How to Improve Your Property’s DSCR: My Step-by-Step Guide for Real Estate Investors

My Step by Step Guide to Improving Your Rental Property DSCR to Get the Best Rates and Terms in 2025

Last updated:

As a real estate investor, you know that the Debt Service Coverage Ratio (DSCR) is one of the most important numbers when it comes to underwriting a rental property investment. I’ve used DSCR loans to finance over 120 of my own rental properties in the United States, and understanding and improving my DSCR ratio has been the key to unlocking new loans, expanding my portfolio, and securing the best possible financing terms. But what happens if your property’s DSCR isn’t quite where you need it to be?

The good news is that your DSCR is not fixed. It’s a metric you can actively manage and improve. In this guide, I’ll walk you through my own step-by-step process that I have used to strengthen my property’s DSCR, get better loans terms, and even qualify properties that might not have got approval. I’ll share practical strategies to help you get the best possible DSCR loan rates for your next investment.

Key Takeaways

- Improve Income: There are various ways to improve your income – and DSCR

- Reduce Costs: You can improve your DSCR by reducing the costs in your PITIA

- Improve Your Application: You can work on your borrower profile to get better rate

- Strategic Choices: There are specific loan options and structures that could help improve your DSCR

VIP PRIORITY INVESTOR LIST

Get the Best DSCR Loan Deals and Off-Market DSCR-Ready Investment Properties in Your Inbox Every WeekYES! ADD ME TO THE PRIORITY INVESTOR LIST

The Four Core Levers for Improving Your DSCR

I’ve learned that there are a number of ways to improve a property’s DSCR. In my experience, there are four main levers you can pull to get your DSCR where it needs to be. These are: increasing your property’s rental income, decreasing its operating expenses, improving the deal structure itself, and strengthening your overall application. If you want to work out the DSCR for any rental property, you can use my own DSCR loan calculators.

Compare DSCR with other loan types:

Hard Money: DSCR Loan vs Hard Money Loan

Bank Statement: DSCR Loans vs Bank Statement Loans

Lever 1: How to Increase Your Rental Income

The easiest way to boost your DSCR is to increase your rental income. A higher income directly increases the top number of the DSCR equation. A higher DSCR generally means a lower rate and better terms (possibly higher LTV). Here are a few simple ways you can do this:

- Improve Rental Income: This mostly applies to properties you already own, but in a few cases I have been able to do this when buying a rental property from another investor. If the current rent is below market rate, you can increase rents in line with the market. Obviously this is easiest if you already own the property and you’re looking to refinance with a DSCR loan. But as I mentioned, there have been a few occasions where I have purchased rental property with an existing tenant, and the seller was able to renew the existing month-to-month lease into a 12-month lease at market rate as part of the deal. There are bunch of free or low-cost online tools you can use to assess the current market rent. Personally, I like Rentometer.

- Implement Strategic Property Upgrades: Nicer properties attract higher rents. You don’t have to do a full gut renovation. Small, cost-effective upgrades can justify a higher rent. Think about adding a washer and dryer unit, modernizing the kitchen with new cabinet hardware and countertops, or improving curb appeal with new landscaping. This has always been important for me. Over the years I’ve learned that nicer properties attract more tenant applications, giving you a wider choice and higher quality tenant pool to choose from.

- Explore Additional Revenue Streams: Look for ways to make a little extra income. Can you charge for storage in a basement or garage? Is there space to install coin-operated laundry? Even pet fees can add up to a significant amount over the course of a year. In one case, I own a property with a vacant lot next door. The lot was fenced off, so I negotiated with the tenant that they could lease it for their 2 dogs for $50 per month.

DSCR Quick Refresher:

DSCR = Gross Monthly Rent ÷ PITIA (Principal + Interest + Taxes + Insurance + HOA).

Example:

Rent $1,900; PITIA $1,600 → DSCR = 1.19×. If you lift rent $50 and cut insurance $25/mo (PITIA $1,575), DSCR becomes 1.21×.

Pro Tip: One thing to bear in mind here is your overall rent pricing strategy. You have to find the balance between charging maximum rent, and aiming to reduce tenant turnovers. While improving your DSCR can be a great way to improve profitability from your rental property, a tenant paying a little less that stays a lot longer will most likely work out far better for you in the long term.

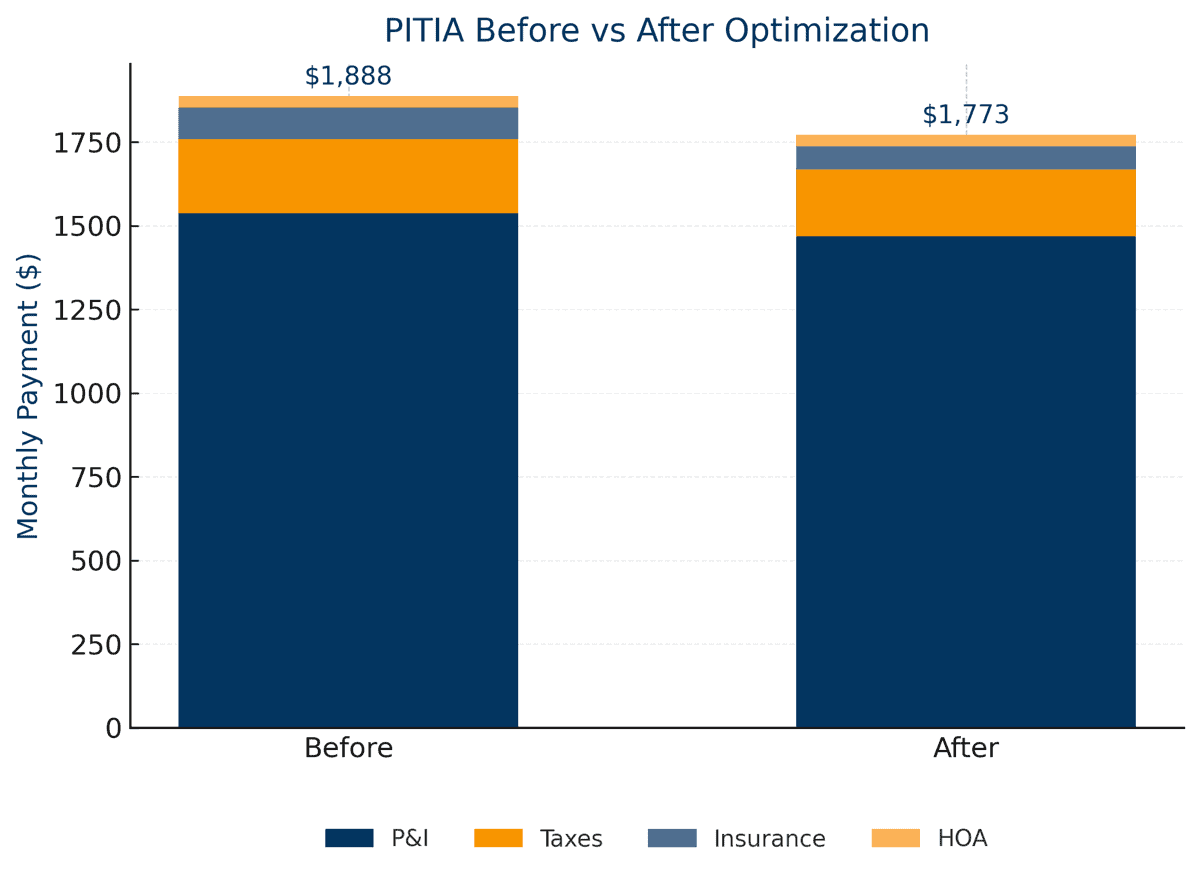

Lever 2: How to Decrease Your Operating Expenses

The second lever you can pull is to decrease your property’s operating expenses. When you lower certain expenses, your PITIA goes down, which in turn improves your DSCR. I’ve found that a few simple strategies can have a significant impact:

- Conduct an Expense Audit: As a landlord, it’s easy to get lazy with expenses. I’ve learned it’s worth taking the time to review every bill related to the property. The low hanging fruit here is your landlord insurance. This is part of your PITI, and so getting a better deal on your insurance will improve your DSCR.

Lever 3: How to Strengthen Your Application (Beyond the Property)

While the DSCR is primarily a measure of the property’s financial health, it’s not the only thing DSCR lenders look at. Your overall application, including your personal finances, plays a big role in the loan’s final terms and approval. A stronger application can lead to a lower interest rate, which in turn improves your DSCR.

- Improve Your Personal Credit Score: While the credit score requirements for DSCR loans vary from one lender to another, and better credit score generally gets you better terms. This can lead to a lower interest rate on your DSCR loan. Even a small drop in your interest rate can lower your monthly mortgage payment (the “I” in PITIA), which helps to improve your DSCR. Check your credit score regularly and take steps to pay down debt and make on-time payments.

- Build and Maintain Strong Cash Reserves: Lenders like to see that an investor has cash on hand. Having strong reserves makes you a safer bet in the eyes of a lender. It shows you can handle unexpected repairs or a period of vacancy without falling behind on the mortgage. This confidence can often translate into better loan terms.

- Get a Partner: Most DSCR lenders will require you to provide a personal guarantee. That’s why your credit score matters. They will also take into account your level of experience in real estate. If you can work with a more experienced partner, or get a guarantor with better credit, this can improve your chances of getting a better deal.

- Be Prepared with an Organized Document Package: One of the easiest ways to get a loan approved faster – and maybe even get better terms – is to be organized. Have all your property documents, bank statements, and other relevant paperwork ready before you even submit your application. A smooth, organized application process can sometimes influence a lender to offer better terms to keep the deal moving quickly.

While these factors won’t exactly improve your DSCR, they will strengthen your application and could lead to getting better terms. For some borrowers with difficult to prove income – like self-employed or business owners, a bank statement loan might be a better choice. You can read my comparison here: DSCR Loans vs Bank Statement Loans – A Comparison for Real Estate Investors.

Lever 4: How to Improve the Deal Structure Itself

The final lever is all about how you structure the loan. Even if you don’t change anything about the property or your application, you can still improve your DSCR by getting a lower monthly payment. As a reminder, the DSCR is calculated as Gross Rents / PITI, so putting forward the best deal will improve the DSCR.

- Make a Larger Down Payment: This is one of the most powerful and direct ways to improve your DSCR. When you increase your down payment, the loan amount decreases, which in turn lowers your monthly mortgage payment (the “P” and “I” in PITIA). This instantly makes your DSCR ratio look better to a lender. For example, if you put down 25% on a loan instead of 20%, your payment will be lower and your DSCR higher.

- Consider an Interest-Only DSCR Loan: With an interest-only loan, your monthly payment for a set period is much lower because you are only paying the interest, not the principal. This can significantly reduce your P&I payment, which means a higher DSCR. I’ve used interest-only loans on a few of my rental properties to give them a higher cash flow in the first five to ten years. For a property with a marginal DSCR, this can make all the difference in getting the deal approved.

- Consider an ARM DSCR Loan: Like interest only loans, the initial fixed rate period on an ARM loan tends to be lower than 30-year fixed rate loans. If you plan to sell or refinance just after the fixed rate period ends, or if you think interest rates might fall in the future, an ARM vs fixed rate loan might be a better choice.

Boosting DSCR with Interest-Only/ARM Loan Structures

One proven way to raise your DSCR — and help a deal qualify — is to choose an interest-only or ARM DSCR loan. By reducing the monthly payment during the initial fixed rate and/or interest-only period, you can improve your property’s cash flow and DSCR ratio without raising rents or cutting expenses.

| Scenario | Mortgage Payment | + T/I/HOA | Total PITIA | DSCR @ $2,200 Rent |

|---|---|---|---|---|

| 30-Year Fixed @ 7.50% | $1,398.43 | $350.00 | $1,748.43 | 1.26× |

| Interest-Only (10yr IO) @ 7.75% | $1,291.67 | $350.00 | $1,641.67 | 1.34× |

- DSCR lift without rent changes: Lower PITIA during the IO/fixed period boosts DSCR, making it easier to qualify under lender guidelines.

- Strategic flexibility: Ideal for thin-margin properties or investors planning value-add improvements in the early years.

- Know the trade-offs: IO loans often have slightly higher rates (+0.25%) and will see payment increases when amortization begins.

Tip: Not all lenders offer interest-only DSCR programs, and underwriting rules vary.

Check which DSCR lenders offer IO options before you apply.

- Explore an Interest Buydown: Another way to lower your monthly payments is to “buy down” the interest rate. This involves paying a fee upfront to a lender, usually in the form of points, to get a lower interest rate for a certain period. For a property with a marginal DSCR, the buydown can be a great way to lower your monthly payment and increase the DSCR enough to get the deal approved.

| Scenario | Rate | P&I/mo | Taxes+Ins+HOA | PITIA | Rent | DSCR |

|---|---|---|---|---|---|---|

| Baseline | 8.25% | $1,245 | $355 | $1,600 | $1,900 | 1.19× |

| Buydown −50 bps | 7.75% | $1,180 | $355 | $1,535 | $1,900 | 1.24× |

| Interest-Only (10-yr IO) | 8.50% | $1,063 | $355 | $1,418 | $1,900 | 1.34× |

| Rent +$50 & Insurance −$25 | — | — | $330 | $1,575 | $1,950 | 1.24× |

Pro Tip: I’d like to point out here that many people will say you should put down as little down payment as possible when buying real estate. I disagree. While this could be a good idea in some specific cases, my own investment strategy is to hold my rental properties for as long as possible. I’m happy to trade off a bigger down payment for better cashflow, and a less risky equity margin.

VIP PRIORITY INVESTOR LIST

Get the Best DSCR Loan Deals and Off-Market DSCR-Ready Investment Properties in Your Inbox Every WeekYES! ADD ME TO THE PRIORITY INVESTOR LIST

Is a Higher or Lower DSCR Better? Understanding Your Target Ratio

In short: a higher DSCR is always better. The Debt Service Coverage Ratio is a measure of a property’s financial health and its ability to pay for itself. A higher DSCR means the property is generating more than enough income to cover its debt payments.

From a lender’s perspective, a higher DSCR indicates a safer loan. It shows there’s a larger cushion between the property’s rental income and its expenses, making it less likely that you’ll default on the loan. This can lead to:

- Better Interest Rates: A lender may offer you a lower interest rate. That’s going to improve your cashflow and reduce the total amount of interest you pay over the term of the loan.

- Higher Loan-to-Value (LTV): You might be able to get a higher loan amount with a lower down payment.

- Fewer Restrictions: Lenders may be more flexible with their underwriting guidelines for properties with an excellent DSCR.

What is a Good DSCR?

- < 1.00×: cash flow shortfall (high risk, few lenders)

- 1.00–1.09×: weak coverage (limited programs, tighter pricing)

- 1.10–1.24×: fair coverage

- 1.25–1.49×: good coverage (common lender target)

- 1.50×+: excellent coverage (best pricing/terms)

Some lenders accept DSCR < 1.00× with heavy pricing/overlays; most prefer ≥ 1.10–1.25×.

For an in-depth analysis of a live deal we funded with a DSCR loan, and how we stress test the numbers, you can review my DSCR Loan Case Study.

Pro Tip: If you are using a DSCR cash-out refinance loan to pull equity out of an existing property, there may be a higher DSCR requirement and lower LTV caps. See my guide on DSCR Cash-Out Refinance.

Your DSCR Pre-Application Checklist

This DSCR checklist brings all of our strategies together. Before you submit your loan application, use this list to make sure you’ve done everything you can to get the best deal. A few extra hours of work here can save you literally thousands of dollars over the life of the loan.

- Calculate Your Current DSCR: Know your starting point. Use my DSCR loan calculators to get a clear picture of where you stand right now. This number will be your benchmark. You can also model various scenarios using different loan types (fixed/ARM/interest only).

- Analyze Your Income and Expenses: Review your current lease and assess market rates. Do an audit of your expenses, especially your insurance costs. Make a plan to increase income and reduce expenses where possible. Then reassess the DSCR based on these new metrics. In some cases it may be more appropriate to use conventional, or hard money financing.

- Check and Improve Your Credit Score: Know your current credit score. If it’s on the lower end, work on improving it by paying down debt and making on-time payments. A better score can lead to a lower interest rate, which directly improves your DSCR. If you’re a non-U.S. resident, you can skip this step. See Foreign national DSCR loans.

- Review Your Financing Options: Consider how you will structure your financing. Will a larger down payment help you get a better DSCR? Does an interest-only loan make sense for your cash flow goals? Do you have the option to buy points for an interest buydown?

- Organize Your Documents: Gather all your property and personal financial documents. Having everything ready and in order will make the process smoother and faster, which can be an advantage when dealing with lenders.

I currently have about $3.2 million in DSCR loans funding my rental property portfolio in the USA. When I first started out, I would take whatever loan terms I was offered. But over time, I’ve learned to be lot more strategic about my application. Having your documents ready and in order will for sure help you get the best initial loan quote.

I always look for opportunities to improve the DSCR pre-application, and to present the strongest deal possible to the lender. This has helped me secure DSCR loans for properties that might not have qualified, and it’s certainly helped me to get better rates and terms!

The Importance of Working with the Right Lender

While all of these strategies will help you improve your DSCR, it’s not a journey you have to take alone. Working with the right lender or broker can (and will) make all the difference. I’ve found that a knowledgeable broker who specializes in DSCR loans can be your greatest asset.

A good broker doesn’t just process your application. They should be your partner, helping you structure your deal in the best possible way. They can look at your specific situation and advise you on which of the four levers you should pull to get the best loan terms. They can help you understand the nuances of an interest buydown, or whether an interest-only loan is a good fit for your investment strategy. Over the last 10 years, I’ve learned that real estate is a people game, and my partnerships have been a game changer.

Conclusion: Taking Action to Secure the Best Financing

The property’s cashflow, the deal structure, the types of loan, and your personal financial standing are all important factors for getting the best DSCR loan rates and terms. Comparing DSCR loans vs conventional loans, and DSCR vs hard money loans you’ll see DSCR loans are a specific tool for a specific job. But by being proactive and using these four levers, you can improve your DSCR and position yourself to get better loan terms from a lender.

The time you spend making these improvements will pay for itself many times over in the form of a lower interest rate, better cash flow, and a more robust rental property portfolio. I’ve used these exact strategies to build my own portfolio of over 120 properties, and they work!

Remember that you’re in control. By taking these steps, you are not just getting a loan; you are building a stronger, more profitable real estate business for the long term.

If you want to find a lender who specializes in this type of loan, you can join my VIP Priority Investor List. I send out weekly emails with the best DSCR loan deals, and exclusive off-market DSCR-ready investment properties that have been pre-approved for funding by my own lender.

GET PRE-APPROVED FOR THE BEST DSCR LOAN RATE

Start your real estate investment journey today, and get pre-approved for the Best DSCR Loan Interest Rates from market leading lenders!

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GET PRE-APPROVED FOR THE BEST DSCR LOAN INTEREST RATES TODAY!

Start your real estate investment journey today get pre-approved for the best DSCR loan interest rates from market leading lenders!

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

FAQs About Improving Your DSCR

Here are some of the most common questions investors ask about DSCR and how to improve it.

What is a good DSCR ratio for a rental property?

In most cases, lenders will look for a DSCR of 1.25 or higher. That said, I have seen plenty of lenders offering DSCR loans with a negative DSCR (0.75). While I haven’t used this type of loan, I suspect the lender would focus more on the borrower’s income as well as the property income.

A higher DSCR is always better. It means there is a larger cushion between the property’s rental income and its debt payments. Generally, a DSCR of 1.25 to 1.50 is considered good, and anything above 1.50 is excellent. A higher DSCR can lead to better loan terms, including a lower interest rate and a higher Loan-to-Value (LTV).

Do I need a 20% down payment for a DSCR loan?

A 20% down payment is a common minimum requirement for many DSCR loans, but it’s not a universal rule. The required down payment can vary depending on the lender, the property type, the loan amount, and your credit score. For example, some lenders may offer a lower down payment if the property has an exceptionally high DSCR.

What are the main downsides of a DSCR loan?

While DSCR loans are a powerful tool for real estate investors, they do have a few downsides. The interest rates are typically higher than those for traditional mortgages, and many DSCR loans come with prepayment penalties. This means if you sell or refinance the property within the first few years, you may have to pay a fee.

Can you pay off a DSCR loan early?

Yes, you can pay off a DSCR loan early. However, most DSCR loans come with a prepayment penalty, which is a fee you pay if you pay off the loan before a certain time period (often the first 3-5 years). It’s crucial to understand these terms before you sign, as they can impact your long-term investment strategy.

Can I refinance a DSCR loan?

Yes, you can refinance a DSCR loan. Many investors do this to get a lower interest rate as the market changes or to get a new loan with different terms. As with any mortgage, you’ll need to go through an application process and meet the lender’s current requirements.