Private Money Lending – An Introduction

David Garner

Are you curious about private money lending? You’re in the right place. In this article I’ll answer some of the most common questions I get asked about private lending.

Contents:

- My Experience With Private Lending

- What is Private Money Lending?

- How Does it Work?

- Why do People Use Private Loans?

- How are Private Loans Structured?

- How Much Interest do Private Lenders Charge?

- How do I start Private Lending?

The contents of this guide won’t make you an expert, but it will provide you with answers to the need-to-know questions. I hope you find it useful.

Related Content: Private Lending 101 – A Complete Guide for Investors

My Experience with Private Lending

I have been actively investing in real estate since 2010. I have bought and sold mortgage notes with a total face value into tens of millions of dollars. My real estate portfolio currently consists of around 70 rental properties, all of which are also funded by private lenders.

Related Content: The Complete Guide to Private Lending

What is Private Money Lending?

Broadly speaking, the term ‘private money lending’ refers to non-bank lending. It is often referred to as hard money lending, and the terms are largely interchangeable. That said, it is generally accepted that a hard money lender is a professional business with a sole purpose of lending money, whereas a private money lender could be anyone willing to loan their own funds.

In a typical private money lending scenario, a private individual or company (but not a bank), makes a loan to another private individual or company – usually for the purchase of real estate.

For example, most of my rental properties are financed by private lenders. These are private investors who use funds from their retirement accounts to loan me money. I use those funds to buy houses that I rehab and rent (and sometimes sell). Effectively, my private lenders replace the bank.

Related Content: The Essential Private Money Lenders Checklist

How Does it Work?

While there is always lots to consider with every private lending transaction, there are some fundamental basics that remain pretty much the same for every loan.

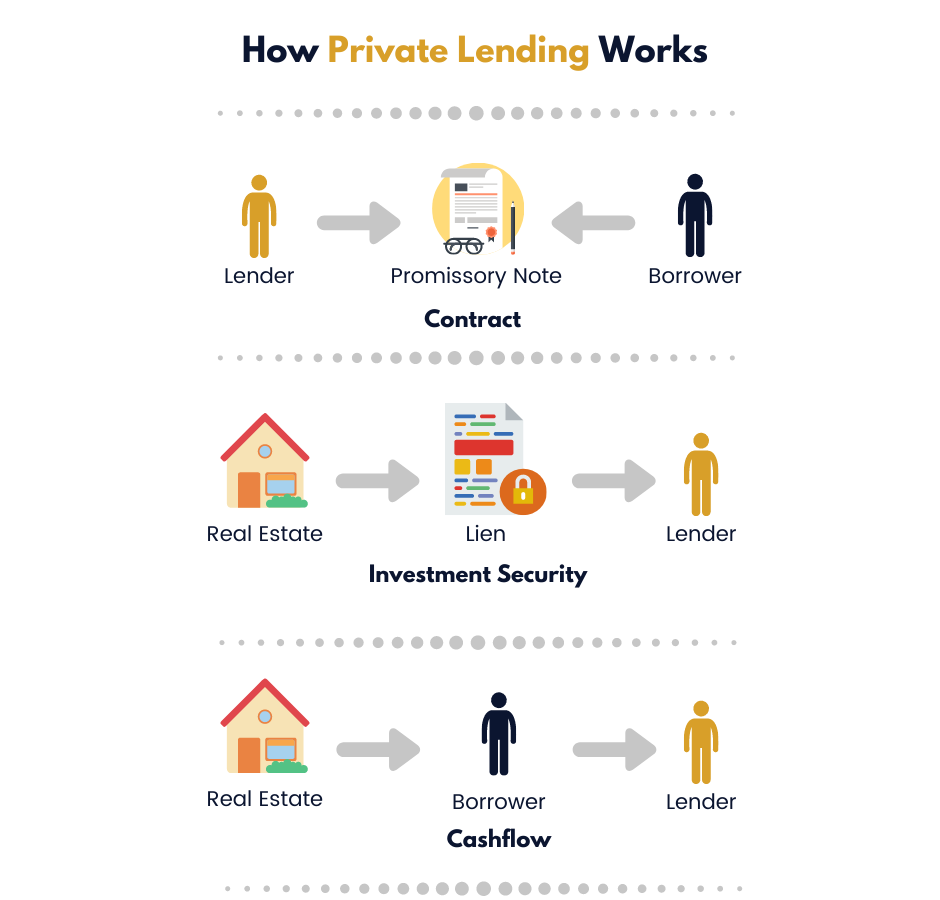

There is a lender, a borrower and a piece of real estate. The lender provides funds to the borrower under the terms of a contract which takes the form of a promissory note. The ‘note’ defines the amount of the loan, interest rate and term among other things.

The lender also gets a lien against the real estate which acts a security for the loan. This will be either a Mortgage Deed or Deed of Trust, depending on local State laws.

The borrower is usually required to make regular payments to the lender, and ultimately repay the loan according to the terms of the note. If the borrower fails to meet their commitments, the lender can foreclose the loan and take ownership of the real estate.

Related Content: A Guide to Credit Risk for Private Lending Investors

Why do Investors Use Private Money Loans?

There are lots of reasons for real estate investors to use private money. Speaking from personal experience, sometimes getting the best deal on a house requires you to act very fast and close quickly with cash. This means it’s not possible to wait for the lengthy bank lending process.

It may also be the case that the real estate needs major repair work. In fact, that’s how many investors – myself included – are able to add value to the properties we buy and make a profit. That being the case, it is highly unlikely a bank will make a loan against a property in need of such repairs, and so private lenders can fill the gap.

Sometimes, if I am flipping a house for example, I will only need a loan for a short period of time. Again, a conventional mortgage would not be appropriate where a short term private money loan would be be perfect fit.

Private lenders are usually much more flexible than banks, requiring less paperwork and being more flexible when it comes to the terms of the loan. Private lenders can charge higher interest rates to offset risk, so they can offer investors a higher loan-to-value than a bank.

Sometimes investors might turn to private lending if they have bad credit, or no credit, or a high debt to income ratio that would prevent them from qualifying for a conventional loan. In other cases, the borrower might have reached the limit on the number of mortgage loans their bank can finance.

Related Content: A Guide to Promissory Notes for Private Lending Investors

How are These Loans Structured?

As with any type of mortgage loan, private and hard money loans can be structured a number of ways. That’s one of the benefits for both borrowers and lenders – they can agree terms that suit both parties and the deal at hand. Banks on the other hand tend to be much more rigid with standard product offering that cannot be tailored that much.

Most commonly, private money loans will be structured as interest-only. This means that the borrower will make interest payments to the lender – usually on a monthly basis – and then a final repayment of all the capital at the maturity of the loan. This means that every monthly payment is 100% interest (profit) for the private lender.

Some lenders will also extend amortized loans. This is where each monthly payment consists of interest and a small repayment of some of the principal. These tend to be quite rare in the private money lending world, mostly because private money loans tend to be quite short term, whereas amortized loans are written over a longer period of anywhere between 10 and 30 years.

Related Content: Understanding Lien Position and Priority

How Much Interest do Private Lenders Charge?

For private money and hard money lenders, interest makes up a the lion’s share of profits. Typically, professional hard money lender’s will charge interest rates of between 8% and 15% depending on the terms of the loan and the amount of risk they feel is involved.

There are other ways to make money as a private lender. For example, most hard money lenders will document preparation fees and some form of points. Points are essentially upfront payments of interest. One point equals 1% of the loan amount, so a hard money lender might charge an interest rate of 10%, plus 2 points and $1,000 in document prep fees.

Related Content: The Investors Guide to Private Lending Appraisals

How do Start Private Money Lending?

If you’re looking for a way to generate passive income, then private money lending could well be for you. If you can find a credible borrower with a good deal to fund, and you can negotiate mutually acceptable terms, you’re on to a winner.

If you can’t find a credible borrower to work with locally, you can join as a Member of our Private Lender Portal, where we regularly post investor-ready private lending opportunities with proven borrowers. Or you can join our VIP Priority Investor list to receive details of the latest private lending opportunities every Thursday.