Map Shows Investors Are Buying in These Affordable U.S. Markets

Strategic U.S. Property Investment: Why Real Estate Investors are Targeting Affordable States for Cash Flow

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

For international investors eyeing the U.S. real estate market, a significant trend is emerging: a strategic pivot towards more affordable states. While high home prices and elevated mortgage rates continue to challenge traditional buyers, savvy real estate investors are finding unparalleled value and strong consistent cash flow potential in markets often overlooked by mainstream headlines.

This article, tailored for property investors, delves into the latest research highlighting where and why investors are “snapping up homes” in these affordable regions. We’ll translate these trends into actionable insights for your U.S. property investment strategy, focusing on how a larger, more competitive tenant pool, reduced vacancies, and lower turnover costs contribute to stable and desirable cash flow.

Related: The Best U.S. Real Estate Markets for Non-Resident Foreigners

Key Takeaways: Affordable U.S. States for International Investors

- Strategic Shift: Investors are increasingly turning to affordable U.S. states and cities in the South and Midwest for better returns amidst high national home prices and mortgage rates.

- Debt Financing Dominance: Unlike previous cycles, investors are now more reliant on debt financing than all-cash purchases, signalling a matured, strategic approach to leveraging assets.

- Top States for Investor Buyers: Missouri, Oklahoma, and Kansas lead the nation in investor share, offering a blend of affordability and strong rental market dynamics.

- Key City Hotspots: Metropolitan areas like Memphis, Oklahoma City, St. Louis, and Kansas City are seeing high investor activity due to competitive pricing and strong rental demand.

- Benefits for Rental Investors: These trends create a larger tenant pool, foster competition among renters (potentially leading to higher rents), reduce vacancies, and minimize turnover costs, all contributing to robust and consistent cash flow.

- Leverage with DSCR Loans: Specialized financing solutions like DSCR loans are critical for international investors to access these markets, bypassing traditional U.S. credit and income verification barriers.

Related: The Best U.S. Property markets for First Time investors

The Strategic Shift: Why Investors are Flocking to Affordable U.S. States

The U.S. housing market continues its complex dance with high home prices and elevated mortgage rates. However, recent data reveals a clear strategic response from real estate investors: rather than retreating, they are re-allocating capital to areas where the numbers still make sense.

According to a recent Realtor.com report, “Investors Are Snapping Up Homes in These Affordable States“, a notable shift is underway:

- National Investor Share: In 2024, investors accounted for 13.0% of all homes purchased nationwide, a slight increase from 12.7% in 2023. This uptick occurred even as overall home purchasing slumped, highlighting investors’ growing presence in a smaller market (Source: Realtor.com Investor Report, June 10, 2025).

- Less Cash, More Debt: A significant evolution is the decline in all-cash investor sales, which fell to their lowest level since 2008. This indicates that both individual (“mom-and-pop”) and corporate investors are increasingly utilizing debt financing to leverage their acquisitions, a crucial point for international investors who rely on financing solutions.

This trend is driven by key factors that make these markets particularly attractive: affordability, strong rental prices relative to local incomes, and scarce inventory (which keeps pressure on renters to continue renting).

Related: 5-Year Forecast and Predictions for the U.S. Property Market

The Data Revealed: Top Affordable Markets for U.S. Property Investors

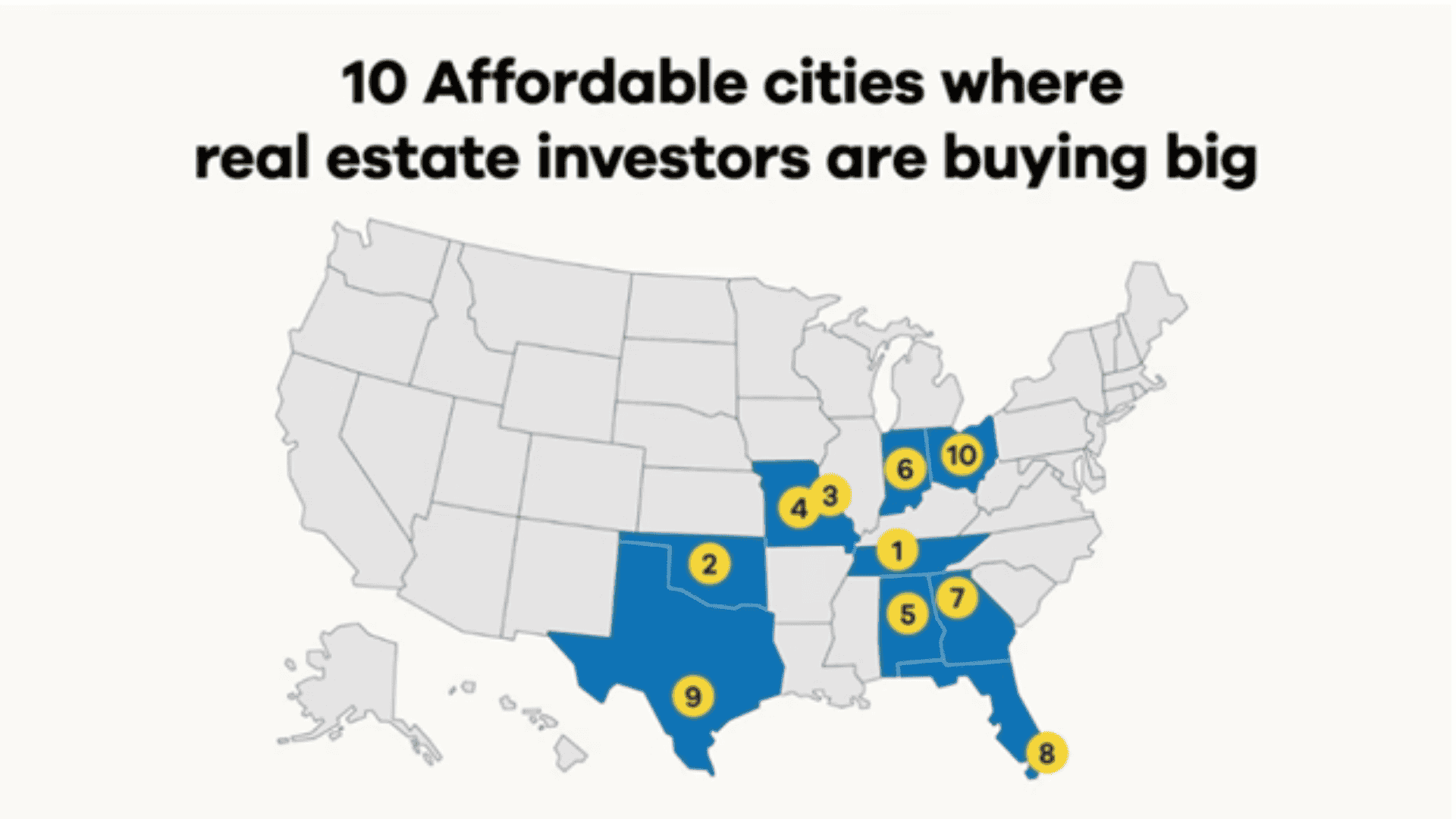

The Realtor.com study identifies specific states and metropolitan areas that have become hotspots for real estate investors. These regions, primarily in the U.S. South and Midwest, offer the balance of lower property acquisition costs and robust rental demand that international investors prioritize.

Visualizing Investor Activity Across the U.S.

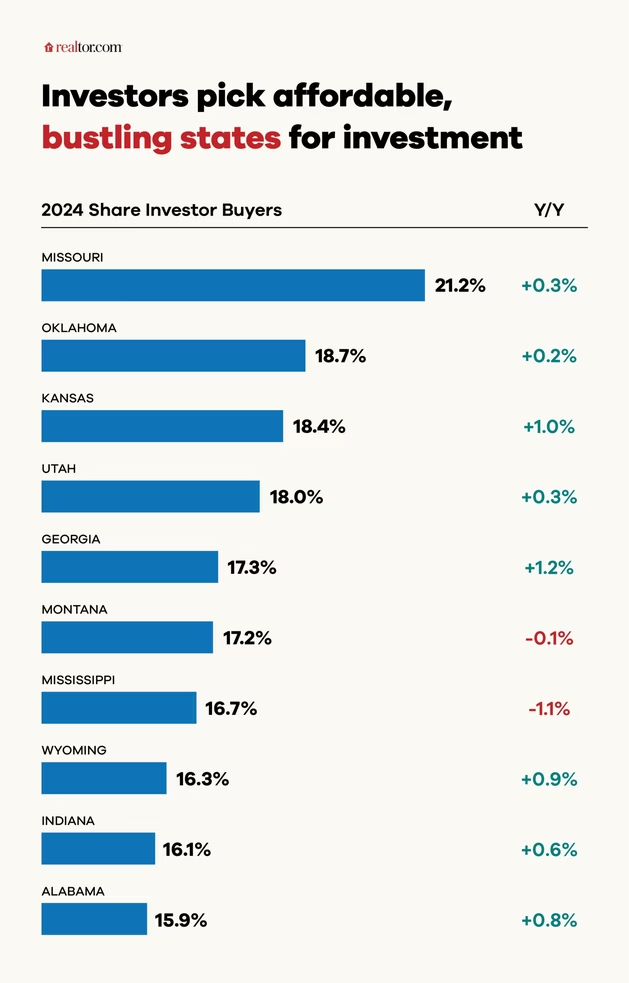

Top 10 States Where Investors Bought Properties in 2024

This table provides a concise overview of the states with the highest share of investor purchases in 2024, along with their year-over-year change. (Source: Realtor.com Investor Report, June 16, 2025)

| State | 2024 Share of Investor Buyers | Year-over-Year Change (from 2023) |

|---|---|---|

| Missouri | 21.2% | +0.3% |

| Oklahoma | 18.7% | +0.2% |

| Kansas | 18.4% | +1.0% |

| Utah | 18.0% | +0.3% |

| Georgia | 17.3% | +1.2% |

| Montana | 17.2% | -0.1% |

| Mississippi | 16.7% | -1.1% |

| Wyoming | 16.3% | +0.9% |

| Indiana | 16.1% | +0.6% |

| Alabama | 15.9% | +0.8% |

States with Largest Growth in Investor Buying Share (Year-over-Year 2024)

These states, while not necessarily having the highest overall share, saw the most significant increase in investor activity:

- Delaware: +3.8 percentage points

- Ohio: +2.2 percentage points

- Washington D.C.: +1.8 percentage points

- Hawaii: +1.4 percentage points

- Nevada: +1.3 percentage points

Affordable Cities Attracting Significant Investor Activity

Beyond statewide trends, certain metropolitan areas have become particularly strong magnets for investors, often characterized by median investor purchase prices below $300,000, and in many cases, even below $200,000. These cities combine affordability with robust rental demand:

- Memphis, TN: Consistently ranked among the cities with the highest investor buyer share. Known for its affordable properties and a strong demand for rentals.

- Oklahoma City, OK: Another top metro for investor buyer share. Offers attractive entry points for property acquisitions.

- St. Louis, MO: Features high investor buyer activity and properties with a median investor purchase price below $300,000.

- Kansas City, MO: Noted for seeing the highest rental price growth in the country in April 2025 (Source: Realtor.com, June 16, 2025), making it highly attractive for cash flow.

- Birmingham, AL: A Southern metro that rounded out the top cities with high investor share.

- Toledo, OH: Ranked as a top housing market overall by the Wall Street Journal/Realtor.com Housing Market Ranking, with investor buying a major reason for its strong performance, driven by affordability and low cost of living.

View Investment Properties: Visit out investor portal and view investor-ready turnkey rental properties

Visualizing the Shift in Investor Buying Share

Strategic Implications for International Investors

These trends offer compelling strategic advantages for international investors looking to build or expand their U.S. property investment portfolios.

Bigger, More Competitive Tenant Pool

The rising share of homes bought by investors, particularly in affordable states, directly correlates with a robust rental market. This means:

- Higher Demand for Rentals: As homeownership remains challenging for many Americans due to affordability, more individuals and families are entering or staying in the rental market. This expands your potential tenant pool.

- Ability to Attract “Better Tenants”: With increased demand, you can be more selective in your tenant screening process, leading to tenants with stronger financial profiles and more stable rental histories. This reduces your risk and improves the overall quality of your rental portfolio.

- Potential for Competitive Rents: A larger, more competitive tenant pool can support stable or even increasing rental rates, enhancing your property’s consistent cash flow.

Related: U.S. Mortgage Rate Forecast 2025 to 2026

Less Vacancies & Lower Turnover Costs

The focus on affordable markets, coupled with the national trend of increased renting, directly impacts vacancy rates and turnover expenses:

- Reduced Vacancy Periods: High demand means properties are leased more quickly, minimizing periods when your property is vacant and not generating income.

- Longer Tenant Stays: When renting becomes a long-term solution rather than a temporary stopgap before buying, tenants tend to stay in properties for extended periods. This drastically reduces turnover costs (e.g., cleaning, repairs, marketing, lost rent between tenants).

- More Consistent and Stable Cash Flow: Lower vacancy rates and reduced turnover translate directly into predictable and consistent cash flow, a primary driver for international investors.

Related: Definitive Guide to U.S. Taxes for Non-Resident Property Investors

3.3 Leveraging Specialized Financing: Your Gateway to These Markets

For international investors, capitalizing on these affordable markets is made significantly easier through specialized financing solutions:

- DSCR (Debt Service Coverage Ratio) Loans: These loans are ideally suited for acquiring properties in these high-demand rental markets. They primarily qualify based on the property’s rental income potential, eliminating the need for a U.S. credit history or traditional personal income verification. This is a game-changer for global property investors looking to scale their portfolios efficiently. Learn more in our definitive guide: “DSCR Loans for International Investors: Your Definitive Guide”.

- Strategic Debt Utilization: As the Realtor.com report indicates, investors are increasingly using debt financing. This allows you to magnify your returns and diversify across multiple properties, rather than tying up all your capital in all-cash purchases.

Related: The Best U.S. Mortgage Options for Non-Resident Foreigners

The Indispensable Local Team

Success in these affordable markets, especially for international investors, hinges on a strong local team. A knowledgeable real estate agent can identify properties aligning with these trends, and a proactive property management company is essential for managing tenants, minimizing vacancies, and ensuring the property continues to generate optimal consistent cash flow.

Conclusion: Unlocking Opportunity in Affordable U.S. Real Estate

The data is clear: real estate investors are strategically targeting affordable states and cities across the U.S. for their next acquisitions. This trend, driven by market dynamics that push more Americans towards long-term renting, presents a compelling and sustainable opportunity for international investors.

By focusing on these high-demand, high-value markets, leveraging specialized financing, and prioritizing properties that offer strong rental income and attract stable tenants, global property investors can build resilient portfolios characterized by reliable occupancy, lower operational costs, and exceptional consistent cash flow. The time to capitalize on this strategic shift is now.

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your U.S. real estate investment journey today with high-quality cashflow real estate. Book a Free 1-2-1 Discovery Call with a member of our senior management team to discuss your personalized strategy.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

Frequently Asked Questions (FAQs) on Affordable U.S. Real Estate Markets for International Investors

Here are answers to common questions international investors have about targeting affordable U.S. states and cities for property investment.

Q: Why are real estate investors focusing on more affordable U.S. states?

A: Investors are pivoting to more affordable states because high home prices and mortgage rates in traditional markets make returns less attractive. Affordable states offer better price-to-rent ratios, higher cash flow potential, and stronger investor returns.

Q: Which U.S. states are attracting the most real estate investors?

A: States with the highest share of investor buyers in 2024 include Missouri, Oklahoma, Kansas, Utah, and Georgia. These states often combine affordability with strong rental market fundamentals.

Q: What types of cities within these states are most attractive to investors?

A: Investors are targeting affordable cities primarily in the South and Midwest, such as Memphis, Oklahoma City, St. Louis, Kansas City, and Toledo. These cities often have median investor purchase prices below $300,000 and strong rental growth.

Q: How does this trend benefit international rental property investors?

A: This trend means a larger and more competitive tenant pool, which can lead to higher rents and the ability to select better tenants. It also results in reduced vacancies and longer tenant stays, contributing to lower turnover costs and more stable, consistent cash flow.

Q: Are investors primarily buying all-cash in these affordable markets?

A: No. While all-cash sales were popular during the pandemic, the trend has shifted, with investors increasingly relying on debt financing (mortgages) to acquire properties in these affordable markets, demonstrating a strategic approach to leveraging capital.

Q: What financing options are available for international investors looking at these affordable markets?

A: International investors can leverage specialized financing solutions like DSCR (Debt Service Coverage Ratio) loans. These loans are ideal because they qualify based on the property’s rental income potential, bypassing the need for a U.S. credit history or traditional personal income verification, making access to these markets much easier.

Q: How can international investors find the best opportunities in these affordable states?

A: It’s crucial for international investors to partner with a knowledgeable local U.S. real estate agent specializing in investment properties and a robust property management team. These experts can identify properties that align with current demand for affordable rentals and ensure efficient management for consistent cash flow.

![USA Property Investment for Foreign Buyers [2025 Guide]](https://cashflowrentals.net/wp-content/uploads/2025/07/USA-Property-Investment-for-Foreigners-Expert-2025-Guide-500x383.png)