Navigating US Housing Market Dips: The 5-Year Rule

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

🏡Navigating US Housing Market Dips: The 5-Year Rule for International Property Investors

By David Garner

Headlines can be attention-grabbing, often highlighting every small shift in the housing market. If you’re an international property investor, hearing about “home prices starting to dip in some markets” might cause you to second-guess your strategic investment plans in the US. However, it’s crucial to look beyond the immediate noise and understand a fundamental principle of long-term real estate investment: The Five-Year Rule.

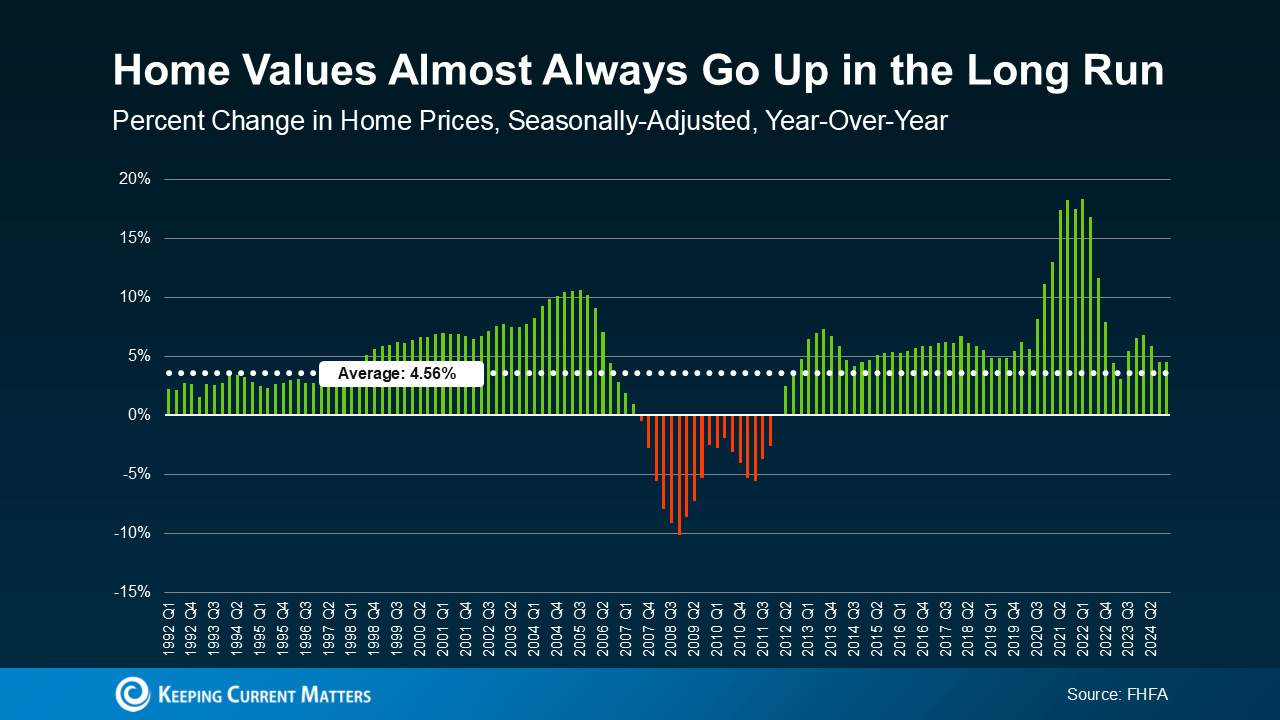

While it’s true that some overheated US metro markets are seeing price adjustments, don’t let this overshadow a simple truth: Property values almost always appreciate over time. For strategic international property investors, short-term market fluctuations often present a different narrative than daily headlines suggest.

The first thing to bear in mind is that the US housing market is regional. While prices in Florida, Texas and Florida are adjusting back towards affordability, markets in the Midwest and Northeast remain well-priced. The regional variance is significant.

In San Diego for example, house prices have risen 129% in just five years. As a result, San Diegans now spend around 50% of their income on housing, and the number of homes for sale is now 38% higher than in 2019.

Meanwhile Cleveland homeowners spend just 20% of their income to keep a roof over their head, and there are still 20% less homes for sale than 6 years ago. Unsurprisingly, the property market is thriving.

With all that said, let’s take a look at the 5-year rule, and how you can implement it into your investment strategy to ride out shirt term market fluctuations and build long-term wealth.

Understanding the “Five-Year Rule”: An Investment Framework

In real estate, particularly for long-term wealth building, the “five-year rule” is a widely discussed concept. The core idea is that if you plan to own your investment property for at least five years, short-term price dips usually don’t significantly impact your overall return. That’s because, historically, property values tend to rebound and grow over time, even if they experience minor downturns for a year or two.

As Lance Lambert, Co-Founder of ResiClub, puts it: “…there’s the ‘five-year rule of thumb’ in real estate — which suggests that most buyers can buffer themselves from mild short-term declines if they plan to own a property for at least that amount of time.”

It’s vital to remember the context of historical market events. While many recall the housing crash around 2008, that period was an extreme exception, not the rule. The market dynamics back then were vastly different, characterized by relaxed lending standards, a widespread lack of homeowner equity, and a significant oversupply of homes. Today’s national housing market is on a much more stable footing. Therefore, any headline about prices slowing down, normalizing, or even slightly dipping doesn’t signal an impending large-scale crash.

Current US Housing Market: Beyond the Headlines for Investors

What’s happening in today’s market should further ease any anxieties for serious investors. Most US housing markets continue to see home prices rise, just not at the accelerated pace of a few years ago.

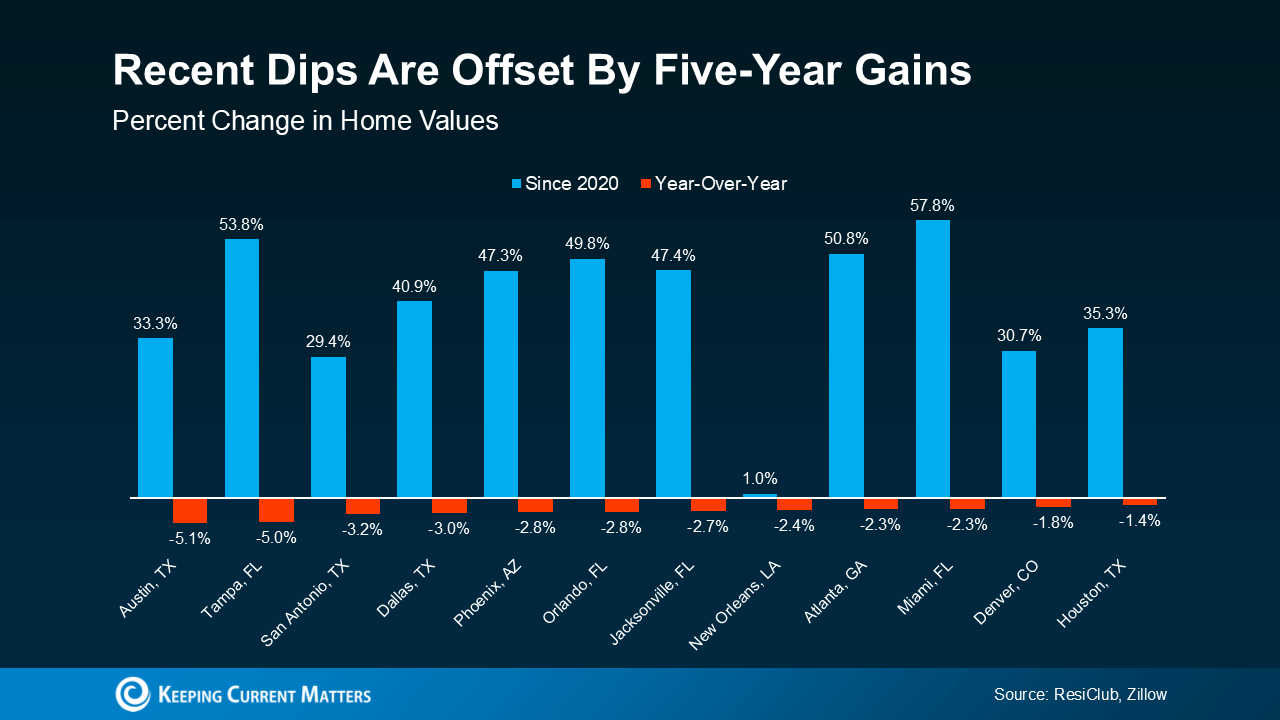

In the major metros where prices are indeed experiencing a slight cooling (often depicted with red bars in market graphs), the average drop has been relatively modest — around -2.9% since April 2024. This is a far cry from the severe declines observed in 2008.

(Source: Keeping Current Matters)

Moreover, when you look at the bigger picture, it’s clear that property values in most of these markets are still significantly up compared to where they were five years ago. This means that investors who have held their properties for a few years or more are still seeing substantial gains.

(Source: Keeping Current Matters)

The Power of Long-Term Growth: What 5 Years Means for Your Portfolio

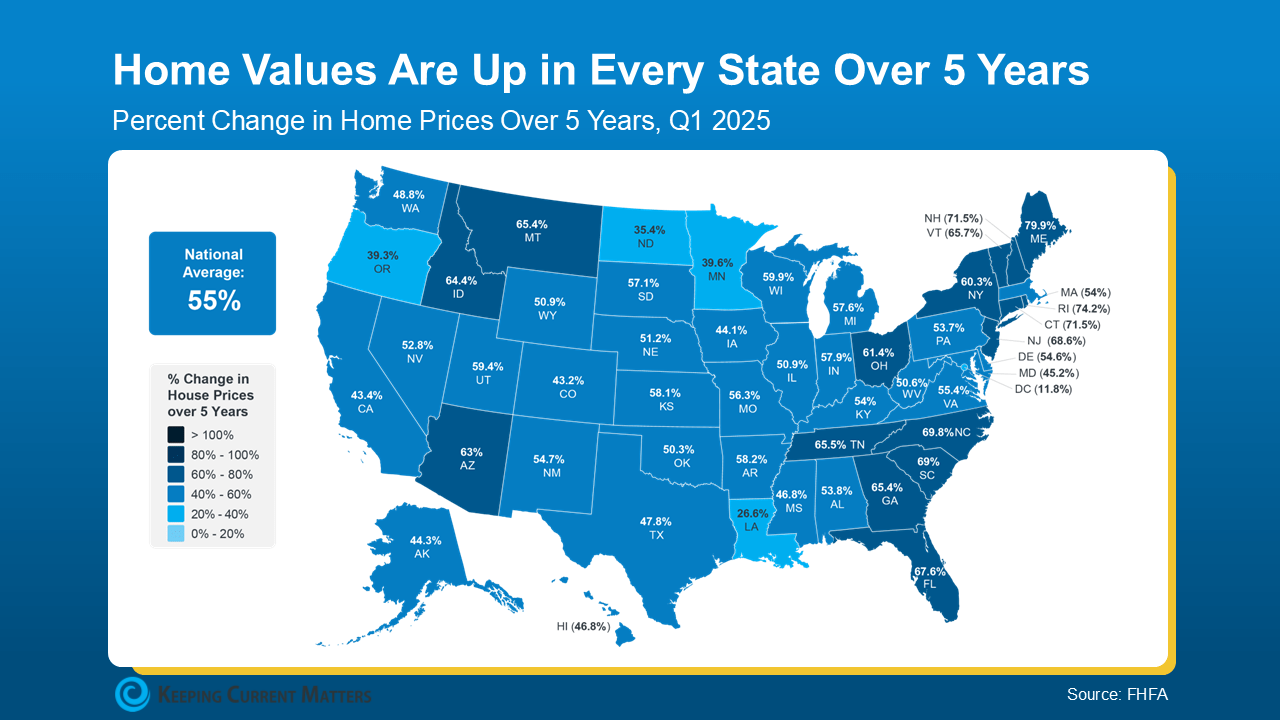

Over the past five years, US home prices have risen a remarkable 55%, according to data from the Federal Housing Finance Agency (FHFA). This historical performance underscores why a small short-term dip is not a significant loss in the context of long-term portfolio growth. Even if your target investment city experiences a minor downturn of 2% or so, your asset’s value is still up far more than that over a five-year horizon.

Breaking down these five-year gains further, FHFA data confirms that home values have increased in every single US state over the last five years.

(Source: Keeping Current Matters)

This pervasive, long-term appreciation is why it’s crucial for international investors not to become overly fixated on month-to-month or even year-to-year fluctuations. If you’re acquiring properties with a long-term investment horizon, your assets are highly likely to grow substantially in value over time.

Strategic Implications for International Property Investors

For international property investors, the “Five-Year Rule” offers a powerful framework for making informed decisions:

- Patience is a Virtue: Resist the urge to react to short-term market headlines. Successful long-term real estate investment relies on patience and a steady hand. The market rewards time-in, not timing.

- Focus on Fundamentals: While prices can shift, underlying factors like population growth, job creation, and consistent rental demand in specific markets remain the true drivers of long-term value.

- Underwriting Accuracy: Always conduct thorough due diligence, factoring in both the acquisition costs and the ongoing costs of property ownership to understand true cash flow, and ensure your long-term projections remain sound.

- Equity Building: Consistent appreciation over the five year cycle builds significant equity in your investment, which can open doors for future refinancing, portfolio expansion, or a strong exit strategy.

- An Opportunity: If buyers are hesitant, inventory pile up. Houses sit on the market for longer, and seller get nervous. This is the BEST time to buy. With the power dynamic shifting to buyers, it’s possible to negotiate better deals like lower prices and concessions to pay for closing costs, property improvements, and mortgage rate buydowns.

Ultimately, while prices can experience short-term shifts, history overwhelmingly demonstrates that US property values almost always appreciate over a five-year period. By embracing this long-term perspective, international property investors can navigate market cycles with confidence and build a resilient, profitable real estate portfolio in the United States.

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

Related Articles

Related: Best US Property Markets for Foreign Investors

Related: How to Buy Property in the USA as a Foreigner

Related: Can Foreign Nationals Buy Property in the USA – 2025 Guide

Related: US Housing Market Predictions – All the Major Expert Forecasts for 2025 to 2029

Related: The Most and Least Expensive US States to Own a Property

Related: Why The US Property Market is a Goldmine for UK Investors

Related: Shift in US Property Market is Huge Buying Opportunity for International Investors

Related: How I built My Thriving US Property portfolio From the UK

Related: The US Property Markets Most Popular With Foreign Buyers

![USA Property Investment for Foreign Buyers [2025 Guide]](https://cashflowrentals.net/wp-content/uploads/2025/07/USA-Property-Investment-for-Foreigners-Expert-2025-Guide-500x383.png)