5 Pro Tips for Vetting Borrowers | Private Money Lending

Investor Bonus: See Investor-Ready Private Lending Deals Every Thursday

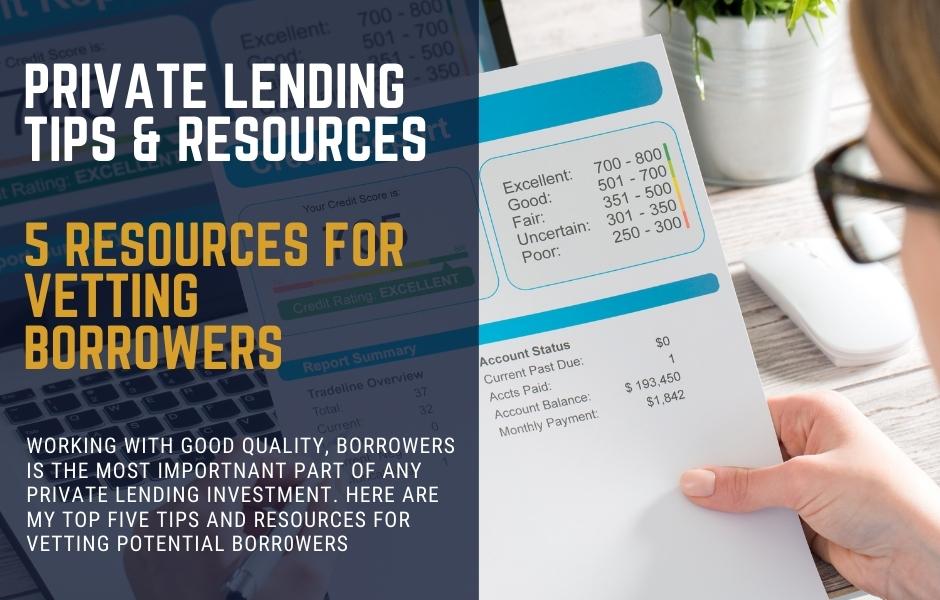

As an investor, making good private lending decisions is about working with good borrowers. Here are 5 useful tips and resources to help you vet and verify potential borrowers and reduce your credit risk with private money lending

David Garner

5 Private Lending Tips for Vetting Borrowers

Having completed well over 100 private lending transactions as lender and borrower, I can tell you one thing…

A good borrower can save a bad project, and a bad borrower can ruin a good project!

I’ve seen this play out many times over the past ten years. In fact, almost every single default and/or foreclosure I’ve ever seen in the private lending space has been down to the borrower screwing up in one way or another.

The good news is, there’s plenty you can do upfront to ensure you are working with the best borrowers possible, reducing your risk of losing money due to someone else’s error or poor judgement.

In this article you’ll find 5 useful tips and resources to help you vet potential borrowers and filter out the bad apples, leaving you only the best possible folk to work with, and the best chances of executing successful, profitable private money lending investments..

1. Communication

First and foremost (and for good reason), how does your borrower communicate?

In the preamble to funding a deal, there will be a lot of communication between you and your prospective borrower. How they act during this phase of initial relationship building will tell you a lot about how they do business.

Here are three questions to ask yourself that I’ve found useful over the past 10 years.

Question: Are they interested in building a long-term relationship? Are they interested in finding out about your lending criteria? Or are they just trying to shove deals down your throat?

Answer: Personally, I’m looking to business with folk that want mutually beneficial and sustainable relationships.

Question: Do they answer their phone when you call, or at least call you back if you leave a message? Same thing with emails and text messages.

Answer: Slow or no response during early stage (or any) communication is a big red flag for me.

Question: Do they have the basic required documents ready and to hand when you ask need them (project plan etc.)? or do you have to chase them down?

Answer: Preparedness and organization is a vital skillset when managing a real estate project, so you want to see them demonstrate that to a degree in how they communicate before you lend.

Communication is key when dealing with prospective borrowers

The Takeaway: In my experience, how a borrower communicates pre-funding is the best indicator of how they will communicate during the project, and especially if something goes sideways.

Lenders who aren’t tight on their borrower selection tend to find out there is a problem because the borrower misses a payment or deadline. By then, it might be too late to remediate the issue and you could be looking at much larger problem.

Only do business with people you feel are a good fit for you in how they communicate.

Related: A Guide to Assessing Credit Risk for Private Lenders

2. Experience

Once you’ve found a potential borrower that you feel you will be able to work with, you will want proof of their experience completing similar projects in their market.

You may be prepared to work with a borrower with less experience, but in my opinion this aspect of private lending shares a direct and very strong correlation with the level of risk you’ll be taking.

Here is the key question to ask, and how to verify the answer…

Question: Has the borrower already completed similar projects in their market? If so… how many, and were they successful?

Answer: For verification purposes you can ask for copies of settlement statements, rehab invoices, refinance documentation, and/or copies of tenant leases to check out the success of their previous projects.

If you want to go one step further, you can also verify some of that documentation in the County records.

Verify your borrowers experience by referencing county records

For example, if a borrower wants me to fund the acquisition and rehab of a rental property, I want to know if they have they completed this type of project this before. Did they meet their budget and timeline? was the refinance successful? and did they achieve the rents they were expecting?

If it’s a flip, then the same questions concerning budget and timelines apply, along with proof of sale at or around their projected sale price. You want to know their projections are in line with actual market conditions.

The Takeaway: The risk of lending to a newbie investor is much higher, so if you are prepared to lend to such a borrower, you will need to adjust your terms accordingly in order to better protect your investment, and ensure you are appropriately rewarded for the risk you are taking.

My advice would be to lend less of the total budget, thus ensuring a greater margin for error if things go wrong.

You can also ask to speak to other private lenders they have worked with in the past. Did they make their payments on time? and did their exit strategy and loan payoff come to fruition as planned?

3. Background

This one is fairly simple… do a background check!

For me, a clean background check is far more valuable than a high credit score. A person’s credit score can be affected by all sorts of factors that don’t necessarily impact ‘lendability’ for me, but I certainly don’t want to entrust my funds to someone with a recent criminal history!

Fortunately, a background check is relatively cheap and easily accessible through a number of online portals, including the local police or court system.

Your borrower can attend their local police department where they reside or last resided, and request that the police conduct a local or state criminal records search and provide them with a document reflecting that there is no history of a criminal record.

Of course, you may want to exercise some flexibility here. A single 20-year old DUI charge might not be a huge red flag, but of course your own personal discretion is advised.

Again, asking for references for previous lenders the borrower has worked with is also a good idea.

The Takeaway: Be wary of anyone with a recent criminal record. This is far more telling of their likely behaviour (and responsibility) than a credit score.

See Fully-Vetted Deals: Join 5,000+ investors and get exclusive private lending investment opportunities delivered to your inbox every Thursday

4. Project Plan

Most borrowers will come to you with a project already in hand for which they are looking for funding.

You’ll at least want a cursory glance at their plan in order to know that the project broadly meets your own lending criteria in terms of location/market, loan size, loan parameters (LTV, length of loan etc.), and project type.

If it gets a green light, and everything else stack up so far, then you can start to really get into the details.

Now remember, the scope of this article extends only to assessing the borrower. As such, I’m not going to do a deep dive into project or real estate due diligence here (we’ll save that for another time). Instead, we’re just going to assess the broad accuracy and viability of the plan, and how that relates to the ‘lendability’ of a prospective borrower.

At the very least you want to see the following (depending on the type of project):

- Purchase Contract/Sales Agreement

- Valuation including both as-is value and ARV (After Repair Value).

- Scope of Work

- Expected timelines

- Financial analysis

- Exit strategy planning and contingencies

There are other factors, too. For example, if you’re providing a bridge loan to pay off another lender, you could ask to see the existing loan pay history.

If your borrower doesn’t have this info together right now, then they’re not ready, period!

Assuming your borrower has provided you with all of the information you have requested (in a timely manner), you should then focus on verifying the accuracy of that information. In particular, you should be concerned with the accuracy of rehab budgeting, timelines, and valuations.

Here are some useful questions to ask…

Question: How much are they paying for the property in relation to it’s as-is value?

Answer: Often, real estate investors (myself included) pay far less than current market value for our deals because we source properties through various off-market channels. From the lender’s perspective, the lower the purchase price in relation to current disposal value the better.

Ask for a copy of the Sale Agreement/Purchase Contract, and look at the final sale price for sold properties in similar condition in the local market, and/or speak to a local Realtor to verify the information.

Question: Is the future valuation projection (ARV) provided accurate?

Answer: If you’re operating in a local market that you have a lot of personal experience in, you might already have a good feel for the accuracy of the valuation. If not, then a Brokers Price Opinion from an experienced local Realtor is a cheap (free) and easy way to figure this out.

In my opinion, online tools such as Zillow or Trulia do have their uses, but as an accurate valuation tool they usually fall way far from the mark.

Again, your best foot forward is to look at comparable sold listings of similar local properties, and a BPO will tell you that exactly that.

Question: Are the rehab plans appropriate and accurately priced?

Answer: Ideally, you want an itemized and costed Scope of Work from an experienced local contractor that is going to be carrying out the work, and who has based their estimate on a physical inspection of the property.

You then want to verify the accuracy of the pricing, and also whether the planned level of rehab is appropriate for the market/exit strategy.

A rental rehab will be quite different from a retail resale rehab, and over-rehabbing can be just as much of a problem as under-rehabbing.

Ideally, your borrower will have worked with the same contractor on previous project, and so can demonstrate the accuracy and efficacy of the Scope of Work with evidence of completed projects.

The Takeaway: What you’re really trying to ascertain is whether the borrower’s plans and projections are accurate. This is one of the reasons it’s better to work with experienced active investors who know their market, and have already completed multiple projects of a similar nature.

See Fully-Vetted Deals: Join 5,000+ investors and get exclusive private lending investment opportunities delivered to your inbox every Thursday

5. Credit

Many investors new to the world of private lending think that selecting borrowers with a great credit score is a top priority. But in my experience, a great credit score does not necessarily a reliable lender make!

As I have already stated in this article, for me, a clean background check comes higher on the list than a great credit score.

OK, so you probably don’t want to lend to a borrower with a REALLY bad score, but there are lots of reasons for a lower score, and not all of them mean you’re looking at a bad borrower.

For example, if you go take a personal loan right now, your credit score is likely to drop significantly. Does this mean you’re a bad prospect for a private lender? No… not at all.

If I do pull a borrower’s credit, then I am specifically looking for things that show me how they handle their responsibilities. Things like late payments, defaults, bankruptcies and alike. Those are the things to look out for, not so much just the number.

But it’s also worth mentioning that a regular credit report won’t tell you the whole story.

Since 2018, most tax liens and civil judgements no longer appear in a borrower’s credit report. If you want a more comprehensive picture of the borrower’s credit, a LexisNexis Riskview Liens and Judgement Report gives you all the borrower’s liens and judgements.

The Takeaway: If you do pull credit, then look for specific instances of bad debt management, such as late payments, defaults or bankruptcies.

Summing Up…

So, there you have it, 5 tips for assessing potential borrowers when entering into private lending investments,.

Of course, this article is not a template for your due diligence. That would require a much, much longer piece. But for now, I hope this helps to give you a some useful guidance towards making better lending decisions.

See Fully-Vetted Deals: Join 5,000+ investors and get exclusive private lending investment opportunities delivered to your inbox every Thursday

Useful Links and Resources:

- Pro Title – Title and tax due diligence

- Richmond Monroe – Collateral File Review

- US Census Data – Market and demographic due diligence

- Lexis Nexis – Liens, Judgements and Credit Due Diligence

More Private Money Lending Education

- Private Money Lending Case Study July 2022 II

- Private Money Lending Case Study July 2022 I

- 5 Pro Tips for Vetting Private Money Lending Borrowers

- How to Lend Money Legally and Safely

- Where to Buy Mortgage Notes – A Complete List of Verified Sources

- Private Lending 101 | The Complete Guide to Private Money Lending

- Note Investing 101 – Everything you Need to Know About Note Investing

- How to Invest in Notes – 7 Note Investing Strategies

- What is a Note and What Terms Should It Contain?

- Performing vs Non-Performing Notes – Which is the Better Investment?

- The Private Lender’s Guide to Assessing Credit Risk

- Understanding Lien Position and Priority

- How to Buy Mortgage Notes Online in 2021

- How to Assess Real Estate for note Investing and Private Lending

- Find Performing Notes for Sale in 2021

- Private Lending 101 – Everything you Need to Know About Private Money Lending

- Is Buying Mortgage Notes a Good Investment in 2021?

- Note Investing vs Rental Properties – Which is the Best Investment?

- Performing Notes – What Why and How to Buy

- Is Real Estate Note Investing Risky?

- Real Estate Notes vs REITs – Which is the Better Investment?

- The 3 Best Real Estate Investing Opportunities in 2021

- What is the Difference Between a Note and a Mortgage?

- Real Estate Notes – Everything You Need to Know

- My Top 5 Real Estate Note Investing Tools and Resources

- 3 Note Investing Funds for Passive Investors

- Using Note Investing to Boost Your Monthly Income

- Non Performing Notes – Everything You Need to Know

- Forbes – How to get started as a private money lender

- Wallethub – What is private lending and how does it work