Top US Housing Markets With Rising House Prices (2025)

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

Top US Housing Markets: Strategies for International Investors (2025)

Published On: June 16th, 2025

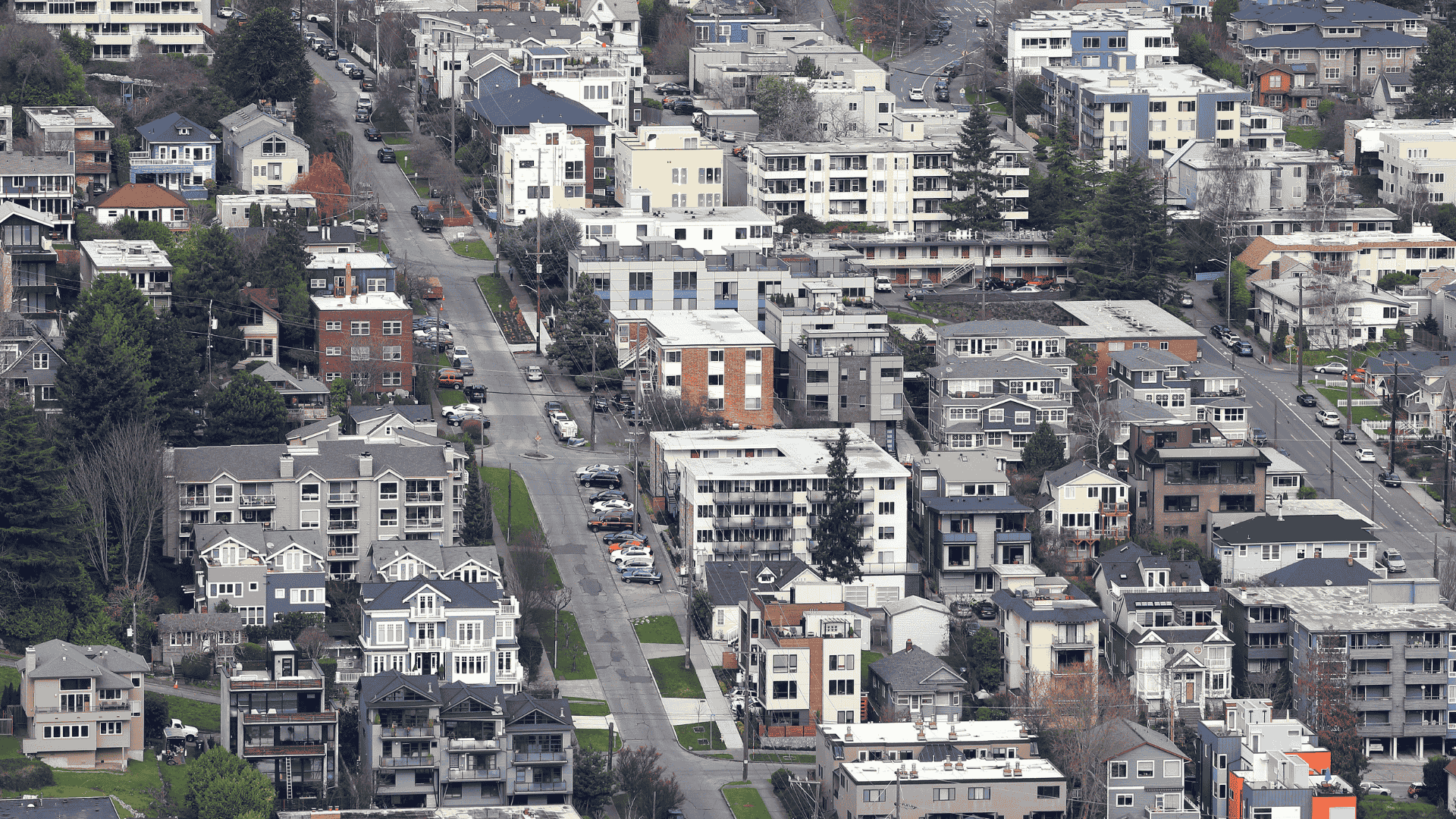

For international investors interested in U.S. real estate, the pursuit of “hot” markets—where demand is strong and values are climbing—is the foundation of our investment strategy . These are the regions where home prices are not just rising, but soaring, indicating strong demand and potential for significant capital appreciation. However, for investors operating from abroad, understanding the nuances of these markets—beyond just price tags—is crucial for sustainable success.

This article explores some of the hottest housing markets across the United States in 2025. We’ll examine the forces driving their growth and, more importantly, translate what these trends mean for international investors like us. Our goal is to help you assess whether these high-growth areas align with your investment goals, be they aggressive appreciation, stable cash flow, or a blend of both.

What Makes a U.S. Housing Market “Hot”?

A “hot” housing market isn’t just about rising prices; it’s a symphony of factors creating strong demand and competitive conditions:

- Rapid Price Appreciation: Homes sell quickly, often receiving multiple offers and closing above asking price.

- High Buyer Demand: Numerous eager buyers compete for limited available properties, driving up values.

- Low Inventory: Fewer homes are on the market compared to the number of interested buyers.

- Economic Strength: Robust job growth, low unemployment, and diversified industries attract new residents and bolster local economies.

- Population Expansion: A steady influx of new residents fuels the need for more housing.

- Desirability: Quality schools, local amenities, well-developed infrastructure, and an appealing lifestyle collectively enhance a location’s attractiveness.

For international investors, these markets signal potential for substantial capital gains. However, they also demand readiness for higher entry costs, intense competition, and a nuanced understanding that initial rental yields might be lower than in less heated, cash-flow-centric markets.

Key Factors for International Investors in Hot Markets

When considering high-growth U.S. markets, international investors should carefully consider factors that contribute to both appreciating value and long-term stability:

- Appreciation Potential vs. Cash Flow Goals: Decide if your priority is aggressive capital appreciation (often found in hot markets) or consistent monthly rental income.

- Sustainable Fundamentals: Look beyond short-term trends to underlying economic drivers like housing affordability, consistent job creation, and favourable demographic shifts.

- Market Liquidity: In dynamic markets, the ability to sell a property quickly if needed is often higher, offering flexibility.

- Competition: Be prepared for swift decisions and potentially aggressive bidding wars. A strong, responsive local team is indispensable.

- Tailored Financing: High property values in hot markets might necessitate larger down payments. Specialized foreign national mortgages require careful planning to align with your investment strategy.

Top 10 Hottest Housing Markets in the U.S. (2025)

Here are the U.S. cities currently experiencing the most significant real estate momentum, ranked by their year-over-year median home price increase, based on recent market data.

| Rank | Metro Area | Median Home Price Increase (YoY) | Median Home Price | Investor Focus |

|---|---|---|---|---|

| 1 | Jackson, MS | 28.7% | $251,600 | High Appreciation, Emerging Market |

| 2 | Peoria, IL | 19.6% | $172,500 | Strong Value, High Growth, Affordability |

| 3 | Chattanooga, TN | 18.2% | $346,700 | Growth, Southern Charm, Diverse Economy |

| 4 | Elmira, NY | 17.6% | $167,800 | Affordability, Steady Growth, Regional Hub |

| 5 | Fond du Lac, WI | 17.6% | $263,800 | Midwest Value, Stable Economy |

| 6 | Cleveland, OH | 16.4% | $221,900 | Urban Revitalization, Healthcare, Cash Flow |

| 7 | Bismarck, ND | 15.8% | $312,200 | Stable Economy, Energy Sector, Steady Demand |

| 8 | Akron, OH | 15.5% | $209,600 | High Affordability, Manufacturing, Education |

| 9 | Blacksburg, VA | 15.0% | $311,900 | University Town, Tech, Stable Market |

| 10 | Canton, OH | 14.9% | $207,000 | Affordable Entry, Diversifying Economy |

1. Jackson, Mississippi

Topping the list with remarkable price growth, Jackson offers a unique opportunity for international investors seeking aggressive appreciation. I personally purchased my first ever U.S. investment properties in Jackson back in 2016. This surge is largely driven by its relative affordability attracting strong demand and a favourable tax environment, making it an appealing destination for new residents and investors alike.

2. Peoria, Illinois

Peoria, located in the heart of the Midwest, showcases strong growth fuelled by a renewed investor confidence and a modest resurgence in office space demand among smaller users. Its economic growth, coupled with a limited housing inventory, has led to significant price increases, making it a compelling market for value-driven international investors.

3. Chattanooga, Tennessee

Nestled in the scenic Appalachian Mountains, Chattanooga is gaining recognition for its vibrant economy driven by a mix of established industries and innovative startups, particularly in sustainability and technology. This economic vitality fuels strong demand and has contributed to its impressive price growth, appealing to international investors seeking appreciation in a dynamic Southern market.

4. Elmira, New York

Elmira’s significant price surge highlights the potential in smaller regional markets, particularly those offering strong affordability. The strong appreciation here is a result of consistent demand meeting a relatively limited supply, suggesting that value-seeking buyers are increasingly turning to more accessible markets like Elmira.

5. Fond du Lac, Wisconsin

Another Midwest standout, Fond du Lac combines affordability with impressive price appreciation. This market is benefiting from its stable local economy and increasing desirability, likely due to its quality of life and proximity to larger Wisconsin metropolitan areas, making it attractive for a steady influx of residents and investors.

6. Cleveland, Ohio

Cleveland continues its impressive resurgence, evidenced by robust price growth. This is driven by significant economic revitalization, particularly in world-class healthcare (Cleveland Clinic), a growing biomedical sector, and ongoing urban redevelopment projects. These factors attract an influx of younger professionals and a growing demand for rental housing, benefiting international investors focused on both appreciation and cash flow.

7. Bismarck, North Dakota

Bismarck’s consistent growth underscores its stable economy, heavily influenced by the energy sector and government employment. Its strong price appreciation signals a resilient market with steady demand, as it attracts residents seeking stable job opportunities and a high quality of life. International investors looking for stability and reliable growth can consider this market.

8. Akron, Ohio

Akron, known for its strong presence in polymer science, healthcare, and higher education, offers a highly affordable entry point into a market experiencing significant price appreciation. The city’s ongoing diversification and revitalization efforts are attracting new residents and jobs, creating a robust environment for both home values and rental demand, appealing to international investors seeking accessible growth.

9. Blacksburg, Virginia

As a vibrant university town (home to Virginia Tech), Blacksburg benefits from a consistent demand driven by inventory shortages, the needs of its large student population, and the significant economic impact of the university itself. Its strong price appreciation makes it attractive for international investors looking for stable capital gains in a market with a reliable tenant base tied to academia and a growing tech presence.

10. Canton, Ohio

Canton, home to the Pro Football Hall of Fame, rounds out the list with compelling price growth and an affordable median home price. Its economy is actively diversifying beyond traditional industries into growing healthcare and education sectors. This creates new job opportunities, attracting residents and driving housing demand, offering international investors accessible price points for both appreciation and reliable cash flow.

Navigating Hot Markets as an International Investor

Investing in a rapidly appreciating market from abroad demands a well-thought-out strategy. I’ve purchased over 120+ investment properties in the U.S. since 2016, and I’ve definitely learned a lot along the way:

- Clearly Define Your Goals: Determine whether your primary aim is capital appreciation, consistent cash flow, or a blend of both. Hot markets often favour appreciation.

- Investment Structure: How you set up your U.S. property investment will have huge implications for your U.S. tax obligation and personal liability protection. You can read my guide here.

- Rigorous Due Diligence: Even in thriving markets, each property warrants thorough analysis. Don’t let market excitement overshadow detailed inspections and financial vetting.

- Indispensable Local Expertise: Partner with a reliable local team. This includes a real estate agent experienced with international investors, a proactive property manager, a U.S. tax advisor, and a specialized mortgage broker. They are your essential eyes and ears on the ground.

- Tailored Financing Solutions: Familiarize yourself with specialized Foreign National Mortgages, such as DSCR (Debt Service Coverage Ratio) loans or traditional foreign national options. These are designed for non-resident aliens and can be adapted to your investment property needs.

- Understand Tax Implications: Be aware of U.S. tax regulations for foreign investors, including FIRPTA (Foreign Investment in Real Property Tax Act) and U.S. estate tax considerations. Proper legal and tax structuring from the outset is vital.

Conclusion

While some U.S. markets are currently experiencing a rebalancing as houses prices start to fall back towards a more reasonable level of affordability, the U.S. housing markets experiencing rapid growth in 2025 offer exciting potential for international investors seeking capital appreciation.

While these markets present unique challenges, they also provide opportunities for robust returns when approached with a clear strategy, thorough due diligence, and the support of an experienced local team. By understanding the dynamics of these hot spots and leveraging specialized financing, you can strategically position your U.S. real estate portfolio for success.

Frequently Asked Questions (FAQ) for International Investors

Q1: Are “hot” housing markets always the best investment for international investors?

A1: Not necessarily. “Hot” markets typically mean rapid price appreciation, which is great for capital gains. However, they often come with higher purchase prices, which can reduce your monthly rental income (cash flow). It depends on your investment strategy – whether you prioritize appreciation, cash flow, or a balance.

Q2: How do I finance a property in a competitive U.S. market as an international investor?

A2: As a non-resident alien, you’ll typically need a “Foreign National Mortgage.” Options include DSCR (Debt Service Coverage Ratio) loans, which qualify based on the property’s rental income, or traditional foreign national loans that assess your foreign income and assets. These differ from standard U.S. mortgages.

Q3: What are the biggest risks of investing in a rapidly appreciating market from abroad?

A3: Risks include:

- Overpaying: Intense competition can lead to emotional decisions.

- Market Correction: Rapid growth can sometimes be followed by a slowdown or correction.

- Management Challenges: Managing a property remotely in a fast-paced market requires an excellent local property management team.

- Liquidity Traps: If the market cools unexpectedly, selling quickly might be challenging.

Q4: Do I need to visit the U.S. to buy property in these hot markets?

A4: While not always strictly necessary, especially with a trusted local team, an initial visit can provide invaluable insight into the local market, neighbourhoods, and property conditions. Many international investors conduct virtual tours and rely on their U.S. partners for on-the-ground due diligence.

Q5: What kind of local team do I need to invest in a hot U.S. market?

A5: A robust local team is critical. It should include:

- A real estate agent experienced with foreign investors.

- A property manager who understands your investment goals.

- A U.S. tax advisor specializing in international taxation.

- A foreign national mortgage broker.

- A real estate attorney (recommended for closings).

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your U.S. real estate investment journey today with high-quality cashflow real estate. Book a Free 1-2-1 Discovery Call with a member of our senior management team to discuss your personalized strategy.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

![USA Property Investment for Foreign Buyers [2025 Guide]](https://cashflowrentals.net/wp-content/uploads/2025/07/USA-Property-Investment-for-Foreigners-Expert-2025-Guide-500x383.png)