These Americans Want to Live in Single Family Homes

Young Americans’ Housing Preferences: Millennials and Gen Z Want Single Family Homes

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

For international investors navigating the dynamic U.S. real estate market, understanding the evolving preferences of its largest demographic—young Americans—is a powerful tool. Recent research from the Institute for Family Studies (IFS) sheds light on what young adults truly desire in housing, offering critical insights that can shape your U.S. property investment strategy for consistent cash flow and long-term appreciation.

This article delves into the IFS findings, translating them into actionable strategies for global property investors. We’ll explore the clear demand for single-family homes, key amenities, and even delve into how political affiliations might subtly influence housing choices, ensuring your portfolio is optimally aligned with the future of U.S. rental demand.

Key Takeaways: Young American Housing Preferences for International Investors

- Dominant Single-Family Home Demand: Young Americans overwhelmingly prefer detached single-family homes, confirming this property type as a prime investment for long-term rental stability.

- Suburban/Exurban Focus: The desire for quiet neighbourhoods, low crime, and large yards points towards strong rental demand in suburban and exurban areas over dense urban centers.

- Amenity Priorities: Proximity to parks/green space, good schools, and a quiet environment rank high, guiding market and neighbourhood selection for international investors.

- Political Preference Alignment: Understanding subtle differences in housing ideals between Democrats and Republicans can offer nuanced market insights, though broad appeal remains key.

- Strategic Investment: Incorporate these preferences into your property selection to ensure high occupancy rates, stable rental income, and strong resale value, optimizing your consistent cash flow.

- Leverage with Financing: Financing solutions like DSCR loans enable international investors to acquire single-family homes that align with these preferences, even without a U.S. credit history.

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

Decoding Young Americans’ Housing Desires: Insights from Recent Research

A recent report by the Institute for Family Studies (IFS), titled “Homes for Young Families: A Pro-family Housing Agenda” (published march 2025), offers compelling data on the housing aspirations of young adults in the U.S. This research, based on the American Family Survey, provides a clear roadmap for where future rental demand will concentrate.

Here are the key findings, illustrated by the research’s original charts, and their direct implications for global property investors:

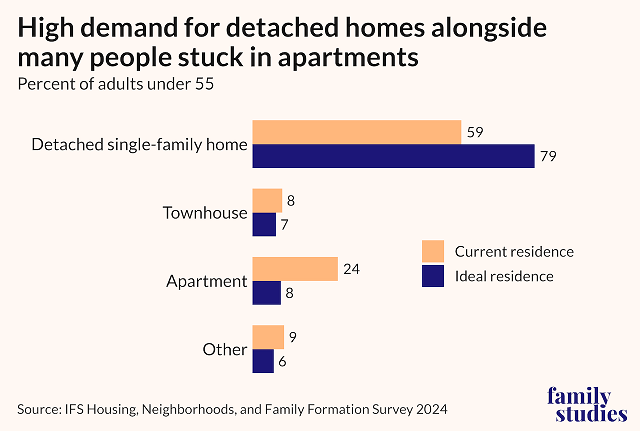

Chart 1: Current Residence vs. Ideal Residence (Visualizing the Aspiration Gap)

- Implication for Investors: This chart highlights a significant gap between where young Americans currently live and where they want to live. The data clearly shows that a substantial majority aspire to live in detached single-family homes, far exceeding the percentage currently residing in them. For international investors, this gap represents an unmet demand, signalling strong long-term rental potential for single-family homes. Investing in these properties positions you to capitalize on a deeply rooted American housing ideal.

Chart 2: Homebuyer Preference (The Overwhelming Choice)

#image_title

- Implication for Investors: Reinforcing the previous point, this chart shows an overwhelming preference for detached single-family homes. This is not just a passing trend but a fundamental desire. For property investors seeking stability and a large tenant pool, focusing on single-family rental (SFR) properties is a validated strategy. These homes are likely to experience lower vacancy rates and more consistent demand.

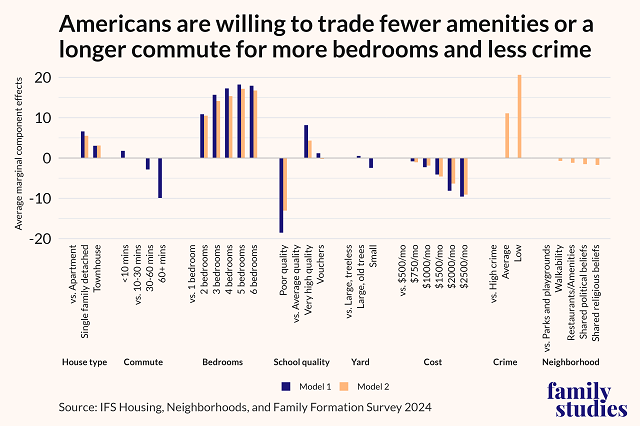

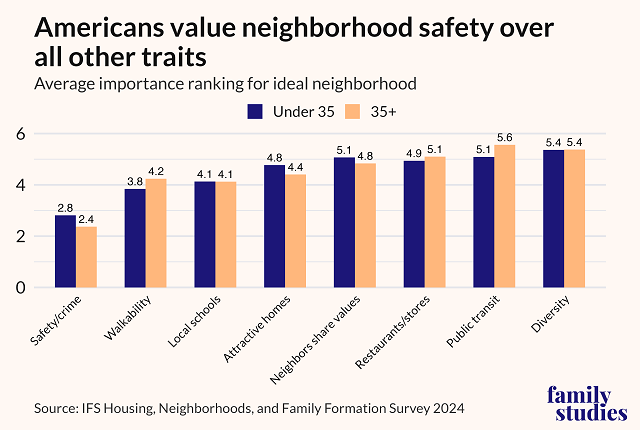

Chart 3: Importance Ranking for Local Amenities (What Attracts Tenants)

- Implication for Investors: This data moves beyond property type to location attributes. Young Americans prioritize:

- Quiet Neighbourhood: Points to suburban and exurban areas away from urban bustle.

- Low Crime: Essential for family formation and safety, drawing tenants to stable communities.

- Large Yard: Directly aligns with the single-family home preference and family needs.

- Good Public Schools: A critical factor for young families, making areas with highly-rated schools particularly attractive for long-term rentals and resale value. For international investors, this guides market selection beyond just price points, focusing on quality of life indicators that attract and retain desirable tenants.

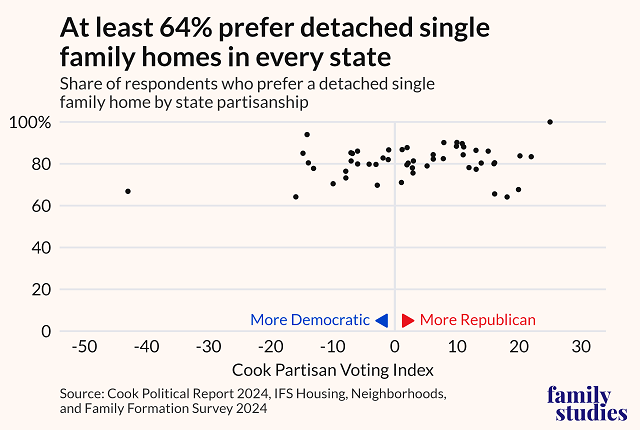

Chart 4: Housing Preference Democrat vs. Republican (Nuanced Market Segmentation)

- Implication for Investors: While the overall preference for detached single-family homes is strong across the board, this chart offers a nuanced view. It indicates that Republicans show an even stronger preference for detached homes, particularly in suburban and rural settings, compared to Democrats, who, while still favouring detached homes, show slightly more openness to urban or attached dwellings. For international investors, this could inform hyper-local market selection within a metropolitan area or even across different states. For example, states or regions with a higher concentration of residents aligning with Republican preferences might see even more robust long-term demand for traditional single-family homes in suburban environments. However, the overarching takeaway remains that detached single-family homes are broadly desired, regardless of political affiliation.

Translating Preferences into Your U.S. Property Investment Strategy

The IFS research provides clear directives for international investors aiming to optimize their U.S. property investment strategy for consistent cash flow and appreciation.

2.1 Prioritizing Single-Family Rental (SFR) Properties

The overwhelming preference for detached single-family homes validates SFRs as a cornerstone of an international investor’s portfolio.

- Meeting Core Demand: By investing in SFRs, you’re tapping into the most desired housing type for the largest segment of the U.S. population. This translates to higher demand, lower vacancy rates, and more stable rental income.

- Long-Term Appeal: SFRs often attract longer-term tenants (e.g., families), reducing turnover costs and management headaches for remote investors.

- Appreciation Potential: Historically, SFRs have shown consistent appreciation, offering a dual benefit of cash flow and equity growth.

2.2 Strategic Market and Neighbourhood Selection

The amenity preferences directly influence where international investors should focus their property search.

- Embrace the Suburbs and Exurbs: Move beyond dense urban cores to identify suburban and exurban areas that offer the desired lifestyle: quiet streets, low crime rates, and access to green spaces. These are the areas where young families and individuals are seeking to establish roots.

- Invest in Good School Districts: For family-oriented tenants, access to quality public schools is a non-negotiable. Research school ratings and prioritize properties within highly-rated districts, as this significantly boosts desirability and potential resale value.

- Focus on Livability: Consider overall community appeal, local amenities like parks, recreation centers, and convenient, yet quiet, commercial areas. These factors contribute to long-term tenant satisfaction and retention.

Related: The Best U.S. Real Estate Markets for Non-Resident Investors

2.3 Tailoring Your Property Positioning

While the structure (SFR) is key, how you present and maintain the property matters.

- Yard Maintenance: A “large yard” is a significant draw. Ensure your property management strategy includes professional yard care to maintain appeal.

- Safety & Security: Highlight features that contribute to a sense of security and low crime (e.g., well-lit areas, secure doors/windows).

- Family-Friendly Features: If targeting families, consider features like extra bedrooms, family-oriented layouts, and proximity to playgrounds.

2.4 Addressing Affordability: The Role of Financing

While demand for SFRs is high, affordability remains a challenge for many young Americans. This creates a powerful opportunity for international investors who can leverage financing.

- DSCR Loans as a Bridge: DSCR (Debt Service Coverage Ratio) loans are perfectly suited for international investors looking to acquire these in-demand single-family rental properties. They allow you to finance based on the property’s rental income potential, bypassing the need for a U.S. credit score or complex personal income verification. This enables you to be the landlord providing the housing solution that young Americans desire but may not yet be able to afford to buy.

- Strategic Leverage: By using DSCR loans, you can acquire multiple cash-flowing SFRs, building a diversified portfolio that aligns with long-term demographic shifts.

Related: U.S. Mortgages for Non-Residents and Foreign Nationals: Your Essential Guide

Strategic Execution for International Investors

Successfully incorporating these insights requires a well-structured approach for remote international investors.

- The Indispensable Local Team: Your U.S. real estate agent, property manager, and tax advisor are vital. They possess the nuanced local knowledge to identify neighbourhoods meeting these preferences and manage properties effectively to attract the desired tenant demographic.

- Long-Term Horizon: Investing in properties aligned with fundamental demographic shifts is a long-term play. Be prepared to hold properties to capture appreciation and benefit from sustained rental demand.

- Data-Driven Decisions: Continuously review local market data, vacancy rates, and rental comps to ensure your properties remain competitive and profitable.

Related: How to Structure Your U.S. Property Investment: A Comprehensive Guide

Conclusion: Aligned for Success in U.S. Real Estate

The research from the Institute for Family Studies provides clear, actionable intelligence for international investors: young Americans overwhelmingly desire detached single-family homes in safe, quiet, amenity-rich suburban or exurban environments.

By strategically focusing your U.S. property investment on these preferences, leveraging appropriate financing tools like DSCR loans, and relying on a strong local team, you can position your portfolio for exceptional consistent cash flow, high occupancy rates, and sustainable long-term appreciation. Understanding these fundamental desires is key to unlocking enduring success in the U.S. real estate market.

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your U.S. real estate investment journey today with high-quality cashflow real estate. Book a Free 1-2-1 Discovery Call with a member of our senior management team to discuss your personalized strategy.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

![USA Property Investment for Foreign Buyers [2025 Guide]](https://cashflowrentals.net/wp-content/uploads/2025/07/USA-Property-Investment-for-Foreigners-Expert-2025-Guide-500x383.png)