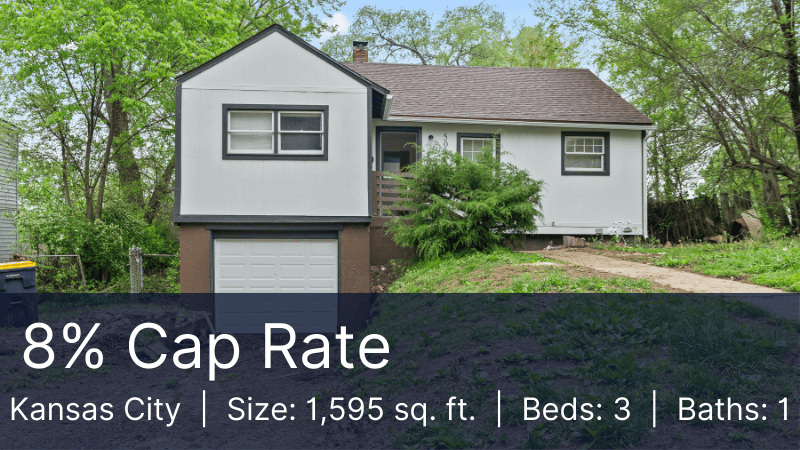

Kansas City, MO

Single Family Home

|

Turnkey Rental

✅ 75% Financing Available for Non-U.S Citizens

Purchase Price

$189,000

Initial Investment*

$62,370

Current Rent

$1,695

Cap Rate

8% p.a.

10 Year ROI

31.6% p.a.

Initial Investment comprises: 30% down payment and 6% closing costs.

Property Description

Own this fully renovated 3-bedroom 1-bathroom single family home generating $1,695 in monthly rents, and expected to deliver a leveraged ROI of +31.6% p.a. over 10 years.

Property Details

🏢 Single Family

🛏️ 3 Bedroom

🛁 1 Bathroom

📐 1,595 sq. ft.

🛠️ Fully Renovated

💵 $1,695/month rents

Neighbourhood Analysis

This neighbourhood in the southern suburbs of Kansas City houses approximately 4,108 residents, up +9.72% over the past 5 years, and is expected to grow by another +17% through 2030. This organic population growth is being driven primarily by excellent housing affordability and is expected to drive forward house price appreciation as demand for good quality housing continues to increase. CoreLogic data suggests house price appreciation of +32% through Q1 2028, equating to an average annual appreciation rate of +9.76% p.a. for the next 3 years. Rents are also rising at an average annual rate of +6.7% p.a.

Property Condition

The home has been renovated to an exceptional standard, including a ground-up remodel throughout. Quite literally everything is brand new! See construction video below.

Due Diligence

🔍 Our team has completed phase 1 due diligence. All sales contracts are subject to:

✅ Clear title search

✅ Independent appraisal

✅ Home inspection

✅ Sewer scope

✅ Financing approval

For access to the supporting documents for this property, please Download the Financial Analysis or Schedule a Call.

Investment Pro-Forma

To access the comprehensive 30-year buy and hold cashflow analysis, please download the Property Factsheet.

IMPORTANT INFORMATION

Cashflow rentals is a consultancy company and does not act as a real estate broker. The information listed on this page was provided by the property owner/seller/broker. All information is deemed to be reliable, but not guaranteed.

Projected returns are based on a cash-on-cash basis using a mortgage to fund 70% of the purchase.

This property is subject to final due diligence before closing, including independent property inspections and lender’s appraisal.

It is the responsibility of a prospective buyer to confirm the accuracy of any pro forma, including estimated rent ranges, closing costs, taxes, insurance, appraisals, and third-party inspections before purchasing any property. Mortgage interest rates are subject to change and actual rates will vary.

Projection Assumptions:

Mortgage Rate: 7.25%

Mortgage LTV: 70%

Annual Capital Appreciation: 5%

Annual Rent Appreciation: 3%

Annual Expense Appreciation: 2%

Closing Costs: 6% of purchase price