Zillow’s Updated U.S. Home Price Forecast: Insights

Zillow’s Updated U.S. Home Price Forecast: Strategic Insights for International Investors

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

For international investors committed to building a profitable U.S. real estate portfolio, accurate home price forecasts are a useful metric to stay on top of. Recent data released by Zillow offers a crucial update, painting a picture of a more “buyer-friendly” market that, while signalling slower national appreciation, presents unique opportunities for global property investors focused on consistent cash flow and strategic acquisitions.

This article delves into Zillow’s latest home price predictions for over 400 U.S. cities and markets, translating these insights into actionable intelligence for non-U.S. residents. We’ll explore where the strongest and weakest growth is expected, discuss the underlying market dynamics, and outline how these trends can be leveraged to your advantage, especially when seeking properties for long-term rental income.

Related: 5-Year Forecast for the U.S. Housing Market: Expert Opinions

Key Takeaways: Zillow’s Forecast for International Investors

- National Deceleration: Zillow now expects U.S. home prices to decline by 0.7% between May 2025 and May 2026, a significant downgrade from earlier forecasts.

- Buyer-Friendly Shift: Increased inventory (+20% YoY), more options, reduced competition, and price cuts signal a market favouring buyers.

- Regional Variance is Key: While the national outlook is softer, specific cities are forecast for strong appreciation (e.g., Atlantic City, Knoxville) while others face notable declines (e.g., several Louisiana and Texas metros, San Francisco).

- Opportunity in Negotiation: The shift in market dynamics provides international investors with greater negotiation power and potentially better entry points for acquiring cash-flowing properties.

- Focus on Cash Flow over Speculation: This market reinforces the importance of investing for consistent cash flow and long-term holds, rather than relying solely on rapid appreciation.

- Leverage with DSCR Loans: Specialized financing like DSCR loans allows international investors to strategically acquire properties in this evolving market, bypassing U.S. credit and income verification.

Related: The Top U.S. Real Estate Markets for Non-Resident Real Estate Investors

The Evolving U.S. Housing Market: Zillow’s Latest Forecast

Heading into the year, Zillow economists had a more optimistic outlook, forecasting that U.S. home prices were likely to rise 2.6% in 2025. However, newly released data paints a different picture, reflecting a market softer than expected, particularly in some areas of the Sun Belt.

According to the latest insights from Zillow, U.S. home prices have significantly decelerated to a year-over-year increase of just 0.4%. Looking ahead, Zillow economists now expect U.S. home prices to decline by 0.7% between May 2025 and May 2026.

What’s Driving the Shift? A More “Buyer-Friendly” Market

Zillow economists pinpoint several factors contributing to this deceleration and a more balanced, buyer-friendly market:

- Increased Inventory: “With inventory up nearly 20% over the previous year, buyers had more options in May than at any time since July 2020,” wrote Zillow economists.

- Reduced Competition: “Competition among buyers declined to the lowest level seen in May in Zillow records, reaching back through 2018.”

- Sellers Outnumber Buyers: Despite a slight increase in sales, “sellers still outnumber buyers.” This dynamic gives buyers “more time to decide and more power in negotiations.”

- Price Cuts: “Home values have fallen in 22 of the 50 largest metro areas over the past year, and sellers cut prices on almost 26% of listings nationwide—another May high in Zillow records.”

- Longer Selling Times: Homes that sell typically do so in 17 days, about four more than last year and only two days fewer than pre-pandemic averages.

This national outlook, while seemingly less bullish on appreciation, translates into an opportune environment for international investors seeking strategic entry points and stronger negotiation leverage.

Related: The Top U.S. Real Estate markets for First Time Investors

Decoding Zillow’s City-Level Predictions: Opportunities & Warnings

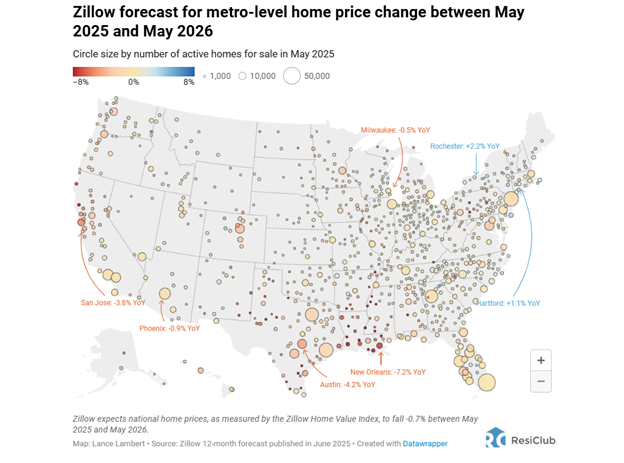

While the national forecast points to deceleration, Zillow’s granular data for 300 largest U.S. housing markets reveals significant regional disparities. Understanding these city-specific predictions is vital for targeted U.S. property investment.

Source: ResiClub

Source: ResiClub

Top 10 U.S. Cities for Strongest Home Price Appreciation (May 2025 – May 2026)

These markets are predicted by Zillow to buck the national trend and see the most robust price growth. For international investors, these could be areas offering a balance of strong rental demand and potential for capital gains.

| City & State | Predicted Appreciation (May 2025 – May 2026) |

|---|---|

| Atlantic City, New Jersey | 3.4% |

| Kingston, New York | 2.7% |

| Knoxville, Tennessee | 2.6% |

| Pottsville, Pennsylvania | 2.5% |

| Torrington, Connecticut | 2.4% |

| Rochester, New York | 2.2% |

| Syracuse, New York | 2.1% |

| Fayetteville, Arkansas | 2.1% |

| Rockford, Illinois | 2.1% |

| Yuma, Arizona | 2.0% |

Top 10 U.S. Cities for Weakest Home Price Appreciation (May 2025 – May 2026)

Conversely, these markets are expected to experience price declines. For international investors, these areas require extreme caution or a very specific, high-yield cash flow strategy, often avoiding them if capital preservation is a primary goal.

- Houma, Louisiana: Expected to see a significant decline of -9.4%.

- Lake Charles, Louisiana: Forecasted for a substantial drop of -8.9%.

- New Orleans, Louisiana: Predicted to decrease by -7.2%.

- Alexandria, Louisiana: Another Louisiana city on the decline, with a forecast of -6.7%.

- Lafayette, Louisiana: Expected to fall by -6.6%.

- Shreveport, Louisiana: Forecasted decline of -6.4%.

- Beaumont, Texas: Expected to see prices drop by -6.2%.

- San Francisco, California: A notable West Coast market, predicted to decline by -5.5%.

- Midland, Texas: Forecasted for a -5.3% decrease.

- Odessa, Texas: Expected to see a -5.3% decline.

Related: Investors are Buying More Homes in These Affordable U.S. Housing Markets

Strategic Implications for International Investors in a Shifting Market

Zillow’s latest forecast, characterized by national deceleration and regional variations, presents specific strategic opportunities and considerations for international investors:

- Leverage Buyer-Friendly Conditions: The increased inventory and reduced competition mean international investors have more choices and greater negotiation power. This is a crucial advantage for securing properties at better prices, directly impacting your return on investment and potential consistent cash flow.

- Prioritize Cash Flow Over Speculative Appreciation: In a market where national appreciation is slowing or even declining, the focus on reliable consistent cash flow from rental income becomes even more paramount. Identify properties in stable, in-demand areas where rental yields remain strong, irrespective of minor price fluctuations.

- Target Growth Markets for Dual Benefit: While prioritizing cash flow, the top 10 appreciation markets identified by Zillow could offer the dual benefit of solid rental income and capital gains. Thoroughly research these specific cities to understand local demand drivers, rental rates, and long-term growth potential.

- Avoid High-Risk Depreciation Markets: The list of markets expected to see significant price declines serves as a clear warning. Unless you have a highly specialized strategy for these areas (e.g., distressed property acquisition and value-add), it’s generally prudent for international investors focused on stable U.S. property investment to avoid them.

- The Power of DSCR Loans: In a market favouring buyers, international investors can strategically leverage DSCR (Debt Service Coverage Ratio) loans. These loans allow you to finance properties based on their income potential, enabling you to act quickly on good deals without the traditional hurdles of U.S. credit checks or extensive personal income verification. This is especially valuable when negotiating. (For a detailed guide, see: “DSCR Loans for International Investors: Your Definitive Guide”).

- Refine Your Local Team: With market conditions becoming more nuanced, the expertise of your local U.S. real estate agent, property manager, and tax advisor is more critical than ever. They can provide on-the-ground intelligence, help identify truly cash-flowing properties, and manage your assets effectively.

Related: How to Structure Your U.S. Property Investment for Tax Efficiency and Liability Protection

Conclusion: Adapting for Success in the U.S. Real Estate Market

Zillow’s updated home price forecast highlights a shift towards a more balanced and potentially more buyer-friendly U.S. housing market. While overall appreciation may slow or decline nationally, significant opportunities persist in specific, strategically chosen cities and regions.

For international investors, this landscape underscores the importance of a data-driven, cash-flow-centric approach. By understanding the granular market predictions, leveraging your increased negotiation power, and utilizing specialized financing tools like foreign national mortgages, you can confidently navigate these changes and continue to build a robust portfolio generating consistent cash flow from your U.S. property investment.

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your U.S. real estate investment journey today with high-quality cashflow real estate. Book a Free 1-2-1 Discovery Call with a member of our senior management team to discuss your personalized strategy.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

Frequently Asked Questions (FAQs) on Zillow’s U.S. Home Price Forecast for International Investors

Here are answers to common questions international investors have about Zillow’s updated U.S. home price forecast and its implications.

Q: What is Zillow’s latest national home price forecast for 2025-2026?

A: Zillow economists now expect U.S. home prices to decline by 0.7% between May 2025 and May 2026, a downgrade from earlier predictions of modest appreciation.

Q: Why is Zillow predicting a softer housing market?

A: Zillow attributes the softer market to increased housing inventory (up nearly 20% year-over-year), more options for buyers, reduced buyer competition, sellers outnumbering buyers, and a rise in price cuts on listings.

Q: How does a “buyer-friendly” market benefit international investors?

A: A buyer-friendly market gives international investors more negotiation power, more time to make decisions, and potentially better entry points for acquiring properties. This can lead to more favorable purchase prices and stronger overall returns.

Q: Which U.S. cities are expected to see the strongest home price appreciation, according to Zillow?

A: Zillow expects the strongest appreciation between May 2025 and May 2026 in cities like Atlantic City, NJ (3.4%), Kingston, NY (2.7%), Knoxville, TN (2.6%), and Pottsville, PA (2.5%).

Q: Which U.S. cities are predicted to see the weakest home price appreciation or declines?

A: Zillow forecasts significant declines in several Louisiana cities (e.g., Houma, Lake Charles, New Orleans) and some Texas cities (e.g., Beaumont, Midland, Odessa), as well as San Francisco.

Q: Should international investors still focus on cash flow in a declining appreciation market?

A: Absolutely. In a market with slower or declining appreciation, focusing on properties that generate strong and consistent cash flow from rental income becomes even more critical. This strategy provides stability and returns independent of short-term price movements.

Q: How can international investors leverage DSCR loans in this type of market?

A: DSCR loans are ideal for international investors in a buyer-friendly market because they allow quick financing based on the property’s income potential, without U.S. credit checks or extensive personal income verification. This enables investors to act fast on good deals and leverage their capital strategically.

![USA Property Investment for Foreign Buyers [2025 Guide]](https://cashflowrentals.net/wp-content/uploads/2025/07/USA-Property-Investment-for-Foreigners-Expert-2025-Guide-500x383.png)