Fed Decision: US Real Estate Impact for Global Investors

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

Federal Reserve Rate Decision: Impact on US Real Estate for International Investors (June 2025)

Published On: June 16th, 2025

As international investors continue to eye the robust U.S. real estate market, macro-economic factors like the Federal Reserve’s interest rate decisions become increasingly critical. The recent Federal Open Market Committee (FOMC) meeting, concluding on June 12, 2025, has offered fresh insights into the Fed’s stance on monetary policy.

Understanding these decisions is paramount. They influence everything from borrowing costs to overall market sentiment, directly impacting your potential property acquisitions and returns. Let’s break down the latest Fed decision and its implications for the U.S. housing market, and specifically for international investors.

Key Takeaways:

- No Rate Cut Expected: The Federal Reserve held the federal funds rate steady, with a near-unanimous consensus for no change at this meeting.

- Inflation Remains Key: The Fed’s primary focus remains on bringing inflation down to its 2% target, guiding future policy.

- Mortgage Rate Influence: Long-term mortgage rates are indirectly tied to the Fed’s actions and broader economic data, impacting affordability.

- Housing Market Resilience: Despite elevated rates, strategic opportunities persist for property investors.

- Implications for Foreign National Mortgages: Borrowing costs for specialized foreign national loans will continue to track the wider market.

The Fed’s June Meeting: Holding Steady Amidst Economic Signals

The Federal Open Market Committee (FOMC) concluded its latest meeting on June 12, 2025, as widely anticipated. The committee voted to maintain the federal funds rate within its current range. This decision reflects the Fed’s cautious approach, as it assesses incoming economic data, particularly regarding inflation and the labor market.

Why No Change? The primary reason for holding rates steady is the ongoing battle against inflation. While there have been signs of cooling, inflation has yet to consistently reach the Fed’s target of 2%. Recent Consumer Price Index (CPI) and Producer Price Index (PPI) data play a significant role here, providing the Fed with a clearer picture of price pressures across the economy.

The “Dot Plot” and Future Projections: A key element for market watchers is the Fed’s “dot plot,” which illustrates each FOMC member’s projection for future interest rates. The updated dot plot from this meeting indicates that most officials anticipate fewer rate cuts in 2025 than previously projected. This shift suggests a longer period of elevated rates might be expected, emphasizing the Fed’s commitment to price stability even at the risk of slower economic growth.

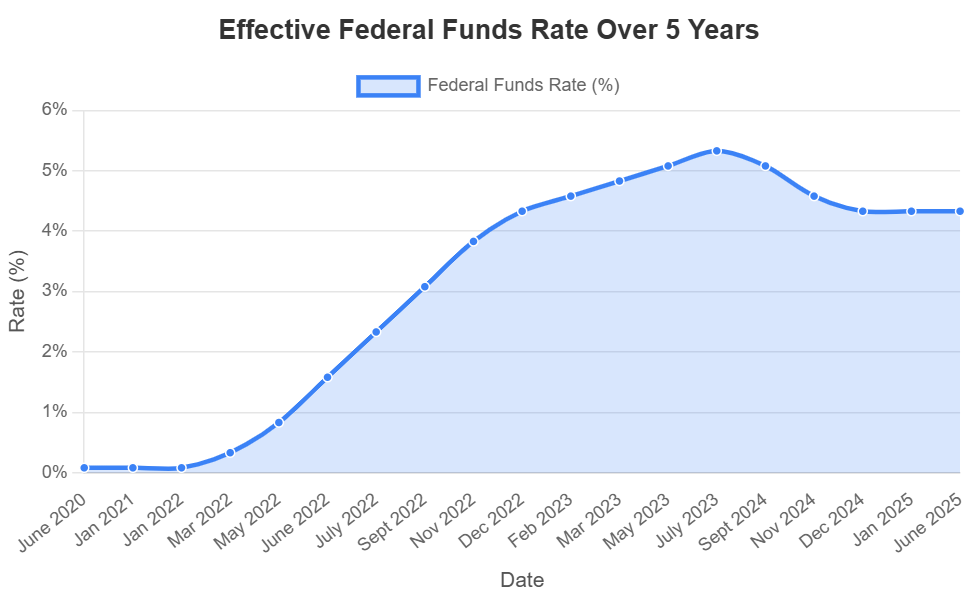

Federal Funds Rate: Past 5 Years Trend

To fully appreciate the current Federal Reserve stance, it’s helpful to look at the trajectory of the Federal Funds Rate over the past five years. This period has seen significant shifts, from near-zero rates during the pandemic to a rapid series of hikes aimed at combating inflation, followed by a period of stabilization and recent minor adjustments.

You can view a detailed chart illustrating the Federal Funds Rate’s movement over the last five years here. This visual representation highlights the sharp increases from early 2022 to mid-2023 and the subsequent plateau, providing crucial context for the Fed’s current “hold” strategy.

Source: Fed Fund Rate

Impact on U.S. Mortgage Rates

It’s crucial to understand that the federal funds rate, controlled by the Fed, directly impacts short-term borrowing costs. However, long-term mortgage rates, such as the popular 30-year fixed mortgage, tend to follow the yield on the 10-year U.S. Treasury note. This yield reacts to market expectations about inflation, economic growth, and the Fed’s overall trajectory.

When the Fed signals a “higher for longer” interest rate environment, or if inflation data remains stubborn, it can put upward pressure on Treasury yields, and consequently, on mortgage rates. This is why, even with the Fed holding steady, we’ve seen mortgage rates remain elevated, hovering around or slightly below the 7% mark for a considerable period.

For homebuyers, sustained higher rates continue to challenge affordability, requiring larger monthly payments or smaller loan amounts. This dynamic has a ripple effect on the broader housing market.

U.S. Housing Market Implications for Investors

The persistence of higher mortgage rates continues to shape the U.S. housing market. Affordability remains a significant hurdle for many prospective buyers, leading to:

- Moderated Sales Volume: Home sales activity can be subdued as buyers face higher borrowing costs.

- Inventory Shifts: Some areas might see an increase in housing inventory as properties stay on the market longer, or as homeowners with low existing mortgage rates hesitate to sell.

- Increased Rental Demand: When homeownership becomes less accessible, rental demand typically strengthens, which is a positive signal for property investors focused on income-generating assets.

For international investors looking to buy property in the U.S., this environment presents a strategic landscape. While borrowing costs are higher, the emphasis shifts to properties that demonstrate strong cash flow potential and those in resilient rental markets. Opportunities may arise from sellers motivated by personal circumstances or in areas where rental yields remain robust despite higher acquisition costs.

Foreign National Mortgages: Navigating the Landscape

For international investors who are non-resident aliens, conventional U.S. mortgages are often not an option. This is where specialized U.S. mortgages for foreign nationals become indispensable. These products are tailored to the unique financial situations of individuals residing outside the U.S.

Here’s how these specialized loans are generally structured and influenced by the current rate environment:

- DSCR (Debt Service Coverage Ratio) Loans: These are highly favored for U.S. investment properties. Instead of focusing on your personal income, qualification is primarily based on the property’s ability to generate enough rental income to cover its mortgage payments (a Debt Service Coverage Ratio typically above 1.0 or 1.25). In a higher rate environment, achieving a strong DSCR becomes even more critical for qualifying for these loans.

- Traditional Foreign National Loans: These are more akin to conventional mortgages but designed for foreign nationals without a U.S. credit history or extensive U.S. income documentation. They usually require verifiable foreign income and assets, and sometimes proof of a solid banking relationship in your home country. Higher U.S. rates translate directly to higher interest rates on these loans as well.

Here’s an illustrative table of example rates and terms for these specialized foreign national loan products.

Please note: These are illustrative example rates and terms only and will vary significantly based on the lender, borrower’s financial profile, property type, and prevailing market conditions.

| Loan Type | Example Interest Rate Range (%) | Example LTV (Loan-to-Value) | Key Qualification Criteria |

|---|---|---|---|

| DSCR Loan | 6.75* – 9.00% *with rate buydown | Up to 75% | Property’s rental income covers debt service (DSCR > 1.25 usually); no personal income required. |

| Foreign National Loan (Conventional-like) | 7.85 – 8.50% | Up to 85% | Verification of foreign income/assets; strong foreign credit history; typically requires more documentation. |

Commentary on Foreign National Mortgages: For international investors, understanding these specialized loan products is crucial for financing your U.S. real estate acquisitions. While their interest rates might be slightly higher and LTVs lower compared to the lowest conventional U.S. rates, they provide a vital pathway to leverage your investment. DSCR loans are particularly attractive for their focus on property performance, simplifying the application process for investors with established rental income streams. Traditional foreign national loans cater to those who prefer to qualify based on their robust financial standing in their home country.

Conclusion

The Federal Reserve’s decision to hold interest rates steady signals a commitment to taming inflation, even if it means prolonged higher borrowing costs. For international investors, this environment demands a strategic and informed approach to the U.S. real estate market.

Focus on properties that align with your cash flow goals, understand the nuances of specialized foreign national mortgage products, and ensure robust due diligence. The U.S. market continues to offer significant opportunities, particularly for those who navigate its complexities with expert guidance.

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your U.S. real estate investment journey today with high-quality cashflow real estate. Book a Free 1-2-1 Discovery Call with a member of our senior management team to discuss your personalized strategy.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

![USA Property Investment for Foreign Buyers [2025 Guide]](https://cashflowrentals.net/wp-content/uploads/2025/07/USA-Property-Investment-for-Foreigners-Expert-2025-Guide-500x383.png)