DSCR Loans vs. Bank Statement Loans: A Detailed Comparison

DSCR Loans vs. Bank Statement Loans: A Detailed Comparison for Self-Employed Investors

For self-employed real estate investors, securing financing for investment properties can be a complicated. Conventional mortgage loans require W-2s and tax returns, which can be a problem if your business deductions result in a low net income. Take me for example. Most of my income is from real estate, so I make a ton of deductions and have almost zero taxable income. Conventional mortgages just aren’t an option for me .

Fortunately, there are some great non-qualified mortgage (non-QM) options available for people like us. Two of the most common non-QM loans are DSCR loans and bank statement loans. While both are great options, they serve different purposes. This guide will provide a detailed comparison to help you determine which is the best fit for your real estate journey (also compare DSCR vs conventional loans and fixed rate vs ARM DSCR mortgages).

VIP PRIORITY INVESTOR LIST

Get the Best DSCR Loan Deals and Off-Market DSCR-Ready Investment Properties in Your Inbox Every WeekYES! ADD ME TO THE PRIORITY INVESTOR LIST

What is a DSCR Loan? A Focus on Property Cash Flow

A DSCR (Debt Service Coverage Ratio) loan is a type of non-qualified mortgage designed specifically for real estate investors. I use DSCR loans to purchase and/or refinance all of my rental properties in the US. The reason I use this particular type of loan product is that approval is based on the investment property’s cash flow, not my personal income. To learn more, check out my comprehensive guide on DSCR loans

The DSCR is a simple calculation: the property’s gross rental income is divided by its monthly mortgage payment (principal, interest, taxes, and insurance). For example, if a property generates $2,500 in monthly rental income and the monthly mortgage payment is $1,800, the DSCR would be 1.38 ($2,500 / $1,800). Lenders typically look for a DSCR of 1.25 or higher, but this can vary. To work out the DSCR for any property, you can use my DSCR loan calculator.

- How it Works: The loan is based on the subject property’s cash flow (rental income) rather than the borrower’s personal income.

- Key Features: No personal income verification is required, making DSCR loans ideal for investors buying rental properties. Refer to my list of the Best DSCR Lenders in 2025.

What is a Bank Statement Loan? A Focus on Verifying Borrower Income

A bank statement loan is another type of non-qualified mortgage that offers a potential solution for self-employed borrowers. Instead of relying on tax returns, which may show minimal income due to business write-offs, lenders use your business or personal bank statements to verify your income to qualify for the loan. Lenders typically look at 12 to 24 months of statements to determine an average monthly cash flow, which is then used to calculate your debt-to-income ratio (DTI).

Bank statement loans are particularly useful for business owners and entrepreneurs who can show a healthy cash flow through their bank accounts but have a lot of deductions on their tax returns.

- How it Works: Lenders use business or personal bank statements to verify income, bypassing the need for tax returns or W-2s.

- Key Features: Designed for borrowers who write off significant expenses, flexible for those with fluctuating income.

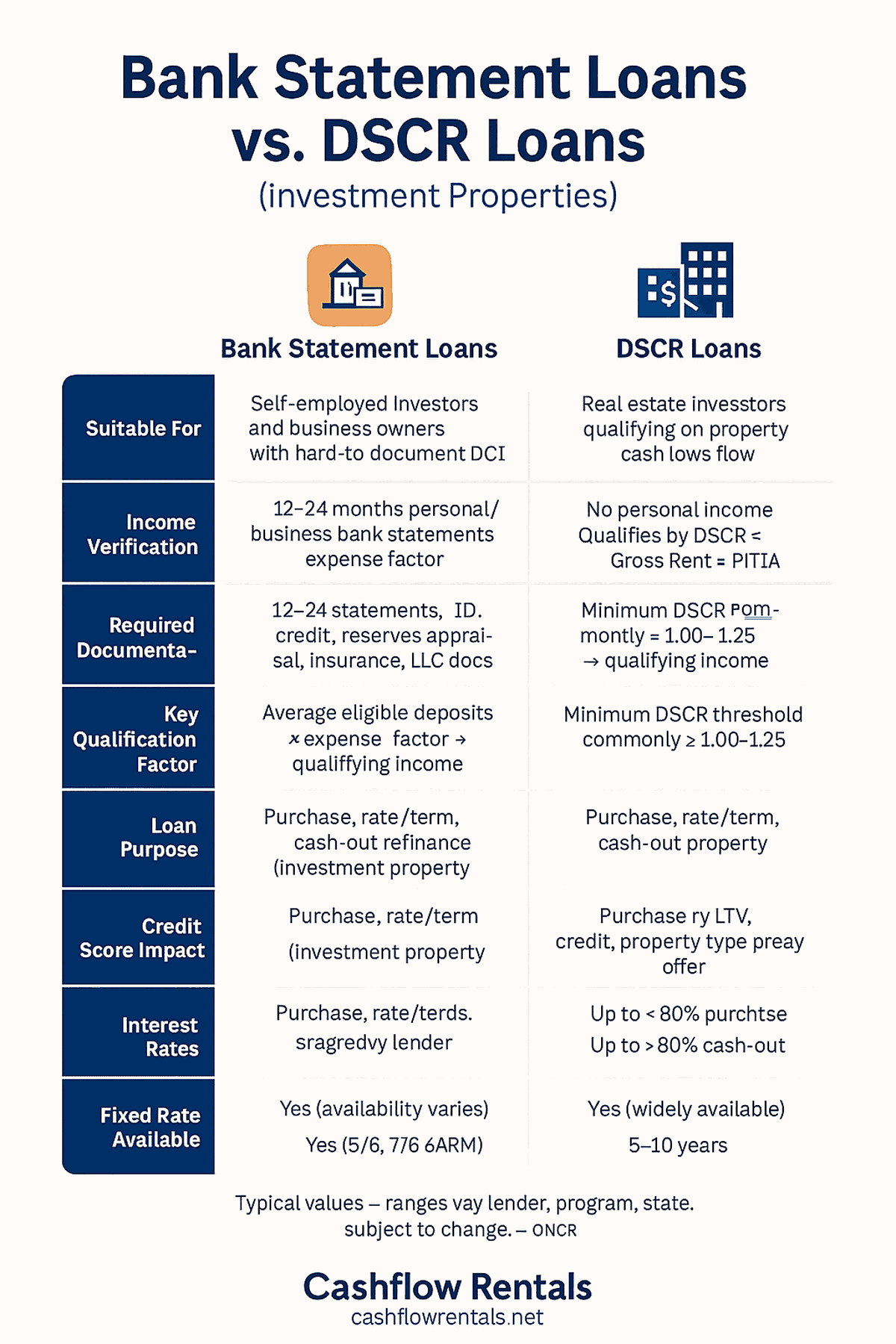

The Ultimate Comparison Table: DSCR vs. Bank Statement Loans

DSCR Loans and Bank Statement Loans are both powerful non-QM mortgage options for self-employed borrowers, and for people like me who make a lot of deductions from their taxable income, but there are some differences between the two.

The best choice depends on your specific financial situation, the type of property you’re intending to purchase, and your investment strategy. The following table provides a high-level overview to help you see the key differences between bank statement loans and DSCR loans at a glance.

VIP PRIORITY INVESTOR LIST

Get the Best DSCR Loan Deals and Off-Market DSCR-Ready Investment Properties in Your Inbox Every WeekYES! ADD ME TO THE PRIORITY INVESTOR LIST

| Feature | Bank Statement Loans (Investment) | DSCR Loans (Investment) |

|---|---|---|

| Suitable For | Self-employed investors/business owners with strong deposits but hard-to-document taxable income. | Investors qualifying by property cash flow rather than personal income. |

| Income Verification | 12–24 months personal and/or business bank statements with lender expense factor. | No personal income used; qualification by DSCR (Rent ÷ PITIA). |

| Required Documentation | Bank statements, ID, credit, reserves, appraisal, insurance; LLC docs if applicable; sometimes CPA letter/P&L. | Lease/market rent (1007/1000), appraisal, ID, credit, reserves, insurance; LLC docs if applicable. |

| Key Qualification Factor | Average eligible deposits × expense factor → qualifying income/DTI. | Minimum DSCR (commonly ~1.10–1.25+) based on rents vs. PITIA. |

| Loan Purpose | Purchase, rate/term, cash-out (investment property). | Purchase, rate/term, cash-out (investment property only). |

| Credit Score Impact | Typical minimums ~620–680+; pricing by score, LTV, months of statements. | Typical minimums ~620–680+; pricing by score, LTV, DSCR, property type, prepay. |

| Interest Rates | Higher than conventional; priced by LTV, credit, statement length, occupancy. | Higher than conventional; priced by LTV, credit, DSCR, property type, prepay. |

| Loan to Value (LTV) | Up to ~80% purchase/rate-term; ~70–75% cash-out (program-dependent). | Up to ~80–85% purchase/rate-term; ~70–80% cash-out (lender-dependent). |

| Property Types | 1–4 units, condos/townhomes; some allow 5+ units and STRs (program-dependent). | 1–4 units standard; many offer STR and 5+ unit DSCR programs. |

| Fixed Rate / ARM / IO | Fixed & ARMs available; IO often 5–10 yrs (overlays apply). | Fixed & ARMs available; IO common to maximize cash flow (overlays apply). |

Notes: “Typical” values vary by lender, program, state, and market conditions. DSCR = Gross Rent ÷ PITIA.

Quick Decision Guide

- Choose DSCR when the property’s DSCR is ~1.10–1.25+ and you want minimal personal income docs.

- Choose Bank Statement when DSCR is thin but your 12–24 months deposits are strong and steady.

- For STRs/condos/5+ units, compare overlays (LTV, reserves, prepay) — programs vary widely.

When to Choose a DSCR Loan for Your Investment Property

A DSCR loan is often the preferred choice if you are buying rental properties that produce income.

You should consider a DSCR loan if:

- You’re a Portfolio Investor: You already own multiple rental properties and want to expand without impacting your personal debt-to-income ratio.

- Your Personal Income is Low on Paper: You’ve made significant deductions on your tax returns, so your personal income doesn’t meet the requirements for a conventional mortgage.

- You Value Speed and Simplicity: The DSCR loan process is often faster and requires less personal documentation than a bank statement loan, as the focus is almost entirely on the property’s numbers.

- The Property Has Strong Cash Flow: The investment property you are looking to finance has a healthy rental income that comfortably covers the mortgage payment.

When to Choose a Bank Statement Loan for Your Investment Property

The bank statement loan is a ideal for self-employed people with hard to prove income. It bridges the gap for business owners who have a strong cash flow but don’t have the W-2s or tax returns that traditional lenders require.

You should consider a bank statement loan if:

- You’re a Self-Employed Professional: You are a real estate agent, doctor, lawyer, or business owner with a reliable cash flow that shows up in your bank accounts.

- Your Tax Returns Don’t Reflect Your True Income: You write off a lot of business expenses, which lowers your taxable income and makes it difficult to qualify for a conventional loan.

- You’re a First-Time or Single-Property Investor: You are a self-employed individual looking to purchase your first or a single investment property and need to use your own income to qualify.

Getting Started: The Next Steps for Self-Employed Investors

Choosing the right type of financing for your property purchase is a critical step in your real estate journey. For me, DSCR loans are the best choice because of my personal circumstances. For some of my clients who are self-employed or business owners, bank statement loans are often a better solution. Here’s a brief guide to help you take the next steps:

- Assess Your Goals: Are you buying an investment property that produces income? Or are you buying a vacation home or second home? Your long-term goals will help determine the best loan choice. Remember… DSCR loans for rental properties, and bank statement loans for second homes or vacation homes.

- Gather Your Documents: Even with non-traditional loans, you’ll need to be organized. Have your bank statements, and/or property details ready. Lenders love organized paperwork!

- Consult with a Specialist: The world of non-QM loans can be complex. Working with a lender or a mortgage broker who specializes in DSCR and bank statement loans is highly recommended. They can help you navigate the nuances and find the best fit for your unique situation. if you’d like to connect with my personal broker, there’s a ‘Get Pre-Approved’ button at the end of this post.

Conclusion: Making the Best Choice for Your Real Estate Journey

Both DSCR loans and bank statement loans are both excellent options that provide a clear path to financing for self-employed real estate investors. The key is to understand the fundamental difference: a DSCR loan looks at the property, while a bank statement loan looks at you, the borrower. By identifying whether the strength of your loan application lies in a property’s cash flow or your business’s bank statements, you can confidently choose the loan that will help you achieve your investment goals.

GET PRE-APPROVED FOR THE BEST DSCR LOAN INTEREST RATES TODAY!

Start your real estate investment journey today get pre-approved for the best DSCR loan interest rates from market leading lenders!

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

GET PRE-APPROVED FOR THE BEST DSCR LOAN RATE

Start your real estate investment journey today, and get pre-approved for the Best DSCR Loan Interest Rates from market leading lenders!

“Having personally invested in over 120 US rental properties from overseas, I know the true value of getting the right advice and support.

David Garner – Cashflow Rentals

Frequently Asked Questions

What’s the difference between a DSCR loan and a bank statement loan?

A DSCR loan qualifies based on the property’s cash flow (DSCR = gross rent ÷ PITIA), not your personal income. A bank statement loan uses 12–24 months of personal and/or business bank statements to derive qualifying income. Both are popular non-QM options for investors who don’t fit conventional guidelines.

Which is better for investment properties: DSCR or bank statement loans?

If the rental or STR cash flow is strong (often DSCR ≥ ~1.10–1.25), a DSCR loan is usually more straightforward and purpose-built for investors. If DSCR is marginal but your business shows strong, steady deposits, a bank statement loan can be a better fit. You can also compare pricing—see our DSCR loan rates today.

Can I qualify for a DSCR loan without personal income?

Yes. Most DSCR programs do not use personal income, tax returns, or W-2s. Qualification hinges on meeting the lender’s minimum DSCR, credit score, reserves, and LTV criteria.

How do lenders calculate DSCR for rentals and STRs?

DSCR = Gross Monthly Rent ÷ PITIA (Principal, Interest, Taxes, Insurance, HOA). For long-term rentals, lenders use lease or appraiser market rent. For STRs, many lenders accept documented short-term income or an appraiser-supported STR income analysis; overlays vary by lender and property type.

What bank statements do lenders need for a bank statement loan?

Typically 12–24 months of consecutive, complete statements (personal and/or business). Lenders average eligible deposits and apply an expense factor to estimate income. Expect to document liquidity/reserves, credit, ID, and the property appraisal as well.

Are bank statement loans available for short-term rentals (Airbnb/VRBO)?

Often, yes—program availability is lender-specific. STRs can carry tighter LTV caps, higher reserve requirements, and additional documentation. Some lenders exclude condotels or certain STR-heavy buildings, so check program overlays.

What credit score do I need for DSCR vs. bank statement loans?

Typical minimums start around ~620–680+, with better pricing from ~700–740+. Expect adjustments for higher LTVs, lower DSCR, STRs, 5+ units, and cash-out. Individual lender matrices control final eligibility and pricing.

What are typical LTV limits for DSCR and bank statement loans?

For DSCR: purchases/rate-term often up to ~80–85% LTV; cash-out ~70–80% (lower for condos, STRs, and 5+ units). For bank statement (investment): purchases/rate-term commonly up to ~80%; cash-out ~70–75%, subject to credit and deposit strength.

Are interest-only options available on DSCR and bank statement loans?

Yes—both commonly offer 5–10 years of IO before amortization begins. IO can improve cash flow and DSCR during the IO period, but it usually prices higher and may carry tighter LTV/credit overlays.

Can I close in an LLC with DSCR or bank statement loans?

DSCR loans frequently allow entity vesting (LLC) with personal guarantees; many bank statement programs do as well. Title/vesting rules can be state- and lender-specific, and some lenders require closing in personal name with post-close transfer—verify program terms.

Do DSCR loans require tax returns or W-2s?

Generally, no. DSCR loans are underwritten primarily to property cash flow, credit, reserves, and collateral. Bank statement loans also avoid tax returns but verify income using your statements instead.

When should an investor choose a bank statement loan over DSCR?

Consider a bank statement loan when:

- DSCR is marginal but your business deposits are strong and consistent.

- You want to leverage 12–24 months of income history rather than current lease/market rent.

- Program pricing/terms penciled better for your scenario after comparing LTV, reserves, and prepay.