U.S. Housing Affordability at Historic Lows – JPMorgan

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

U.S. Housing Affordability Crisis 2025: What International Investors Need to Know

For international investors eyeing the U.S. real estate market, understanding the concept of housing affordability is more crucial than ever. Recent data from JPMorgan reveals a deepening crisis, where the dream of homeownership is becoming increasingly out of reach for many American households. This shift doesn’t just impact local buyers; it fundamentally alters the landscape for global property investors, presenting both challenges and strategic opportunities for consistent cash flow and long-term growth.

This in-depth guide will dissect the current state of U.S. housing affordability, focusing on the dramatic changes observed between 2019 and 2024. We’ll explore why this affordability gap matters profoundly to international investors and how understanding these dynamics can inform a more resilient and profitable U.S. property investment strategy.

The Widening Affordability Gap: A Deeper Dive into the Numbers

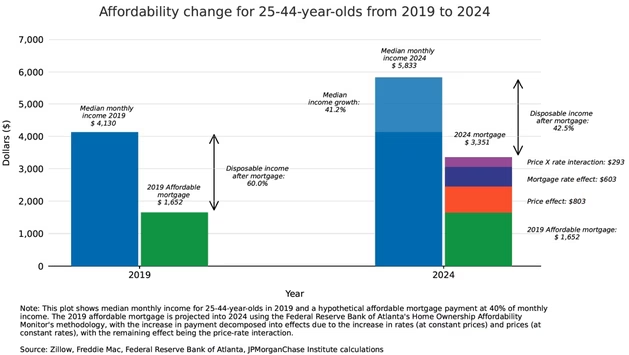

The stark reality of U.S. housing affordability is best understood by looking at how key financial metrics have shifted in just five years. The rapid increase in home prices, coupled with rising mortgage rates, has significantly outpaced income growth, creating a formidable barrier for many.

The Staggering Financial Shift (2019 vs. 2024)

According to data analysed by Realtor.com, derived from JPMorgan Chase, the median household income has not kept pace with the soaring costs of housing, particularly the monthly mortgage payment. This disparity highlights the intense pressure on prospective homebuyers.

Here’s a direct comparison of key financial figures:

| Metric | 2019 (October) | 2024 (October) | Percentage Change |

|---|---|---|---|

| Median Household Income (approx.) | $4,130 | $5,833 | +41.2% |

| Median Mortgage Payment (approx.) | $1,652 | $3,351 | +102.8% |

Data Source: JPMorgan Chase

This table illustrates that while median incomes rose by over 40% in five years, the median mortgage payment more than doubled. This means a much larger portion of a household’s income is now consumed by housing costs.

The Dual Impact on Mortgage Payments: Prices vs. Rates

The increase in monthly mortgage payments isn’t solely due to one factor. It’s a powerful combination of both rising home prices and higher mortgage rates. The Realtor.com report details this dual impact:

- Impact of Higher House Prices on Mortgage Payment: Approximately $803 of the increase is attributed to the rise in home prices.

- Impact of Higher Mortgage Rates on Mortgage Payment: Approximately $603 of the increase is due to the shift in mortgage interest rates.

This means that over half of the increase in monthly mortgage payments comes from soaring home values, demonstrating a structural issue in affordability, not just a cyclical one tied to interest rates.

As Hannah Jones, a senior economic analyst at Realtor.com, highlighted: “The main takeaway is that affordability has steadily worsened. It just goes to show how much more difficult it is to afford a home now than it was five years ago. It’s hard to find good news in the data.“

Why This Matters to International Investors: Opportunity in Adversity

The U.S. housing affordability crisis might seem like a deterrent, but for international investors with a strategic long-term view, it can unveil unique opportunities for consistent cash flow and resilient investments.

Increased Rental Demand

When homeownership becomes unaffordable for a significant portion of the population, the demand for rental properties naturally surges. This is a direct benefit for international investors focused on income-producing assets.

- Growing Renter Pool: More individuals and families are forced to remain renters for longer periods, or even permanently, creating a larger and more stable tenant base.

- Reduced Vacancy Risk: High rental demand typically translates to lower vacancy rates for landlords, ensuring a more consistent stream of rental income.

Driving Consistent Cash Flow

The sustained high demand in the rental market, especially for well-located and reasonably priced properties, supports higher rental yields.

- For international investors, acquiring properties in markets where the purchase price is balanced against strong rental income potential is key to generating consistent cash flow.

- The affordability crisis for homeowners directly contributes to the robust health of the rental market, making well-chosen rental properties a stable investment.

Market Resilience in Affordable Regions

The very areas most affected by unaffordability (typically large, expensive coastal cities) are often the most prone to sharp price corrections when market conditions shift. Conversely, markets that maintain a healthier level of affordability tend to be more resilient.

- In these more affordable markets, the demand from local buyers remains stronger, acting as a buffer against drastic price declines even if national trends show some softening.

- This resilience provides greater stability for investors, protecting capital and ensuring a more predictable return trajectory over time.

Related: My Comprehensive Guide to U.S. Taxes for Foreign Property Investors

Strategic Considerations for International Investors

Navigating the current U.S. housing market requires a nuanced approach for international investors. The key is to identify the right markets and leverage appropriate investment strategies that align with the prevailing affordability dynamics.

Focus on Fundamentally Strong, Affordable Markets

Instead of chasing inflated prices in highly unaffordable regions, global property investors should prioritize markets that offer a healthier balance of price and income. These are often found in the Midwest and parts of the South.

- Strong Local Economies: Look for markets with diversified job growth that can sustain a local population.

- Positive Demographics: Inward migration and population growth are indicators of sustained housing demand.

- Good Rent-to-Price Ratios: This ensures that rental income can comfortably cover expenses and generate positive cash flow.

(For detailed examples of the most affordable U.S. housing markets that offer strong investment potential, refer to our article: Cashflow Rentals, “The 10 Most and Least Affordable Housing Markets in America Right Now,” June 2, 2025)

Long-Term Perspective and Patience

The current environment emphasizes the importance of a long-term investment horizon. Market fluctuations are inevitable, but properties in fundamentally sound, affordable markets tend to offer reliable appreciation over years, not months. For international investors, this means less focus on short-term gains and more on building equity and sustained income.

Leveraging Specialized Financing

The affordability challenge for local buyers also highlights the importance of tailored financing solutions for international investors.

- Foreign National Mortgages: These loans are specifically designed for non-U.S. residents, allowing access to the market without a U.S. credit history.

- DSCR Loans: Ideal for income-focused investors, these loans qualify based on the investment property’s projected rental income, making them a powerful tool for achieving consistent cash flow.

Related: The Best USA Mortgages for Non-Residents

Conclusion: Adapting to the New Affordability Reality

The U.S. housing affordability crisis, starkly illustrated by the widening gap between incomes and mortgage payments, defines the current market. For international investors, this is not a roadblock but a directional signal. By understanding the profound impact of affordability on market dynamics, and by strategically focusing on resilient, cash-flow-rich opportunities in more accessible regions, global property investors can thrive in this evolving landscape.

The key to success lies in adapting investment strategies to this new affordability reality, prioritizing stable rental demand and sustainable growth over speculative appreciation.

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your U.S. real estate investment journey today with high-quality cashflow real estate. Book a Free 1-2-1 Discovery Call with a member of our senior management team to discuss your personalized strategy.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

Frequently Asked Questions (FAQs) for International Investors on U.S. Housing Affordability

Here are answers to common questions international investors have about the U.S. housing affordability crisis and its implications for real estate investment.

Q: What is the current state of U.S. housing affordability for international investors?

A: U.S. housing affordability has significantly worsened between 2019 and 2024, with median mortgage payments more than doubling while median incomes increased at a slower pace. This creates a challenging environment for local buyers but can boost rental demand for investors.

Q: How has the median mortgage payment changed from 2019 to 2024?

A: The median U.S. mortgage payment increased from approximately $1,652 in October 2019 to $3,351 in October 2024, a rise of over 100%. This increase is due to both higher home prices and elevated mortgage rates.

Q: What is the primary impact of the affordability crisis on the U.S. rental market?

A: The affordability crisis for homeowners directly fuels increased demand for rental properties. As homeownership becomes more difficult, a larger segment of the population remains renters, leading to higher occupancy rates and more consistent cash flow for investors.

Q: Why are affordable markets considered more resilient for real estate investment?

A: Affordable markets are more resilient because properties have less “room to fall” in value during market downturns. A broader base of local buyers can still afford homes, maintaining demand and preventing the sharp price declines seen in overheated, less affordable regions.

Q: Can international investors still find consistent cash flow in the U.S. housing market?

A: Yes, international investors can find consistent cash flow by focusing on fundamentally strong, affordable markets. Lower acquisition costs combined with high rental demand in these areas often translate to superior rent-to-price ratios and stable income streams.

Q: What role do median income and mortgage rates play in current affordability challenges?

A: Both play significant roles. While median incomes have risen, the surge in home prices (contributing roughly $803 to increased monthly payments) and elevated mortgage rates (contributing roughly $603) have collectively made housing significantly less affordable, as highlighted by JPMorgan Chase data.

Q: What strategic approach should international investors take given the affordability crisis?

A: International investors should adopt a long-term perspective and focus on acquiring properties in affordable, fundamentally strong markets. Leveraging specialized financing like Foreign National or DSCR loans can also facilitate investment, focusing on consistent cash flow over speculative appreciation.

Q: Are there specific U.S. regions that offer better affordability for international investors?

A: Yes, regions like the Midwest and parts of the South often offer better housing affordability. Cities such as Cleveland, Pittsburgh, Kansas City, Indianapolis, and Toledo are examples of markets with a healthier balance of price and income, strong economies, and good rental potential.

Q: What is a DSCR loan, and why is it relevant for international investors in this environment?

A: A DSCR (Debt Service Coverage Ratio) loan is a specialized mortgage that qualifies the borrower based on the investment property’s projected rental income rather than the investor’s personal income. This is highly relevant for international investors as it simplifies financing and directly aligns with achieving consistent cash flow from rental properties.

![USA Property Investment for Foreign Buyers [2025 Guide]](https://cashflowrentals.net/wp-content/uploads/2025/07/USA-Property-Investment-for-Foreigners-Expert-2025-Guide-500x383.png)