The Hottest and Coldest US Property Markets Right Now

David Garner

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

📍Buyers or Sellers Market? Zillow Ranks 250 U.S. Property Markets (Spring 2025)

🏠 Is it still a seller’s market—or have buyers finally gained the upper hand?

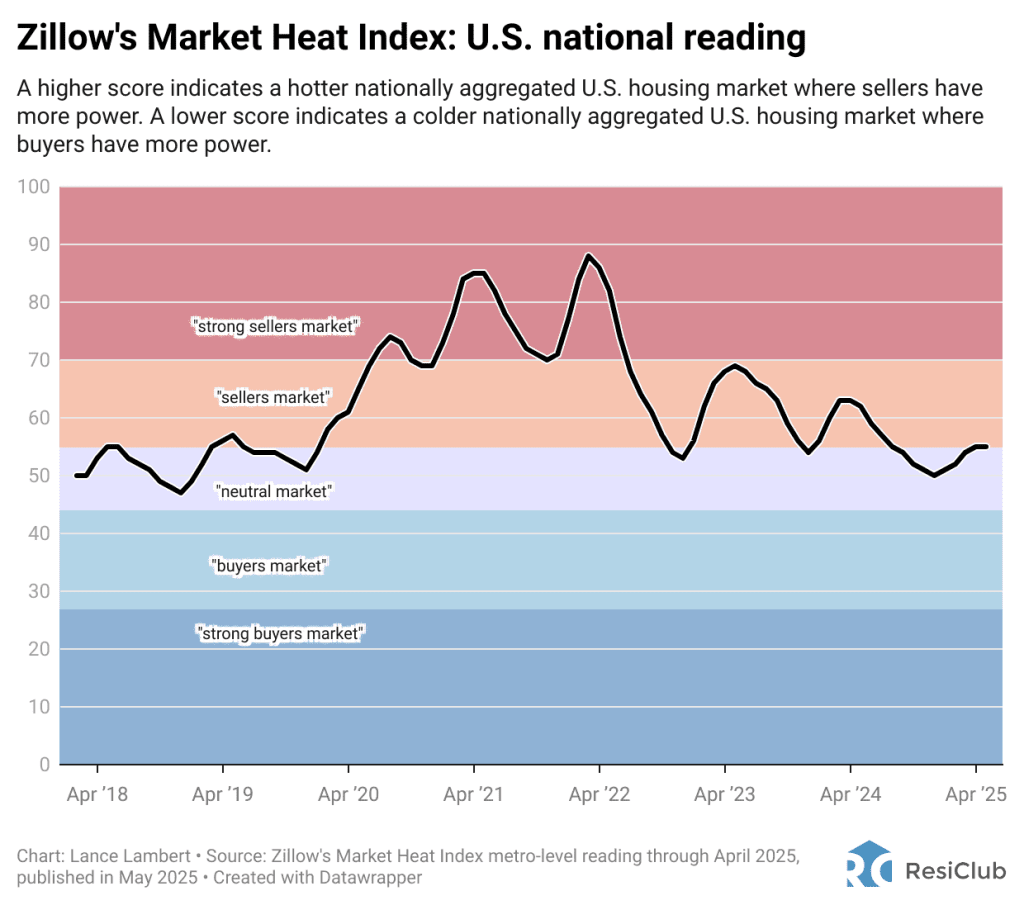

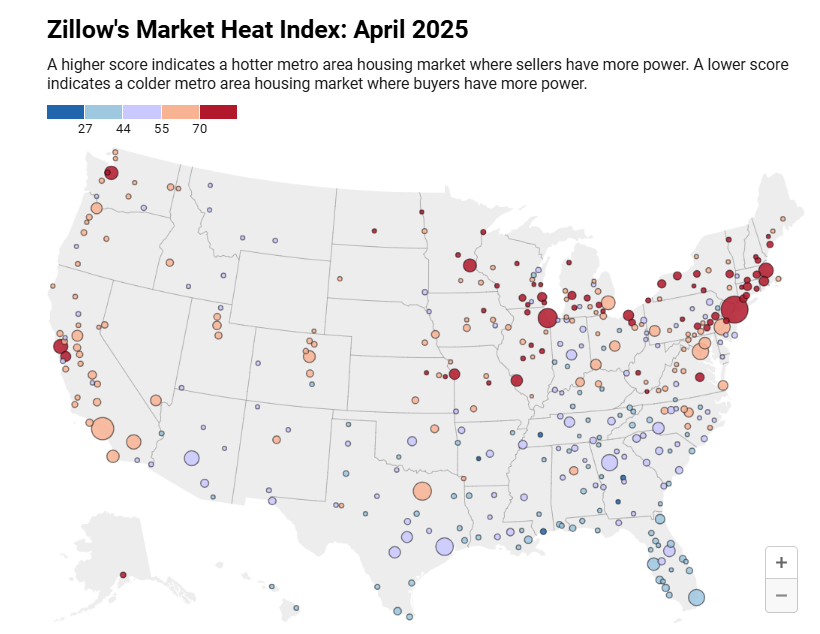

According to Zillow’s Market Heat Index, the U.S. housing market is now teetering on the edge of neutrality, with big differences from city to city. In their latest April 2025 data (released May 2025), Zillow assigns the national market a score of 55—just barely in seller territory.

But a closer look reveals major regional swings, with some cities booming for sellers and others cooling rapidly, favoring buyers. Let’s break it down.

🔥 Zillow’s Housing Market Heat Index: How It Works

Zillow’s Market Heat Index measures the competitiveness of each metro’s housing market by combining:

-

📈 Home price appreciation

-

📉 Inventory levels

-

⏳ Days on market

Each metro receives a score between 0 and 200:

| Score Range | Market Type |

|---|---|

| 70+ | 🔥 Strong Seller’s Market |

| 55–69 | 🏠 Seller’s Market |

| 44–54 | ⚖️ Neutral Market |

| 28–43 | 🛒 Buyer’s Market |

| 0–27 | ❄️ Strong Buyer’s Market |

🌡️ National Market Snapshot (April 2025)

-

🏠 National Score: 55

📊 Straddles the line between a seller’s and a neutral market

🌟 Top 10 Hottest Markets for Sellers (April 2025)

These metros are red-hot, with sellers holding the power—homes are moving fast, and prices are rising sharply.

| 🔝 Rank | Metro Area | Market Heat Score |

|---|---|---|

| 1️⃣ | Rochester, NY | 169 |

| 2️⃣ | Buffalo, NY | 126 |

| 3️⃣ | Charleston, WV | 107 |

| 4️⃣ | Syracuse, NY | 105 |

| 5️⃣ | Hartford, CT | 97 |

| 6️⃣ | Albany, NY | 97 |

| 7️⃣ | Manchester, NH | 93 |

| 8️⃣ | Anchorage, AK | 86 |

| 9️⃣ | Boston, MA | 85 |

| 🔟 | Lansing, MI | 85 |

🧭 Trend Insight: The Northeast and Upper Midwest continue to lead the pack in market tightness—though some analysts argue Zillow may be overstating seller power in these areas.

🧊 10 Coldest Markets for Buyers (April 2025)

In these metros, buyers now have more negotiating power—more inventory, longer time on market, and price softening.

| 🔝 Rank | Metro Area | Market Heat Score |

|---|---|---|

| 1️⃣ | Jackson, TN 23 | 23 |

| 2️⃣ | Macon, GA | 25 |

| 3️⃣ | Gulfport, MS | 26 |

| 4️⃣ | Brownsville, TX | 27 |

| 5️⃣ | Naples, FL | 27 |

| 6️⃣ | Cape Coral, FL | 30 |

| 7️⃣ | Daphne, AL | 30 |

| 8️⃣ | Panama City, FL | 30 |

| 9️⃣ | Punta Gorda, FL | 31 |

| 🔟 | Beaumont, TX | 33 |

🧭 Trend Insight: Southwest Florida and Central Texas now show the softest housing conditions nationally, with buyer leverage at multi-year highs.

📌 5 Key Takeaways from Zillow’s Spring 2025 Report

-

Buyers gain leverage in the South

Florida’s Gulf Coast and parts of Texas are now decisively buyer-friendly, as supply rises and prices stabilize. -

Sellers still winning in the Northeast

Cities like Rochester and Buffalo remain strongholds for sellers, though analysts caution Zillow’s index may slightly overstate the strength of these markets. -

Mixed conditions in the Midwest

Lansing and other Michigan metros are showing seller dominance—but on the ground, market conditions may be closer to neutral. -

The West Coast cools down

Despite high price tags, many West Coast metros have softened compared to the peak pandemic boom—but Zillow’s data may not fully reflect the shift. -

Overall market stabilizing

The national index at 55 suggests the post-pandemic market frenzy is giving way to a more balanced landscape, especially as inventory levels slowly rise.

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

🧭 What This Means for Buyers and Sellers

-

If you’re buying in Florida or Texas: 🎯 Now may be your window. More listings, longer days on market, and price flexibility work in your favor.

-

If you’re selling in the Northeast: 💸 Still a hot ticket—but be aware that competition is heating up and momentum may be slowing in coming months.

-

If you’re on the fence: 🕵️♂️ Watch your local market carefully. Zillow’s tool is a great starting point, but local trends may vary. Work with an agent who knows your area well.

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

📌 Related Articles

Related: Best US Property Markets for Foreign Investors

Related: Top 10 US Housing Markets to Buy a Home With a $125,000 Salary

Related: The 10 Most and Least Affordable Housing Markets in America

Related: How Much have US House Prices Gone up in the Last 30 Years

Related: How to Buy Property in the USA as a Foreigner

Related: International Investors are Buying up America’s Affordable Housing

Related: US Pending Home Sales in May 2025 – Trends and Forecasts

Related: The Hidden Wealth in America’s Affordable Housing Markets

Related: US Housing Affordability is the Gold Standard Metric for Property Investors

Related: US Cities With The Most Home Sale Cancellations

Related: Is the US heading Towards a Property market Crash and Debt Bubble in 2025

Related: Top US Housing Markets for First Time Investors in 2025

Related: Top 10 US Counties for Single Family Home Investors

Related: Foreigners Win Big in US Housing Market

Related: The Top 10 Most and Least Affordable Housing Markets in the US in 2025

Related: Growing Housing Affordability Gap Creating Golden Opportunity for Investors

Related: Unlocking Value in the US Housing Market

Related: Top 5 Riskiest US Property Markets in 2025

Related: The Market Advantage for Foreign Property Investors in the USA

Related: Hidden Costs of Buying Cheap Investment Property in the USA

Related: Local Market Expertise is Essential for Overseas Property Investors

Related: Top 10 Counties for Single Family Home Investors in 2025

Related: Successful Foreign Investors Use Local Market Data to Identify Opportunities

Related: Why Foreigners Are Buying Investment Properties in the Northeast Midwest and South

Related: Population Trends Driving Foreign Investment In USA Property

Related: Real Estate Closing Costs in the USA for Foreign Property Investors

Related: Cleveland’s Population Shift is Driving Real Estate Investing Opportunities

Related: Hidden Risks for Section 8 Property Investments

Related: Landlord Friendly Real Estate Markets for Overseas Property Investors

Related: How Remote Property Investing Has Become Easier and Safer

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals