewhere predicting the next market crash.

The things is…. markets do cycle, and a crash or correction is an important part of that. So if you predict a crash consistently enough, at some point you’ll be right.

Even a broken clock tells the right time twice a day!

That said, you should understand the broader dynamics for the economy and real estate markets.

Things like interest rates, inflation, house prices, homes sales, inventory etc. All of these things work in conjunction with each other to drive the housing market in one direction or another.

But the United States is huge.

What happens in the real estate market in San Francisco, for example, will have no bearing on what happens to the real estate market in a small town in Ohio.

The point is… build your due diligence process to help you understand if the specific property you are lending against is a good fit for the local market, and the plan the borrower has for it.

Even in a downturn market, there are great opportunities to invest in real estate, so just try to understand the micro picture of the project, as well as the macro picture of the wider market.

So now you have an idea of the general areas of risk… here’s a real life private lending horror story that I was personally involved in…

A Real Life Horror Story

The first time I saw private lenders burn their fingers was back in 2016 when I came across a real estate investor based out of Portland, Oregon owned some 300 rental properties.

Most of them were C-Class single family homes in tough neighborhoods. The vast majority were located in Jackson, MS, the State capital of the poorest State in the Union.

This guy had used private lenders to fund all of his properties.

So, if you imagine an average loan amount of about $35,000 – he would have had approximately $10 million in private debt.

Now it’s probably worth mentioning that I know all of this because I loaned this guy some money myself!

Now, admittedly these kinds of low grade properties can be difficult to manage.

Often they are in poor condition, and the are not that many good tenants in these kinds of neighborhoods. That said, they can also be very profitable IF you put in the work and manage them well.

Well, this guy didn’t do that!

Despite starting out well enough, eventually he got greedy.

He started to skimp on rehab, and eventually he wasn’t completing any of the promised renovations at all.

Property taxes were never paid, and many of the houses were never rented.

In the end, this guy was using funds from the next Lender to fund interest payments on existing loans.

It turned into a classic ponzi scheme.

As with all arrangements of this types, it eventually collapsed as money from new Lenders dried up.

Most of the properties were lost in tax sales, and the Lender’s lost everything.

I was one of the lucky ones.

I was keeping a closer eye on things than others, I noticed when things started going South and I went out there to walk the streets and check on things.

In the end, I managed to take ownership of the properties I had loaned against before the investment was lost, but it still cost me a LOT of money to put right…. and I still own some of those houses today.

Now, I am not without fault in this story. If my systems and processes would have been tighter, maybe I would have picked up the scam earlier and saved some pain.

But pain is a great teacher, and this investment taught me a heck of a lot in terms of how to get things right the next time!

10 Ways to Lose Money in Private Lending

Here are ten real life reasons I have seen private lending deals fall apart and the Lender lose some – or all – of their investment.

You will note that the majority of these are down to incompetence, bad luck or willful fraud on the part of the Borrower:

- Failing to pay property taxes

- Not rehabbing to a good standard – or at all!

- Houses with severe underlying mechanical issues such as foundation work

- Failing to properly record liens

- Not ensuring clean title, or no title insurance

- Being unable to sell/refinance

- Borrower going AWOL or collapsing financially

- Rehabs running hugely over budget

- Not being named Loss Payee on insurance

- Market conditions suppressing resales

So, as you can see, private lending is far from risk free.

But, as I have discussed in these pages, there is plenty you can do to ensure you invest in deals (and with borrowers) that have the greatest chance of success.

I’m going to finish up this guide now, but I will add some FAQs and some links to useful tool and resources before I go.

I hope that this guide has been useful for you.

I hope I’ve been able to pass on some of my experience and help you to fill your toolbox with at least some of the basics that you’ll need to be a successful private lender.

I wish you all the luck in the world, and if I can be of any personal assistance, you can always reach out to me via our website www.garanco.net or any of our social media channels which are usually @garncogroup

Private Lending FAQs

What is the difference between hard money and private money?

The difference between hard money and private money is that hard money lenders are professional lenders, whereas private money lenders tend to be private individuals making personal investments with their own money.

Hard money lenders often charge a lot of fees, and are known to be less flexible with borrowers of things don’t go to plan.

How start a private lending company

Sometimes a private lender will want to expand beyond the capacity of their own capital, usually because they have more (or bigger) deals to fund than they have personal capital available.

In those cases they might start a prove lending company to partner with other passive investors that want the outcome of private lending investment s(passive income), but who don’t wan tto do all the work of educating themselves, and finding, vetting and structuring deals.

The originating private lender could partner with others on individual loans, or they could broker loans to other lenders. Some will even start a small investment fund to raise money from passive investors to lend on deals they find.

The private lending company will earn it’s money in a number of ways, including charging their borrowers fees, adding points to loans, and sharing the interest payments with their own investors.

If you want to start a private lending company, go seek out the advice of others that have done the same, and get yourself qualified legal counsel immediately.

Who regulates private lending?

There is no short answer to this because various parts of the act and process of private lending fall under the oversight of different organisations.

Some of it will depend if you are lending to consumers, and if so, you might need a banking licence in some states.

Lending to consumers against their primary residence (owner-occupied) is also an area fraught with regulations such as the Dodd Frank Act.

There are also state and federal Usury laws that prohibit private and institutional lenders from charging excessively high interest rates.

The golden rule remains… get legal advice!

How do I close a private loan?

Quite simply, use a title/escrow company or attorney to close any loan you originate. And make sure you have full title work completed and get lenders title insurance.

Never send money to your borrow direct!

What is private lending?

Broadly speaking, private lending is when a private individual loan money to another private individual or corporate entity.

This could take many forms, such as person to person lending (P2P), or most commonly, private lending in real estate where a private person loan a real estate investor money to buy and/or renovate a property.

Is private lending safe?

As described in the risk section of this guide, when it’s done right, private lending can be a great, fairly low risk way to earn passive income from real estate.

Thats said, there are risks to consider around your borrower, the property, the project plan and the market.

Can I lend money without a licence?

In most cases yes, although there are regulations that you do not want to fall foul of. You should seek out qualified legal counsel to discuss private lending laws in the State you wish to lend in.

References and Resources

Here are some link to useful private lending tools and resources.

Garnaco Private Lending Program

Here you can join more than 5,000 private investors, and pick from fully-vetted private lending deal to fund, with new deals distributed by email every Thursday.

Garnaco Private Lending Program

Geraci Law Firm

Geraci Law Firm specialize in advising private lenders, and have a range of products and services to help, as well as a great newsletter to keep you up to date with the latest news around private lending.

Private Lender Link

PLL is a platform that connects private lenders with borrowers.

Private Lenders

Private Lenders is another platform that connects private lenders with borrowers seeking capital.

American Association of Private Lenders

The American Association of Private Lenders is the first association representing the private real estate lending industry nationally.

American Association of Private Lenders

National Association of Private Lenders

The NPLA supports, protects, and grows the Private Lending Industry, serving as a platform for members collaborate, share ideas, and stay informed.

More Private Lending and Note Investing Articles

- Where to Buy Mortgage Notes – A Complete List of Verified Sources

- Private Lending 101 | The Complete Guide to Private Money Lending

- Note Investing 101 – Everything you Need to Know About Note Investing

- How to Invest in Notes – 7 Note Investing Strategies

- What is a Note and What Terms Should It Contain?

- Performing vs Non-Performing Notes – Which is the Better Investment?

- The Private Lender’s Guide to Assessing Credit Risk

- Understanding Lien Position and Priority

- How to Buy Mortgage Notes Online in 2021

- How to Assess Real Estate for note Investing and Private Lending

- Find Performing Notes for Sale in 2021

- Private Lending 101 – Everything you Need to Know About Private Money Lending

- Is Buying Mortgage Notes a Good Investment in 2021?

- Note Investing vs Rental Properties – Which is the Best Investment?

- Performing Notes – What Why and How to Buy

- Is Real Estate Note Investing Risky?

- Real Estate Notes vs REITs – Which is the Better Investment?

- The 3 Best Real Estate Investing Opportunities in 2021

- What is the Difference Between a Note and a Mortgage?

- Real Estate Notes – Everything You Need to Know

- My Top 5 Real Estate Note Investing Tools and Resources

- 3 Note Investing Funds for Passive Investors

- Using Note Investing to Boost Your Monthly Income

- Non Performing Notes – Everything You Need to Know

- The Ultimate List of 24 Investments That pay Monthly Income