Daily US Mortgage Rate Update: June 12, 2025

FREE DOWNLOAD: 10 Costly Mistakes Foreigners Make Buying U.S. Real Estate

🏠 Daily Mortgage Rate Report: June 12, 2025

Welcome to your daily update on the U.S. mortgage market, crafted to provide essential insights for international real estate investors from the UK, Canada, Australia, and Latin America, as well as domestic US homebuyers. Today’s report highlights continued rate volatility influenced by evolving inflation data.

Key Takeaways for June 12, 2025:

- Rates Mostly Down on Cooling Inflation: Following fresh inflation data, key mortgage rates, including 30-year and 15-year fixed rates, have seen a slight decline, aligning with market expectations of cooling inflation.

- Fed’s Caution Persists: Despite some positive inflation signals, the Federal Reserve appears to be maintaining a cautious stance on rate cuts, potentially delaying significant moves until September.

- Opportunity for Investors: Lowering rates, even modestly, can slightly improve cash flow projections for new investment acquisitions. Vigilance remains key for international investors to lock in favourable terms.

- Affordability for Homebuyers: While rates have dipped, they remain elevated compared to historical lows, continuing to challenge affordability for U.S. homebuyers.

Today’s U.S. Mortgage Rates Overview (Purchase Loans)

Below are the national average rates for various purchase loan types as of Thursday, June 12, 2025. These rates are sourced from reliable financial outlets including Bankrate, Freddie Mac, and Fannie Mae, and represent current market averages. Individual rates may vary based on lender, borrower creditworthiness, and specific loan terms.

| Mortgage Type | Average Rate (%) | Daily Change | Weekly Change |

|---|---|---|---|

| 30-year Fixed | 6.76 | N/A | N/A |

| 20-year Fixed | 6.34 | N/A | N/A |

| 15-year Fixed | 5.96 | N/A | N/A |

| 5/1 ARM | 6.84 | N/A | N/A |

| 7/1 ARM | 6.46 | N/A | N/A |

| 30-year VA | 6.28 | N/A | N/A |

| 15-year VA | 5.65 | N/A | N/A |

| 5/1 VA | 6.20 | N/A | N/A |

Note: Daily and weekly changes for these specific loan types were not available in the reference source’s table format. Rates are approximate national averages.

Today’s U.S. Mortgage Refinance Rates Overview

For those considering refinancing their existing loans, here are the average national refinance rates as of Thursday, June 12, 2025.

| Refinance Type | Average Rate (%) | Daily Change | Weekly Change |

|---|---|---|---|

| 30-year Fixed | 6.83 | N/A | N/A |

| 20-year Fixed | 6.35 | N/A | N/A |

| 15-year Fixed | 5.95 | N/A | N/A |

| 5/1 ARM | 7.13 | N/A | N/A |

| 7/1 ARM | 6.59 | N/A | N/A |

| 30-year VA | 6.31 | N/A | N/A |

| 15-year VA | 6.04 | N/A | N/A |

| 5/1 VA | 6.08 | N/A | N/A |

Note: Daily and weekly changes for these specific refinance loan types were not available in the reference source’s table format. Rates are approximate national averages.

In-Depth Commentary: Navigating the Current Rate Environment

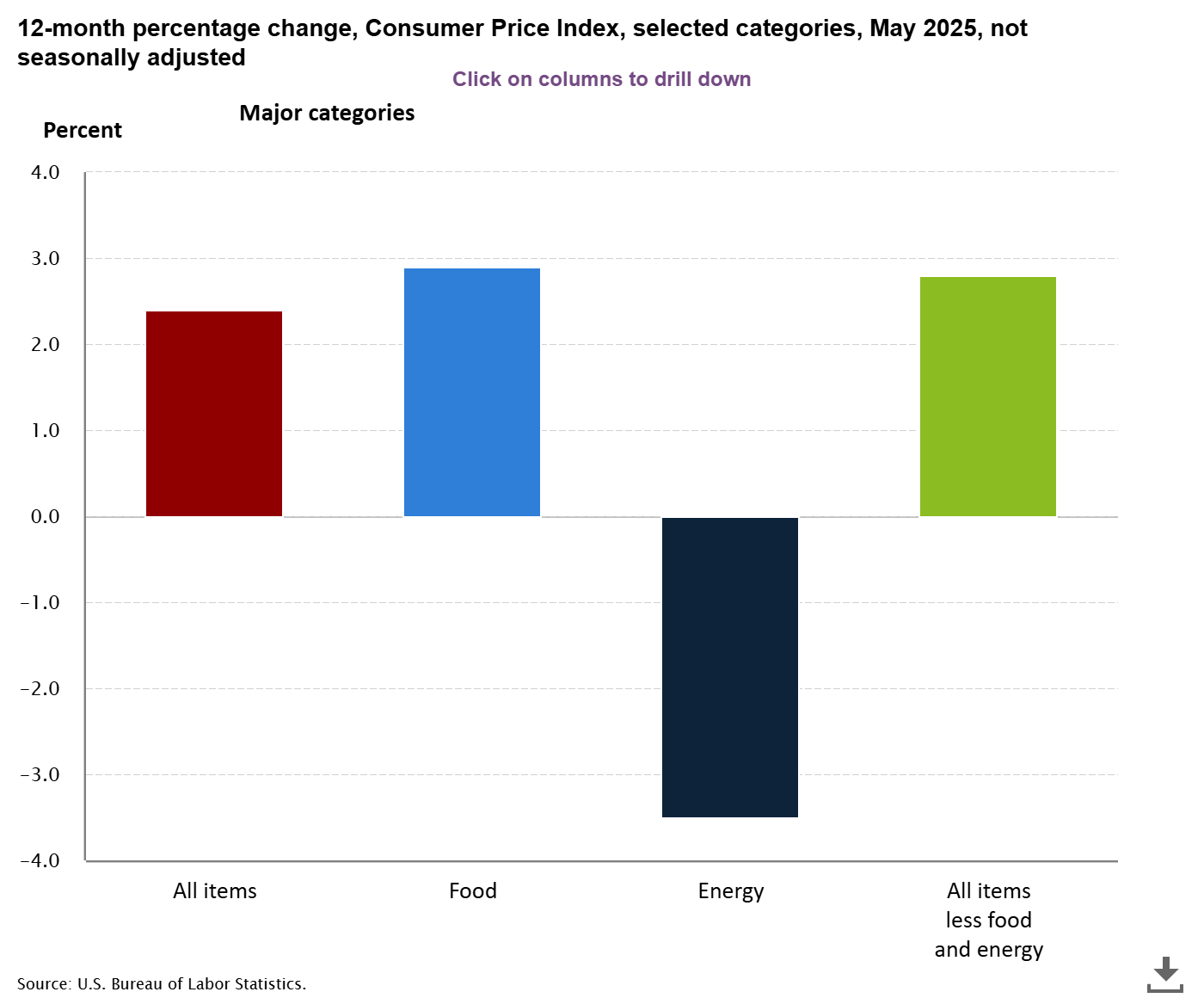

The U.S. mortgage market continues to dance to the tune of inflation data and Federal Reserve policy. Today’s slight dip in rates for key loan types is largely a reaction to new data suggesting a cooling in inflation. Specifically, a recent Consumer Price Index (CPI) report indicated a modest 0.1% rise, which, while still inflationary, hints at a deceleration compared to previous periods. This news has provided some relief to the bond market, which directly influences mortgage rates.

Source: U.S. Bureau of Labor and Statistics

However, despite these positive signals, the Federal Reserve appears to be maintaining a cautious stance. Their dual mandate of managing inflation and fostering employment means they are closely scrutinizing all economic indicators before making aggressive moves on interest rates. This hesitation suggests that while a rate cut remains a possibility later in the year, significant reductions are unlikely in the immediate term, with market sentiment currently suggesting potential delays until September or even later in 2025.

This sustained environment of rates hovering near the mid-to-high 6s and low 7s reflects the ongoing economic balancing act. For borrowers, this means a continued emphasis on prudent financial planning and remaining agile in their financing strategies, as significant rate shifts are unlikely in the immediate short term.

Impact on Investors & Homebuyers

For U.S. Homebuyers: The current rate landscape, with 30-year fixed mortgages around 6.76%, continues to present significant affordability challenges for many. For every $100,000 borrowed at this rate, a homebuyer faces a principal and interest payment of approximately $649. This higher monthly cost limits purchasing power and can make entry into the housing market difficult, especially for first-time buyers. While home prices have shown some moderation in growth in certain areas, the elevated interest rates keep overall monthly housing expenses high. Buyers need to thoroughly assess their budgets, consider different loan products (like adjustable-rate mortgages if suitable for their long-term plans), and explore down payment assistance programs.

For U.S. Real Estate Investors: For domestic investors, these rates directly impact cash flow and return on investment (ROI). Lowering rates, even modestly as seen today, slightly improves the debt service component of a property’s expenses, thus potentially enhancing net rental income and cash flow. However, with rates still elevated, investors must be even more diligent in their financial modelling, focusing on:

- Strong Cash Flow: Prioritize properties that can generate positive cash flow even with current mortgage payments.

- Value-Add Opportunities: Look for properties where renovations or operational efficiencies can significantly increase rental income or property value, thereby boosting ROI.

- Long-Term Strategy: Remember that real estate is a long-term play. While current rates affect immediate cash flow, appreciation, and inflation hedging remain compelling aspects of a long-term investment.

For International Investors: For our international clients, understanding these rates is paramount as they directly influence the viability and profitability of U.S. real estate investments. Today’s slight rate dip offers a small window of improved financing, but the overall landscape of elevated rates means a larger portion of rental income goes towards debt service, potentially impacting desired cash-on-cash returns. However, this environment also presents unique opportunities:

- Negotiating Power: A slightly less active U.S. buyer pool due to affordability concerns can give international investors more negotiating leverage on property prices, potentially offsetting higher borrowing costs.

- Dollar Strength: Depending on currency exchange rates, a strong U.S. dollar might make the initial investment more expensive, but once the property is acquired, consistent USD-denominated rental income can be attractive, especially if your local currency weakens against the USD or is particularly volatile.

- Long-Term Stability & Diversification: U.S. real estate offers unparalleled stability, robust property rights, and diversification for global portfolios. While entry costs might be higher, the underlying demand for housing and the strong legal framework remain powerful draws. Focus on understanding the local market dynamics and working with experienced partners to identify high-demand rental areas that can sustain strong rental yields.

Foreign National Mortgages: A Niche Market Update

Specific daily and weekly rate changes for Foreign National Mortgages are not publicly reported in the same standardized manner as conventional U.S. loans. This is because Foreign National loans are highly specialized products, with rates and terms often determined on a case-by-case basis by individual lenders, depending on a variety of factors including:

- The borrower’s country of origin and financial standing.

- The loan-to-value (LTV) ratio.

- The property type and location.

- The lender’s specific risk assessment.

General Outlook & Typical Terms:

While precise daily shifts aren’t available, rates for foreign national mortgages typically follow the general trend of the broader U.S. market, often with a slight premium due to perceived higher risk and additional administrative requirements. Based on recent market observations, here’s a general overview of what foreign national investors might expect:

| Loan Type | Typical Interest Rate Range | Down Payment Required | Loan Terms (Fixed/ARM) | Key Requirements (General) |

|---|---|---|---|---|

| Foreign National (Residential) | 7.0% – 9.5% | 15% | 5/1 ARM, 7/1 ARM, 30-Year Fixed | Proof of income, credit report and tax returns |

| DSCR | 6.75% – 8.5%+ | 25% | 30-Year Fixed | No US income or credit requires |

Note: These are ranges and typical terms. Actual rates and conditions will vary significantly by lender and individual borrower profile. It is crucial to get a personalized quote.

Recommendation for Foreign Nationals: Due to their bespoke nature, it is crucial for international investors to:

- Work with Specialized Lenders: Connect with financial institutions that have specific programs and expertise in foreign national lending.

- Obtain Direct Quotes: Always seek personalized quotes based on your specific financial profile and the property you intend to purchase.

- Factor in All Costs: Be aware of potential higher closing costs or reserve requirements.

About the Author

With over 120+ personal property acquisitions in the USA since 2016, David Garner is a seasoned expert in international real estate investment, specializing in helping clients from the UK, Canada, Latin America and Australia navigate the complexities of the U.S. property market. With extensive experience in identifying high-potential, cash-flowing assets, David provides strategic guidance to optimize returns and build robust global portfolios. He is committed to empowering investors with timely market insights and personalized solutions to achieve their financial goals in the dynamic U.S. real estate landscape.

GROW YOUR WEALTH WITH U.S. REAL ESTATE

Start your US real estate investment journey today, and book a Free 1-2-1 Discovery Call with a member of our senior management team.

“Having personally invested in over 120+ US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

Frequently Asked Questions (FAQs)

Q1: How do US mortgage rates compare to rates in the UK, Canada, or Australia?

A1: US mortgage rates are influenced by the Federal Reserve and the bond market, distinct from central bank policies in other countries. It’s essential for international investors to compare the ROI potential of US properties against their domestic investment opportunities, considering the difference in borrowing costs.

Q2: Will mortgage rates go down significantly in the near future?

A2: While the Federal Reserve’s long-term goal is to bring inflation to target levels, leading to potential rate cuts, the timing and extent of these cuts are uncertain. Market sentiment currently suggests potential delays until late 2025, or even 2026, depending on economic data. It’s advisable to stay informed about economic indicators and Fed announcements.

Q3: What are the key benefits of investing in US real estate from overseas, despite current rates?

A3: The U.S. offers a stable political and economic environment, strong property rights, and a diverse range of investment markets. It provides a hedge against inflation and currency fluctuations, consistent rental income potential, and opportunities for long-term capital appreciation, making it an attractive diversification tool for global portfolios.

Q4: How can I minimize the impact of rising mortgage rates on my investment property’s cash flow?

A4: To mitigate the impact, focus on properties with strong rental demand, negotiate favorable purchase prices, explore opportunities for value-add improvements to increase rental income, and maintain a robust financial reserve. Considering shorter-term loans or ARMs if your investment horizon is shorter can also be an option, but with careful risk assessment.

Q5: Are there specific U.S. markets that are more attractive for international investors in the current rate environment?

A5: Markets with strong population growth, diverse economies, and a high demand for rental housing often remain attractive. Look for regions with stable job markets, landlord-friendly regulations, and favourable property tax environments. These factors can contribute to consistent cash flow even with higher financing costs.

Related Articles

Related: The Best USA Mortgages for Foreign Nationals in 2025

Related: How to Get a Foreign National Mortgage Without a Visa or SSN

Related: Navigating US Mortgage Rate Uncertainty for Foreign Property Investors

Related: Why US Mortgage Rates Change Every Day

Related: USA Mortgage Rates Improve on June 11th 2025

Related: USA Mortgage Rates Dip Slightly Again on June 10th 2025

Related: US Mortgage Rates Pull Back Slightly on June 9th 2025

Related: US Mortgage Rates Sneak Back up Again on June 7th 2025

Related: US Mortgage Rates Decline Again on June 6th 2025

Related: US Mortgage Rates Fall Sharply on June 5th 2025

Related: US Mortgage Rates Edge Up Slightly on June 4th 2025

Related: US Mortgage Rates Edge Back Up Again on June 3rd 2025

![USA Property Investment for Foreign Buyers [2025 Guide]](https://cashflowrentals.net/wp-content/uploads/2025/07/USA-Property-Investment-for-Foreigners-Expert-2025-Guide-500x383.png)