Complete List of All 53 Stocks That Pay Monthly Dividends

David Garner

All 53 Monthly Dividend Stocks

Whether you are actively growing wealth for the future, or you have already made the transition into retirement, generating income should be at the core of your investment strategy. And when it comes to income, the more frequent the better! In this article, you will find my list of all 53 publicly traded stocks that pay monthly dividends.

Download the Full List: Click Here to Download the Full List of Monthly Dividend Stocks

Table of Contents

- Why Monthly Income is so Important

- How Do Monthly Dividend Stocks Work?

- How to Invest in Monthly Dividends Stocks

- The Full List of Monthly Dividend Stocks

- 5 Of the Best Monthly Dividend Stocks for 2020

- What Are The Risks of Investing Monthly Dividend Stocks?

We’ll do our best to keep this list up to date, but be sure to subscribe to our email list for regular updates and expert tips and opportunities.

Why Monthly Income Is So Important

If you are aiming to grow your investment portfolio or retirement account as quickly and safely as possible, then you definitely need to incorporate investments that generate regular income. investment income – when immediately reinvested – creates compound growth. And compound growth the most efficient and fastest strategy for growing your wealth.

If you are already living off your retirement portfolio, then investments that pay regular monthly income allow you to keep your seed capital intact while managing your living costs in the most efficient way possible.

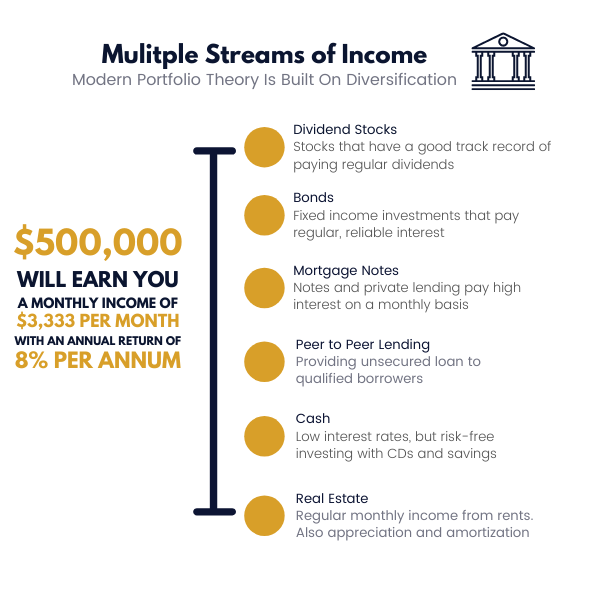

Whatever you investing goal, you should always diversify your income streams as much as possible. Doing so reduces the risk of loss in any one single investment, as well as exposing you to a wider potential for income, growth and profit.

While this list focusses on stocks that pay monthly dividends, there are of course many other options to consider. Today, investors are seeking out alternatives to the stock market in an effort to reduce their exposure to the volatility that has come to define global financial markets. If you’re interested, you can see my list of 24 investments that pay monthly income here.

How Do Monthly Dividend Stocks Work?

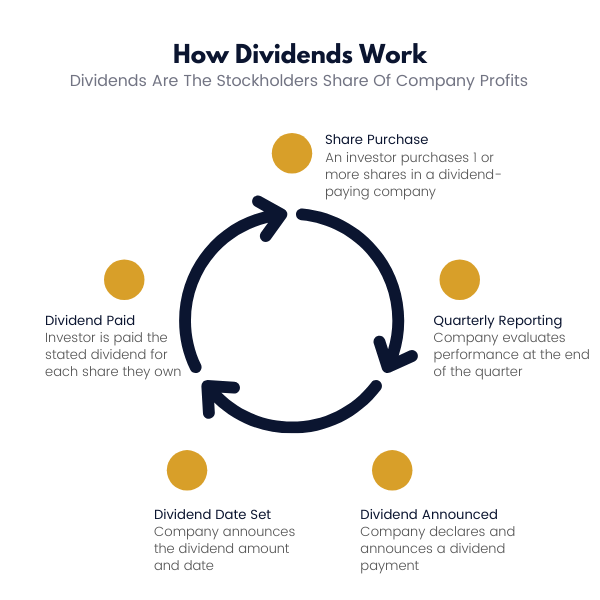

Dividends are simply a share of company profits, distributed to shareholders. Most companies pay dividends annually or quarterly. Some companies pays pay shareholders every month, and it is those I have included in this list.

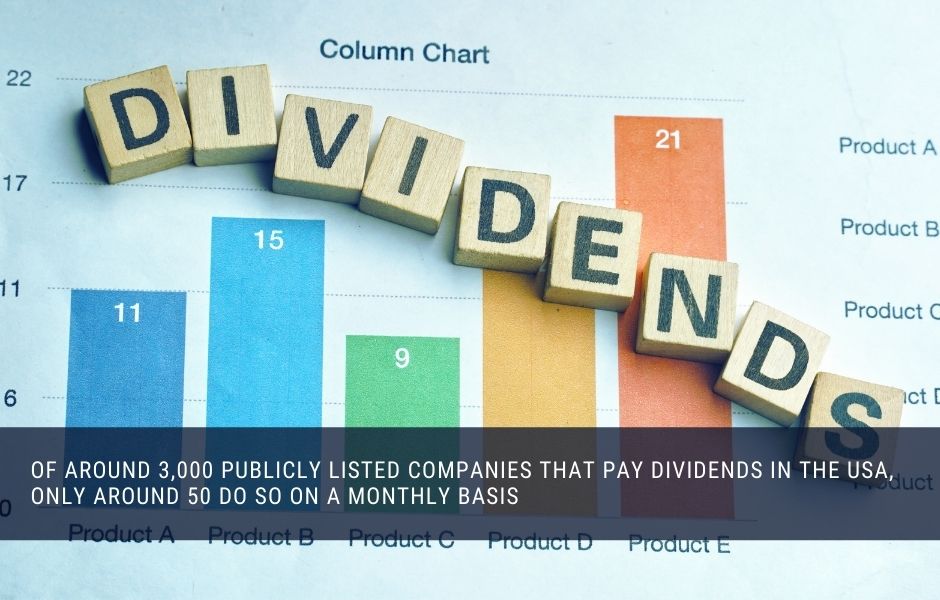

Not all public companies pay dividends. Some will reinvest up to 100% of their profits in order to grow the business. Of around 3,000 publicly-listed companies that do pay dividends regularly, only around 50 pay dividends monthly.

Some of the most common types of monthly dividend-paying stocks are:

- Real Estate Investment Trusts (REITs)

- Business Development Companies (BDCs)

- Royalty Income Trusts

- Master Limited Partnerships (MLPs)

These types of companies tend to collect their operational income on monthly basis, and so distribute their profits to shareholders accordingly.

How Are Monthly Dividends Paid?

Monthly dividends work in exactly the same way as quarterly and annual dividends. A proportion of company profits is distributed to shareholders on a per-share basis. So every stockholder receives a dividend payment relative to the amount of stock they own in the company.

Here’s an example of how a monthly dividend distribution works:

If a company has 10 million shares outstanding, and declares a monthly dividend of 25 cents, the total dividend payment would be $2.5 million. If you owned 5,000 shares of this stock, you would receive a dividend payment of $1,250 for that month.

Assuming the company paid out the same 25 cent/share dividend every month for one year, and the stock price was $50 per share, your total annual dividend income would be $3 per share (25 cents x 12). Your annual yield in this case would be 6% ($3/$50).

How To Invest in Monthly Dividend Stocks

If there were a foolproof way to consistently pick good investments, it would not be a secret. The formula itself would be worth a fortune, and it’s inventor would be rich beyond all comprehension. That said, there is a great deal you can do to narrow down your stock selection process in the hope of picking solid long-term investments.

Investors and analysts use data from a company’s financial statements to curate a set of ratios. These ratios can then be used to assess the financial health of the company. Here are some of the key ratios you can use to assess a particular stock:

- Price-to-Book Ratio

- Price-to-Earnings Ratio

- PEG Ratio

- Dividend Yield

Price-to-Book Ratio

Essentially the price to book ratio represents the value of a company as the sum of its parts. I.e. the sum total of the value of its individual assets should they be broken up and sold separately. These assets include things like real estate, equipment, and investments such as holdings in other companies.

Its important to note that the book value of Business Development Companies can fluctuate because the assets they hold can also fluctuate in value (stock in other companies, for example).

Companies of a more industrial nature tend to have a more stable book value it is based on hard assets such as real estate and machinery. These types of assets also depreciate annually in the company accounts.

Regardless of the type of company, investors are usually looking for a low price-to-book ratio. This means the stock price is more reflective of the raw asset value of the company, and is not over inflated.

Price to Earning Ratio

The price-to-earnings ratio is a key metric for investors. It defines the stock price in relation to the earnings of the company. This is helps to identify overpriced stock. It is a good buy/hold/sell indicator for investors.

If a stock price shoots up because of some great piece of news or PR, but the company does not have the earnings to support that inflated price, then the price will – at some point – fall back into line.

One important thing to consider is that price-to-earnings ratios tend to be similar for companies operating in the same or similar sectors. So, one should really only compare apples with apples, so to speak.

Investors tend to think of the price-to-earnings ratio as the length of time a stock investment will take to repay your initial purchase price of the stock. For example, a stock price of $10 with an earnings per share of $1 will take 10 years to pay back the purchase price of the stock – assuming of course that nothing changes in the meantime.

The PEG Ratio

In addition to the price-to-earnings ratio, investors use price to earnings growth as a further measure of the financial health of a company. The PEG ratio takes in to account previous years earnings growth. While it is speculative, this is a great way to compare similar companies.

Quite simply, the PEG ratio is calculated by dividing the price-to-earnings ratio by the annual growth rate of the company’s earnings. The lower the PEG ratio, the better the stock price in relation to it’s projected future earnings.

The higher the PEG ratio, the more you are paying for future (estimated) growth. A stock with a PEG of 2 costs twice as much (for growth) compared with a stock with a PEG of 1.

The PEG ratio plotted on a chart gives you a snapshot of previous price-to-earnings ratio, which can then be used to make predictions for future growth.

Dividend Yield

As we are looking specifically at stocks that pay monthly dividends, yield should be a key factor in your stock selection process.

Dividend yield is simple. It is calculated as the total amount of annual dividends divided by the stock price, expressed as a percentage. A stock priced at $10 per share with a total annual dividend of $0.50 cents, has a dividend yield of 5% (0.50/10=0.05).

Some of the things dividend investors look out for are:

- Companies that pay out around half of their annual profits (or less) to shareholders. You want to invest in companies that reinvest at least 50% of their profits for future growth.

- Stocks with yields of between 4 per cent (4%) and 6 per cent (6%). That’s pretty solid income performance.

- Companies that have a good recent history on generating profits consistently for at least 3 years.

- Companies that have a long history of increasing their dividend payouts every year.

Taking into account all of these ratios, you will be well-positioned to make informed investment decisions. I will add a list of useful websites and resources at the end of this article to help with your research.

Related: The Ultimate List of 24 Investments That Pay Monthly Income

The Full List of Monthly Dividend Stocks

If you’ve got this far, you’re probably of a mind to add some monthly dividend stocks to your portfolio. But where to find them? Well, here is a an up to date list (August, 2021) of stocks that pay monthly dividends.

Remember, I have excluded oil and gas royalty trusts due to the high level of risk associated with those particular stocks. If you’re interested, you can see my separate article on Royalty Income Trusts here.

Pro Tip: Click Here to Download This List and Stay Up to Date With the Best Monthly Dividend Stocks

Ultimate List of 50+ Stocks That Pay Monthly Dividends

| Stock Ticker | Company | Stock Price | Dividend Yield |

| BRMK | Broadmark Realty Capital, Inc. | $9.18 | 3.8% |

| AFIN | American Finance Trust, Inc. | $7.36 | 14.4% |

| AGNC | AGNC Investment Corp. | $13.65 | 13.1% |

| APLE | Apple Hospitality REIT, Inc. | $8.89 | 8.8% |

| ARR | ARMOUR Residential REIT, Inc. | $9.38 | 17.2% |

| AVAL | Grupo Aval Acciones y Valores SA | $4.69 | 7.3% |

| CHP-UN.TO | Choice Properties REIT | $12.72 | 5.8% |

| CHR.TO | Chorus Aviation Inc. | $2.40 | N/A |

| CLDT | Chatham Lodging Trust | $5.46 | 15.7% |

| CLNC | Colony Credit Real Estate, Inc. | $6.56 | 22.5% |

| CPTA | Capitala Finance Corp. | $2.22 | 44.2% |

| CRT | Cross Timbers Royalty Trust | $6.30 | 15.3% |

| D-UN.TO | Dream Office REIT | $19.99 | 4.99% |

| DIR-UN.TO | Dream Office REIT | $10.91 | 6.43% |

| DX | Dynex Capital, Inc. | $15.51 | 12.2% |

| EFC | Ellington Financial, Inc. | $12.03 | 14.03% |

| EIF.TO | Exchange Income Corporation | $27.13 | 8.4% |

| EPR | EPR Properties | $30.41 | 14.2% |

| ERF | Enerplus Corp. | $2.48 | 3.5% |

| GAIN | Gladstone Investment Corp. | $9.31 | 8.8% |

| GECC | Great Elm Capital Corp. | $4.47 | 21.4% |

| GLAD | Gladstone Capital Corp. | $7.28 | 11.2% |

| GOOD | Gladstone Commercial Corp. | $18.22 | 8.1% |

| GORO | Gold Resource Corp. | $4.39 | 0.6% |

| GROW | U.S. Global Investors, Inc. | $3.31 | 0.8% |

| GRT-UN.TO | Granite REIT | $76.26 | 3.8% |

| GWRS | Global Water Resources, Inc. | $10.65 | 2.7% |

| HCAP | Harvest Capital Credit Corp. | $3.99 | 24% |

| HRZN | Horizon Technology Finance Corp. | $11.57 | 10.4% |

| IPL.TO | Inter Pipeline Ltd. | $13.13 | 3.7% |

| ITUB | Itaú Unibanco Holding SA | $5.38 | 7.8% |

| LAND | Gladstone Land Corp. | $16.21 | 3.3% |

| LTC | LTC Properties, Inc. | $38.64 | 5.9% |

| MAIN | Main Street Capital Corp. | $30.20 | 8.1% |

| MTR | Mesa Royalty Trust | $4.19 | 19.1% |

| O | Realty Income Corp. | $60.30 | 4.5% |

| ORC | Orchid Island Capital, Inc. | $5.03 | 18.9% |

| OXSQ | Oxford Square Capital Corp. | $2.75 | 28.6% |

| PBA | Pembina Pipeline Corp. | $24.56 | 7.2% |

| PBT | Permian Basin Royalty Trust | $3.42 | 13% |

| PFLT | PennantPark Floating Rate Capital Ltd. | $8.40 | 13.5% |

| PRT | PermRock Royalty Trust | $2.06 | 30.9% |

| PSEC | Prospect Capital Corp. | $5.01 | 14% |

| PVL | Permianville Royalty Trust | $1.08 | 26% |

| RNW.TO | TransAlta Renewables Inc. | $15.06 | 6.24% |

| ROYT | Pacific Coast Oil Trust | $0.37 | 88% |

| SBR | Sabine Royalty Trust | $29.51 | 9.9% |

| SJR | Shaw Communications, Inc. | $18.16 | 6.6% |

| SJT | San Juan Basin Royalty Trust | $2.26 | 4/9% |

| STAG | STAG Industrial, Inc. | $32.79 | 4.7% |

| SUNS | Solar Senior Capital Ltd. | $12.63 | 11% |

| VET | Vermilion Energy, Inc. | $4.18 | 45.2% |

| WSR | Whitestone REIT | $6.75 | 14.1% |

5 Of the Best Monthly Dividend Stocks for 2021

If you are looking for some pointers to get going with your own research, here is my shortlist (in no particular order) comprising my personal top 5 picks of monthly dividend stocks for 2021. Remember, I’m not giving you advice, just my opinion!

Note: This is not an offer or recommendation to buy these stocks. These are my personal picks based on my own analysis and circumstances. You should seek proper qualified advice before making any investment.

Realty Income

Realty Income (NYSE: 0) is a REIT specializing in multi-purpose retail properties such as gas stations. It has a well-diversified and resilient portfolio, and has a strong track record of increasing dividends. With an annual yield of 4.1% (August, 2021), and average annualized returns of more than 15% p.a. since it’s IPO, Realty Income makes a great addition to a monthly dividend investment strategy. You can read my analysis of this stock here.

Shaw Communications

Shaw Communications (NYSE: SJR) is a leading Canadian telecoms provider. It has businesses in mobile, internet and traditional telephony, producing more than $4 billion in annual revenue. Currently delivering an annual yield of 6.6% for shareholders, you can read my analysis of Shaw Communications here.

TransAlta Renewables

TransAlta Renewables is a holding company that owns assets producing renewable energy. Having shown reslience and even growth through the coronavirus crisis, the 6.6% annual yield and monthly dividend schedule is appealing. You can read my analysis of this stock here.

STAG Industrial

I like STAG Industrial (NYSE: STAG) because this specialized REIT owns industrial real estate that forms an essential (and growing) part of the global supply chain. As the world economy moves more and more online, logistics, warehousing and distribution real estate that is well-located and fit for purpose will continue to thrive. STAG pays dividends monthly, and has a yield of 3.8% (August, 2021). You can read my analysis of STAG here.

Main Street Capital

If you want to own stocks that pay monthly dividends, adding a Business Development Company (BDC) to your portfolio is probably a good idea. One of my favourites is Main Street Capital (NYSE: MAIN). Main currently offer an annualized dividend yield of 5.8% (August, 2021). You can read my analysis of MAIN here.

What Are The Risks of Investing Monthly Dividend Stocks?

Whether you want regular monthly income to reinvest, or to draw down and live on, monthly dividend stocks should certainly form part of your overall investment strategy.

Of course, as with any investment there are risks. If you are buying a stock purely for it’s monthly dividend, you should conduct your due diligence as you would with any other stock. After all, you want to own financially sound businesses that will still be around in 10 years time.

This Month’s Dividend is Based on Last Month’s Income

Because monthly dividends are usually contingent on a company’s monthly income, there is a risk that dividend distributions would be affected if the underlying business encounters problems. Paying dividends on a monthly basis is contingent on the business collecting all of their monthly revenue (often rents, lease payments, contractual income and/or interest).

Because of this, a lack of rents, loan defaults and other operational difficulties would have an almost impact affect on a company’s ability to continue to pay monthly dividends.

Cash Starved and Low Growth Potential

As most profits are paid out to shareholders, little cash is retained, or reinvested for growth. This means that monthly dividend stocks often fuel growth with debt. Whilst using leverage like this is par for the course in some sectors such as real estate, it can make a company’s financials look shaky when the market experiences a downturn.

Final Thoughts on Monthly Dividend Stocks (for now…)

If you’ve reached the end of this article, congratulations. I admire your staying power. This will serve you well if you decide to add monthly dividend stocks to your portfolio because you will need to do your homework!

Not all stocks are created equal. Some carry more risk than others, and it is always true that bigger returns equate to bigger risks. Remember, the return on your investment is your reward for the risk you took.

Monthly dividend stocks can (and probably should) form at least a part of your portfolio. But of course, there are other options to consider. The JOBS Act in 2012 opened up a host of investment opportunities to the general public, many of which had previously been accessible only by wealthy accredited investors. You can read my Ultimate List of Investments That Pay Monthly Income here.

Best of Monthly Dividend Stocks

Monthly Income Investor Resources

- The Ultimate List of Monthly Income Investments

- Your Quick One Stop Guide to Investing in Preferred Stock

- Everything You Need to Know About Investing in Royalty Income Trusts

- Investing in Master Limited Partnerships for Monthly Income

- The Monthly Income Investors Guide to Business Development Companies

- US Money – 8 Stocks that Pay Monthly Dividends

- Yahoo – 10 Best High Yield Monthly Dividend Stocks to Buy Now

- Sure Dividend – 49 Monthly Dividend Stocks

- Investopedia – Price to Book Ratio

- Omnicalculator – Price to Earnings Ratio Calculator

- Corporate Finance Institute – What is the PEG Ratio

- The Balance – Understanding Dividend Yield

- Dividend.com – Monthly Income from Monthly Dividends

- Sure Dividend

- Yahoo Finance

- Kiplinger

- Investors.com