Everything You Need To Know About Investing For Income

David Garner

Income Investing: What, Why & How?

Investing for income is an important part of any investment plan. In fact, one could argue it’s the most important.

If you are growing your wealth for the future, leveraging the power of compound interest is by far the fastest, safest and most reliable way to do it. If you are at or approaching retirement, investments that generate income allow you to draw down funds to live on while keeping your capital intact, rather than selling off your assets for a lump sum.

Irrespective of your personal timeline or financial circumstances, investing for income should form a core part of your overall plan.

As the title suggests, in this article you will find everything you need to know about investing for income in today’s economy.

The ‘New Normal’ Economy

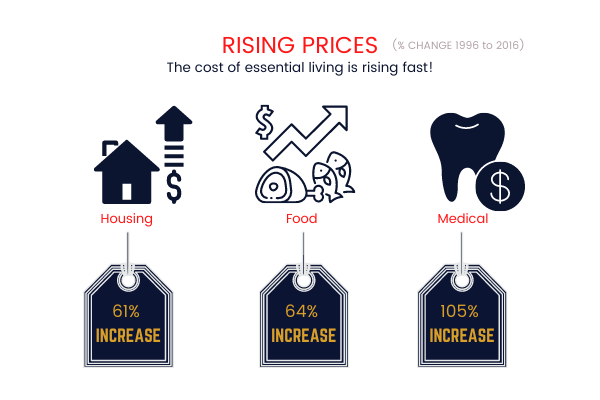

The world is changing fast. It took 200,000 years up to 1970 to populate the earth with 3.6 billion people. Then, only 50 years more to double it! With rising demand and limited resources, inflation – the rising cost of living – is a real problem, even as the rate of population growth slows!

Little wonder then, that way we live and do business has changed beyond all recognition in just a few decades.

As the global economy evolves to accommodate this new ageing demographic, so too must our approach to investing. We can no longer rely on the same tools as our parents and grandparents to provide the investment income we need to meet our needs. But how different are our needs, exactly?

Staying Alive is Expensive

According to the US Bureau of Labor Statistics, the average over-65 household spent nearly $50,000 in 2019. That includes about $6,600 on healthcare, $7,500 on transport, and $3,815 on groceries. And prices of essentials such as food, healthcare and housing are among those rising most rapidly.

Research in 2019 showed that in Hawaii, you will need an annual income of $117,000 to live comfortably in retirement. For those on a budget, Mississippi came in cheapest at a touch over $53,000.

Social Insecurity

Recent research from Boston College tells us that actual median retirement income in the average US household is just $43,696 in 2020. Markedly less than the minimum required to live comfortably in any US State.

But the Government has your back, right?

Many of us rely on social security to supplement any shortfall in our investment income. More than 85% of people 65 and older get Social Security in the US today.

But government checks are not keeping pace with real life inflation. The average monthly Social Security income rose by just 1.6%, from $1,479 in 2019, to $1,503 in 2020.

Who even knows if social security will even be around in 20 years time?

All things considered, our retirement accounts are not growing fast enough, and about 50 per cent (50%) of retirees leaving work now risk not having enough income to live the lifestyle they had planned for.

The solution? We to invest more efficiently in order to accumulate more wealth while we are working. We must then demand a better rate of interest from our investments when we retire. If we do both of these things, there is a good chance that we will get the retirement we actually want (and deserve).

Fortunately, there are some very clear steps you can take into order to take back control of your money, and invest for a better rate of income return. Here are my 7 steps to investing for income in 2020 and beyond.

1: Take Control of Your Investments And Your Future

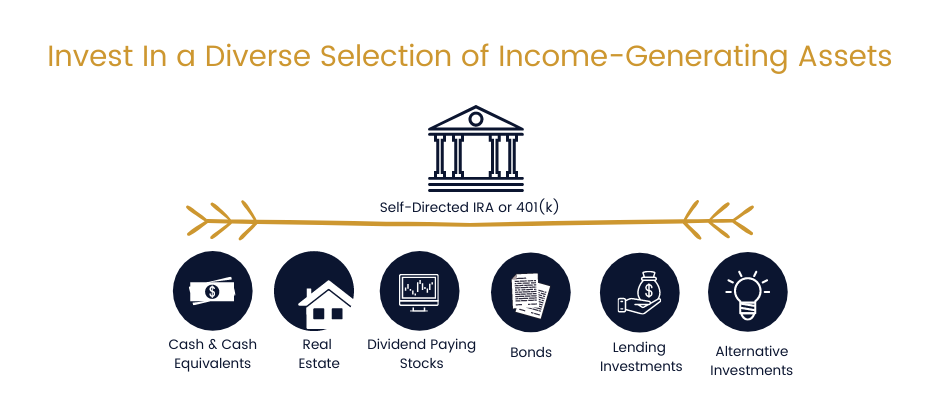

Before you start to consider income investing options, you must first take control of your cash. Moving your retirement funds into a self-directed wrapper such as a self-directed IRA or 401(k) is a good first step. This will give you the freedom to make your own investment choices, and take advantage of the widest range of income investing options.

Most SD-IRAs and 401(k)s allow a huge range of investing options. From real estate to physical gold, cryptocurrency to crowdfunding, and everything in between. With the right type of account you will have access to a far greater range of options, and stand a much better chance of creating the income you need.

2: Reverse Engineer Your Income Requirement

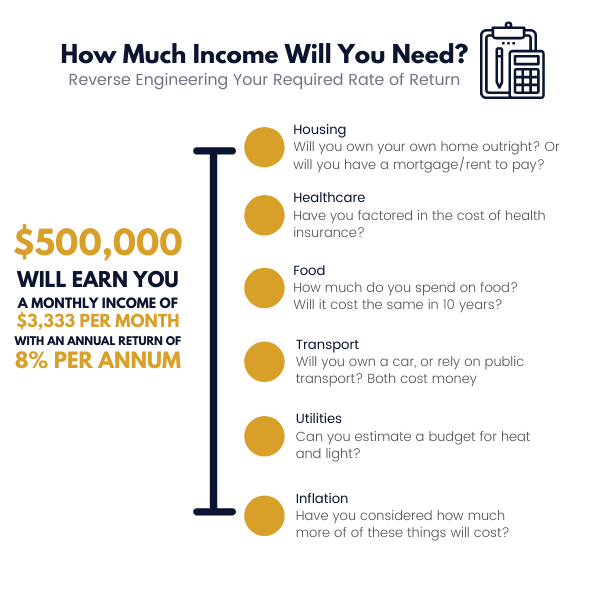

Once you’re set up with the best type of investing account, you should figure out exactly what return you’ll need from your income investing endeavours in order to fund your lifestyle.

This starts with figuring out how much monthly or annual income you’ll need. Don’t forget things like healthcare, and adjustments for inflation. Once you know your income requirement, you can use an online investment calculator to figure out what rate of return you’ll need to meet that income goal.

You can you the free investment calculator from Vanguard here to work it out.

3: Keep Diversification in Mind

Once you have funded your self-directed account (you can roll your existing IRAs and 401(k)s into your new account), you can start to asses the options available to you.

Since the introduction of the JOBS Act in 2012, there are more investment options available to the general public than ever before. You are no longer limited to cash, stocks, bonds and insurance policies. This is good news because diversification is the key to superior risk-adjusted returns.

You should aim to invest across a range of asset classes and sectors. In doing so, you will drastically reduce the impact of any one single investment failing.

4: Utilize The Magic of Compound Interest

If goal is to grow your money in the most efficient and consistent way possible, then you absolutely need to understand the power of compound interest. Without a shadow of a doubt, compound interest is the best way to grow your wealth consistently, regardless of market conditions.

Albert Einstein said it best; “Compound interest is the eighth natural wonder of the world and the most powerful thing I have ever encountered.”

The concept of compound interest is simple. You buy investments that pay monthly income, or even quarterly or annually (monthly is most efficient). You then immediately invest the dividends and interest in more income-generating assets. By getting interest on your interest, you increase the growth factor in your portfolio almost exponentially.

5: Know Your Income Investing Options

5: Know Your Income Investing Options

There are tons of options out there if you are investing specifically for income. Here is a list of some of the more common (and some less common) income-generating investments that you can include in your portfolio.

- Dividend Paying Stocks

- Certificates of Deposit

- Bonds

- Floating Rate Funds

- Money Market Funds

- Real Estate

- Master Limited Partnerships (MLPs)

- Royalty Income Trusts

- Peer to Peer Lending

- Business Development Companies

Related: The Ultimate List of Investments That Pay Monthly Income

Now you have all of the tools and information you need to start investing for income. So, let’s start putting it all together!

Step 6: Constructing Your Income Investing Portfolio

Let’s take a look at the most common investment options first.

A traditional income investing portfolio is typically comprised of stocks, bonds, cash (or cash equivalents), insurance polices and real estate. You can now also mix in some more exotic alternative investments. This ensures a diversified portfolio which can help reduce risk and significantly boost overall yield.

Once we’ve covered the usual suspects, we’ll take a look at some of those alternatives. Remember, diversification is the cornerstone of superior risk-adjusted returns

a. Dividend Paying Stocks – Equities With Income

Whilst income returns to the wider stock market are pretty poor, there are still plenty of individual securities and funds yielding above-average income. You just need to know what to look for.

What to Look for in Dividend-Paying Stocks

Here’s some advice for picking the best yielding stocks.

- Look for companies that pay out around half of their annual profits (or less) to shareholders. You want to invest in companies that reinvest at least 50% of their profits for future growth.

- You should target stocks with yields of between 4 per cent (4%) and 6 per cent (6%). That’s pretty solid.

- The company should have a good recent history on generating profits consistently for at least 3 years.

- Invest in companies that have a long history of increasing their dividend payouts every year.

There are a couple of other considerations too, including return-on-equity and debt-to-equity ratios. You want to buy companies with a good return on equity combined with low levels of debt. This being the case, the company should be well-positioned to continue paying you dividends during a recession.

How to Invest in Dividend Stocks

As with all types of investing, knowledge is power. Educate yourself as much as possible. Read books. Join social media groups. The more you know, the better your decision making will be.

You can invest in individual securities with an online brokerage account. Or, you can leave the stock-picking to a professional fund manager and invest in mutual funds and ETFs with an income-focused investment strategy. There are plenty of online trading accounts that will allow you to do this with relative ease.

b. Bonds – The Fixed Income Investment

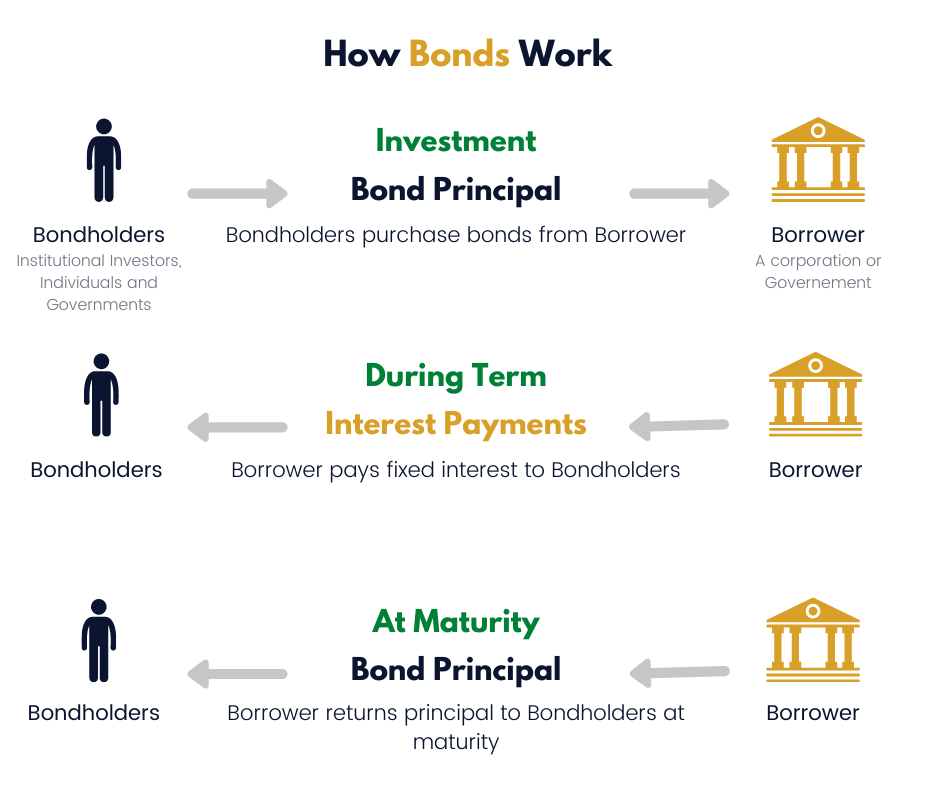

Bonds are fixed income securities, making them an ideal part of your income investing strategy. When I say fixed income, I mean the coupon (the interest payment to bondholders) is paid at a fixed rate. It is a fixed sum of money and doesn’t change for the life of the bond. If a bond coupon is $1, you will get payments of $1 at every distribution until the maturity date.

Whilst income is fixed, bond prices are not. Despite the par value (face value)of a remaining the same, the price bonds are traded at can fluctuate as prices rise and fall in reaction to movements in Federal interest rates. As interest rates rise, bond prices fall, and vice versa. So, the safest way to invest in bonds is to hold them until maturity, thus avoiding price fluctuations.

What Type of Bonds Should I Invest In?

The corporate bond market is vast. So is the Government bond (treasuries) market. So, there are all types of bonds to choose from. Here’s a short list for your reference:

- Short term corporate bonds

- Long term corporate bonds

- Treasury bonds

- Treasury bills

- Treasury notes

- Municipal bonds

- Savings bonds

- International bonds & foreign bonds

As a general rule, short term bonds are less risky because they are exposed to interest rate risk for less time, and your returns are less-eroded by inflation. As such, yields on short term bonds also tend to be lower.

For super-low risk bonds, look to short term US Government Bonds (Treasury Bills have the shortest terms). For higher returns, look to lower-rated corporate bonds that have a high yield (by comparison).

Remember that bonds are debt securities. So, as a bondholder you are effectively a lender to the issuer. As with any type of lending, higher interest rates on the loan (bond) usually mean bigger risks for the lender.

How to Invest in Bonds

There are a number of ways to invest in bonds. You can buy directly with an online brokerage account, or you can invest in bond funds, including traditional mutual funds and ETFs. There are funds that invest in both corporate and Government debt.

Whichever way you decide to add bonds to your portfolio, buying mostly short term (less than 6 years), and holding all the way to the maturity date is the safest investment strategy.

c. Real Estate – One of the Best Long-Term Income Investing Assets

Real estate is a great investment for monthly income. Rents and lease payments from residential, commercial and other types of property should be a welcome addition to any portfolio.

There are all sorts of real estate to invest in, and all sorts of ways to do it. Residential real estate includes single family homes, apartments and condos. Commercial real estate includes apartment buildings with more than 4 units (multifamily), and all types of business-related property, including malls, office buildings and industrial space.

One big benefit of real estate is that you can use a mortgage to maximize your withdrawal rate, because property prices appreciate over the long term.

How to Invest in Real Estate

In 2102, the JOBS Act relaxed securities regulations in order to encourage investing in small enterprises. As a result, there are now a ton of new ways for the general public to invest in real estate. Here’s a list of some of the options:

- Buy rental property

- Buy shares in a REIT

- Invest in a multifamily syndicate

- Invest through a crowdfunding site (residential & commercial options)

- Joint venture with an experienced real estate investor

There are versions of all of the above that will allow you to invest in any type of real estate. You could invest in shopping malls through a crowdfunding site, be a limited partner in a multifamily syndicate, buy a residential rental property, or JV with a real estate investor on an industrial warehouse unit.

A word of caution. Real estate offers much higher income returns than stocks and bonds. The temptation then can be to invest a disproportionate amount of your portfolio in property. While this mat give your investment income a boost during the goods time, having all your eggs in one basket is rarely a good idea, and you would be overexposed if/when the real estate market corrects.

d. Cash and Cash Equivalents – Keeping Some Powder Dry

Cash and cash equivalents are an important part of any income investing portfolio. You may need to access cash quick for healthcare, housing repairs or some other emergency. If all of your funds are tied up in long-term investments, you may find yourself caught short.

The problem is that cash is a depreciating asset. Due to the fact that the costs of goods and services goes up (inflation, right?!), the value of your money is going down by comparison. This means your dollars need to still earn dollars.

Here is a list of cash equivalents:

- Savings Account

- Treasury Bills

- Commercial Papers

- Marketable Securities

- Money Market Funds

- Short-Term Government Bonds

The income to cash equivalent investments is predictably very low, so don’t keep more than you need in near-liquid assets.

e. Lending Investments – Turning Your Retirement Account Into a Bank

One of the best ways to invest for income is to lend money to borrowers in exchange for interest payments. Nowadays, there are a number of ways to access lending investments with funds in your self-directed IRA or 401(k).

Here are some of the most easily accessible ways to turn part of your retirement account into a lending bank:

- Private Lending RE Investments

- Mortgages and Trusts Deeds (Note Investing)

- Peer to Peer Lending (Unsecured Notes)

- Private Business Loans

- Car Notes

Income returns from money lending tend to be far higher than stocks and bonds. However, as with any loan there is risk. The higher the return, the higher the risk, so don’t be tempted with the lure of double digit income returns without doing your due diligence first.

Here’s a breakdown of some of the most accessible lending options:

Private Lending Real Estate Investments

If you want to capture the income from real estate, but you don’t want to be a landlord (or experience the volatility of the housing market), private lending is the way forward. By taking the position of the bank and lending money to real estate investors, you get all the security of physical real estate, a passive monthly income, and none of the hassles of ‘tenants, toilets and trash’.

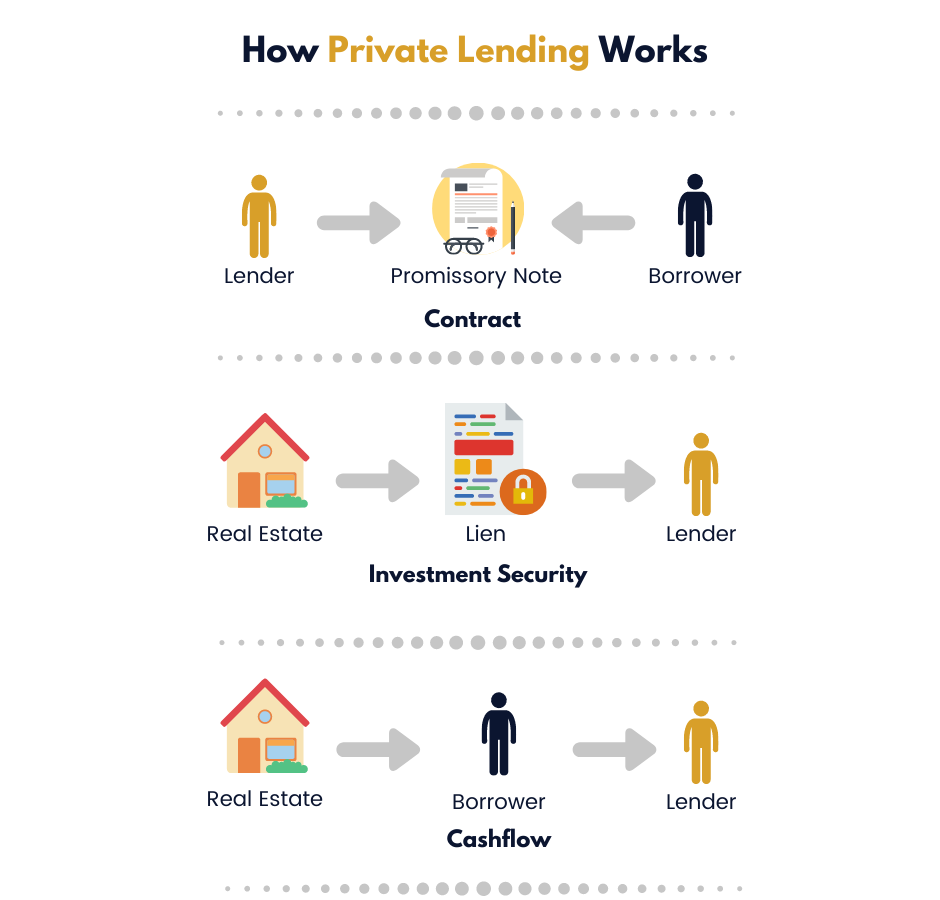

As a lender, you get a promissory note and a lien. The note contains the terms of the loan, and lien provides security for your investment. As a private lender, you need to understand lien position and priority in order to make good lending decisions.

Loans to real estate guys tend to be short term, interest only, and pay interest of between 5 per cent (5%) and 15 per cent (15%), depending on the deal.

As with any type of lending, make sure you understand the credit risk (the risk of the borrower defaulting). You also need to understand the worst case scenario, including disposal value of the real estate in as-is condition.

You can view private lending investments in Garnaco’s Private Lending Portal.

Investing in Mortgages and Trust Deeds – Note Investing

Where private lending involves making a new loan to a real estate investor, investing in mortgage notes involves buying existing notes on the secondary market. You are still technically a lender, but chances are you will never meet your borrower.

Broadly speaking, there are two types of notes; performing and non-performing. A note is considered performing when the borrower is up to date on payments and the note is generating cashflow as per the terms of the contract (the promissory note).

A note becomes non-performing when the borrower falls into default. You can buy non-performing notes very cheap, and they may seem like great investment opportunities. but, a lot of hard work, time and experience goes into turning a profit on a non-performing note investment.

If you are investing for income, you will definitely want to stick to performing notes. You can buy performing notes from a range of sources, including online notes exchanges, form note brokers, and in Garnaco’s Private Lender Portal.

Peer to Peer Lending

A relatively new investment option, P2P lending websites allows investors (lenders) to make unsecured personal and business loans to borrowers.

As a lender, you can choose to provide an entire loan to a single borrowers, or you can buy part of a loan in the form of a note. This can be a great way to diversify your lending investments across multiple borrowers and loans with relatively little capital outlay.

There are lots of P2P lending sites to choose from, all offering different terms for investors and borrowers. Rates to borrowers vary tremendously, and investors often realize returns from 8 per cent (8%) to 15 per cent (15%) p.a., depending on the borrower risk and the loan terms.

f. Alternative Investments – Sexy, Wild and Exotic – Or Not

The final puzzle piece for a well-diversified income investing portfolio is alternative investments. This is extremely broad, and technically covers anything that is not stocks, bonds or cash. In fact, even real estate is considered an alternative investment.

In a self-directed IRA or 401(k), you can hold almost any type of alternative investment. But be careful! There are rules, and you do not want the IRS on your back for breaking them. Always seek professional advice, and educate yourself as well as possible ion order to perform your own due diligence.

Here is a list of some alternative investment options that generate income:

- Lease options on real estate

- Farmland

- Timberland

- Storage units

- Water rights

- Fishing rights

- Airspace rights

- Mineral rights

- Cell Tower Leases

- Private company stock

- Oil & Gas LPs

- Royalties

- Fixed Annuities or Equity-indexed annuities

Of course, this is not an exhaustive list. Because of the broad nature of the term, I don’t think there could be a definitive list of alternative investments.

As with all of the investment options listed in this article, be sure to do your due diligence. this is particularly important when it comes to alternative investments, which often require specialist skills or expertise to acquire manage, trade or sell.

Conclusion

So, there you have it. If you have decided that you should be investing for income, you now have all the basic first steps to constructing your own income investing portfolio.

Remember the golden rules. If you are growing your wealth for the future, utilize the power of compound interest. If you are investing for income to draw down today, make sure you diversify, and look for investments that pay a better rate of returns than stocks, binds and cash.

I’ll continue to add to this article as time goes on. If you’d like to receive regular market news, investing tips and access to some of my own joint venture passive income investments, you can subscribe to my newsletter below.