DSCR Loan Rates: The Best Current DSCR Loan Rates Today

Updated:

DSCR Loan Rates Today (September 2025)

Three times per week we apply a range of borrower profiles (credit, DSCR, U.S citizen vs foreign national etc.), and loan types (fixed/ARM/IO/Cash Out) to one of our own turnkey rental properties. We then submit that to a pool of over 25,000 lenders to arrive at today’s best DSCR rates. Rates and terms vary significantly based on a range of borrower and property specific factors. Use the links below the table to stay informed, receive special offers from DSCR lenders, or get pre-approved today.

| Loan Type | Previous Rates | Updated Rates | Notes |

|---|---|---|---|

| 30-Year DSCR Fixed | 7.58% – 8.08% (Aug 2025) | 6.75% – 6.98% (Sept 1, 2025) | Current market range for 30-Year DSCR loans, reflecting early September pricing trends. |

| 30-Year DSCR Fixed (avg) | ~7.47% (June 2025) | ~6.87% (Sept 1, 2025) | Estimated national average, based on the midpoint between recent market and lender benchmarks. |

| DSCR Cash-Out Refinance | 7.20% – 8.50% (Aug 2025) | 6.95% – 7.95% (Sept 1, 2025) | Cash-out refinance DSCR loans typically price slightly higher than standard fixed rates. |

| ARM (5/6, 7/6, 10/6) | 6.60% – 7.65% (Aug 2025) | 6.70% – 7.60% (Sept 1, 2025) | Adjustable-rate DSCR loans generally track just below fixed-rate ranges. |

| Interest Only (Purchase) | 7.15% – 8.30% (Aug 2025) | 6.90% – 7.90% (Sept 1, 2025) | Interest-only DSCR loans usually carry a small premium over traditional fixed products. |

Note: Ranges vary by DSCR/LTV, property type (incl. STRs), state, credit, and lender overlays. Foreign National DSCR loans are available from select lenders. Get Pre-Approved Today

STAY INFOMRED!

Get the Best DSCR Loan Deals and Off-Market DSCR-Ready Investment Properties in Your Inbox Every WeekYES! ADD ME TO THE PRIORITY INVESTOR LIST

DSCR Loan Rates: Everything Your Need to Know to Get the Best DSCR Loan Interest Rates in 2025

I’ve purchased over 120 rental properties in the USA since 2016, and DSCR loans are the cornerstone of my own real estate financing strategy. While DSCR loan rates can be slightly higher than conventional mortgage rates, the easy approval and underwriting process has allowed me to build and scale my own real estate portfolio, and help other investors from all over the world build their own rental property portfolios in the USA.

In this guide I’m going to tell you everything I’ve learned about DSCR loan interest rates over the past 10 years. By the end of reading this, you’ll have a good understanding of what influences rates, and how to get the best possible rate for your own loan.

First… What is a DSCR Loan?

What is a DSCR Loan

If you got here, you probably already know what a DSCR loan is. But for the sake of clarity, here’s a brief explanation: A DSCR loan is an investor friendly mortgage that real estate investors like me and my clients use to purchase rental properties.

They are a fantastic financing option for investors because DSCR lenders look at the income from the rental property rather than the borrowers personal income and debt-to-income ratio. That makes the approval process much quicker and easier, and allows investors with a low taxable income or high debt-to-income ratio scale their rental property portfolios.

Now let’s get into it and talk specifically about interest rates…

Types of DSCR Loan Interest Rates in 2025: Fixed, Adjustable (ARM), Interest Only

Fixed Rate vs ARM DSCR Mortgages

There are three types loan structure offered by DSCR lenders; fixed rate, adjustable rate (ARM), and interest only. Here’s a breakdown of the different loan types.

Fixed Rate DSCR Loans

This is the most common type of loan. Interest rates are fixed for the full term of the mortgage. In most cases, there are two fixed term options available:

- 30 Year Fixed Term DSCR

- 15 Year Fixed Term DSCR

I typically use 30-year fixed rate DSCR loans to purchase and/or refinance all of my own rental properties in the USA. I like the lower monthly payments and predictability for my long-term cashflow projections.

Benefits of Fixed-Rate DSCR Loans

- Predictable monthly payments: The biggest advantage of a fixed-rate loan is the stability it provides. Your principal and interest (P&I) payments remain the same, simplifying budgeting and financial projections when underwriting rental property.

- Protection against rising interest rates: If interest rates go up (which often they do), your monthly payments will not change, potentially saving you money compared to an adjustable-rate loan.

- Cashflow growth: One of my goals is to grow my cashflow every year by moderately increasing my rents in line with market prices. Because my financing costs with a fixed rate loan don’t change, this moderate rent increase can significantly increase my monthly margin over time. For example, I own properties that delivered $200/month in net cashflow when I bought them, that now deliver more than $500/month.

Challenges for Fixed-Rate DSCR Loans

- Higher initial interest rates: Fixed-rate loans often have a slightly higher interest rate than adjustable-rate loans.

- Less flexibility with prepayment: Most fixed-rate loans have prepayment penalties. This can make early refinancing and/or payoff expensive.

Adjustable DSCR Loan Rates (ARM)

Adjustable-rate DSCR loans (ARMs) are less common, although some DSCR lenders do offer them. These loans typically have a lower initial interest rate compared to fixed-rate loans options. They can be structured with different adjustment periods, such as 5/1, 7/1, or 10/1 ARMs. That means the rate is fixed for the first period, then reverts to a variable rate for the remainder of the loan.

For example, with a 5/1 ARM loan, the rate is fixed for the first 5 years. Then after five years, the rate adjusts annually. The new rate will determine your monthly payments for the subsequent year. Most ARMs have rate caps to limit how much the rate can change per adjustment and over the loan’s life, including initial, periodic, and lifetime caps

Pros of Adjustable Rate DSCR Loans

- Lower initial interest rates: ARMs usually have a lower interest rate than fixed-rate loans. This could potentially improve initial the cash flow from your rental property.

- Easier qualification: A lower interest rate and mortgage payment means a lower DSCR. That might mean you could qualify for a higher loan-to-value (LTV) and larger loan amount. It could also help a rental property with thin margins qualify for a DSCR loan.

- Suitability for short-term strategies: If you plan to sell or refinance your property within the initial fixed-rate period, the lower initial payments can be an advantage.

- Ideal if interest rates fall: If interest rates fall before your initial lower rate ends, you can refinance for a better rate – although there may be pre-payment penalties.

Cons of Adjustable Rate DSCR Loans

- Rate volatility: This might seem obvious, but the main risk with ARMs is that the interest rate and monthly payments can increase after the fixed-rate period. This could severely impact your cash flow is interest rase rise!

- Higher closing costs: ARM mortgages tend to have higher upfront fees than fixed rate mortgages.

- Higher overall interest: Over the life of the loan, an ARM might end up costing more in total interest than a fixed-rate loan if rates rise significantly.

Interest Only DSCR Loans (IO)

For investors looking to improve the cashflow from their rental properties – and possibly qualify a property with lower rents or higher LTV – an interest only DSCR loan might be a good option.

Interest only DSCR loans are typically 40-year loans. The first 10 years is interest only, and the remaining 30 years are amortized with principal and interest.

Pros of Interest Only DSCR Loans

- Improved Cashflow: Lower monthly payments on your mortgage mean more cashflow in your pocket.

- Better DSCR: A lower monthly payment means a better DSCR ratio. This can help a property qualify for a DSCR loan if the rents are lower or costs are higher.

Cons of Interest Only DSCR Loans

- Higher Interest Rate: The interest rate on an interest only DSCR loan is usually about 0.25% higher than a fixed or adjustable rate loan.

- Longer Term: The 40-year term means you’ll have to hold your rental property for a long time before you own it outright.

- No Paydown: Unlike fixed rate and adjustable rate mortgages, you won’t benefit from any mortgage paydown during the first 10 years of your loan.

You can also use a DSCR loan to refinance your existing rental property. I do this regularly to access the equity in my portfolio for growth and improvements. You can learn more in my guide to DSCR Cash Out Refinance Loans.

| Loan Type | Typical Term | Rate Structure | Typical Interest Rate Range | Best For | Key Pros | Key Cons |

|---|---|---|---|---|---|---|

| Fixed–Rate DSCR Loan | 15 or 30 years | Fixed for full term | 6.75% – 8% | Long-term investors seeking stability |

|

|

| Adjustable-Rate DSCR Loan (ARM) | 30 years (fixed 5–10 years, then adjusts) | Variable after initial fixed period | 6.25% – 7.5% | Investors planning to sell/refinance within 5–10 years |

|

|

| Interest Only DSCR Loan | 40 years (10 years interest only, 30 years amortized) | Interest only for first 10 years | 7% – 8.25% | Maximizing short-term cashflow |

|

|

Choosing the Right Type of DSCR Loan for Your Rental Property Investment

Interest rates vary between fixed rate vs ARM DSCR, and interest-only loan products. But a lower initial rate isn’t always the best choice. You should also consider DSCR vs conventional loans as rates and fees vary between them. The type of loan you choose should be based on:

- Your own investment goals

- The rental property you’re buying

- How long you intend to keep your property

- The closing costs

- Your thoughts on the future prospects for interest rates

- Your risk tolerance

If you intend to hold your rental property for the long term, and want to lock in your interest rate for predictable cashflow, then a fixed rate loan could be a the better choice.

If you are buying a rental property with thin margins, an interest only loan could help the property qualify and improve your monthly cashflow.

If you intend to sell your rental property during the lower initial fixed rate period of an ARM, or think interest rates might fall in the future, then you might consider a ARM mortgage.

How Are DSCR Loan Interest Rates Calculated: Interest Rates, Property & Borrower Criteria

DSCR Loan Interest Rates are Calculated Based on a Range of Factors

Understanding all of the factors that influence interest rates for this type of loan will help you to secure the best possible rate for your rental property financing.

Factors Affecting DSCR Loan Interest Rates

It’s a common misconception that DSCR loan interest rates are calculated based purely on the DSCR ratio and borrower profile. In fact, rates are based on a combination of the borrower, property, and the current ‘risk free’ rate.

- 5-Year Treasury Bond Yield: This is the ‘risk free’ rate. While conventional mortgage rates track the 10-year treasury bond yield, DSCR loans track the shorter term rates because rental property investors tend to own the property for shorter time periods than homeowners.

- DSCR Ratio: Your DSCR ratio is the amount of gross rental income relative to your total monthly Principal Interest Taxes & Insurance (PITI) payment. Lenders typically want to see a DSCR of 1.0 to 1.25 or higher. A higher DSCR usually means a lower interest rate.

- Loan Amount: This is interesting. Smaller loans (under $100,000) tend to have a higher interest rate than loans above $100,000. That said, much larger loans tend to have higher rates due to the higher lender risk.

- Points and Fees: It’s often the case that paying higher upfront fees (points), can reduce your interest rate. You can also ‘buy down’ the rate by paying points upfront in exchange for a lower rate in the term of the loan.

- Loan-to-Value (LTV) Ratio: Loans with a higher loan-to-value (LTV) typically have a higher interest rate. From my experience, the rates start to creep up above a 75% LTV.

- Credit Score: For U.S. citizens, a higher FICO credit score usually means a better interest rate. If you’re a non-U.S. citizen, you can still get a DSCR loan in the U.S., but your interest rates will be slightly higher.

- Prepayment Penalties: DSCR loans always have a prepayment penalty. The longer the lock-in period and higher the penalty, the lower the interest rate, and vice versa.

- Loan Term: 15-year fixed rate loans have lower interest rates than 30-year fixed rate loans.

- Your Lender: Interest rates (and fees) can vary wildly between lenders. That’s why its important to work with a broker that has access to the whole lender market, and can find you the best deal to suit your borrower profile and deal.

Current DSCR Loan Rates in August 2025

Current rates vary based on a range of factors

Considering all the factors above, interest rates on DSCR loan products vary all the time. As a general rule of thumb, current rates will always be around 0.5% to 2% higher than conventional U.S. mortgage rates. Your specific rate will vary depending on all the factors mentioned above, but here’s a guideline for rates I’m seeing for my clients today in August 2025:

| Loan Type | Previous Rates | Updated Rates | Notes |

|---|---|---|---|

| 30-Year DSCR Fixed | 7.58% – 8.08% (Aug 2025) | 6.75% – 6.98% (Sept 1, 2025) | Current market range for 30-Year DSCR loans, reflecting early September pricing trends. |

| 30-Year DSCR Fixed (avg) | ~7.47% (June 2025) | ~6.87% (Sept 1, 2025) | Estimated national average, based on the midpoint between recent market and lender benchmarks. |

| DSCR Cash-Out Refinance | 7.20% – 8.50% (Aug 2025) | 6.95% – 7.95% (Sept 1, 2025) | Cash-out refinance DSCR loans typically price slightly higher than standard fixed rates. |

| ARM (5/6, 7/6, 10/6) | 6.60% – 7.65% (Aug 2025) | 6.70% – 7.60% (Sept 1, 2025) | Adjustable-rate DSCR loans generally track just below fixed-rate ranges. |

| Interest Only (Purchase) | 7.15% – 8.30% (Aug 2025) | 6.90% – 7.90% (Sept 1, 2025) | Interest-only DSCR loans usually carry a small premium over traditional fixed products. |

Notes: Cash-out typically prices ~0.25%–0.50% higher than rate-and-term. ARM start rates are usually lower than 30-yr fixed; resets follow index + margin with caps. Interest-Only often carries a small pricing premium vs amortizing but lowers the qualifying payment. If you combine features (e.g., cash-out + IO), expect premiums to stack.

JOIN MY VIP PRIORITY INVESTOR LIST

Get the Best DSCR Loan Deals and Off-Market DSCR-Ready Investment Properties in Your Inbox Every WeekYES! ADD ME TO THE PRIORITY INVESTOR LIST

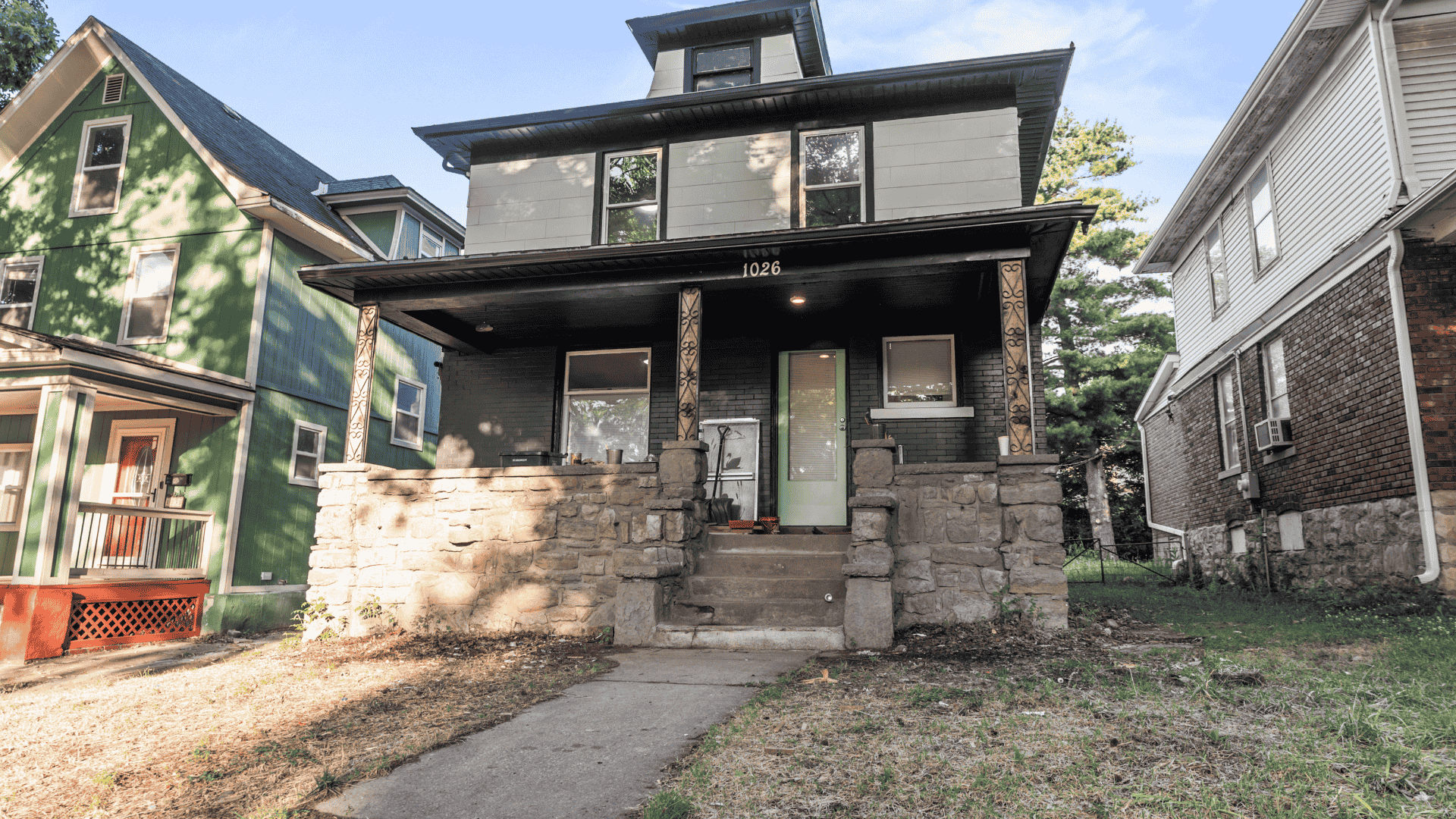

Case Study: How we Used a DSCR Loan to Buy This Rental Property in Kansas City

We used a DSCR loan to help a client purchase this rental property in Kansas City

Here’s a case study based on an off-market 5 bedroom rental property I helped a client purchase in Kansas City, Missouri in July 2025. This was a turnkey rental property with a tenant paying $2,150 rent. We used a DSCR loan with an interest rate of 7.25% to purchase the property.

First, let’s calculate the monthly PITI:

- Purchase Price: $240,000

- Monthly Rent: $2,150

- Down Payment: $60,000

- Mortgage Amount: $180,000 (75% LTV)

- Interest Rate: 7.25%

- Monthly P&I: $1,227.92

- Property Tax: $81.50 (monthly)

- Insurance: $120 (monthly)

- Total PITI: $1,429.42

Now, let’s work our the DSCR:

- Gross Rent: $2,150

- PITI: $1,429.42

- DSCR: 1.50

So this property easily qualified for a loan with a DSCR of 1.50. This mortgage had a slightly higher interest rate because the buyer is a non-U.S. resident without a U.S. credit score. That said, this property still delivered $720 per month in positive cashflow before reserves for repairs, vacancy, and capital expenditures.

Remember, when you’re underwriting a potential rental property for real net cashflow, don’t rely on the DSCR calculation alone. Make sure you include all of your expected costs and reserves! You can review a more detailed case study with more in-depth analysis of the financing strategy and numbers here: DSCR Loan Case Study – Cleveland, Ohio.

How to Get The Best DSCR Loan Rates Today

There are few ways to get a better rate today

There are few things you can do ahead of time to make sure you get the best possible interest rate on your DSCR loan.

The first thing you need to have in place is a good quality rental property with a tenant that pays on time. While some lenders will consider a vacant property, you stand a much better chance of getting the best rate if the property is generating verifiable, consistent income.

Then, you can look at how to improve the DSCR ratio in order to get a better interest rate. There are few things you can do, including:

- Maximize Income: If the property is under-rented, you can increase rent to market price. This will help to improve you DSCR ratio and get you a better interest rate.

- Reduce Costs: One element of your PITI that you can improve is the insurance element. Shop around for the best landlord insurance quote. The lower your insurance cost, the higher your DSCR, and the better rate you’ll get.

- Add Value: If you can add value to the property with cost-effective improvements, you will improve your loan-to-value. This could help you to get a better interest rate.

Of course, if you are purchasing a property (not refinancing), you may not have the opportunity to increase rents or add value immediately. That’s one of the main reasons I focus on buying high quality turnkey investment properties. That way, I know the property has been renovated to a high standard, maximizing value, attracting the highest paying tenants and improving the DSCR.

DSCR Interest Rate Estimator Tool: Get an Estimated DSCR interest Rate Today

Use this DSCR loan rate estimator tool to find the best rate for you

If you want to get an estimated DSCR loan interest rate, you can plug some basic information into my free DSCR Loan Rates Calculator below. If you want to see a more comprehensive breakdown, including closing costs and cash reserves, you can also find all of my loan Calculators here: DSCR Loan Calculators

DSCR Interest Rate Estimator

JOIN MY VIP PRIORITY INVESTOR LIST

Get the Best DSCR Loan Deals and Off-Market DSCR-Ready Investment Properties in Your Inbox Every WeekYES! ADD ME TO THE PRIORITY INVESTOR LIST

Final Thoughts

So, now you know exactly how DSCR loan interest rates are calculated, and what rates are looking like today. I hope you found it useful!

There a couple of things you can do right now to make sure you stay on top of things. You can join my VIP Priority Investor List, and I’ll send you the best DSCR loan deals and pre-approved DSCR-ready investment properties every week. Or, if you’d like to get pre-approved for a DSCR loan today, you can use the button below!

GET PRE-APPROVED FOR THE BEST DSCR LOAN RATE

Start your real estate investment journey today, and get pre-approved for the Best DSCR Loan Interest Rates from market leading lenders!

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GET PRE-APPROVED FOR THE BEST DSCR LOAN INTEREST RATES TODAY!

Start your real estate investment journey today get pre-approved for the best DSCR loan interest rates from market leading lenders!

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

Frequently Asked Questions About DSCR Loan Rates

What are the interest rates for DSCR loans?

DSCR loan rates typically range from 6.75% to 9%, depending on your credit, property type, and lender.

Do DSCR loans require 20% down?

Yes, most DSCR lenders require at least 20% to 25% down payment.

What is a good DSCR rate?

A DSCR of 1.25 or higher is generally considered strong and preferred by lenders.

What is the downside to a DSCR loan?

Higher interest rates, larger down payments, and limited lenders are common downsides.

Is it hard to qualify for a DSCR loan?

Not usually. If the property’s rental income covers the loan payments, you can qualify—even without U.S. income or credit.

Can an LLC get a DSCR loan?

Yes, most DSCR loans are made to LLCs to protect investors and simplify ownership.

Do banks offer DSCR loans?

Traditional banks usually don’t. DSCR loans are typically offered by private or non-QM lenders.

Can I get a DSCR loan without a job?

Yes. DSCR loans are based on property income, not personal employment or W-2 income.

How much can you borrow with a DSCR loan?

You can typically borrow up to 75% of the property’s value (LTV), depending on the lender.

Can you pay off a DSCR loan early?

Yes, but some loans have prepayment penalties, so check your loan terms.

What is a good DSCR for a loan?

1.25 or higher is ideal, but some lenders accept lower with compensating factors.

Does a DSCR loan require appraisal?

Yes, lenders require a full appraisal to confirm value and rental income.

Are DSCR loan rates dropping?

DSCR loan rates are based on the 5 year treasury bond yield. DSCR Rates may drop in late 2025 if U.S. Treasury yields continue to fall, but they remain volatile.

Is there a DSCR HELOC?

Some private lenders offer investor HELOCs based on rental income, but it’s not common.

What is the interest rate for a 30 year fixed DSCR loan?

Rates for 30-year fixed DSCR loans are typically between 6.75% and 8.5%.

What is the interest rate for a 15 year fixed DSCR loan?

Rates for 30-year fixed DSCR loans are typically between 6.5% and 8%.