Mortgage and Housing Market Analysis Q2 2022

Whether you're a homeowner, rental property investor, or mortgage note investor, keeping up to date with the housing and mortgage markets is an absolute must. This article has all the US mortgage market and real estate market statistics and analysis you need to know right now

David Garner

Analysis of the US Mortgage and Housing Markets July 2022

Unless you’ve been living under a rock, you will already know that interest rates are on the up and up.

This comes as no surprise, as the Federal Reserve has doubled down in it’s battle against inflation. Said inflation, I may add, that was caused in no small part by unprecedented money-printing by the Fed, as well as supply chain bottlenecks arising during the Covid pandemic.

But if I’ve learned anything over the past few years, it’s that trying to form any kind of meaningful (or accurate) projection past maybe 24 hours at the most, is a fool’s game.

That said, there’s never any shortage of pundits and commentators all too keen to offer you their opinion, much of which it has to be said, ranges from ridiculous, disaster-porn clickbait, through to purposeful misinformation.

So, what do the current mortgage and housing markets actually look like right now? How might current policy play out in the short, mid, and long-term? and how does that affect you as an investor or homeowner?

Let’s take a look at the numbers and find out what’s really going on.

A Mini-Reversal of Fortune for Borrowers

Now that the numbers are in for Q1, there are actually a few surprises (no surprise there!).

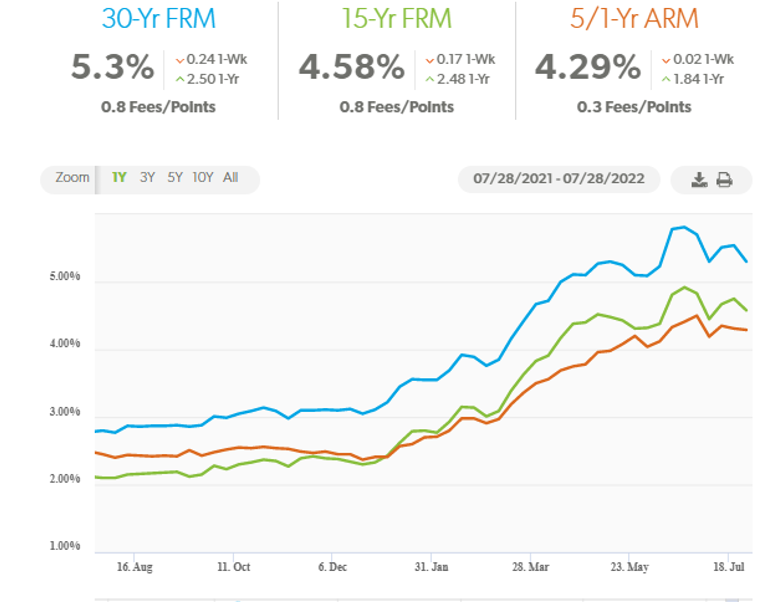

While mortgage rates have indeed been going up in correlation with (or, ahead of) Fed rates, much as one would expect, the first week of July saw a somewhat unexpected reversal of fortune for prospective borrowers.

Rates for average 30-year fixed mortgage loans actually fell to 5.3% after hitting a high of 5.81% during June as, according to Freddie Mac, fears of a looming recession continue to rise.

Borrowers looking for shorter rate-fix periods also benefitted, with the cost of 15-year fixed loans falling to 4.45%, down from 4.83% a week earlier.

I didn’t see many commentators predicting that a month ago, did you?

And that’s kind of defines markets today. Things are just wildly unpredictable in the short term, and every prediction, projection, and forecast should be taken with a large spoonful of salt.

Related: The Complete Guide to Investing in Mortgage Notes

Cooling in the Right Places

Of course, the aim of the Fed’s interest rate policy is to cool or ‘normalize’ the housing market by making the purchase of homes more expensive and reducing the relative purchasing power of prospective buyers.

The logic being that prices will fall to accommodate buyer’s with less spending capacity.

It’s economics 101 (to an extent)… reduce demand and/or increase supply to drive prices down.

And that’s not such a bad thought considering the unprecedented and wholly unsustainable boom in house prices in recent years. Things certainly need reigning in, especially in some of the more aggressive regional and local markets.

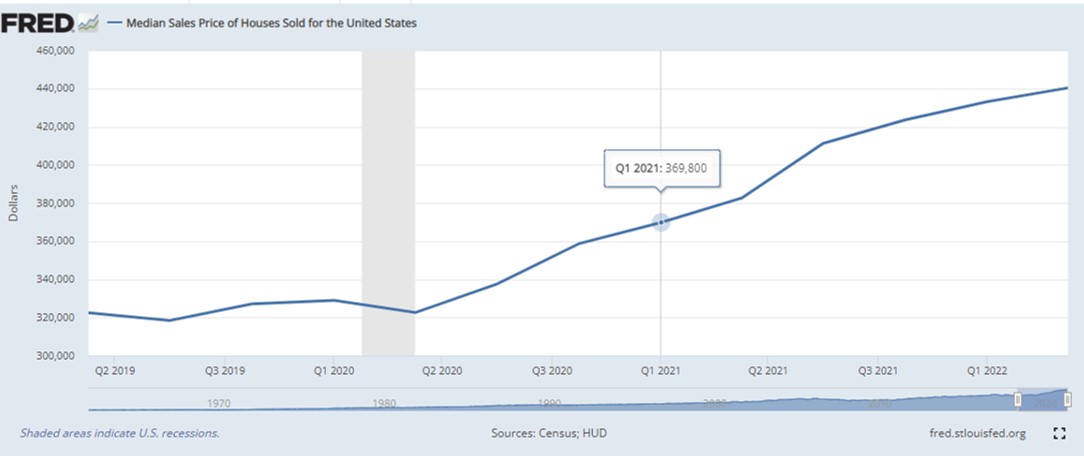

According to CoreLogic, house prices skyrocketed by 20.2% year-on-year in May – the 16th consecutive month of double-digit growth.

So, when you add to that the fact that interest rates for 30-year fixed rate loans exploded from about 3% to well over 5% this year so far, then yes… the cost of buying an average house has ballooned by about $500!

Looking at it another way… if you had a monthly budget of $1,500 in January, you could borrow up to $355,000. Today, the same monthly payment buys you a staggering $85,000 less… just $270,000.

For buyers, that means putting more of their own money down to buy the same home, or buying a cheaper home, or no home at all in some cases.

So the Fed’s policy is working insofar as it is making house-buying a way more expensive pastime, effectively reducing demand.

In reality, this likely means that the price of some homes will fall as sellers compete for fewer buyers with smaller budgets. But, as I said, that will occur mostly in markets that were grossly over-inflated in the first place.

Those markets where houses are still affordable to local buyers will be insulated from any great price drop-off, at least to some degree due to the fact that demand for homes on the whole still outpaces supply by a significant margin.

And that brings us on to the elephant in the room… Supply!

Related: Rental Properties vs Mortgage note Investing – Which is the Better Investment?

A Chronic Lack of New Homes

While the Fed’s rate policy is impacting demand, not much is being done about the chronic lack of new homes coming onto the market.

Housebuilders are simply not building enough, and with inflation now making materials and labour so much more expensive, coupled with concerns over the state of the economy in general, it’s highly unlikely that there will be any meaningful uptick in building activity any time soon.

Quite the opposite in happening in fact, but more on that later.

So in summary, house prices in areas with good affordability will continue to rise, albeit at a much slower and more sustainable pace, and prices in overheated markets will correct back to affordable levels.

No bad thing in my opinion!

So, with all that said, what does the mortgage market look like right now? Let’s take a look…

Related: How to be the Bank – A Complete Guide to Private Money Lending

Mortgage Market Highlights

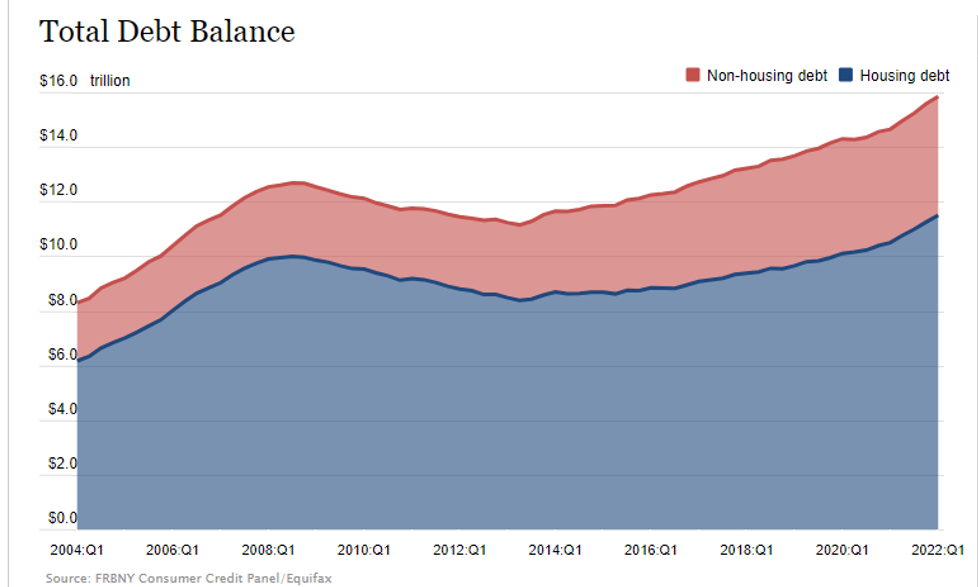

By the end of Q1, total mortgage borrowing in the residential market topped $11.18 trillion, up $250 billion on the previous quarter.

That a lot of money, but as always, the devil is in the detail.

In terms of total household debt, housing-related debt is about 18 percent higher than Q4 2007 ($11.5 trillion compared to $9.75 trillion). However, that account for about 72.5 percent of total debt, compared to 78.8 percent in Q4 2007.

So people are spending less of their monthly income on housing payments than pre-Great recession.

At the same time, non-housing debt is up a whopping 66 percent over the same period ($2.62 trillion in Q4 2007, compared to $4.35 trillion in Q1 2022), and also contributes a larger share of total household debt at 27.4 percent compared to 21.2 at the end of 2007.

What does all this tell us?

Well, it tells us that mortgage borrowers have spent the last few years cashing in on Fed rate policy and fixing in super low interest rates, bringing down the amount of money they pay each month for housing costs.

But, it looks very much like many households might have taken our way more ‘other’ credit, and used their extra spare cash to service that debt on much more expensive, non-housing debt like credit cards, car payments and personal loans.

Is this good or bad?

It’s neither, really. It just is what it is. Now that mortgage rates are on the up again however, borrowers have less purchasing power, so they will either put down larger deposits (unlikely), buy smaller homes (also unlikely), or sellers will have to accommodate their offers – especially in markets that have become untenably unaffordable (most likely).

Related: How to Spot Risky Borrowers – The Guide to Credit Risk in Private Lending

Opportunities Abound in Every Market

So if the saying holds true that there are opportunities in every market, where are the opportunities today (and tomorrow)?

My personal bet for 2022 and beyond, is in the affordable housing market.

There is a huge (7 million +) shortage of affordable homes to rent and buy, and yet the lowest income demographic groups have seen the highest wage increases in recent years.

Focussing on markets and asset classes with high (and growing) demand and inherently limited supply seems like a common sense approach to investing right now, and with rents also on the up, it seems like there’s extra cashflow to be had in these markets, too.

Mortgage Originations and Consumer Confidence

Lenders issued 2.71 million mortgage loans (residential) during Q1. This amounts to a relatively large drop-off. The largest, in fact, since 2014.

According to the New York Fed:

Mortgage originations, measured as appearances of new mortgages on consumer credit reports and which include refinances, were at $859 billion in 2022Q1. This represented a decrease from the high volumes seen during 2021, but still was $197 billion higher than the volume seen in 2020Q1.

To shine some contextual light on this, mortgage originations hit a record high of $4.4 trillion in 2021.

And it’s unlikely to get much better according to Fannie Mae. The lending behemoth suggests that 2022 will end with around $2.7 trillion in originations, and even less ($2.25 trillion) in 2023.

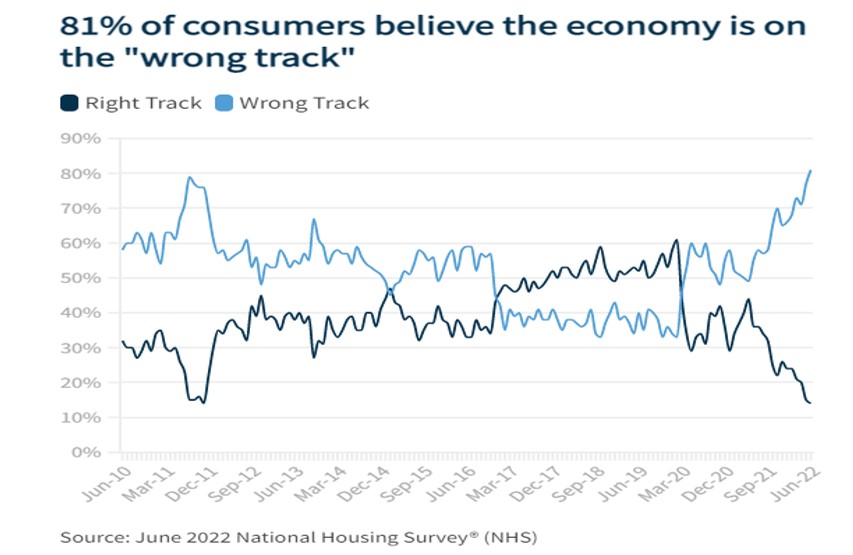

Buyers and Sellers Both Less Confident

So, less loans being issued equals less confidence in the real estate market among prospective buyers.

In fact, according to the Fannie Mae Home Purchase Sentiment Index buyer sentiment decreased 3.4 points in June to 64.8, its second-lowest reading in a decade.

At the same time, the percentage of consumers who believe it’s a “Good Time to Sell” fell from 76% to 68%.

So right now it’s a bit of a Mexican standoff between buyers and sellers.

Buyers don’t want to/can’t afford current prices with borrowing costs where they are, and sellers don’t want to lose that ‘on-paper’ equity they think they’ve earned over the past 2 or 3 years.

In reality, to get buyers buying again, sellers will ultimately have to adjust their prices expectations accordingly. And again, this will happen in those overcooked markets, whilst elsewhere will remain mostly business as usual, but with some slowdown is appreciation and volumes expected.

Related: 24 Solid Investments that pay Monthly Income in 2022

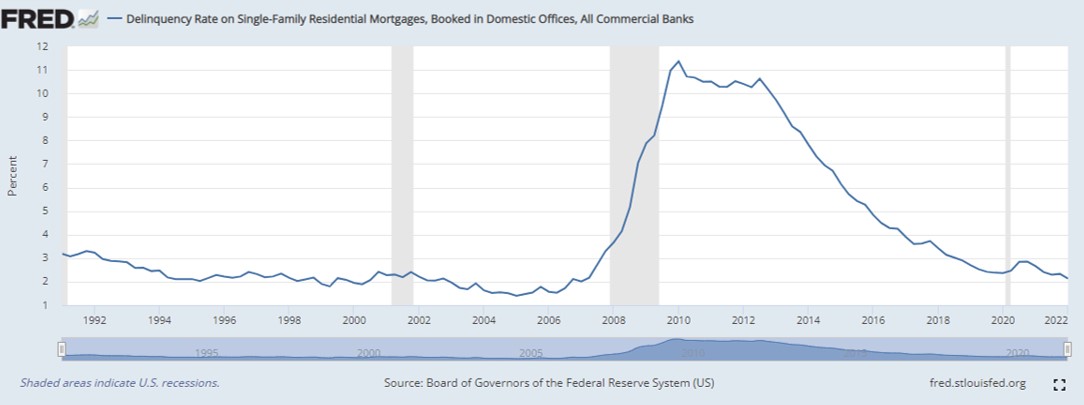

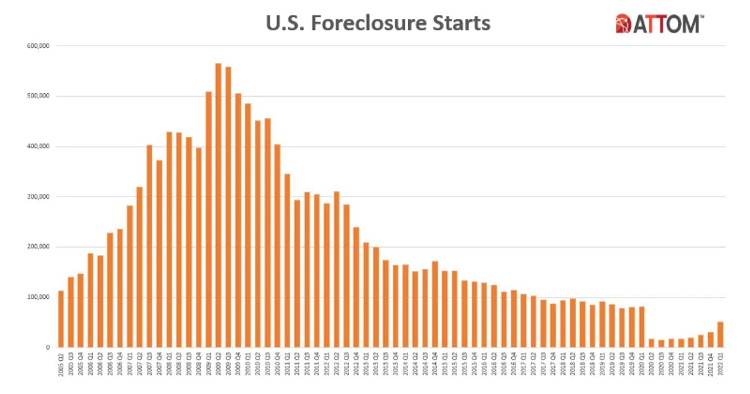

Mortgage Delinquencies and Foreclosures

A common theme among the doom and gloom brigade of market commentators, pundits and spin men right now is the ‘coming tidal wave of foreclosures’.

Of course, more often than not, whoever is telling you the apocalypse is coming is often also offering to sell you and ‘opportunity’ to profit from said financial collapse at the same time.

Convenient, no?

But as a sales spin, it works. I mean… who doesn’t want to cash in on ‘the biggest opportunity since 2008’? How lucky this guy has a unique secret strategy that’ll help you become a millionaire in 3 easy steps.

Step 1… Pay the man for his secrets!

As usual, the real picture is not quite as dramatic.

Mortgage delinquency rates remained flat in Q1 this year. And that’s still very low after dropping fall a cliff through the pandemic.

That’s due to the fact that lenders offered struggling borrowers forbearance (voluntarily and via the CARES Act) instead of foreclosure while the World was pinned down due to Covid.

As such, borrowers credit was protected was the reporting of late or missed payments, and most borrowers have now caught back up rather than falling further behind as many had predicted.

As of the end of March 2022, only around 2.7% of outstanding debt was in some stage of delinquency.

To put that into perspective, that’s almost half the delinquency rate of Q4 2019, just pre-Covid.

Of the current $431 billion in overdue payments, $299 billion is more than 90 days late, and considered “seriously derogatory”.

So the current overall mortgage loan market is looking pretty healthy, as of right now at least. But what’s to come?

Well, the share of loans entering into delinquency has increased by a small amount for all type of debt expect student loans.

But I stress that it is a small increase. Just 0.2 percentage points more credit card debt, and 0.1 percentage points more mortgage and auto loan debt is transitioning into delinquency in Q1.

Foreclosures remain historically very low, with a mild increase through Q1, and bankruptcies are at the lowest level in recorded history, as is the number of consumers with a 3rd party collection account (about 6 percent of consumers).

Overall, I’d say that there’s no sign of any tidal wave just yet. But continue to watch this space as inflation takes hold and squeezes household finances, and a recession looms.

Related: Mortgage Notes for Sale – A Complete List of 2022 Sources

Current Mortgage Rates in Perspective

lately, much has been said in the mainstream media about the rapid and significant hike in the cost of borrowing.

So, before we move on to look at the housing market in more detail, I think it’s helpful to get some historical perspective when it comes to today’s mortgage rates.

Here are the current average mortgage rates according the latest survey results from Bankrate.com:

- 30-year fixed for purchases: 5.750%

- 15-year fixed for purchases: 4.930%

- 30-year fixed for refinances: 5.690%

- 15-year fixed for refinances: 4.930%

- 5/1 ARM rate: 4.230%

- 7/1 ARM rate: 4.950%

While these rates might seem high compared to the 3% money we’ve become accustomed to, in reality, they’re still pretty low.

In fact, 30-year fixed rates are roughly about the same as they were in December 2008, and nothing like the 18% high of October 1981.

Source: Freddie Mac

So what does the immediate future hold for prospective homebuyers and borrowers?

No-one has a crystal ball. And, as I alluded to at the start of this article, making predictions in today’s rapidly changing economic landscape is nothing short of a fool’s game.

However, I do think that it’s probable rates will continue to rise as the Fed troops along in it’s battle against inflation.

This, combined with the possibility of falling house prices, means refinancing will slow significantly.

According to Freddie Mac, refinance originations are likely to fall from $2.8 trillion in 2021 to $960 billion this year, and then to $535 billion in 2023. That’s a drop off of more than 80 percent.

Source: Freddie Mac

But the market (and prices) rely on supply and demand, and there will always be new buyers that need homes.

In fact, if there is any tidal wave to speak of, it’s the tsunami of millennials coming of property-buying age right now. And with their household finances relatively stable, current mortgage rates are not entirely prohibitive.

Combine that with a chronic and growing shortage of new home constructions, and I think house prices will remain stable and growing – albeit much slower – in all but the most overdone of markets.

But let’s take a more detailed look at the housing market and see if we can’t find some clarity on where things actually stand right now….

Related: What are Real Estate Notes – A Complete Guide for Investors

House Prices and Home Sales

I’ve already put across my thoughts on housing throughout the body of this article, but in case you missed it, here are the bullet points…

- House prices have risen unsustainably fast this past two years.

- The cost of buying an average home has risen by more than $500/month when accounting for rising prices and rising mortgage rates.

- Some markets are now hugely overpriced when weighing the cost of buying a home (prices and borrowing costs) against local income levels.

- Prices in those overheated markets will likely correct back into a more affordable range as sellers give way to buyers with less purchasing power.

- In other markets where affordability is still good, we will likely see market activity reduce somewhat, and prices rise slower through 2022/23, or stagnate in some places.

- There is still a massive shortage of new homes being built.

- Rising demand from a massive demographic of millennial first-time homebuyers will continue to support prices in most markets.

- Overall, rising borrowing costs should regulate runaway price appreciation, while not causing a crash the likes of which we saw in 2008.

There are a ton of metrics available to assess the current state of the real estate market. For me, new and existing homes sales, new home starts, new mortgage applications, and consumer/industry sentiment surveys are all useful in curating an opinion as to where we are at, and what the immediate future might hold.

So, let’s go ahead and take a look at those metrics and see what we find.

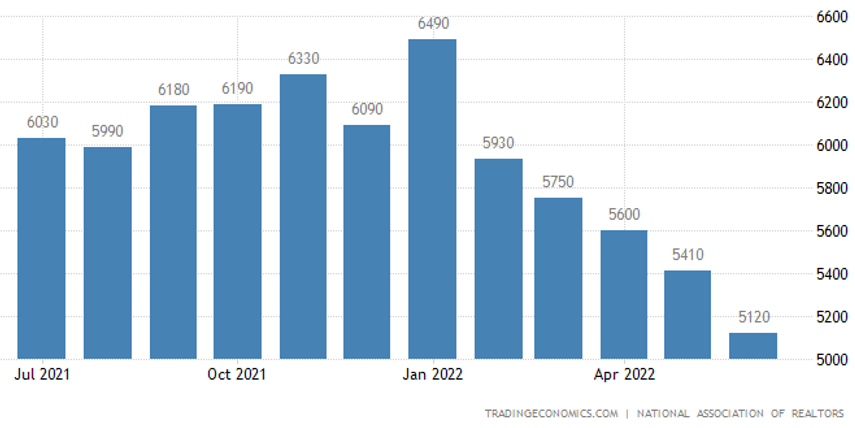

Existing Home Sales

Existing-home sales hit their highest level in 15 years in January 2022, at 6.49 million.

Existing Home Sales

As of June 2022, the number of existing homes sold had fallen to 5.1 million, a drop off in activity of 14.2% year-on-year according to the National Association of Realtors.

New Home Sales and Supply

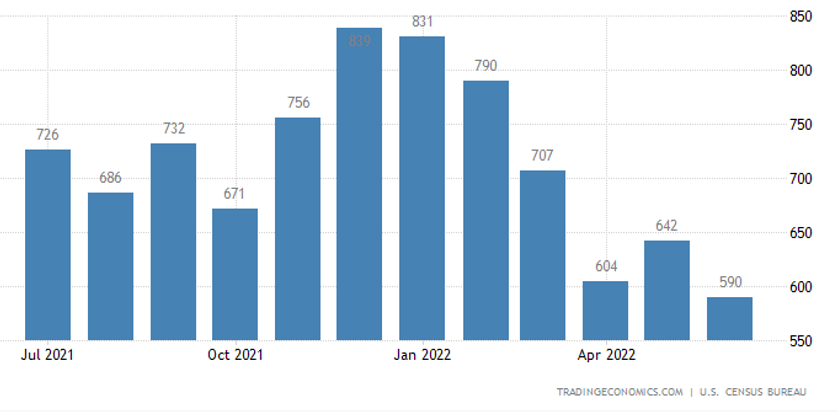

New homes sales are also down for 740,000 units sold in May 2021, to 590,000 in June 2022.

Inventory of new homes is also up a whopping 72 percent from 5.4 months to 9.3 over the same period.

New Home Sales

New Housing Starts

With sales of newly constructed homes down and inventory significantly up, it’s little wonder that housebuilders are scaling back their activities right now.

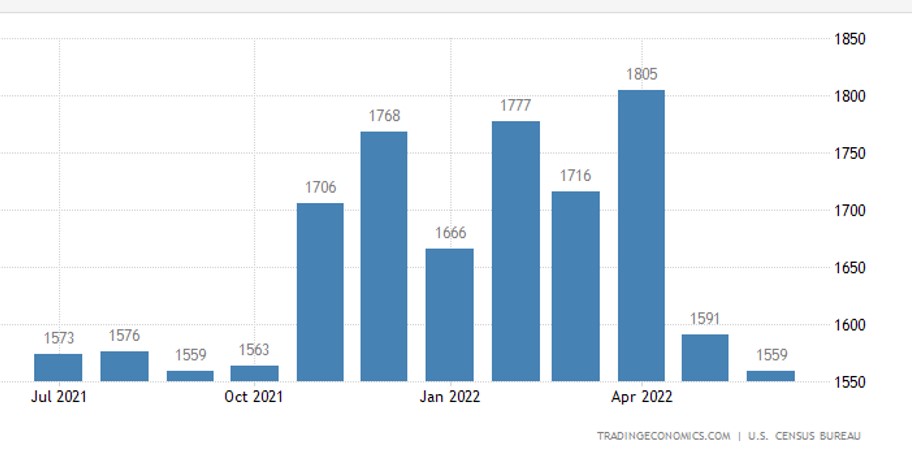

US Housing Starts

The number of new construction homes started in June fell 2% month-over-month to an annualized rate of 1.559 million homes. This is the lowest number since September 2021. Construction of single-family homes specifically fell 8.1% to 982,000.

Mortgage Applications

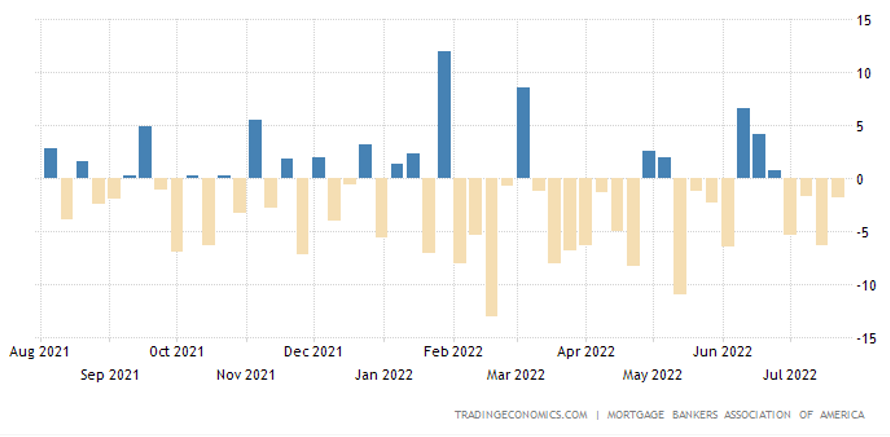

According the Mortgage Banks Association of America:

Mortgage applications in the US fell by 1.8% in the week ended July 22nd, a fourth consecutive week of declines and pushing the index to the lowest level since February of 2000

To give some perspective, mortgage applications averaged 0.61 percent between 1990 and 2022, hitting a peak of 112.10 percent in November of 2008 and a bottom of -40.50 percent in January of 1993.

According to Trading Economics, United States MBA Mortgage Applications will trend around 0.60 percent in 2023

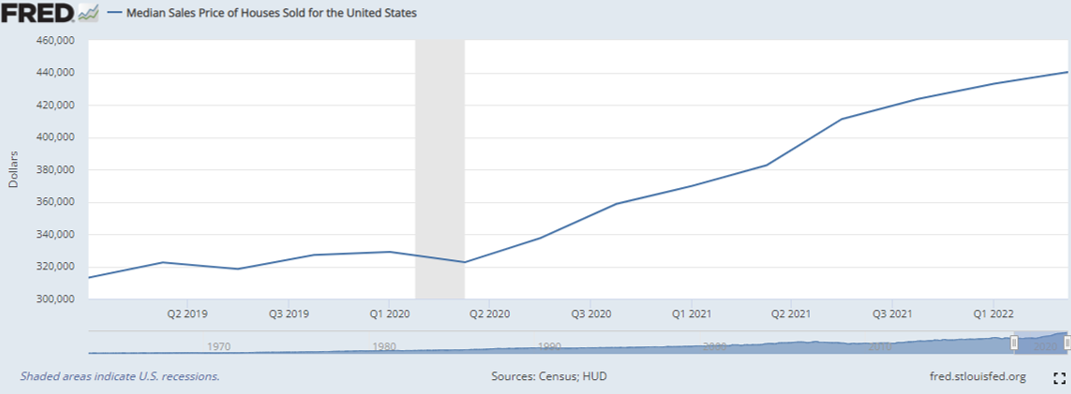

House Prices

So both new and existing homes sales are down, inventory of new homes is up, and mortgage applications are down.

So that must mean the market is crashing, right?

Well, I’ve read more than one clickbait headline saying as much in the past week.

But in reality, it isn’t. In fact, it looks nothing like a crash.

At the same time as all of this is going on, house prices have actually continued to rise, up 13.4% year-on-year to an Average $416,000.

So that kind of fits with my analysis that rising rates will dampen activity without causing an out-and-out crash.

In fact, according to a spring forecast from Freddie Mac, home prices are expected to grow by 10.4 percent in 2022 and 5 percent in 2023, according to a spring 2022.

Related: Where to Invest 100k in 2022

Conclusions

If you got this far, well done and thank you for reading. I hope you found this factual account of the mortgage market and housing market useful in clearing through some of the media-driven fog that’s out there right now.

On a final note, I’d like to reiterate my point of view, and of course remind you that my opinion is exactly that… my opinion. Your may differ, and that’s fine. If it does, you might well be right, and I quite wrong, or vice versa. The truth is, no-one really knows.

Anyway, my opinion remains that rising interest rates will continue to dampen market activity and price growth, and hopefully create pricing rollback in some of the worst overheated markets.

Expect less home sales, which will help with supply side economics. But also expect less building of new homes, which will of course counterbalance the lack of sales activity to some extent.

The truth of the matter is that there are still far more buyers than sellers, and while that remains true, and all other things being equal, the real estate market should remain fairly stable, at least for the foreseeable future.

Let’s check back in a couple of months and see how right or wrong we are.